Australia's New Mining Tax Will Affect Only A Handful Of Companies

July 01 2010 - 10:17PM

Dow Jones News

The government's revised Minerals Resource Rent Tax released

Friday greatly reduces the number of mining companies affected by

the new tax compared with that of the original proposal.

The plan will apply only to iron ore and coal and be applied at

a rate of 30%, as opposed to 40% under the original proposal, while

the existing offshore petroleum resource rent tax will be extended

to onshore companies.

The exclusion of commodities other than iron ore, coal, and

onshore oil and gas means the number of affected companies will be

cut to around 320 from 2,500, the government said.

Some of Australia's biggest listed domestic miners, including

Newcrest Mining Ltd. (NCM.AU), Alumina Ltd. (AWC.AU) OZ Minerals

Ltd. (OZL.AU), Lihir Gold Ltd. (LGL.AU), and Iluka Resources Ltd.

(ILU.AU), would be largely unaffected thanks to their concentration

on other commodities.

The plan also introduces a threshold of A$50 million annual

resource profits before miners incur a tax under the iron ore and

coal regime.

Among Australia's listed iron ore and coal miners, only BHP

Billiton Ltd. (BHP), Rio Tinto Ltd. (RTP), Fortescue Metals Group

Ltd. (FMG.AU), Macarthur Coal Ltd. (MCC.AU), Mount Gibson Iron Ltd.

(MGX.AU), Centennial Coal Co. Ltd. (CEY.AU), Whitehaven Coal Ltd.

(WHC.AU), Grange Resources Ltd. (GRR.AU), and New Hope Corp.

(NHC.AU) have breached that level of operating profits since

2005.

Several offshore miners, such as Xstrata PLC (XTA.LN) and Anglo

American PLC (AAL.LN), will likely be included in regime.

Among other companies listed in Australia, OneSteel Ltd.

(OST.AU) also recorded A$161.9 million in operating profits from

iron ore mining in 2009, and Wesfarmers Ltd. (WES.AU) made A$915

million in coal mining profits in the same year.

"It's a long way improved from the original resource super

profits tax," said David George, a mining analyst at JPMorgan in

Sydney.

Analysis by JPMorgan prepared before the new tax proposal and

based on a 5% uplift rate and 28% corporate tax rate, rather than

the 7% uplift and 29% rate under Friday's proposal, posits a target

price of A$38.80 for BHP Billiton, A$92.53 for Rio Tinto, A$4.01

for Fortescue, and A$5 for Centennial.

That compares to share prices at 0140 GMT of A$37.38, A$65.84,

A$4.12 and A$4.49.

George said the target prices would, if anything, probably be

increased by the latest changes in the tax proposal.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689; david.fickling@dowjones.com

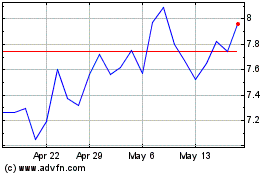

Iluka Resources (ASX:ILU)

Historical Stock Chart

From Apr 2024 to May 2024

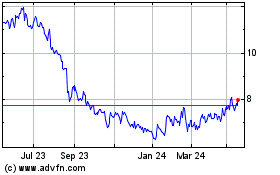

Iluka Resources (ASX:ILU)

Historical Stock Chart

From May 2023 to May 2024