UPDATE: Rio Tinto Slows Argyle Project, Cuts Diamond Output

January 13 2009 - 11:57PM

Dow Jones News

Rio Tinto Ltd. (RTP) said Wednesday it will stop producing

diamonds from its Argyle mine in Western Australia state for three

months and slow work on the US$1.5 billion development of an

underground operation at the mine in response to global market

conditions.

The move is the latest in a steady stream of cutbacks the miner

is making in a drive to cut 14,000 jobs and reduce capital spending

by US$5 billion as it acts to pay down some of its US$38.9 billion

debt and respond to sagging demand for commodities.

The underground project is to be slowed to only critical

development activities, resulting in a workforce reduction and a

demobilization of contractors.

"Given global market conditions, we will also reduce diamond

production by taking an extended maintenance shutdown of the

diamond processing facilities for up to three months, commencing in

March," said Kevin McLeish, chief operating officer of Rio Tinto

subsidiary Argyle Diamonds.

The transformation of Argyle, in the remote Kimberley region of

Western Australia, from an open pit to an underground mine was due

for completion in December 2010 and designed to extend the life of

the mine beyond 2018.

The mine, which is one of the world's biggest and produces about

20 million carats of diamonds a year, is acknowledged in Australia

as a leader in providing employment to local indigenous people.

Rio Tinto would not say how many jobs would be lost at the mine

but said the vast majority would be among contractors, with its

employees to be redeployed to maintenance, training and other

activities where possible.

Engineering contractor Macmahon Holdings Ltd. (MAH.AU), which is

carrying out the work on the underground project, said it expects

to have to cut its workforce at the mine to about 140 from about

360 currently.

A spokeswoman for Macmahon said it would also look to redeploy

workers, but given the slowdown in the mining sector was expecting

about 200 redundancies.

Macmahon said its contract will be realigned to take into

account the revised development program now being pursued at Argyle

and this will reduce its contract revenue to just under A$20

million a year from A$80 million a year, until development

activities recommence.

News of the changes at Argyle saw Macmahon's shares fall 10% or

4 Australian cents to 36 Australian cents by 0435 GMT while Rio

Tinto was up 0.6% at A$40.61.

Rio Tinto is due to release its fourth quarter production report

Thursday and investors will be watching closely for any further

announcements of cuts to production and spending on growth

projects.

-By Alex Wilson, Dow Jones Newswires; 61-3-9671-4313;

alex.wilson@dowjones.com

Click here to go to Dow Jones NewsPlus, a web front

page of today's most important business and market news, analysis

and commentary. You can use this link on the day this article is

published and the following day.

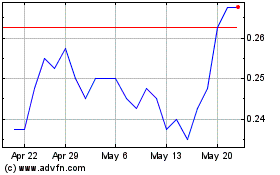

Macmahon (ASX:MAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

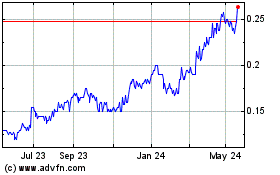

Macmahon (ASX:MAH)

Historical Stock Chart

From Apr 2023 to Apr 2024