RioCan REIT Announces Public Offering of $150 Million of Series U Senior Unsecured Debentures

January 16 2014 - 10:18AM

Marketwired Canada

NOT FOR DISTRIBUTION IN THE UNITED STATES OR OVER UNITED STATES WIRE SERVICES

RioCan Real Estate Investment Trust ("RioCan") (TSX:REI.UN) announced today that

it has reached an agreement to issue to the public on a bought deal basis,

subject to regulatory approval, $150 million principal amount of Series U senior

unsecured debentures (the "Debentures").

The Debentures are being issued by a syndicate of underwriters co-led by RBC

Capital Markets, TD Securities and BMO Capital Markets. The Debentures will

carry a coupon rate of 3.62% and will mature on June 1, 2020.

The net proceeds will be used by RioCan to fund development, for property

acquisitions, to repay certain indebtedness and for general trust purposes.

It is a condition of closing that DBRS Limited ("DBRS") assign a rating of

BBB(high) with a stable trend and Standard & Poor's, a division of the McGraw

Hill Companies, Inc. ("S&P") assign a rating of BBB- for the Debentures.

The offering is being made under RioCan's base shelf short form prospectus dated

June 11, 2012. The terms of the offering will be described in a prospectus

supplement to be filed with Canadian securities regulators. The offering is

expected to close on or about January 23, 2014.

The press release shall not constitute an offer to sell, or the solicitation of

an offer to buy, any securities in any jurisdiction. The Debentures being

offered have not been and will not be registered under the U.S. Securities Act

of 1933 and state securities laws. Accordingly, the Debentures may not be

offered or sold to U.S. persons except pursuant to applicable exemptions from

registration.

About RioCan:

RioCan is Canada's largest real estate investment trust with a total

capitalization of approximately $13.6 billion as at September 30, 2013. It owns

and manages Canada's largest portfolio of shopping centres with ownership

interests in a portfolio of 346 retail properties containing more than 83

million square feet, including 51 grocery anchored and new format retail centres

containing 14 million square feet in the United States as at September 30, 2013.

RioCan's portfolio also includes 15 properties under development in Canada. For

further information, please refer to RioCan's website at www.riocan.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

RioCan Real Estate Investment Trust

Rags Davloor

Executive Vice President & CFO

(416) 642-3554

www.riocan.com

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Mar 2024 to Apr 2024

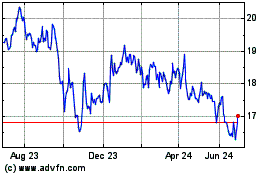

RioCan Real Estate Inves... (TSX:REI.UN)

Historical Stock Chart

From Apr 2023 to Apr 2024