Skybridge CEO Lists Factors To Spur Crypto Market Recovery

August 15 2022 - 12:00PM

NEWSBTC

The crypto industry is gradually seeing a glimpse of light with

promising improvement in the performance of digital assets. Based

on the flowing uptrend, Anthony Scaramucci, the founder and

managing partner of Skybridge Capital, expressed optimism about the

crypto future. Furthermore, he pointed out the key players that

would positively impact crypto markets in the future. Scaramucci

advised that investors should keep up their confidence and focus as

they look beyond the present atmosphere. There would be a change

for greater market profitability due to a long-term overtake with

price surges. The manager expressed his views during an interview

with CNBC. He maintained that lots of new projects and innovations

in the crypto space are making a difference. But, to him, it would

be long before the increased commercial flows in the space would

yield more rewards. Related Reading: Ethereum Sees Setback After

Breaking $2k, But Price Likely to Maintain Upward Trajectory

Further, Scaramucci pointed out some key factors that he believes

are contributory to the recovery of the crypto market. First, he

stated that the Ethereum blockchain is finally getting its

long-awaited upgrade as the Merge takes place on September 15. As

the world’s second-largest cryptocurrency, the upgrade from

Ethereum would significantly impact its market price. With the

Merge launch, the network would transit from a Proof-of-Work (PoW)

consensus mechanism to a Proof-of-Stake (PoS). The outplay of

events preceding the Merge is already creating positive results for

the Ethereum network. Investments are increasing daily for Ether

and its derivatives in the market. This comes with the positive

sentiment from the Merge, which Scaramucci noted is spiking the

demand for Ethereum and its products. Developments Likely To

Brighten Crypto Market According to Scaramucci, more investors are

buying the Ethereum Merge rumor. They might have to sell also due

to news on the transitions. But, Scaramucci advised participants to

desist from such motives while investing. To him, the assets are

long-term investments that should go with higher profitability in

the long run. Additionally, Scaramucci listed other positive

indicators that would spike the crypto market in the future. This

includes the Lightning Network, a layer two payment protocol built

on the Bitcoin blockchain, with increasing improvement signs. Also,

there’s the partnership between BlackRock and Coinbase and

BlackRock’s launch of a spot Bitcoin private trust fund. Related

Reading: Litecoin Breezes Past $64 Level As LTC Picks Up Speed In

Scaramucci’s opinion, the CEO of BlackRock, Larry Fink, understands

the high institutional demands for digital assets. This prompts his

moves in making some collaborations, especially with Coinbase, and

developing relevant products. Though prices still fluctuate, some

cryptocurrencies are making progressive upward moves. For example,

Bitcoin had about a 20% increase last month while Ether gained 62%.

Also, while noting the impressive record of July on the inflation

rate, Scaramucci anticipates a better float of the global economy.

As a result, he expects the next 6 to 12 months to give strong

output similar to the Q4 of 2019. Featured image from Pixabay,

Charts from TradingView.com

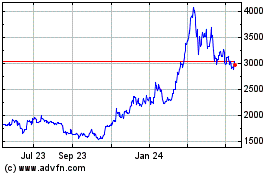

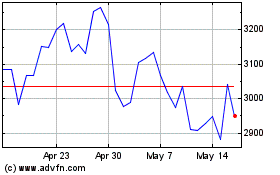

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024