Notification That Annual Report Will Be Submitted Late (nt 10-k)

April 18 2023 - 12:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

| | | | | | | | | | | | | | | | | | | | |

| (Check one): | ☒ Form 10-K | ☐ Form 20-F | ☐ Form 11-K | ☐ Form 10-Q | ☐ Form 10-D | ☐ Form N-CEN |

| ☐ Form N-CSR | | | | | |

| | | | | | | | | | | | | | | | | |

| For Period Ended: | December 31, 2022 | | |

| ☐ Transition Report on Form 10-K | |

| ☐ Transition Report on Form 20-F | |

| ☐ Transition Report on Form 11-K | |

| ☐ Transition Report on Form 10-Q | |

| For the Transition Period Ended: | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | |

| Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

| | |

| PART I — REGISTRANT INFORMATION |

|

| Unique Fabricating, Inc. |

| Full Name of Registrant |

|

| N/A |

| Former Name if Applicable |

|

| 800 Standard Parkway |

| Address of Principal Executive Office (Street and Number) |

|

| Auburn Hills, Michigan 48236 |

| City, State and Zip Code |

| | | | | | | | | | | |

| PART II — RULES 12b-25(b) AND (c) |

| | | |

| If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate) |

| | | |

| ☒ | (a) | The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| | |

| (b) | The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| | |

| (c) | The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

In January 2023, an investigation led by the Company’s Audit Committee was initiated into allegations that the Company’s internally prepared monthly financial statements for November 2022, which are required to be provided to the Company’s bank lenders, were reported inaccurately. The investigation is in process and has not yet been completed. However, based on findings revealed to date, management has determined that the Company has a material weakness in the Company’s internal control over financial reporting related to the appropriate review and approval of manual journal entries. The investigation has not reached a conclusion but it has not discovered any matters that indicate any previously-issued financial statements for any year or interim period should no longer be relied upon. However, until the investigation is concluded and any and all internal control deficiencies are identified and evaluated, management is unable to complete the Company’s financial reporting process and preparation of its financial statements for the fiscal year ended December 31, 2022. The Company does not anticipate that it will be able to file its Annual Report on Form 10-K on or before the fifteenth calendar day following the prescribed filing date as a result of the circumstances described above. Likewise, management believes that, until the errors are fully investigated and the internal controls over financial reporting properly evaluated, the Company is not in a position to issue its earnings announcement or to report preliminary unaudited financial data for the 2022 fourth quarter or the 2022 fiscal year.

The Company has experienced significant turnover of personnel in its finance and accounting departments. Furthermore, the Company’s financial condition limits its ability to augment the finance and accounting departments with outside resources. The Company believes that this will impair its ability to timely complete the preparation of financial statements for the fiscal year ended December 31, 2022.

The Company is currently operating past the expiration date of the forbearance period under its forbearance agreement with its bank lenders with respect to its credit agreement and has not been able to negotiate an extension of the forbearance period or a waiver of the defaults under the credit agreement. The Company at this time continues to have access to its revolving line of credit to fund its operations. There is no assurance that its lenders will continue to allow the Company to borrow under the line or that the Company will be able to extend the forbearance period or obtain waivers of defaults. A failure or refusal to permit the Company to access its credit facilities would render the Company unable to satisfy its liabilities as they come due in the ordinary course of business.

PART IV — OTHER INFORMATION

(1)Name and telephone number of person to contact in regard to this notification

| | | | | | | | | | | | | | | | | |

|

| |

| Brian Loftus | | (248) | | 409-4597 |

| (Name) | | (Area Code) | | (Telephone Number) |

(2)Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). Yes ☒ No ☐

(3)Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

Yes ☒ No ☐

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

The Company currently expects that its net sales will be approximately $10.1 million higher than the last fiscal year or approximately $135.6 million, driven by increased demand for our products from transportation customers as a result of higher North American light vehicle production and the impact of our increased cost recovery efforts to pass higher manufacturing costs to our customers compared to 2021. The Company expects its net loss will be higher than the net loss of the last fiscal year, however, given the work that remains to be completed the Company is unable to provide a reasonable estimate of the increase of the net loss.

| | | | | | | | | | | | | | | | | |

| | UNIQUE FABRICATING, INC. | | |

| | Name of Registrant as Specified in Charter) | | |

| | | | | |

| has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | | |

| Date: | April 18, 2023 | | By: | /s/ Brian P. Loftus |

| | | | Brian P. Loftus |

| | | | Chief Financial Officer |

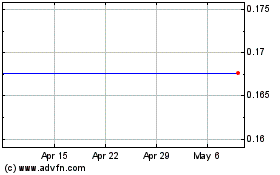

Unique Fabricating (AMEX:UFAB)

Historical Stock Chart

From Apr 2024 to May 2024

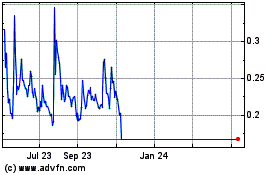

Unique Fabricating (AMEX:UFAB)

Historical Stock Chart

From May 2023 to May 2024