By Julie Jargon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 14, 2018).

Chipotle Mexican Grill Inc. on Tuesday named Taco Bell Chief

Executive Brian Niccol as its next CEO, tapping a fast-food veteran

to try to revive the struggling burrito chain.

Mr. Niccol, 43 years old, has run Taco Bell for three years as

the chain has been the most successful in the portfolio of Yum

Brands Inc., which also owns Pizza Hut and KFC. He will succeed

Chipotle founder Steve Ells on March 5.

Mr. Ells said last year that he would step down as chief

executive and become executive chairman to allow an outsider to

address Chipotle's battles with food-safety problems and a decline

in customer visits. On Tuesday, Mr. Ells said Mr. Niccol's

"expertise in digital technologies, restaurant operations and

branding make him a perfect fit for Chipotle."

Chipotle has struggled to lure back diners after food-safety

scares began in 2015, including outbreaks of E. coli, salmonella

and norovirus. The chain's problems attracted the attention of

activist shareholder William Ackman, who negotiated to fill two

seats on Chipotle's board.

Despite the introduction of food giveaways, a loyalty program

and new menu items like chorizo sausage and queso dip, many

customers have stayed away. Chipotle executives have acknowledged

neglecting basic operational details, like keeping restaurants

clean and up-to-date, while they focused on food safety.

Chipotle shares, which had lost nearly 40% of their value in the

past year through Monday, slipped 1.2% in Tuesday's regular session

before rising sharply in after-hours trading on news of the CEO

appointment.

"Other companies were working on doing a better job to close the

gap between them and Chipotle through value offerings and improved

quality," said Deutsche Bank analyst Brett Levy.

Mr. Niccol must also get along with Mr. Ells, who has been

described by people who know him as a hands-on leader and a

perfectionist. "I fully intend to have the new CEO be in charge,"

Mr. Ells had said when Chipotle reported earnings earlier this

month.

Mr. Niccol has experience turning around a brand with perception

problems regarding quality. He helped revive Taco Bell's image and

financial performance after a disgruntled customer filed a lawsuit

in 2011 alleging that its taco mixture was more filler than beef.

The suit was withdrawn, but the publicity hurt Taco Bell's

reputation and sales.

As marketing and innovation chief of Taco Bell at the time, Mr.

Niccol repositioned the chain as a youthful lifestyle brand. The

company hired interns to handle the brand's Twitter and Pinterest

accounts, circulated a petition in favor of a taco emoji, created a

taco lens on Snapchat and developed an ad showcasing photos of

people posting Taco Bell food on Instagram.

Mr. Niccol aims to draw on that work at Chipotle, using social

media to make the brand more youthful and culturally relevant,

according to a person familiar with the matter.

Mr. Niccol is also known at Taco Bell for welcoming ideas from

employees, including its restaurant workers. He has told investors

that during a visit to a Taco Bell, he noticed employees using

tortillas to make miniature wraps, which became the inspiration for

Taco Bell's crunchwrap sliders.

Also under Mr. Niccol's watch, Taco Bell introduced breakfast,

mobile ordering and payment, and hit products like Doritos Locos

Tacos, Quesalupas and Nacho fries. The chain also opened "Cantina"

restaurants in urban markets to compete directly for Chipotle

customers with open kitchens serving small bites and alcoholic

beverages.

Some of those ideas earned him a reputation as a risk taker.

That could help Chipotle -- which is categorized as a fast-casual

chain -- win back the 75% of former Chipotle customers who now

favor fast-food brands, according to investment firm Cowen &

Co.

In monthly surveys of 2,500 consumers, Cowen has found that

ratings of Chipotle's food quality and trustworthiness have fallen

since 2015.

One customer, George Nenni, who is a digital-marketing

consultant for retail automotive dealers in Middletown, Ohio, ate

at Chipotle twice a month before the chain's food-safety problems.

Now he visits about once every two months.

Mr. Nenni, 52, said he can find healthier options elsewhere,

including at the fast-food chains he frequents a few times a week.

He said those restaurants are also more consistent than Chipotle.

Sometimes, he said, Chipotle guacamole is so overwhipped it

resembles green mayonnaise, the barbacoa meat is too fatty or the

burritos are too stuffed for his liking.

"It's just really inconsistent," he said.

Write to Julie Jargon at julie.jargon@wsj.com

(END) Dow Jones Newswires

February 14, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

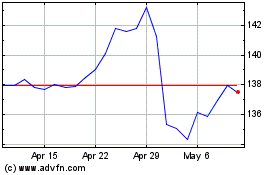

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

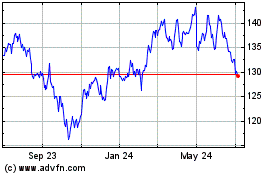

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024