Report of Foreign Issuer (6-k)

February 08 2018 - 6:07AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February, 2018

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Avenida Presidente Vargas, 409 - 13th floor,

Edifício Herm. Stoltz - Centro, CEP 20071-003,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

CENTRAIS ELETRICAS BRASILEIRAS S/A

CNPJ: 00.001.180/0001-26 Companhia Aberta

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

To approve the sale of all shares, except 1 (one) common share, issued by

|

|

|

|

|

|

|

|

Companhia de Eletricidade do Acre (hereinafter referred to as “Eletroacre”), owned by

|

|

|

|

|

|

|

|

Eletrobras, in a privatization auction to be conducted by Brasil, Bolsa, Balcão S.A. –

|

|

|

|

|

|

|

|

B3, for the price of BRL 50,000.00 (Fifty Thousand Brazilian Reais), connected to the

|

|

|

|

|

|

|

|

granting of concession by the Granting Power for the term of 30 (thirty) years, under

|

|

|

|

|

|

|

|

the terms of Paragraph 1-A of Article 8 of Law 12,783/2013 and in accordance with

|

|

|

|

|

|

|

|

the conditions established under the Resolution of the Investment Partnership

|

|

|

|

|

|

|

|

Program Council - CPPI number 20, dated November 8, 2017, with the amendments

|

|

|

|

|

|

|

|

1

|

34,796,780

|

45.50%

|

40,706,182

|

53.23%

|

967,800

|

1.27%

|

|

to the Resolutions of the Investment Partnership Program Council - CPPI number 28,

|

|

|

|

|

|

|

|

dated November 22, 2017, and number 29, dated December 28, 2017, including the

|

|

|

|

|

|

|

|

assumption by Eletrobras of debts of said Distribution Company and/or the conversion

|

|

|

|

|

|

|

|

of the debts of said Distribution Company in capital increase by Eletrobras, at an

|

|

|

|

|

|

|

|

amount up to BRL 113,779,871.99 (One Hundred and Thirteen Million, Seven

|

|

|

|

|

|

|

|

Hundred and Seventy-Nine Thousand, Eight Hundred and Seventy-One Brazilian

|

|

|

|

|

|

|

|

Reais and Ninety-Nine cents), in the period established by the 169th Extraordinary

|

|

|

|

|

|

|

|

General Meeting, held on December 28, 2017;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

To approve, as long as item 1 disclosed above is not approved, the dissolution and

|

|

|

|

|

|

|

|

2

|

28,830,927

|

37.70%

|

46,672,035

|

61.03%

|

967,800

|

1.27%

|

|

liquidation of Eletroacre;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

To approve, since the sale referred to in Item 1 disclosed above is approved, that

|

|

|

|

|

|

|

|

Eletrobras assumes the rights of Eletroacre, regarding the Fuel Consumption Account

|

|

|

|

|

|

|

|

- CCC and the Energy Development Account - CDE, recognized in the Financial

|

|

|

|

|

|

|

|

Statements of the Distribution Companies on the base date of the studies considering

|

|

|

|

|

|

|

|

the adjustments up to June 30, 2017, amounting up to BRL 296,167 thousand (Two

|

|

|

|

|

|

|

|

3

|

Hundred Ninety-Six Million, One Hundred and Sixty-Seven Thousand Brazilian Reais),

|

31,775,327

|

41.55%

|

43,682,635

|

57.12%

|

1,012,800

|

1.32%

|

|

and Eletrobras shall, on the other hand, assume obligations in equivalent amounts, in

|

|

|

|

|

|

|

|

accordance with conditions established in the Resolution of the Investment

|

|

|

|

|

|

|

|

Partnership Program Council - CPPI number 20, dated November 08, 2017, amended

|

|

|

|

|

|

|

|

by the Resolutions of the Investment Partnership Program Council - CPPI number 28,

|

|

|

|

|

|

|

|

dated November 22, 2017, and number 29, dated December 28, 2017;

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

To approve the sale of all shares, except 1 (one) common share, issued by Centrais

|

|

|

|

|

|

|

|

Elétricas de Rondônia S.A (hereinafter referred to as “Ceron”), owned by Eletrobras,

|

|

|

|

|

|

|

|

in a privatization auction to be conducted by Brasil, Bolsa, Balcão S.A. – B3, for the

|

|

|

|

|

|

|

|

price of BRL 50,000.00 (Fifty Thousand Brazilian Reais), connected to the granting of

|

|

|

|

|

|

|

|

concession by the Granting Power for the term of 30 (thirty) years, under the terms of

|

|

|

|

|

|

|

|

Paragraph 1-A of Article 8 of Law 12,783/2013 and in accordance with the conditions

|

|

|

|

|

|

|

|

established under the Resolution of the Investment Partnership Program Council -

|

|

|

|

|

|

|

|

CPPI number 20, dated November 8, 2017, with the amendments to the Resolutions

|

|

|

|

|

|

|

|

4

|

34,796,780

|

45.50%

|

40,706,182

|

53.23%

|

967,800

|

1.27%

|

|

of the Investment Partnership Program Council - CPPI number 28, dated November

|

|

|

|

|

|

|

|

22, 2017, and number 29, dated December 28, 2017, including the assumption by

|

|

|

|

|

|

|

|

Eletrobras of debts of said Distribution Company and/or the conversion of the debts of

|

|

|

|

|

|

|

|

said Distribution Company in capital increase by Eletrobras, at an amount up to BRL

|

|

|

|

|

|

|

|

1,872,522,463.42 (One Billion, Eight Hundred and Seventy-Two Million, Five Hundred

|

|

|

|

|

|

|

|

Twenty-Two Thousand, Four Hundred and Sixty-Three Brazilian Reais and Forty-Two

|

|

|

|

|

|

|

|

cents), in the period established by the 169th Extraordinary General Meeting, held on

|

|

|

|

|

|

|

|

December 28, 2017;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

To approve, as long as item 4 disclosed above is not approved, the dissolution and

|

|

|

|

|

|

|

|

5

|

28,830,927

|

37.70%

|

46,672,035

|

61.03%

|

967,800

|

1.27%

|

|

liquidation of Ceron;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

To approve, since the sale referred to in Item 4 disclosed above is approved, that

|

|

|

|

|

|

|

|

Eletrobras assumes the rights of Ceron, regarding the Fuel Consumption Account -

|

|

|

|

|

|

|

|

CCC and the Energy Development Account - CDE, recognized in the Financial

|

|

|

|

|

|

|

|

Statements of the Distribution Companies on the base date of the studies considering

|

|

|

|

|

|

|

|

the adjustments up to June 30, 2017, amounting up to BRL 3,847,293 thousand

|

|

|

|

|

|

|

|

(Three Billion, Eight Hundred Forty-Seven Million, Two Hundred and Ninety-Three

|

|

|

|

|

|

|

|

6

|

31,775,327

|

41.55%

|

43,682,635

|

57.12%

|

1,012,800

|

1.32%

|

|

Thousand Brazilian Reais), and Eletrobras shall, on the other hand, assume

|

|

|

|

|

|

|

|

obligations in equivalent amounts, in accordance with conditions established in the

|

|

|

|

|

|

|

|

Resolution of the Investment Partnership Program Council - CPPI number 20, dated

|

|

|

|

|

|

|

|

November 8, 2017, amended by the Resolutions of the Investment Partnership

|

|

|

|

|

|

|

|

Program Council - CPPI number 28, dated November 22, 2017, and number 29,

|

|

|

|

|

|

|

|

dated December 28, 2017;

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

To approve the sale of all shares, except 1 (one) common share, issued by Boa Vista

|

|

|

|

|

|

|

|

Energia S.A (hereinafter referred to as “Boa Vista Energia”), owned by Eletrobras, in a

|

|

|

|

|

|

|

|

privatization auction to be conducted by Brasil, Bolsa, Balcão S.A. – B3, for the price

|

|

|

|

|

|

|

|

of BRL 50,000.00 (Fifty Thousand Brazilian Reais), connected to the granting of

|

|

|

|

|

|

|

|

concession by the Granting Power for the term of 30 (thirty) years, under the terms of

|

|

|

|

|

|

|

|

Paragraph 1-A of Article 8 of Law 12,783/2013 and in accordance with the conditions

|

|

|

|

|

|

|

|

established under the Resolution of the Investment Partnership Program Council -

|

|

|

|

|

|

|

|

CPPI number 20, dated November 8, 2017, with the amendments to the Resolutions

|

|

|

|

|

|

|

|

7

|

34,796,780

|

45.50%

|

40,706,182

|

53.23%

|

967,800

|

1.27%

|

|

of the Investment Partnership Program Council - CPPI number 28, dated November

|

|

|

|

|

|

|

|

22, 2017, and number 29, dated December 28, 2017, including the assumption by

|

|

|

|

|

|

|

|

Eletrobras of debts of said Distribution Company and/or the conversion of the debts of

|

|

|

|

|

|

|

|

said Distributoion Company in capital increase by Eletrobras, at an amount up to BRL

|

|

|

|

|

|

|

|

342,120,486.20 (Three Hundred and Forty-Two Million, One Hundred and Twenty

|

|

|

|

|

|

|

|

Thousand, Four Hundred and Eighty-Six Brazilian Reais and Twenty cents), in the

|

|

|

|

|

|

|

|

period established by the 169th Extraordinary General Meeting, held on December 28,

|

|

|

|

|

|

|

|

2017;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

To approve, as long as item 7 disclosed above is not approved, the dissolution and

|

|

|

|

|

|

|

|

8

|

28,830,927

|

37.70%

|

46,672,035

|

61.03%

|

967,800

|

1.27%

|

|

liquidation of Boa Vista Energia;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

To approve, since the sale referred to in Item 7 disclosed above is approved, that

|

|

|

|

|

|

|

|

Eletrobras assumes the rights of Boa Vista Energia, regarding the Fuel Consumption

|

|

|

|

|

|

|

|

Account - CCC and the Energy Development Account - CDE, recognized in the

|

|

|

|

|

|

|

|

Financial Statements of the Distribution Companies on the base date of the studies

|

|

|

|

|

|

|

|

considering the adjustments up to June 30, 2017, amounting up to BRL 278,360

|

|

|

|

|

|

|

|

thousand (Two Hundred and Seventy-Eight Million, Three Hundred and Sixty

|

|

|

|

|

|

|

|

9

|

31,775,327

|

41.55%

|

43,682,635

|

57.12%

|

1,012,800

|

1.32%

|

|

Thousand Brazilian Reais), and Eletrobras shall, on the other hand, assume

|

|

|

|

|

|

|

|

obligations in equivalent amounts, in accordance with conditions established in the

|

|

|

|

|

|

|

|

Resolution of the Investment Partnership Program Council - CPPI number 20, dated

|

|

|

|

|

|

|

|

November 8, 2017, as amended by the Resolutions of the Investment Partnership

|

|

|

|

|

|

|

|

Program Council - CPPI number 28, dated November 22, 2017, and number 29,

|

|

|

|

|

|

|

|

dated December 28, 2017;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

|

To approve the sale of all shares, except 1 (one) common share, issued by Amazonas

|

|

|

|

|

|

|

|

|

Distribuidora de Energia S.A (hereinafter referred to as “Amazonas Energia”), owned

|

|

|

|

|

|

|

|

|

by Eletrobras, in a privatization auction to be conducted by Brasil, Bolsa, Balcão S.A.

|

|

|

|

|

|

|

|

|

– B3, for the price of BRL 50,000.00 (Fifty Thousand Brazilian Reais), connected to

|

|

|

|

|

|

|

|

|

the granting of concession by the Granting Power for the term of 30 (thirty) years,

|

|

|

|

|

|

|

|

|

under the terms of Paragraph 1-A of Article 8 of Law 12783/2013 and in accordance

|

|

|

|

|

|

|

|

|

with the conditions established in the Resolution of the Investment Partnership

|

|

|

|

|

|

|

|

|

Program Council - CPPI number 20, dated November 8, 2017, with the amendments

|

|

|

|

|

|

|

|

|

to the Resolutions of the Investment Partnership Program Council - CPPI number 28,

|

|

|

|

|

|

|

|

|

dated November 22, 2017, and number 29, dated December 28, 2017, including the

|

|

|

|

|

|

|

|

|

assumption by Eletrobras of debts of said Distribution Company and/or conversion of

|

|

|

|

|

|

|

|

|

debts of said Distribution Company in capital increase by Eletrobras, amounting up to

|

|

|

|

|

|

|

|

|

BRL 8,911,866,558.94 (Eight Billion, Nine Hundred and Eleven Million, Eight Hundred

|

|

|

|

|

|

|

|

|

Sixty-Six Thousand, Five Hundred and Fifty-Eight Brazilian Reais and Ninety-Four

|

|

|

|

|

|

|

|

|

cents), provided that: (i) the unbundling of generation and transmission activities from

|

|

|

|

|

|

|

|

|

the distribution activities of Amazonas Distribuidora de Energia S.A., with the transfer

|

|

|

|

|

|

|

|

|

of Amazonas Geração e Transmissão S.A. to Eletrobras, happens until March 2,

|

|

|

|

|

|

|

|

10

|

|

34,796,780

|

45.50%

|

40,706,182

|

53.23%

|

967,800

|

1.27%

|

|

|

2018, without any additional assumption of obligations by Eletrobras, in addition to

|

|

|

|

|

|

|

|

|

those set forth in the Resolution of the Investment Partnership Program Council -

|

|

|

|

|

|

|

|

|

CPPI number 20, dated November 8, 2017, as amended by the Resolutions of the

|

|

|

|

|

|

|

|

|

Investment Partnership Program Council - CPPI number 28, dated November 22,

|

|

|

|

|

|

|

|

|

2017, and number 29, dated December 28, 2017; (ii) Amazonas Energia, prior to the

|

|

|

|

|

|

|

|

|

assumption by Eletrobras of debts of said Distribution Company and/or conversion of

|

|

|

|

|

|

|

|

|

debts of said Distribution Company in the capital increase referred to in this item 10,

|

|

|

|

|

|

|

|

|

transfer the entirety of the shares issued by Amazonas Geração e Transmissão S.A. -

|

|

|

|

|

|

|

|

|

Amazonas GT for Eletrobras and/or third party, aiming at the partial settlement of its

|

|

|

|

|

|

|

|

|

debts and whose amount will be deducted from the adjustment amount of BRL

|

|

|

|

|

|

|

|

|

8,911,866,558.94 (Eight Billion, Nine Hundred and Eleven Million, Eight Hundred and

|

|

|

|

|

|

|

|

|

Sixty Six Thousand, Five Hundred and Fifty-Eight Brazilian Reais and Ninety-Four

|

|

|

|

|

|

|

|

|

cents); and (iii) that there is recognition by the regulatory agencies, the Granting

|

|

|

|

|

|

|

|

|

Power and/or by judicial means in a final decision, of the right to full reimbursement by

|

|

|

|

|

|

|

|

|

the Sectoral Funds CCC - Fossil Fuel Account and/or CDE - Economic Development

|

|

|

|

|

|

|

|

|

Account, "take or pay" and "ship or pay" costs established in the Gas Supply Contract

|

|

|

|

|

|

|

|

|

no. OC-1902/2006 and its amendments, according to Law no. 12111/2009.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

To approve, as long as item 10 disclosed above is not approved, the dissolution and

|

|

|

|

|

|

|

11

|

|

28,830,927

|

37.70%

|

46,672,035

|

61.03%

|

967,800

|

1.27%

|

|

|

liquidation of Amazonas Energia;

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

|

To approve, since the sale referred to in Item 10 disclosed above is approved, that

|

|

|

|

|

|

|

|

Eletrobras assumes the rights of Amazonas Energia, regarding the Fuel Consumption

|

|

|

|

|

|

|

|

Account - CCC and the Energy Development Account - CDE, recognized in the

|

|

|

|

|

|

|

|

|

Financial Statements of the Distribution Companies on the base date of the studies

|

|

|

|

|

|

|

|

considering the adjustments up to June 30, 2017, amounting up to BRL 4,055,549

|

|

|

|

|

|

|

|

thousand (Four Billion, Fifty-Five Million, Five Hundred and Forty-Nine Thousand

|

|

|

|

|

|

|

12

|

|

31,775,327

|

41.55%

|

43,682,635

|

57.12%

|

1,012,800

|

1.32%

|

|

|

Brazilian Reais), and Eletrobras shall, on the other hand, assume obligations in

|

|

|

|

|

|

|

|

|

equivalent amounts, in accordance with conditions established in the Resolution of

|

|

|

|

|

|

|

|

the Investment Partnership Program Council - CPPI number 20, dated November 8,

|

|

|

|

|

|

|

|

2017, as amended by the Resolutions of the Investment Partnership Program Council -

|

|

|

|

|

|

|

|

CPPI number 28, dated November 22, 2017, and number 29, dated December 28,

|

|

|

|

|

|

|

|

2017;

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

|

To approve the sale of all shares, except one (1) common share, issued by

|

|

|

|

|

|

|

|

|

Companhia Energética do Piauí (hereinafter referred to as “Cepisa”), owned by

|

|

|

|

|

|

|

|

|

Eletrobras, in a privatization auction to be conducted by Brasil, Bolsa, Balcão S.A. –

|

|

|

|

|

|

|

|

B3, for the price of BRL 50,000.00 (Fifty Thousand Brazilian Reais), connected to the

|

|

|

|

|

|

|

|

granting of concession by the Granting Power for the term of 30 (thirty) years, under

|

|

|

|

|

|

|

|

the terms of Paragraph 1-A of Article 8 of Law 12,783/2013 and in accordance with

|

|

|

|

|

|

|

|

the conditions established under the Resolution of the Investment Partnership

|

|

|

|

|

|

|

|

13

|

|

34,796,780

|

45.50%

|

40,706,182

|

53.23%

|

967,800

|

1.27%

|

|

|

Program Council - CPPI number 20, dated November 8, 2017, with the amendments

|

|

|

|

|

|

|

|

to the Resolutions of the Investment Partnership Program Council- CPPI number 28,

|

|

|

|

|

|

|

|

dated November 22, 2017, and number 29, dated December 28, 2017, including the

|

|

|

|

|

|

|

|

assumption by Eletrobras of debts of said Distribution Company and/or the conversion

|

|

|

|

|

|

|

|

of the debts of said Distribution Company in capital increase by Eletrobras, at an

|

|

|

|

|

|

|

|

amount up to BRL 50,000.00 (Fifty Thousand Brazilian Reais), in the period

|

|

|

|

|

|

|

|

|

established by the 169th Extraordinary General Meeting, held on December 28, 2017;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

To approve, as long as item 13 disclosed above is not approved, the dissolution and

|

|

|

|

|

|

|

|

14

|

|

28,830,927

|

37.70%

|

46,672,035

|

61.03%

|

967,800

|

1.27%

|

|

|

liquidation of Cepisa;

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

|

Approving the sale of all shares, except 1 (one) common share, issued by Companhia

|

|

|

|

|

|

|

|

|

Energética de Alagoas (hereinafter referred to as “Ceal”), owned by Eletrobras, in a

|

|

|

|

|

|

|

|

|

privatization auction to be conducted by Brasil, Bolsa, Balcão S.A. – B3, for the price

|

|

|

|

|

|

|

|

|

of BRL 50,000.00 (Fifty Thousand Brazilian Reais), connected to the granting of

|

|

|

|

|

|

|

|

|

concession by the Granting Power for the term of 30 (thirty) years, under the terms of

|

|

|

|

|

|

|

|

|

Paragraph 1-A of Article 8 of Law 12,783/2013 and in accordance with the conditions

|

|

|

|

|

|

|

|

|

established under the Resolution of the Investment Partnership Program Council -

|

|

|

|

|

|

|

|

|

CPPI number 20, dated November 8, 2017, with the amendments to the Resolutions

|

|

|

|

|

|

|

|

15

|

|

34,796,780

|

45.50%

|

40,706,182

|

53.23%

|

967,800

|

1.27%

|

|

|

of the Investment Partnership Program Council - CPPI number 28, dated November

|

|

|

|

|

|

|

|

|

22, 2017, and number 29, dated December 28, 2017, including the assumption by

|

|

|

|

|

|

|

|

|

Eletrobras of debts of said Distribution Company and/or the conversion of the debts of

|

|

|

|

|

|

|

|

|

said Distribution Company in capital increase by Eletrobras, at an amount up to BRL

|

|

|

|

|

|

|

|

|

50,000.00 (Fifty Thousand Brazilian Reais), provided that there is execution and

|

|

|

|

|

|

|

|

|

judicial homologation connected to the payment of salary differences arising out of

|

|

|

|

|

|

|

|

|

Bresser Plan, in the period established by the 169th Extraordinary General Meeting,

|

|

|

|

|

|

|

|

|

held on December 28, 2017;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

To approve, as long as item 15 disclosed above is not approved, the dissolution and

|

|

|

|

|

|

|

|

16

|

|

28,830,927

|

37.70%

|

46,672,035

|

61.03%

|

967,800

|

1.27%

|

|

|

liquidation of Ceal;

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

|

To approve, according to Decree No. 1,091 of March 21, 1994, the free assignment,

|

|

|

|

|

|

|

|

|

by Eletrobras, of the preemptive right to subscribe new shares to be issued by the

|

|

|

|

|

|

|

|

|

distribution campanies, which transfers of controlling interest were approved under the

|

|

|

|

|

|

|

|

|

terms of Items 1, 4, 10, 13 and 15 disclosed above, under the scope of the capital

|

|

|

|

|

|

|

|

|

increase to be performed by the new controlling shareholder(s), winner(s) of the

|

|

|

|

|

|

|

|

17

|

|

34,840,680

|

45.56%

|

40,662,282

|

53.17%

|

967,800

|

1.27%

|

|

|

Privatization Auctions, to employees and retirees of the respective distribution

|

|

|

|

|

|

|

|

|

companies, as provided for under the Resolution of the Investment Partnership

|

|

|

|

|

|

|

|

|

Program Council – CPPI number 20, dated November 8, 2017, as amended by the

|

|

|

|

|

|

|

|

|

Resolutions of the Investment Partnership Program Council - CPPI number 28, dated

|

|

|

|

|

|

|

|

|

November 22, 2017, and number 29, dated December 28, 2017;

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

|

To delegate powers to the Eletrobras’ Board of Directors to resolve on the exercise of

|

|

|

|

|

|

|

|

|

Eletrobras' option to increase the interest, up to 30% (thirty percent), in the capital of

|

|

|

|

|

|

|

|

|

the Distribution Companies whose controlling interest’s transfers were approved,

|

|

|

|

|

|

|

|

|

under the terms of Items 1, 4, 7, 10, 13 and 15 disclosed above, within the term of up

|

|

|

|

|

|

|

|

|

to 6 (six) months, counted as of the date of execution of the respective controlling

|

|

|

|

|

|

|

|

18

|

|

34,796,780

|

45.50%

|

40,706,182

|

53.23%

|

967,800

|

1.27%

|

|

|

interest transfer agreement, as set forth in the Resolution of the Investment

|

|

|

|

|

|

|

|

|

Partnership Program Council - CPPI number 20, dated November 8, 2017, with the

|

|

|

|

|

|

|

|

|

amendments of the Resolutions of the Investment Partnership Program Council -

|

|

|

|

|

|

|

|

|

CPPI number 28, dated November 22, 2017, and number 29, dated December 28,

|

|

|

|

|

|

|

|

|

2017; and

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

|

For

|

%

|

Against

|

%

|

Abstain

|

%

|

|

|

|

|

To approve the adoption of measures for liquidation and dissolution of the distribution

|

|

|

|

|

|

|

|

|

companies which transfers of controlling interests were not approved under the terms

|

|

|

|

|

|

|

|

|

of Items 1, 4, 7, 10, 13 and 15 disclosed above, in case of non-compliance with the

|

|

|

|

|

|

|

|

19

|

|

34,796,780

|

45.50%

|

40,706,182

|

53.23%

|

967,800

|

1.27%

|

|

|

conditions set forth in items 10 and 15 disclosed above or the term established by the

|

|

|

|

|

|

|

|

|

169th Extraordinary General Meeting for the signing of the contract for the transfer of

|

|

|

|

|

|

|

|

|

the shareholding control held by Eletrobras in the distribution companies.

|

|

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

|

|

|

|

|

|

By:

|

/

S

/

Armando Casado de Araujo

|

|

|

|

Armando Casado de Araujo

Chief Financial and Investor Relation Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

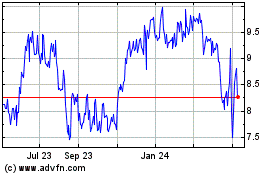

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

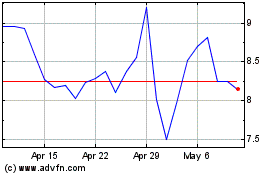

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

From Apr 2023 to Apr 2024