Enerflex Announces Strategic Acquisition of International Contract

Compression, Processing and After-Market Services Business for

US$430 Million

- Adds compression fleet and gas treating facilities under

long-term rental contracts generating stable, repeatable and high

margin revenue

- Provides access to new high growth international markets

- Presents attractive cross-sell opportunities

- Increases recurring Service and Rental revenue from 27% to 33%

of total revenue on a pro-forma basis

- Increases EBITDA margins from 9% to 12% on a pro-forma

basis

- Business generated EBITDA of US$57 million on revenue of

US$128 million for the year ended December 31, 2013, representing a

45% EBITDA margin

- Transaction is expected to be immediately accretive to EPS

- Presentation and conference call tomorrow, June 2, 2014 at

7:00 a.m. MDT

CALGARY, ALBERTA--(Marketwired - Jun 1, 2014) - Enerflex Ltd.

(TSX:EFX) ("Enerflex" or the "Company"), announced today that it

has entered into a definitive agreement to acquire the

international contract compression and processing business, as well

as the after-market services business of Axip Energy Services, LP

("Axip") for US$430 million in cash, subject to certain purchase

price adjustments ("Acquisition").

The transaction is consistent with Enerflex's objective of

increasing recurring revenue streams and expanding geographic

markets while supporting the Company's strategy of being a global

supplier of turnkey energy solutions through compression,

processing and electric power equipment sales, after-market service

and contract operations.

"This acquisition provides Enerflex with an established platform

to expand into growing geographies in a business with attractive

margins and recurring revenue. It accelerates our ability to

deliver full cycle contract services and cross-sell fabrication

product offerings into high-growth international markets," stated

J. Blair Goertzen, Enerflex's President and Chief Executive

Officer.

Key Highlights

- Materially increases recurring revenue and gross margin.

Contracted compression, processing and maintenance businesses are

highly profitable and provide stable, predictable and repeatable

cash flow;

- Significantly increases size and scale of global product and

service offerings;

- Provides new access to attractive oil and gas producing

countries including Mexico, Argentina, Brazil, Peru and Thailand.

Enhances existing operations in Bahrain, Colombia, Malaysia and

Indonesia and diversifies Enerflex's customer base and revenue

streams;

- Provides meaningful "cross-sell" fabrication revenue

opportunities through expanded presence in attractive international

regions;

- Captures first-mover advantage in Mexico's recently announced

oil and gas industry liberalization initiatives through Enerflex's

ability to provide single-source solutions for fabrication,

compression and processing and treating;

- Adds a strong contract operations management team currently led

by Patricia Martinez, Senior Vice President of Axip International

Contract Services. Ms. Martinez will join Enerflex's executive

management team as President, Latin America and will be responsible

for the expansion and growth of the contract operations business

and Enerflex's product sales in the region; and

- The purchase price represents an acquisition multiple of 7.5x

2013 EBITDA, after adjusting for certain non-recurring revenues and

costs, which will not be required for the business going forward,

and excluding any potential synergies. Enerflex expects the

transaction to be immediately accretive to earnings per share.

Acquired Business

Axip's international contract compression and processing

business and after-market service is a leading provider of global

energy services. Headquartered in Houston, Texas, Axip's

international business has 173 employees with operations in Mexico,

South America, Southeast Asia and the Middle East. Key energy

infrastructure assets to be acquired include a 448 unit compression

fleet totaling approximately 285,000 horsepower, running at

utilization levels above 90% and having an average fleet age of

approximately 5.5 years. As well, the assets to be acquired include

gas treating facilities in Mexico, Argentina and Peru. All members

of the current Axip international senior management team will stay

with the business following the closing of the Acquisition. For the

year ended December 31, 2013, combined revenue and EBITDA from

compression, processing and after-market services were US$128

million and US$57 million respectively, after adjusting for certain

non-recurring revenues and costs, representing an EBITDA margin of

45%. The Acquisition does not include Axip's U.S. assets.

Financing of the Transaction

The Acquisition will be financed with at least C$125 million

from cash-on-hand, with the balance funded through new C$675

million committed revolving and operating facilities led by The

Toronto-Dominion Bank and Scotiabank. At closing, Enerflex's

expected pro forma Net Debt/Trailing Twelve Month EBITDA ("TTM

EBITDA") ratio will be approximately 2.0x. As at March 31, 2014,

Enerflex had cash-on-hand of approximately C$219 million.

Closing of the Acquisition and Other Information

Closing of the Acquisition is subject to certain conditions,

including receipt of several regulatory and third party approvals

and is not expected to occur before June 30, 2014. These conditions

are described in the definitive agreement for the Acquisition which

will be available on SEDAR at www.sedar.com.

Advisor

Scotiabank is acting as financial advisor to Enerflex.

Conference Call and Webcast

Analysts, investors, members of the media and other interested

parties are invited to participate in a teleconference and audio

webcast on Monday, June 2, 2014 at 7:00 a.m. MDT to discuss the

Acquisition.

To participate, please call 1.800.734.4208 (North America) or

1.416.981.9000 (Outside North America). Please dial in 10 minutes

prior to the start of the call. No passcode is required. The live

audio webcast of the teleconference will be available on the

Enerflex website at www.enerflex.com under the Investors section on

June 2, 2014 at 7:00 a.m. MDT.

Presentation slides for the conference call will be made

available on the Enerflex website located at www.enerflex.com.

A replay of the teleconference will be available one hour after

the conclusion of the call until midnight, June 9, 2014. Please

call 1.800.558.5253 or 1.416.626.4100 and enter passcode

21718651.

About Enerflex

Enerflex Ltd. is a single source supplier of natural gas

compression, oil and gas processing, refrigeration systems and

electric power equipment - plus in-house engineering and mechanical

service expertise. The Company's broad in-house resources provide

the capability to engineer, design, manufacture, construct,

commission and service hydrocarbon handling systems. Enerflex's

expertise encompasses field production facilities, compression and

natural gas processing plants, CO2 processing plants, refrigeration

systems and electric power equipment servicing the natural gas

production industry.

Headquartered in Calgary, Canada, Enerflex has approximately

3,100 employees worldwide. Enerflex, its subsidiaries, interests in

associates and joint-ventures operate in Canada, the United States,

Colombia, Australia, the United Kingdom, Russia, the United Arab

Emirates, Oman, Bahrain, Indonesia, Malaysia and Singapore.

Enerflex's shares trade on the Toronto Stock Exchange under the

symbol "EFX". For more information about Enerflex, go to

www.enerflex.com.

Advisory Regarding Forward-Looking Statements

In the interest of providing readers with information

regarding Enerflex, including management's assessment of the future

plans and operations of Enerflex, certain statements contained in

this news release constitute forward-looking statements or

information (collectively "forward-looking

statements") within the meaning of applicable securities

legislation. Forward-looking statements are typically identified by

words such as "anticipate", "continue", "estimate", "expect",

"forecast", "may", "will", "project", "could", "plan", "intend",

"should", "believe", "outlook", "potential", "target" and similar

words suggesting future events or future performance. In

particular, this news release contains, without limitation,

forward-looking statements pertaining to the following: certain

anticipated strategic benefits of the Acquisition, including the

anticipated effects of the Acquisition on Enerflex's recurring

revenues, gross margins, international growth, and profitability;

that the Acquisition will be accretive to the Company's earnings

per share; that the Acquisition will provide access to new markets;

that Enerflex will be able to cross-sell its current products; the

possible advantages of being "first mover" in the Mexican market;

expected additions to Enerflex's management team post-Acquisition;

the sources of capital to fund the anticipated purchase price of

the Acquisition, including the expectation that the new revolving

credit facility will be available for use by Enerflex to fund a

portion of the purchase price; certain of the assets expected to be

acquired by Enerflex as a result of the Acquisition; Enerflex's

expected pro-forma net debt and LTM (last twelve month) EBITDA

ratios after the completion of the Acquisition; and the expected

closing date of the Acquisition.

With respect to forward-looking statements contained in this

news release, Enerflex has made assumptions regarding, among other

things: the ability of Enerflex to execute and realize on the

anticipated benefits of the Acquisition; the value and benefits of

the Acquisition; that Enerflex's lenders will not amend, terminate

or otherwise fail to provide the credit facilities described

herein; that the acquired business will perform in a manner

consistent with past periods; that no contractual or other

arrangements in respect of the acquired business will be amended,

modified or terminated as a result of the Acquisition, or

otherwise; that all conditions to closing of the Acquisition,

including receiving all required third party and regulatory

approvals, will be provided in a timely manner and without

unforeseen or onerous conditions; that the Company's presence in

Mexico prior to the arrival of certain other competitors will prove

advantageous; that the current commitments by certain Axip managers

to continue with the business will remain accurate; expectations

and assumptions concerning prevailing usage rates, exchange rates,

interest rates, applicable tax laws; estimates of operating costs;

anticipated timing and results of capital expenditures; the

sufficiency of budgeted capital expenditures in carrying out

planned activities; the state of the economy and the financial

conditions of Enerflex's and Axip's customers; results of

operations; business prospects and opportunities; the availability

and cost of financing, labor and services; the impact of increasing

competition; the effect of seasonality fluctuations; the risk of

violations of law, breaches of policies or unethical behavior;

property and casualty risks; injuries at the workplace or health

issues; the risk of material adverse effects arising as a result of

litigation; and events or series of events may cause business

interruptions.

Although Enerflex believes that the expectations reflected

in the forward looking statements contained in this news release,

and the assumptions on which such forward-looking statements are

made, are reasonable, there can be no assurance that such

expectations will prove to be correct. Readers are cautioned not to

place undue reliance on forward-looking statements included in this

news release, as there can be no assurance that the plans,

intentions or expectations upon which the forward-looking

statements are based will occur. By their nature, forward-looking

statements involve numerous assumptions, known and unknown risks

and uncertainties that contribute to the possibility that the

predictions, forecasts, projections and other forward-looking

statements will not occur, which may cause Enerflex's actual

performance and financial results in future periods to differ

materially from any estimates or projections of future performance

or results expressed or implied by such forward-looking statements.

These risks and uncertainties include, among other things, the

following: that the Acquisition may not close when planned (or at

all) or on the terms and conditions set forth herein; the failure

of Enerflex and/or Axip to obtain the necessary regulatory and

other third party approvals required in order to proceed with the

Acquisition; the risk that the proposed Acquisition could be

modified, restructured or terminated; the failure of Enerflex to

secure its new credit facility on terms satisfactory to it, or at

all; volatility in market prices for oil and natural gas; incorrect

assessment of the value of the Acquisition; risks inherent in

operating in foreign and emerging markets; failure to realize the

anticipated benefits and synergies of the Acquisition; the impact

of general economic conditions; industry conditions, including the

adoption of new laws and regulations and changes in how they are

interpreted and enforced; volatility of oil and gas prices; oil and

gas product supply and demand; risks inherent in the ability to

generate sufficient cash flow from operations to meet current and

future obligations, including future dividends to shareholders of

the Company; increased competition; the lack of availability of

qualified personnel or management (including those that are

expected to continue with the acquired business); labour unrest;

political unrest; fluctuations in foreign exchange or interest

rates; stock market volatility; opportunities available to, or

pursued by, the Company; obtaining financing; and the other factors

described under "Risk Factors" in Enerflex's most recently filed

Annual Information Form available in Canada at www.sedar.com.

Readers are cautioned that this list of risk factors should not be

construed as exhaustive.

The forward-looking statements contained in this news

release speak only as of the date of this news release. Except as

expressly required by applicable securities laws, Enerflex does not

undertake any obligation to publicly update or revise any forward

looking statements, whether as a result of new information, future

events or otherwise. The forward-looking statements contained in

this news release are expressly qualified by this cautionary

statement.

Non‐GAAP Measures

This news release contains the term "Net Debt" and "EBITDA"

(earnings before interest, tax, depreciation and amortization)

which do not have a standardized meaning prescribed by Canadian

generally accepted accounting principles ("GAAP") and therefore may

not be comparable with the calculation of similar measures by other

companies. "Net Debt" and "TTM EBITDA" in this news release are

calculated in accordance with Enerflex's syncidated credit facility

covenant calculation requirements. EBITDA provides the results

generated by the Company's primary business activities prior to

consideration of how those activities are financed, assets are

amortized or how the results are taxed in various jurisdictions.

EBITDA as presented is not intended to represent cash provided by

operating activities, net earnings or other measures of financial

performance calculated in accordance with GAAP. These measures have

been described and presented in this news release in order to

provide readers with additional information regarding the Company's

liquidity and its ability to generate funds to finance its

operations and dividends.

Note on Certain Financial Information

Certain financial and other information provided herein in

respect of Axip's international business that is subject to the

Acquisition has been prepared by management of Axip on a

"carve-out" basis in accordance with US generally accepted

accounting principles which differ in certain respects from those

principles that would have been followed had such financial

information been prepared in accordance with Canadian GAAP. As at

the date hereof, such "carve-out" financial information has not

been audited and, as a result, may be subject to change. All

historical financial information in respect of Axip and the

International Business as the case may be, is based on information

supplied by Axip. The Company has not independently verified such

financial information and as such does not guarantee the accuracy

and completeness of the information.

J. Blair GoertzenPresident & Chief Executive

Officer403.236.6852D. James HarbilasExecutive Vice President &

Chief Financial Officer403.236.6857

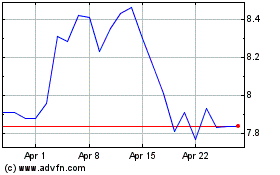

Enerflex (TSX:EFX)

Historical Stock Chart

From Mar 2024 to Apr 2024

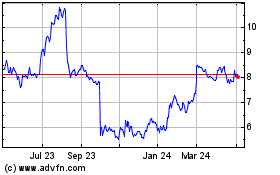

Enerflex (TSX:EFX)

Historical Stock Chart

From Apr 2023 to Apr 2024