Roche's Product Growth on Track, Biosimilars Erode European Sales -- Earnings Review

February 01 2018 - 9:45AM

Dow Jones News

By Sonia Amaral Rohter

Roche Holding AG (ROG.EB) on Thursday reported its full-year

results. Here is how the results came in:

SALES: The Swiss pharmaceuticals company had sales of 53.3

billion Swiss francs ($57.15 billion) in 2017, up from CHF50.58

billion a year earlier. Analysts had expected sales of about

CHF53.15 billion, according to a consensus forecast provided by

FactSet.

EARNINGS: Net profit for 2017 was CHF8.63 billion, down from

CHF9.58 billion in 2016. Core operating profit increased 3.2% to

CHF19.01 billion.

WHAT TO WATCH:

U.S. TAX REFORM: Roche said changes to the U.S. tax rate would

help earnings in 2018. The company expects high single-digit growth

in core earnings per share, compared with growth "broadly in line

with sales" when the effects of U.S. tax reform are excluded. Roche

forecast sales growth of "stable to low single digits at constant

exchange rates" for 2018. The change in the U.S. tax rate resulted

in a transitional expense of CHF116 million in 2017, Roche said. If

the new rates had applied for all of 2017, the effective core tax

rate would have been in the low twenties in percentage terms, Roche

said, excluding any transition impact. Roche's actual core

effective tax rate in 2017 was 26.6%.

HEMLIBRA: Roche said that Hemlibra has had "promising uptake" in

the U.S. and reported sales of CHF3 million for the year. Roche

launched Hemlibra, a hemophilia treatment, after FDA approval in

November. The hemophilia field is increasingly competitive and

analysts have high expectations for Hemlibra sales.

IMPACT FROM BIOSIMILARS: With several of Roche's blockbuster

drugs facing competition from cheaper copycats, the topline impact

of biosimilars was a source of concern. Biosimilar competition had

a noticeable impact in Europe, where Roche called competition from

MabThera/Rituxan copycats a "major driver" of sales decline in

2017. Sales of the cancer treatment grew 1% globally at constant

currency but fell 11% in Europe following the entry of biosimilars

into some markets in mid-2017. Roche expects MabThera/Rituxan

biosimilars to launch in the U.S. market later this year.

NEW PRODUCT GROWTH: Roche is relying on new products to offset

declining sales of some legacy drugs. Analysts were particularly

interested in the performance of Ocrevus, a treatment for multiple

sclerosis, and Tecentriq, a cancer immunotherapy. Together with

Alecensa, another cancer drug, they contributed CHF1.4 billion of

new sales in 2017, representing 65% of pharmaceuticals division

growth, Roche said. Full-year sales of Tecentriq more than tripled,

while Alecensa's doubled. Ocrevus, which launched last year,

brought in CHF869 million in sales in 2017 and "now has over 5%

market share of the U.S. multiple sclerosis market, an impressive

feat after just three quarters of sales," analysts at Berenberg

said.

Write to Sonia Amaral Rohter at

sonia.amaralrohter@dowjones.com

(END) Dow Jones Newswires

February 01, 2018 09:30 ET (14:30 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

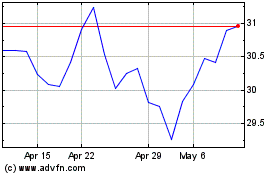

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

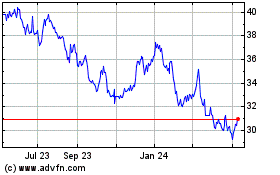

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Apr 2023 to Apr 2024