Additional Proxy Soliciting Materials (definitive) (defa14a)

June 21 2021 - 6:02AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act

of 1934

(Amendment No. __)

Filed by the Registrant ☒

Filed by a Party

other than the Registrant ☐

Check the

appropriate box:

☐ Preliminary

Proxy Statement

☐

Confidential, For Use of the Commission Only (As Permitted by Rule

14a-6(e)(2))

☐

Definitive Proxy Statement

☒

Definitive Additional Materials

☐

Soliciting Material under Rule 14a-12

|

Palatin

Technologies, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the

Registrant)

|

Payment of Filing

Fee (Check the appropriate box):

☒ No

fee required

☐ Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11.

(1) Title

of each class of securities to which transaction

applies:

(2) Aggregate

number of securities to which transaction applies:

(3) Per

unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how it

was determined):

(4) Proposed

maximum aggregate value of transaction:

(5) Total

fee paid:

☐ Fee

paid previously with preliminary materials.

☐ Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the form or schedule and the date

of its filing.

(1) Amount

Previously Paid:

(2) Form,

Schedule or Registration Statement No.:

(3) Filing

Party:

(4) Date

Filed:

June

18, 2021

Dear

Stockholder,

I write

to ask for your support on Proposal 3, an increase in authorized

common stock. This proposal was adjourned from our Annual Meeting

until July 8 at 9:00 a.m. Eastern Daylight Time to provide

shareholders with adequate time to review and consider the impact

of not approving an increase in our authorized common stock. Our

Board of Directors believe it is in the best interests of our

shareholders to approve Proposal 3.

●

We asked

shareholders to approve an increase in our authorized common stock

from 300M to 400M shares. We currently have less than 10% of

authorized stock available.

●

We have no current

plans to initiate an equity offering or otherwise issue any of the

additional shares of authorized common stock being requested, even

if Proposal 3 passes.

●

The increase is

about future flexibility. We need to have access to capital to

ensure we have sufficient funds to advance our development programs

and execute on our business plan and take advantage of any

strategic opportunities that may arise, all of which that could

result in an increase to shareholder value.

●

Both of the leading

independent shareholder voting advisory groups (ISS and Glass

Lewis) have recommended that shareholders vote FOR Proposal

3.

●

If there is not an

increase in our authorized common stock, and we decide that it is

in the best interests of our shareholders to conduct a financing in

the future, we will have to utilize other fund-raising mechanisms

that do not involve our common stock, such as a preferred share

offering, a convertible note offering, or a venture debt facility.

These “non-common stock” financings would likely

disadvantage our common stock shareholders.

Dr.

Carl Spana, Palatin’s CEO, and I are very excited about our

pipeline portfolio. Significant milestones and inflection points

over the next several quarters include:

●

A Phase 3 clinical

study of PL9643 in patients with dry eye disease is planned for the second half of calendar year

2021, with data readout potentially in the first half of calendar

year 2022.

●

A Phase 2 clinical

study with an oral formulation of PL8177 in ulcerative colitis

patients is planned for the second

half of calendar year 2021, with data readout potentially

mid-calendar year 2022.

●

Regarding

Vyleesi®, the quarter

ended March 31, 2021, reflected

significant increases across several metrics: gross product sales

increased 89%, net revenue increased 154%, and prescriptions

increased 24%, over the prior quarter ended December 31, 2020. Our

objective is to continue to show brand growth and license

commercial rights for the U.S. and other regions around the

globe.

We value your investment in Palatin and hope that you remain a

long-term shareholder and supporter. Carl and I are happy to

discuss these developments and Proposal 3 at your convenience.

Please do not hesitate to contact me via email at swills@palatin.com or on my

cell phone (267) 397-6916 or Carl via email at cspana@palatin.com or cell

phone (914) 484-6220.

Sincerely,

Stephen

T. Wills, CPA/MST

CFO/COO, Palatin

Technologies, Inc.

4-B Cedar Brook

Drive, Cedar Brook Corporate Center, Cranbury, NJ 08512 |

609-495-2200 | palatin.com

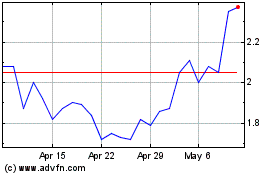

Palatin Technologies (AMEX:PTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Palatin Technologies (AMEX:PTN)

Historical Stock Chart

From Apr 2023 to Apr 2024