This prospectus relates to the resale by the selling stockholders identified in this prospectus of up to (i) 4,247,867 shares of our common stock, or the

preferred common shares, that were issued upon conversion or exchange of outstanding shares of our Series A 20% convertible preferred stock, par value $0.0001 per share, or the preferred stock, and (ii) an aggregate of 5,131,815 shares of our common

stock that are issuable upon the exercise of outstanding warrants to purchase shares of our common stock, or the warrant shares and together with the preferred common shares, the shares. The preferred stock and certain of the warrants were

originally issued to the selling stockholders pursuant to a securities purchase agreement dated March 7, 2018. An aggregate of 3,748,184 of the preferred common shares and warrants to acquire up to an aggregate of 3,748,104 warrant shares were

issued in exchange for the preferred stock pursuant to the terms of such securities purchase agreement on July 16, 2018.

We are not selling any shares of

common stock and will not receive any proceeds from the sale of the shares. Upon the exercise of the warrants for 5,131,815 shares of our common stock by payment of cash, however, we will receive the exercise price of the warrants, which is $2.10

per share (subject to adjustment in certain circumstances).

We have agreed to bear all of the expenses incurred in connection with the registration of

the shares. The selling stockholders will pay or assume brokerage commissions and similar charges, if any, incurred for the sale of the shares.

The

selling stockholders identified in this prospectus, or their pledgees, donees, transferees or other

successors-in-interest,

may offer the shares from time to time

through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. For additional information on the methods of sale that may be used by the selling stockholders, see

the section entitled “Plan of Distribution” beginning on page 9. For information regarding the selling stockholders, see the section entitled “Selling Stockholders” beginning on page 6.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any

amendments or supplements carefully before you make your investment decision.

Our common stock is traded on the Nasdaq Capital Market under the symbol

“SLS”. On July 25, 2018, the closing sale price of our common stock on the Nasdaq Capital Market was $1.30 per share. You are urged to obtain current market quotations for the common stock.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form

S-3

that we filed with the Securities and Exchange

Commission, or SEC, using the “shelf” registration process. Under this process, the selling stockholders may from time to time, in one or more offerings, sell the shares described in this prospectus.

We are responsible for the information contained in or incorporated by reference into this prospectus. We have not authorized anyone to provide you with

different information, and we take no responsibility for any other information others may give you. We are not, and the selling stockholders are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not

permitted. The information contained in this prospectus (and in any supplement or amendment to this prospectus) is accurate only as of the date on the front of the document, and any information we have incorporated by reference is accurate only as

of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since those dates.

Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any

restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

The names “SELLAS Life Sciences Group,

Inc.,” “SELLAS,” the SELLAS logo, and other trademarks or service marks of SELLAS Life Sciences Group, Inc. appearing in this prospectus are the property of SELLAS Life Sciences Group, Inc. Other trademarks, service marks or trade

names appearing in this prospectus are the property of their respective owners. We do not intend the use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of or

by either, of these other companies.

i

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus or incorporated by reference in this prospectus. This summary provides an

overview of selected information and does not contain all of the information you should consider before investing in our securities. You should read this entire prospectus carefully, especially the section titled “Risk Factors” and our

consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. Except as otherwise indicated or unless the context otherwise requires, references to “company,”

“we,” “us,” “our” or “SELLAS,” refer to SELLAS Life Sciences Group, Inc. and its consolidated subsidiaries.

Overview

We are a late-stage biopharmaceutical company

focused on the development and commercialization of novel cancer immunotherapeutics for a broad range of indications. Our lead product candidate, galinpepimut-S, or GPS, is an immunotherapeutic agent licensed from Memorial Sloan Kettering Cancer

Center, or MSK, which targets the Wilms tumor 1, or WT1, protein. WT1 has been shown to be present in 20 or more cancer types and is one of the most commonly expressed cancer antigens. GPS has been engineered to incorporate novel technology to

preserve WT1 antigenicity and overcome the tolerance the immune system commonly develops to tumor antigens, a major challenge in the development of effective immunotherapies for cancer. Based on its mechanism of action as a direct immunizing agent,

GPS has potential as a monotherapy or in combination with other immunotherapeutic agents to address a broad spectrum of hematological malignancies and solid tumor indications.

Phase 2 clinical trials for GPS are completed for two potential indications, acute myeloid leukemia, or AML, and malignant pleural mesothelioma, or MPM. We

have planned Phase 3 clinical trials (pending funding availability) evaluating GPS as monotherapy for these two indications, with AML being our initial priority. GPS is also in early clinical development as a potential treatment for multiple

myeloma, or MM, and epithelial ovarian cancer. We also plan to study GPS in up to four additional indications: as a combination therapy in small cell lung cancer, colorectal cancer, triple-negative breast cancer, or TNBC; and, as a monotherapy in

chronic myelogenous leukemia, or CML. We received Orphan Drug Product designations for GPS from the U.S. Food and Drug Administration, or FDA, for AML, MPM and MM as well as Orphan Medicinal Product designations from the European Medicines Agency,

or EMA, for AML and MPM, and Fast Track designation for AML and MPM from the FDA.

Our pipeline also includes the ongoing development programs of our

predecessor company, including novel cancer immunotherapy programs for NeuVax (nelipepimut-S; a vaccine against the E75 peptide derived from the human epidermal growth factor 2, or HER2, protein), GALE-301 (a vaccine against the E39 peptide derived

from the folate binding protein, or FBP), GALE-302 (a vaccine against the J65 peptide derived from FBP) and GALE-401 (a controlled release version of the approved drug anagrelide). NeuVax is currently in multiple investigator-sponsored Phase 2

clinical trials in breast cancer, including a prospective, randomized, single-blinded, controlled Phase 2b clinical trial of trastuzumab (Herceptin

®

) +/- NeuVax in HER2 1+/2+ breast cancer

patients in the adjuvant setting to prevent recurrences.

On April 2, 2018, we announced that a pre-specified interim analysis of safety and efficacy,

conducted by an independent Data Safety Monitoring Board, or DSMB, for the investigator sponsored Phase 2b Herceptin study demonstrated a clinically meaningful difference in median disease-free survival, or DFS, in favor of the active arm, a primary

endpoint of the study. The interim analysis further demonstrated a statistically significant and clinically meaningful improvement in DFS among a cohort of patients with TNBC associated with the NeuVax + Herceptin combination. Based on these

results, and the DSMB’s recommendation, we plan to expeditiously seek regulatory guidance by the FDA for further development of NeuVax + Herceptin combination therapy in TNBC, a population of breast cancer patients with large unmet need. In

June 2018, we announced that the sponsor-principal investigator of this study, after taking into account that key clinical development objectives were met as well as other regulatory considerations, and with our agreement, determined to terminate

early the study. In addition, in late May 2018, we conducted two advisory meetings with global experts in regulatory affairs and breast cancer clinical development in order to determine the optimal path for further development of the NeuVax +

Herceptin combination in TNBC in a pivotal setting and for engagement with the FDA and EMA.

GALE-301 and GALE-302, our E39 folate binding peptide vaccine

product candidates, have completed early stage trials in ovarian, endometrial and breast cancers. Both candidates have received Orphan Drug Product designation by the FDA.

Corporate Information

We were incorporated on

April 3, 2006 in Delaware as Argonaut Pharmaceuticals, Inc. On November 28, 2006, we changed our name to RXi Pharmaceuticals Corporation and began operations January 2007. On September 26, 2011, we changed our name to Galena

Biopharma, Inc. In December 2017, we completed a business combination with the Bermuda exempted company SELLAS Life Sciences Group Ltd, or Private SELLAS, and changed our name to “SELLAS Life Sciences Group, Inc.,” which we refer to

throughout this prospectus as the Merger.

1

Our principal executive offices are located at 315 Madison Avenue, 4th Floor, New York, NY 10017, and our

phone number is (917)

438-4353.

Our website address is www.sellaslife.com. The information contained on, or that can be accessed through, our website is not part of, and is not incorporated by reference into

this prospectus and should not be considered to be part of this prospectus.

The Offering

The selling stockholders named in this prospectus may offer and sell up to 9,379,682 shares of our common stock, which represents up to (i) 4,247,867 preferred

common shares and (ii) 5,131,815 warrant shares. The warrant shares will become eligible for sale by the selling stockholders under this prospectus only if such warrants are exercised.

Our common stock is currently listed on the Nasdaq Capital Market under the symbol “SLS.” We will not receive any of the proceeds of sales by the

selling stockholders of any of the shares covered by this prospectus. When we refer to the selling stockholders in this prospectus, we are referring to the purchasers under the securities purchase agreement dated March 7, 2018, and their

permitted transferees or other

successors-in-interest

that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the

registration statement of which this prospectus is a part.

2

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks

and uncertainties discussed under the heading “Risk Factors” contained in our current report on Form

8-K

filed with the SEC on July 18, 2018 and incorporated by reference in this prospectus, as the

same may be amended, supplemented or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus. Additional risks not

presently known to us or that we currently believe are immaterial may also significantly impair our business operations. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference contain forward-looking statements about us and our industry that involve substantial risks and

uncertainties. All statements other than statements of historical facts contained in this prospectus and the documented incorporated by reference, including statements regarding our future financial condition, business strategy and plans, and

objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,”

“contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,”

“predict,” “positioned,” “potential,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and

future trends, or the negative of these terms or other comparable terminology.

We have based these forward-looking statements largely on our current

expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of known

and unknown risks, uncertainties and assumptions, including risks described in the section titled “Risk Factors” contained in our current report on Form

8-K

filed with the SEC on July 18, 2018 and

incorporated by reference in this prospectus, as the same may be amended, supplemented or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof and incorporated by

reference into this prospectus, regarding, among other things:

|

|

•

|

|

our ability to continue to operate despite the incursion of substantial losses since our inception and our expectation that we will continue to incur substantial and increasing losses for the foreseeable future;

|

|

|

•

|

|

our ability to continue as a going concern;

|

|

|

•

|

|

whether we will realize the anticipated benefits of the Merger;

|

|

|

•

|

|

our ability to obtain the substantial additional financing necessary to achieve our goals;

|

|

|

•

|

|

whether we will generate revenues and achieve profitability in the future;

|

|

|

•

|

|

the ability of investors to evaluate the success of our business and to assess our future viability given our limited operating history;

|

|

|

•

|

|

our expectations regarding our continued incursion of significant operating and

non-operating

expenses;

|

|

|

•

|

|

the initiation of legal or administrative actions against us;

|

|

|

•

|

|

our ability to use net operating losses to offset future taxable income;

|

|

|

•

|

|

our ability to comply with the regulatory and environmental provisions and laws that we are subject to;

|

|

|

•

|

|

our ability to obtain regulatory approval of our product candidates;

|

|

|

•

|

|

whether the results of our clinical trials will be sufficient to support domestic or global regulatory approvals;

|

3

|

|

•

|

|

the initiation, timing, progress and results of our

pre-clinical

and clinical trials;

|

|

|

•

|

|

the success of our lead product candidate, GPS, and our ability to successfully complete clinical trials and obtain regulatory approval for our other product candidates;

|

|

|

•

|

|

whether our product development program will uncover all possible adverse events that patients who take our product candidates may experience;

|

|

|

•

|

|

whether we can maintain orphan drug exclusivity and fast track designation for certain of our product candidates and whether we will receive orphan drug product designation and fast track designation for additional

product candidates should we seek such designations;

|

|

|

•

|

|

our ability to successfully identify, acquire, develop or commercialize new potential product candidates;

|

|

|

•

|

|

our ability to realize benefits from strategic alliances that we may form in the future;

|

|

|

•

|

|

whether we can continue to rely on third parties to conduct our preclinical studies and clinical trials;

|

|

|

•

|

|

developments or disputes concerning our intellectual property or other proprietary rights;

|

|

|

•

|

|

our expectations regarding the potential market size and the size of the patient populations for our product candidates, if approved, for commercial use;

|

|

|

•

|

|

the implementation of our business model and strategic plans for our business and product candidates;

|

|

|

•

|

|

our ability to maintain and establish collaborations or obtain additional funding;

|

|

|

•

|

|

the market price and value of our common stock;

|

|

|

•

|

|

our ability to compete in the markets we serve; and

|

|

|

•

|

|

the factors that may impact our financial results.

|

These risks are not exhaustive

. Other sections of

this prospectus or the documents incorporated by reference may include additional factors that could harm our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge

from time to time, and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in, or implied by, any forward-looking statements.

You should not rely upon forward-looking statements as predictions of

future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we

cannot guarantee future results, levels of activity, performance or achievements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus or to conform

these statements to actual results or to changes in our expectations.

You should carefully read this prospectus, together with the information

incorporated herein by reference as described under the heading “Incorporation by Reference,” and the documents that we reference in this prospectus and have filed as exhibits to the registration statement of which this prospectus is a

part with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ

materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

4

USE OF PROCEEDS

We will not receive any proceeds from the resale of any shares offered by this prospectus by the selling stockholders. Upon the exercise of the warrants for

5,131,815 warrant shares by payment of cash, however, we will receive the exercise price of the warrants, which is $2.10 per share (subject to adjustment in certain circumstances). Any proceeds from the exercise of the warrants will be used for

working capital and general corporate purposes.

5

SELLING STOCKHOLDERS

On March 7, 2018, we entered into a securities purchase agreement with the investors named therein, pursuant to which sold to the investors, in a private

placement pursuant to Rule 4(a)(2) and Regulation S under the Securities Act, or the private placement, an aggregate of 10,700 shares of our newly-created

non-voting

Series A 20% convertible preferred stock,

par value $0.0001 per share, or the preferred stock, and warrants, or the warrants, to acquire an aggregate 1,383,631 shares of our common stock, par value $0.0001 per share, or the common stock, at an aggregate purchase price of $10,700,000. At the

first closing of the private placement on March 9, 2018, we issued an aggregate 5,987 shares of preferred stock and warrants to acquire an aggregate of 774,186 shares of common stock for aggregate gross proceeds of $5,987,000. At the second

closing of the private placement on May 1, 2018, for which we sought and received stockholder approval on April 25, 2018, we issued an aggregate 4,713 shares of preferred stock and warrants to acquire an aggregate of 609,445 shares of

common stock, for aggregate gross proceeds of $4,713,000.

Under the securities purchase agreement, we issued warrants to acquire an aggregate of

1,383,631 shares of common stock, or approximately 75% of the shares of common stock into which the preferred stock are initially convertible. The warrants had an initial exercise price of $6.59 per share (subject to adjustment in certain

circumstances), may not be exercised until the date that is six months after issuance, and have a term of five years from the initial exercise date. Exercise of the warrants is subject to a beneficial ownership limitation of 4.99% (or 9.99% at the

option of the investor).

On April 30, 2018, in connection with the second closing, we entered into side letters with all the investors party to the

securities purchase agreement, all of whom are purchasers of the preferred stock and warrants issued pursuant to the securities purchase agreement, and include all of the selling stockholders. Pursuant to the side letters, we agreed to prepare and

file the registration statement of which this prospectus forms a part to register for resale the shares of common stock issuable upon conversion of their preferred stock and exercise of their warrants.

As of June 30, 2018, 2,898 shares of preferred stock had already converted into an aggregate of 499,683 shares of our common stock.

On July 16, 2018 we closed an underwritten public offering of 6,845,000 shares of common stock, pre-funded warrants to purchase up to 4,675,000 shares of

common stock and warrants to purchase up to an aggregate of 11,520,000 shares of common stock at a combined offering price of $2.10 per share of common stock and accompanying common warrant. This underwritten public offering we believe constituted a

qualified offering pursuant to the terms of the securities purchase agreement and the preferred stock. Accordingly, pursuant to the terms of the securities purchase agreement, on July 16, 2018, following consummation of the qualified offering, the

selling stockholders had the right to exchange an aggregate of $7,871,186 of stated valued and accrued but unpaid dividends on the preferred stock for an aggregate of 3,748,184 shares of our common stock, and common warrants to purchase an aggregate

of 3,748,184 shares of our common stock. The common warrants have an exercise price of $2.10 per share and a term of five years. In addition, pursuant to their terms, the exercise price of the warrants issued to the selling stockholders in March and

May 2018 was adjusted to $2.10 per share (from $6.59 per share). Following this exchange, there are no longer any shares of preferred stock issued and outstanding.

6

The table below sets forth, to our knowledge, information about the selling stockholders as of July 18, 2018.

Beneficial ownership is determined in accordance with the rules of the SEC. Unless otherwise indicated below, to our knowledge, the selling stockholders named in the table have sole voting and/or investment power with respect to the securities

beneficially owned. Beneficial ownership for the selling stockholders is based on (i) 7,383,509 shares of our common stock issued and outstanding as of June 30, 2018 plus (ii) 6,845,000 shares of our common stock issued in the

qualified offering on July 16, 2018 and (iii) 3,748,184 shares of our common stock issued upon exchange of the preferred stock on July 16, 2018. The inclusion of any securities in this table does not constitute an admission of beneficial ownership

by the person named below. Percentage amounts in the table below reflect beneficial ownership of that class of security.

We do not know when or in what

amounts the selling stockholders may offer shares for sale or if the selling stockholders have already sold some of their shares. The selling stockholders might not sell any or all of the shares registered pursuant to the registration statement of

which this prospectus forms a part. Because the selling stockholders may offer all or some of the shares pursuant to the registration statement of which this prospectus forms a part and because there are currently no agreements or understandings

with respect to the sale of any shares, we cannot estimate the number of shares that will be held by the selling stockholders after completion of this offering. However, for purposes of this table, we have assumed that none of the shares have been

sold to date, and that after completion of this offering, none of the preferred common shares or warrant shares covered by this prospectus will be held by the selling stockholders. Information regarding shares beneficially owned by each selling

stockholder is based solely upon a review of filings with the SEC pursuant to Section 13(d) or Section 13(g), internal records and those of our transfer agent.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior to Offering

|

|

|

Number of

Shares Offered

|

|

|

After Offering

|

|

|

Name and Address

|

|

Number of

Shares

Beneficially

Owned

|

|

|

Percentage of

Shares

Beneficially

Owned

|

|

|

|

Number of Shares

Beneficially

Owned

|

|

|

Percentage of

Shares

Beneficially

Owned

|

|

|

Varia Structured Opportunities S.A.(on behalf of its compartment Life Sciences Strategies)

(1)

|

|

|

4,360,628

|

|

|

|

4.99

|

%

|

|

|

4,360,628

|

|

|

|

0

|

|

|

|

—

|

|

|

Sabby Management, LLC

(2)

|

|

|

2,611,030

|

|

|

|

4.99

|

%

|

|

|

2,207,539

|

|

|

|

403,491

|

|

|

|

2.08

|

%

|

|

Anson Investments Master Fund LP

(3)

|

|

|

1,162,100

|

|

|

|

4.99

|

%

|

|

|

807,381

|

|

|

|

354,719

|

|

|

|

1.91

|

%

|

|

Lincoln Park Capital Fund LLC

(4)

|

|

|

844,133

|

|

|

|

4.57

|

%

|

|

|

763,110

|

|

|

|

81,023

|

|

|

|

*

|

|

|

IntraCoastal Capital, LLC

(5)

|

|

|

662,006

|

|

|

|

3.67

|

%

|

|

|

150,864

|

|

|

|

511,142

|

|

|

|

2.80

|

%

|

|

Hudson Bay Master Fund Ltd.

(6)

|

|

|

548,981

|

|

|

|

3.00

|

%

|

|

|

545,080

|

|

|

|

3,901

|

|

|

|

*

|

|

|

Alto Opportunity Master Fund, SPC –

Segregated Master Portfolio B

(7)

|

|

|

545,080

|

|

|

|

2.98

|

%

|

|

|

545,080

|

|

|

|

0

|

|

|

|

—

|

|

|

*

|

Represents beneficial ownership of less than one percent (1%) of our outstanding common stock.

|

|

(1)

|

Represents common stock received upon exchange of 4,000 shares of preferred stock and 2,438,935 warrant shares. Number of shares beneficially owned includes all shares of common stock received upon exchange of the

preferred stock and underlying the warrants. The ability to exercise the warrants is subject to ownership caps prohibiting exercise of any of the warrants to the extent that after giving effect to such exercise, beneficial ownership would exceed

4.99% of the Company’s common shares. The address of Varia Structured Opportunities S.A. is 3/A rue Guillaume Kroll,

L-1882,

Luxembourg.

|

|

(2)

|

Includes (i) 1,181,516 warrant shares and (ii) common stock underlying other warrants to acquire 253,491 shares, in each case held by Sabby Healthcare Master Fund, Ltd., a Cayman Islands exempted company, or

SHMF, and Sabby Volatility Warrant Master Fund, Ltd., a Cayman Islands exempted company, or SVWMF. Sabby Management, LLC, a Delaware limited liability company, serves as the investment manager of SHMF and SVWMF, and shares voting and investment

power with respect to these shares in this capacity. As manager of Sabby Management, LLC, Hal Mintz also shares voting and investment power on behalf of SHMF and SVWMF. Each of Sabby Management, LLC and Mr. Mintz may be deemed to beneficially

own the shares held by SHMF and SVWMF by virtue of such relationships, but each disclaims beneficial ownership except to the extent of any pecuniary interest in such shares. While number of shares includes all shares of common stock and common stock

underlying warrants, SHMF’s and SVWMF’s ability to exercise the warrants is subject to ownership caps prohibiting them from exercising any of the warrants to the extent that after giving effect to such exercise, SHMF and SVWMF and their

affiliates would beneficially own more than 4.99% of the Company’s common shares. The address of each of Sabby Management, LLC and Mr. Mintz is c/o Sabby Management, 10 Mountainview Road, Suite 205, Upper Saddle River, New Jersey 07458.

|

7

|

(3)

|

Includes (i) 410,157 warrant shares and (ii) common stock underlying other warrants to acquire 179,719 shares. Anson Advisors Inc. and Anson Funds Management LP, the

co-investment

advisers of Anson Investments Master Fund LP, or Anson, hold voting and dispositive power over the common shares held by Anson. Bruce Winson is the managing member of Anson Management GP LLC,

which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these common shares except to the

extent of their pecuniary interest therein. While number of shares includes all shares of common stock and common stock underlying warrants, Anson’s ability to exercise the warrants is subject to ownership caps prohibiting it from exercising

any of the warrants to the extent that after giving effect to such exercise, Anson and its affiliates would beneficially own more than 4.99% of the Company’s common shares. The principal business address of Anson is 190 Elgin Avenue, George

Town, Grand Cayman.

|

|

(4)

|

Includes (i) 426,814 warrant shares and (ii) common stock underlying other warrants to acquire 81,023 shares. Joshua Scheinfeld and Jonathan Cope, the principals of Lincoln Park Capital Fund LLC, or Lincoln

Park, are deemed to be beneficial owners of all the shares of common stock owned by Lincoln Park. Messrs. Scheinfeld and Cope have shared voting and disposition power over the shares being offered. Lincoln Park’s ability to exercise the

warrants is subject to an ownership cap prohibiting it from exercising any of the warrants to the extent that after giving effect to such exercise, Lincoln Park and its affiliates would beneficially own more than 4.99% of the Company’s common

shares. The address of Lincoln Park is 440 N. Wells St., Suite 410, Chicago, Illinois 60654.

|

|

(5)

|

Includes (i) 64,567 warrant shares and (ii) common stock underlying other warrants or convertible notes to acquire an aggregate of 261,142 shares. Mitchell P. Kopin and Daniel B. Asher, each of whom are

managers of IntraCoastal Capital, LLC, or IntraCoastal, have shared voting control and investment discretion over the securities reported herein that are held by IntraCoastal. As a result, each of Messrs. Kopin and Asher may be deemed to have

beneficial ownership (as determined under Section 13(d) of the Exchange Act) of the securities reported herein that are held by IntraCoastal. The address of IntraCoastal is 245 Palm Trail, Delray, FL 33483.

|

|

(6)

|

Includes (i) 304,868 warrant shares and (ii) common stock underlying other warrants to acquire 3,901 shares. Hudson Bay Capital Management LP, the investment manager of Hudson Bay Master Fund Ltd., or Hudson

Bay, has voting and investment power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management LP. Each of Hudson Bay Master Fund Ltd. and Sander Gerber

disclaims beneficial ownership over these securities. The address of Hudson Bay Master Fund Ltd. Is 777 Third Avenue, 30th Floor, New York, NY 10017.

|

|

(7)

|

Includes 304,868 warrant shares. Ayrton Capital LLC, the investment manager to Alto Opportunity Master Fund, SPC – Segregated Master Portfolio B, or Alto, has discretionary authority to vote and dispose of the

shares held by Alto, and may be deemed to be the beneficial owner of these shares. Waqas Khatri, in his capacity as managing member of Ayrton Capital LLC, may also be deemed to have investment discretion and voting power over the shares held by

Alto. Alto and Mr. Khatri each disclaim any beneficial ownership of these shares. The address of Alto is c/o Ayrton Capital LLC, 222 Broadway, 19th Floor, New York, NY 10038.

|

When we refer to the shares of our common stock being offered by this prospectus on behalf of the selling stockholders, we are referring to the shares of our

common stock received upon conversion or exchange of the preferred stock and shares of common stock underlying the warrants sold in the private placement or received upon exchange of the preferred stock.

The selling stockholders may have sold or transferred, in transactions exempt from the registration requirements of the Securities Act, some or all of their

shares of common stock since the date on which the information in the table above is presented. Information about the selling stockholders may change over time.

8

PLAN OF DISTRIBUTION

We are registering the offer and resale of the preferred common shares and the warrant shares, respectively, and collectively, the shares, to permit the sale

of the shares by the selling stockholders from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale of the shares by the selling stockholders. We will bear all fees and expenses incident to our

obligation to register the shares, except that, if the shares are sold through underwriters or broker-dealers, the selling stockholders will be responsible for any underwriting discounts or commissions or agent’s commissions.

The selling stockholders may sell all or a portion of the shares beneficially owned by them and offered hereby from time to time directly or through one or

more underwriters, broker-dealers or agents. The shares may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. These

sales may be effected in transactions, which may involve crosses or block transactions, on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale:

|

|

•

|

|

in the

over-the-counter

market;

|

|

|

•

|

|

in transactions otherwise than on these exchanges or systems or in the

over-the-counter

market;

|

|

|

•

|

|

through the writing of options, whether such options are listed on an options exchange or otherwise;

|

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

sales pursuant to Rule 144 of the Securities Act of 1933, as amended, or the Securities Act;

|

|

|

•

|

|

broker-dealers may agree with the selling stockholders to sell a specified number of such security at a stipulated price per security;

|

|

|

•

|

|

a combination of any such methods of sale; or

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

If the selling stockholders effect such transactions

by selling shares to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from

purchasers of the shares for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of

transactions involved). In connection with sales of the shares or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of our common stock in the course of hedging in

positions they assume. The selling stockholders may also sell shares of our common stock short and deliver shares of our common stock covered by this prospectus to close out short positions and to return borrowed shares in connection with such short

sales. The selling stockholders may also loan or pledge shares of our common stock to broker-dealers that in turn may sell such shares.

The selling

stockholders may pledge or grant a security interest in some or all of the shares of our common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares

of common stock from time to time pursuant to this prospectus or other applicable provisions of the Securities Act, amending, if necessary, the list of selling stockholders to include the pledgee, transferee or other successors in interest as

selling stockholders under this prospectus. The selling stockholders also

9

may transfer and donate the shares of our common stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners

for purposes of this prospectus.

The selling stockholders and any broker-dealer participating in the distribution of the shares may be deemed to be

“underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the

time a particular offering of the shares of our common stock is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of shares of our common stock being offered and the terms of the offering,

including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling stockholders and any discounts, commissions or concessions allowed or reallowed or paid to

broker-dealers.

Under the securities laws of some states, the shares may be sold in such states only through registered or licensed brokers or dealers.

In addition, in some states the shares may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that the selling stockholders will sell any or all of the shares registered pursuant to the registration statement of which this

prospectus forms a part.

The selling stockholders and any other person participating in such distribution will be subject to applicable provisions of the

Exchange Act, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of our common stock by the selling stockholders and any

other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of our common stock to engage in market-making activities with respect to the shares of our common stock. All of the

foregoing may affect the marketability of the shares and the ability of any person or entity to engage in market-making activities with respect to the shares.

We will pay all expenses of the registration of the shares pursuant to the registration statement of which this prospectus forms a part, including, without

limitation, SEC filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that the selling stockholders will pay all underwriting discounts and selling commissions, if any. We will indemnify the

selling stockholders against liabilities, including some liabilities under the Securities Act, or the selling stockholders will be entitled to contribution. We may be indemnified by the selling stockholders against civil liabilities, including

liabilities under the Securities Act, that may arise from any written information furnished to us by the selling stockholders specifically for use in this prospectus or we may be entitled to contribution.

Once sold under the registration statement of which this prospectus forms a part, the shares will be freely tradable in the hands of persons other than our

affiliates.

10

VALIDITY OF SECURITIES

The validity of the securities stock being offered hereby has been passed upon for us by Barbara A. Wood, Esq., our Executive Vice President, General Counsel

and Secretary.

EXPERTS

The consolidated financial statements of SELLAS Life Sciences Group, Inc. as of December 31, 2017, and for the year then ended, the adjustments to apply

the effects of the retrospective change resulting from the reverse merger and the stock split in the 2016 consolidated financial statements described in note 1, and the presentation of the total and net loss per share information to the 2016

consolidated financial statements described in note 3, included in the Annual Report on Form

10-K

for the year ended December 31, 2017, have been audited by Moss Adams LLP, independent registered public

accounting firm, as stated in their report, which is incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the report of such firm given upon their authority as experts in accounting and

auditing. The audit report of Moss Adams LLP contains an explanatory paragraph that states that the Company has incurred recurring losses from operations and has a net capital deficiency that raise substantial doubt about the Company’s ability

to continue as a going concern. The December 31, 2017 consolidated financial statements do not include any adjustments that might result from the outcome of that uncertainty.

The consolidated financial statements of SELLAS Life Sciences Group Inc. as of December 31, 2016 and for the year then ended, incorporated by reference

herein, include the effects of retrospective changes resulting from the merger described in Note 1 to the consolidated financial statements, and the addition of net loss per share information as described in Note 3 to the consolidated financial

statements. KPMG Audit Limited, an independent registered public accounting firm, audited the consolidated financial statements of SELLAS Life Sciences Group Ltd as of December 31, 2016 and for the year then ended, before the effects of the

retrospective changes and the addition of net loss per share information, which financial statements are not incorporated by reference herein. Moss Adams LLP, an independent registered public accounting firm, audited such retrospective changes and

the net loss per share information. The consolidated financial statements of SELLAS Life Sciences Group Inc. as of December 31, 2016 and for the year then ended, have been incorporated by reference herein in reliance upon the report of

(1) KPMG Audit Limited, solely with respect to the consolidated financial statements of SELLAS Life Sciences Group Ltd before the effects of the retrospective changes resulting from the Merger and the addition of net loss per share information,

and (2) Moss Adams LLP, solely with respect to the retrospective changes and the net loss per share information, incorporated by reference herein, and upon the authority of said firms as experts in accounting and auditing. The audit report of KPMG

Audit Limited covering the December 31, 2016 consolidated financial statements of SELLAS Life Sciences Group Ltd and subsidiaries contains an explanatory paragraph that states the Company has suffered recurring losses since its inception that

raises substantial doubt about its ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

SELLAS Life Sciences Group, Inc. has agreed to indemnify and hold KPMG Audit Limited harmless from and against any and all legal costs and expenses incurred

by KPMG Audit Limited in successful defense of any legal action or proceeding that arises as a result of KPMG Audit Limited’s consent to the inclusion (or incorporation by reference) of its audit report on the SELLAS Life Sciences Group

Ltd.’s financial statements as of December 31, 2016 and for the year then ended included (or incorporated by reference) in this registration statement.

WHERE YOU CAN FIND MORE INFORMATION

We are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the SEC. We have filed with the SEC a

registration statement on Form

S-3

under the Securities Act with respect to the resale of the common stock the selling stockholders are offering under this prospectus. This prospectus does not contain all of

the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the common stock offered by the selling stockholders under this prospectus, we refer you to the

registration statement and the exhibits filed as a part of the registration statement. You may read and copy the registration statement, as well as our reports, proxy statements and other information, at the SEC’s Public Reference Room at 100 F

Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330

for more information about the operation of the

public reference room. The SEC also maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, including SELLAS Life Sciences Group, Inc. The

SEC’s Internet site can be found at www.sec.gov. We maintain a website at www.sellaslife.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider

it part of this prospectus.

11

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you by referring you

to another document that we have filed separately with the SEC. You should read the information incorporated by reference because it is an important part of this prospectus. Information in this prospectus supersedes information incorporated by

reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus

and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (Commission File

No. 001-33958):

|

|

•

|

|

our Annual Report on Form

10-K

for the year ended December 31, 2017, filed with the SEC on April 13, 2018;

|

|

|

•

|

|

the information specifically incorporated by reference into our Annual Report on Form

10-K

for the year ended December 31, 2017 from our definitive proxy statement relating

to our 2018 Annual Meeting of Stockholders, filed with the SEC on April 30, 2018;

|

|

|

•

|

|

our Quarterly Report on Form 10-Q, as filed with the SEC on May 15, 2018;

|

|

|

•

|

|

our Current Reports on Form

8-K,

filed with the SEC on January 5, 2018 (as amended on January 11, 2018), January 18, 2018, February 12, 2018, February 20,

2018, February 27, 2018, March 12, 2018 (as amended April 2, 2018 and further amended April 13, 2018), March 19, 2018, April 10, 2018 April 20, 2018, April 24, 2018, April 26, 2018, May 2, 2018,

May 24, 2018, June 1, 2018, June 13, 2018, July 18, 2018, and July 23, 2018; and

|

|

|

•

|

|

the description of our common stock set forth in our registration statement on Form

8-A,

filed with the SEC on February 8, 2008, as amended on February 12, 2008,

including any further amendments thereto or reports filed for the purposes of updating this description.

|

We also incorporate by reference

any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form

8-K

and exhibits filed on such form that are related to such items unless such Form

8-K

expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration

statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective amendment that indicates the termination of the offering of the common stock made by this prospectus and will

become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will

automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify

or replace such earlier statements.

We will furnish without charge to each person, including any beneficial owner, to whom a prospectus is delivered,

upon written or oral request, a copy of any or all of the documents incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits that are specifically incorporated by reference into such documents. You

should direct any requests for documents to SELLAS Life Sciences Group, Inc., Attention: Corporate Secretary, 315 Madison Avenue, 4th Floor, New York, New York 10017. Our phone number is (917)

438-4353.

12

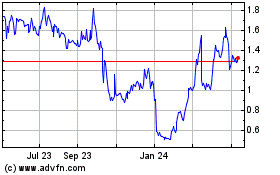

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

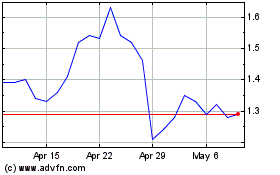

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024