Europe's New Idea: Taxing User-Generated Profit

March 21 2018 - 11:37AM

Dow Jones News

By Paul Hannon

LONDON -- The European Union's justification for a new tax on

technology companies hinges on a novel view of how profits are

generated that the U.K. Treasury presented in November.

Traditionally, the profits of a company operating

internationally have been taxed where its major decisions are made

and its most important assets are controlled. In practice, those

taxes have often been levied in countries where the company also

has a large number of customers. But the location of user of its

product or service hasn't been decisive.

The European Commission, the EU's executive arm, on Wednesday

proposed a tax set at 3% of revenues on some of the digital

activities of a small cadre of tech superpowers, including Facebook

Inc. and Alphabet Inc.'s Google.

European officials say that digital products rely increasingly

on crunching millions' of users data to generate value -- for

example, by targeting niche ads directly at users, or by combining

millions of interactions to improve an app's voice-recognition

capabilities. European officials say that means value is generated

where users are located -- and the system should change so tax

should be paid there, too.

That is a radical departure from the principles that have guided

international business taxation to date, and incorporates a logic

advanced in November by the U.K. Treasury. In a "position paper"

setting out the potential arguments for a tax on digital companies,

Treasury officials argued that "for many digital businesses that

operate in markets through an online platform, the users of the

platform...create material value for a business through their

sustained engagement and active participation."

"That is a brand new principle," said Will Morris, deputy global

tax policy leader at business services firm PwC.

The view that users do help create value under some business

models isn't shared outside Europe. In a report that highlighted

the lack of agreement between governments on how to tax digital

businesses, the Organization for Economic Cooperation and

Development Friday said there are "differences of opinion" on the

question.

Instead, tax authorities such as those of the U.S. argue that

digital businesses compensate users for the data they extract from

them through the provision of services such as data hosting, email

and entertainment. In other words, there is a digital barter

economy, and the only things that should be taxed are the services

provided to users, but as a form of income.

The difference of opinion over the role of users overlays a more

fundamental split between Europe and the U.S. Europeans argue that

some highly digitalized businesses are fundamentally different and

should be targeted through special taxes. The U.S. is against taxes

that single out digital businesses, and instead believes a broader

overhaul of the international tax system is needed to respond to

the digitization of business in general.

For now, the world's largest economies intend to try to work out

their differences.

"The impacts of the digitalisation of the economy on the

international tax system remain key outstanding issues," finance

ministers from the Group of 20 largest economies said in a

statement Tuesday. "We are committed to work together to seek a

consensus-based solution by 2020, with an update in 2019."

But Mr. Mills, who helps represent the view of business in OECD

deliberations on policy, said the Commission's adoption of a

controversial new principle may make that more difficult to

achieve.

"There is the danger that people who disagree with it will walk

away," he said. "And for those countries that adopt these measures,

it eases the political pressure to engage in a difficult

conversation."

Write to Paul Hannon at paul.hannon@wsj.com

(END) Dow Jones Newswires

March 21, 2018 11:22 ET (15:22 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

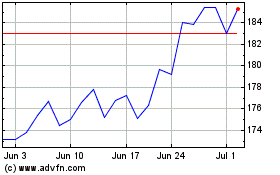

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

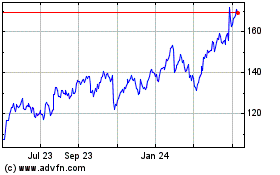

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024