Black Iron Updates Bankable Feasibility Study Showing 48% IRR, 2 Year Payback and US$3.3 Billion NPV for Shymanivske Project

January 22 2014 - 11:05PM

Marketwired Canada

Black Iron Inc. ("Black Iron" or the "Company") (TSX:BKI) (FRANKFURT:BIN) has

updated its current Bankable Feasibility Study ("BFS"), incorporating pilot

plant test work, completed on its Shymanivske Iron Ore Project located in Krivoy

Rog, Ukraine (the "Project"). The updated BFS outlines an operation producing

9.9 million tonnes per year of high-grade 68% iron ore concentrate, projecting a

48% internal rate of return ("IRR"), two year payback and a US$3.3 billion net

present value ("NPV") at an 8% discount rate.

The primary reason for updating the previous report filed in December 2012 is to

include results from pilot plant test work conducted throughout 2013, which

resulted in an optimized process design and layout, along with revised

infrastructure usage rates confirmed through several recently signed protocols

of intent. The most significant changes implemented are: changing from dry

cobbing to more efficient wet cobbing at a finer particle size resulting in an

increase from 10% to 40% rejection of waste rock prior to grinding; elimination

of the second grinding stage resulting in a 14% reduction in total operational

running active power; reducing the plant footprint through a more optimal

layout; and an 8% increase in iron ore concentrate production from 9.2 to 9.9

million tonnes per year with essentially no change in capital cost.

Financial metrics contained in the BFS report are shown on a pre and after tax

basis and in both cases are inclusive of royalties. Ukraine has a corporate tax

rate of 16% effective January 1, 2014 and a mining royalty rate of $0.09 per

tonne of ore mined (less than 1%) payable to the State.

The Table below summarizes the key elements of the BFS:

High-Grade 68% Concentrate (all currency is US$)

----------------------------------------------------------------------------

Measured and Indicated Resources (at 31.6% Total Fe)(i) 646 Mt

----------------------------------------------------------------------------

Proven and Probable Reserves (at 31.1% Total Fe)(i) 449 Mt

----------------------------------------------------------------------------

Annual Production Rate (average life of mine, post ramp- 9.9 Mt

up year)

----------------------------------------------------------------------------

Estimated Mine Life (based on Proven and Probable 14 years

Reserves only)

----------------------------------------------------------------------------

Final Product Iron Grade (Fine Iron Ore Concentrate) 68% Fe

----------------------------------------------------------------------------

Projected Plant Start-up and Commissioning Q4 2016

----------------------------------------------------------------------------

Projected Commencement of Revenue Generation Q1 2017

----------------------------------------------------------------------------

Long Term CFR Benchmark Iron Ore Concentrate Price $95 /t

Estimate (62% Fe)

----------------------------------------------------------------------------

Total Estimated Capital Costs (excluding sustaining $1,097 million

capital)

----------------------------------------------------------------------------

Life of Mine FOB OPEX (Beneficiation, Mine, $44.54 /t

Transportation & Loading) $29.64 /t

Mine Gate OPEX (Beneficiation & Mine)

----------------------------------------------------------------------------

Average Annual Cash Flow (pre-tax) $630 million

Average Annual Cash Flow (after-tax) $536 million

----------------------------------------------------------------------------

NPV at 8% discount (pre-tax) $3.3 billion

NPV at 8% discount (after-tax) $2.6 billion

----------------------------------------------------------------------------

IRR (pre-tax) 48.0%

IRR (after-tax) 39.1%

----------------------------------------------------------------------------

Projected Years to Payback (at 8% Discount Rate, pre- 2.0 years

tax) 2.5 years

Projected Years to Payback (at 8% Discount Rate, after-

tax)

----------------------------------------------------------------------------

(i) See "About Black Iron" section at end of this press release

Matt Simpson, Black Iron's President and CEO, commented, "The operation outlined

by this BFS for the Shymanivske Project continues to clearly illustrate the

potential for a high-value, low net cost iron ore development project. The

optimized process design and layout developed for this new study, based on

significant pilot scale test work, results in increased annual iron ore

concentrate production of approximately 8%, while holding initial capital costs

virtually unchanged. As a result of these improvements, the Project's access to

significant existing infrastructure (railway, power lines and port), and the

availability of competitively-priced skilled labour, the BFS continues to show

extremely attractive and robust economics."

Financial Sensitivities at Various Discount Rates

----------------------------------------------------------------------------

(pre-tax) (after-tax)

----------------------------------------------------------------------------

IRR (pre-tax) 48.0% 39.1%

----------------------------------------------------------------------------

NPV Payback NPV Payback

Discount Rate US$ (Millions) (Years) US$ (Millions) (Years)

----------------------------------------------------------------------------

0% $ 7,165 1.8 $ 5,877 2.1

----------------------------------------------------------------------------

6% $ 3,997 1.9 $ 3,177 2.4

----------------------------------------------------------------------------

8% $ 3,304 2.0 $ 2,609 2.5

----------------------------------------------------------------------------

10% $ 2,756 2.1 $ 2,148 2.6

----------------------------------------------------------------------------

The Project has favourable economic potential across a range of discount rates.

The operations outlined in this BFS are projected to generate over U.S. $1,216

million in average annual revenue over the life of mine.

The life of mine strip ratio is estimated at 1.64:1, which is essentially

unchanged from the December 2012 reported value of 1.63:1. On the basis of the

metallurgical test and beneficiation plant design work completed for this BFS,

it is estimated that the 449 million tonnes of reserves will result in a project

life of 14 years based on the average 9.9 million tonnes per year iron ore

concentrate production rate. The Company believes that additional exploration

and definition drilling work have the potential to expand the existing resource

and upgrade the 188 Mt of Inferred mineral resources to the Measured and

Indicated classification, potentially adding up to five years to the Project

life. With successful exploration in the North end of Shymanivske and the

addition of resources from the nearly adjacent Zelenivske Project, Black Iron

expects to be able to support an even higher annual production rate through a

potential second phase expansion, which would be expected to further increase

the Project NPV.

George Mover, Black Iron's Chief Operating Officer, added, "We are pleased with

the level of detailed engineering proficiency and precision that went into this

BFS. Through this process, we confirmed and implemented several improvements to

the work completed in the previous BFS study. As a result, we are now

considering an initial operation with 8% higher annual production, relatively

unchanged initial capital requirements, and only a modest 1.3% increase in

operating costs relative to our previous study. The updated operating costs are

inclusive of firm letters of intent signed with several infrastructure and

utility service providers and were benchmarked against our development partner's

actual operating experience. The Project's capital intensity is improving,

positioning it even lower into the first quartile of worldwide development

projects that should bode well to source project financing; particularly when

coupled with our relatively low operating cost, and proximity to end-user

markets of Turkey, Middle East and Europe."

Details and Assumptions

The total capital expenditure to develop the mine, concentrator and

infrastructure tie-ins is estimated at U.S. $1,097 million to produce 9.9

million tonnes per year of high-grade 68% iron ore concentrate. The capital cost

estimate excludes the sustaining capital cost of U.S. $483 million spread over

the life of mine. Assessment of the preferred port facility, backed up by a

formal protocol (letter) of intent, confirms that sufficient capacity exists for

the planned production.

----------------------------------------------------------------------------

Summary of Estimated Initial Capital Costs (US$ in Millions)

----------------------------------------------------------------------------

Mine 162

----------------------------------------------------------------------------

Beneficiation Plant 475

----------------------------------------------------------------------------

Tailings and Waste 21

----------------------------------------------------------------------------

Project Infrastructure 113

----------------------------------------------------------------------------

Project In-directs (mainly EPCM) 102

----------------------------------------------------------------------------

Owner's Costs (includes land acquisition) 81

----------------------------------------------------------------------------

Contingencies (15%) 143

----------------------------------------------------------------------------

TOTAL 1,097

----------------------------------------------------------------------------

The 15% contingency estimate includes a 5% design allowance. The total average

Freight On Board operating costs over 14 years are estimated at U.S. $44.54 per

tonne of high grade 68% iron ore concentrate broken out as follows:

----------------------------------------------------------------------------

Summary of Estimated Operating Costs US$/tonne of Concentrate

(Average Mine Life )

----------------------------------------------------------------------------

Mine $ 15.46

----------------------------------------------------------------------------

Beneficiation Plant $ 12.50

----------------------------------------------------------------------------

Tailings & Waste $ 0.08

----------------------------------------------------------------------------

Environmental $ 0.26

----------------------------------------------------------------------------

Infrastructure (primarily rail & port) $ 15.65

----------------------------------------------------------------------------

General & Administration $ 0.59

----------------------------------------------------------------------------

TOTAL $ 44.54

----------------------------------------------------------------------------

Consistent with practice in the industry, this BFS has been prepared with an

engineering accuracy of +/-15%.

Currency Sensitivity

For the purpose of the BFS an exchange rate of 8.2 UAH per US$ has been used for

the CAPEX (up to January 2016) and 9.5 UAH per US$ for the OPEX and Sustaining

Capital (2017 and beyond) based on review of several economic forecasts.

Variations in the exchange rates from year 2016 onward impact the financial

analysis as follows:

Impact of Ukraine Hryvna Exposure - BFS Currency Sensitivity (US$)

----------------------------------------------------------------------------

Exchange Rate as of year 2016 onward (UAH/US$)

----------------------------------------

8:1 9:1 9.5:1 10:1 11:1

----------------------------------------------------------------------------

NPV @ 8% discount

pre-tax (billion) $ 3.2 $ 3.3 $ 3.3 $ 3.3 $ 3.4

after-tax (billion) $ 2.5 $ 2.6 $ 2.6 $ 2.6 $ 2.7

----------------------------------------------------------------------------

Total Estimated Capital Cost

(million) $ 1097 $ 1097 $ 1097 $ 1097 $ 1097

----------------------------------------------------------------------------

Estimated Operating Cost (per tonne) $47.71 $45.48 $44.54 $43.70 $42.24

----------------------------------------------------------------------------

Average Annual Cash Flow

pre-tax (million) $ 575 $ 586 $ 590 $ 594 $ 601

after-tax (million) $ 494 $ 502 $ 506 $ 509 $ 515

----------------------------------------------------------------------------

Updated Bankable Feasibility Study Report

The updated BFS has been prepared in accordance with the guidelines of National

Instrument 43-101 by the independent firms of Lycopodium Minerals Canada Ltd.;

Soutex Mineral & Metallurgical Consultants; Watts, Griffis and McOuat Limited;

and P&E Mining Consultants Inc. The final BFS technical report, which will also

include the current mineral resource and reserve estimate, will be filed on

SEDAR within 45 days of the publication of this news release.

Analyst and Shareholder Conference Call

Black Iron will host a conference call today, January 23, 2014, at 8:30 a.m.,

EST (1:30 p.m., GMT and 3:30 p.m., EET) to discuss the updated BFS results. To

participate in the call please dial the following:

International: +1 647 788 4901

Toll Free (North America): 1 877 201 0168

To register and listen to the webcast of the call, please go to Black Iron's

website at www.blackiron.com.

Qualified Persons

The contents of this press release have been prepared under the supervision of

and reviewed and approved by Qualified Persons, as follows:

-- Balaji Thangavel, P.Eng., Mauro Batista, P.Eng. and Enayat Shahrokni,

P.Eng., Lycopodium Minerals Canada Ltd., QP for the Plant

Infrastructure, CAPEX, and OPEX;

-- Daniel Roy, P.Eng, Soutex Inc., QP for Metallurgical testing and Process

design;

-- Michael Kociumbas, P.Geo. and Rick Risto, P.Geo., Watts, Griffis and

McOuat Limited, QPs for mineral resources estimate and QA/QC and data

verification;

-- Eugene Puritch, P.Eng., P&E Mining Consultants Inc., QP for the mine

engineering aspects and the mineral reserves estimate.

These persons are Qualified Persons as defined by NI 43-101, are independent of

Black Iron, and have reviewed the content of this press release.

About Black Iron

Black Iron is an iron ore exploration and development company, advancing its 100

percent-owned Shymanivske project located in Kryviy Rih, Ukraine. This project

contains an NI 43-101 compliant resource, with 645.8 Mt Measured and Indicated

mineral resources, consisting of 355.1 Mt Measured mineral resources grading

32.0% Total iron and 19.5% Magnetic iron, and Indicated mineral resources of

290.7 Mt grading 31.1% Total iron and 17.9% Magnetic iron, using a cut-off grade

of 10% Magnetic iron. Additionally, the project contains 188.3 Mt of Inferred

mineral resources grading 30.1% Total iron and 18.4% Magnetic iron. The project

is surrounded by five other operating mines, including ArcelorMittal's iron ore

complex. The Company believes that existing infrastructure, including access to

power, rail and port facilities, will allow for a quick development timeline to

production. Further, the Company holds an exploration permit for the adjacent

Zelenivske project, which it intends to further explore to determine its

potential. Please visit the Company's website at www.blackiron.com or write us

at info@blackiron.com for more information.

Forward-Looking Information

This press release contains forward-looking information which may include, but

is not limited to, statements about the results of the BFS and the development

potential of the Company and its project; the timing and amount of future

exploration and development of the project; and the future financial or

operating performance of the Company and its projects. Often, but not always,

forward-looking information can be identified by the use of words such as

"plans," "expects," "is expected," "budget," "scheduled," "estimates,"

"forecasts," "intends," "anticipates" or "believes" or variations (including

negative variations) of such words and phrases, or by the use of words or

phrases that state that certain actions, events or results "may," "could,"

"would," "might" or "will" be taken, occur or be achieved.

Forward-looking information is based on certain assumptions and analyses made by

the Company and based on known facts at the time. Forward-looking information

involves known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the Company and/or its

subsidiaries to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking information contained

in this press release, including, without limitation, those described in the

Company's public disclosure documents which may be found under the Company's

profile on SEDAR. Although the Company has attempted to identify important

factors that could cause actual actions, events or results to differ materially

from those described in such forward-looking information, there may be other

factors that may cause actions, events or results to differ from those

anticipated, estimated or intended. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying such forward-looking

information prove incorrect, actual results, performance or achievements may

vary materially from those expressed or implied by the forward-looking

information contained in this press release. The forward-looking information

contained herein is made as of the date of this press release and the Company

disclaims any obligation to update or review such information or statements,

whether as a result of new information, future events or results or otherwise,

except as required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

Black Iron Inc.

Michael McAllister

Manager, Investor Relations

+1 (416) 309-2950

info@blackiron.com

Black Iron Inc.

Matt Simpson

President & Chief Executive Officer

+1 (416) 309-2138

info@blackiron.com

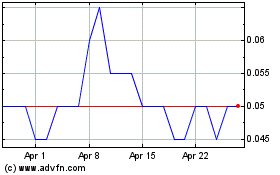

Black Iron (TSX:BKI)

Historical Stock Chart

From Mar 2024 to Apr 2024

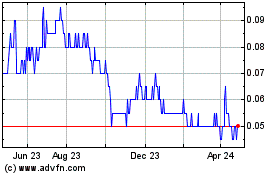

Black Iron (TSX:BKI)

Historical Stock Chart

From Apr 2023 to Apr 2024