IBM Is Working With a 'Crypto Dollar' Stablecoin

July 18 2018 - 5:14AM

ADVFN Crypto NewsWire

IBM is exploring whether a cryptocurrency pegged

to the U.S. dollar may be a better option for making payments than

other digital currencies, which tend to be volatile.

The computing giant is already a pioneer in business applications for

blockchain, using the digital ledger technology that underpins

Bitcoin to help companies track their supply chains as well as to

make international payments more efficient.

For such payments, IBM currently uses a cryptocurrency known as Stellar

Lumens as a conduit. Now, IBM will also begin testing a

so-called stablecoin, or “crypto dollar,”

that runs on the Stellar blockchain network. The stablecoin is

called Stronghold USD, after the fintech startup Stronghold that is behind the project.

“There’s this tremendous opportunity to make blockchain payments

feasible, especially for cross-border,” says Bridget van Kralingen,

IBM’s senior vice president of global industries, platforms and

blockchain. “What is great about this is they are just basically

digital dollars—digital fiat currency.”

That may help cut down on the foreign exchange costs associated

with making cross-border blockchain payments, which until now have

required conversion from one government-issued, or fiat,

currency—say the U.S. dollar—to the Stellar Lumens cryptocurrency,

and back into another fiat currency, such as Mexican pesos. Using a

stablecoin as a proxy for the fiat currency could reduce the risk

of getting a worse exchange rate when the money is converted back

into fiat currency, says van Kralingen, as the prices of digital

currencies like Stellar Lumens as well as Bitcoin can often swing

wildly.

“We believe this experimentation with stablecoins can play a

very big role in improving costs,” she adds. While IBM is currently

only working with the Stronghold USD stablecoin, it is interested

in potentially using similar digital versions of other countries’

legal tender. “I think if it can be done with the U.S. dollar, it

can be done with almost any currency,” says van Kralingen.

Stablecoins have become one of the biggest trends in

cryptocurrency. Tether, the most widely used dollar-backed coin,

now accounts for more Bitcoin trading volume than the

U.S. dollar. A slew of other companies are also developing

their own versions of a $1 coin, including Circle, TrustToken, and Basis.

While most other stablecoins are built atop the blockchain

systems of Bitcoin and Ethereum, Stronghold USD, which is federally

insured by the bank Prime Trust, is one of only two new stablecoins

to run on the Stellar network. That should allow Stronghold USD to

process hundreds of transactions per second, far more than other

blockchains can handle, with Bitcoin limited to an estimated

average of just seven transactions per second, van Kralingen

says.

Already, she adds, central banks are showing interest in using

digital versions of government currencies; stablecoins could

potentially pave the way for a “Fed Coin,” as well as greater usage of

cryptocurrency by banks in general. “I think in the future you’ll

see more,” van Kralingen says. “The way you’d settle FX today with

Citi—I think you could do that with a stablecoin in the

future.”

IBM also announced Tuesday that it is investing in a new

academic partnership with Columbia University to accelerate

startups and innovation in the field of blockchain technology. The

Columbia-IBM Center for Blockchain and Data Transparency represents

the first time the university has adopted the name of a private

sector company for one of its institutions.

By

Jen Wieczner

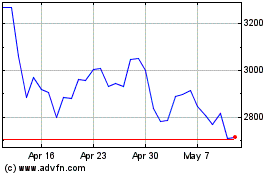

Ethereum (COIN:ETHEUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ethereum (COIN:ETHEUR)

Historical Stock Chart

From Apr 2023 to Apr 2024