By Vanessa Fuhrmans

Companies frequently say employees are their most valuable

asset, yet many don't divulge where those workers live and

work.

Now, thanks to a new regulatory mandate affecting publicly

traded companies, big multinationals are revealing fresh details

about how many people they employ in the U.S. and to what extent

some of the most recognizable American brands rely on workers in

lower-cost countries.

Kellogg Co., the maker of Frosted Flakes and Pop-Tarts, employs

nearly 20,000 people, or 59% of its workforce, overseas. At fruit

and vegetable producer Fresh Del Monte Produce Inc., 80% of workers

live and work in Costa Rica, Guatemala, Kenya and the

Philippines.

In manufacturing, Whirlpool Corp., known for its home

appliances, recently reported that its median worker in 2017 was a

full-time employee in Brazil who earned $19,906. Boiler maker A.O.

Smith said its median employee last year was an hourly factory

worker in Nanjing, China, who made $17,687.

The new data on median incomes stems from a quirk in the way the

Securities and Exchange Commission crafted the rules for a required

employee-pay disclosure that went into effect this year.

Publicly traded U.S. companies have to disclose the gap between

what they pay the chief executive and what they pay their median

worker, and the ratio between the two. The requirement was mandated

by the Dodd-Frank Act of 2010 in the aftermath of the global

financial crisis as a way to help investors better assess

executive-pay practices.

Past securities regulations have only required that publicly

traded U.S. companies report their overall global head count. In

recent years, roughly 25% went further and voluntarily disclosed

how many employees they had in the U.S. versus abroad, according to

researchers at Ohio State University and the University of

Toronto.

The current requirement is that companies disclose pay for the

CEO and the median worker, but not necessarily the size of their

domestic and overseas workforces. Companies, however, must report

these head counts if they opt to exclude some of their overseas

workers -- up to 5% of the total workforce -- from their

calculations of median workers' pay.

"It's another beneficial outcome of the pay-ratio disclosure,"

said Jonas Kron, senior vice president at Trillium Asset

Management, part of a coalition of institutional investors that

last year petitioned the SEC to require companies to disclose more

employee metrics, such as turnover rates and workforce

demographics. "It's more insight into how companies deal with their

human capital, and that's material information for investors."

Of a sampling of more than 180 S&P 500 companies disclosing

CEO pay ratios so far, about a third have opted to disclose the

proportion of their workforce that is outside the U.S. In total,

286 companies in the S&P 500 have disclosed pay-ratio data so

far.

Some companies, such as Fresh Del Monte Produce, say they are

providing details on U.S. versus overseas workers in part to

explain why their median paychecks are lower than at competitors

whose employees are mostly U.S.-based.

Apparel company Hanesbrands Inc., whose global workforce has

increased by 21% since 2010, already discloses in its annual report

how many of its workers are based in the U.S., where head count has

shrunk. Its proportion of overseas workers rose last year to 88% of

67,200 employees overall, compared with 85% of 55,500 workers in

2010.

In March, Hanesbrands disclosed that CEO Gerald W. Evans Jr.

made $9.58 million, or 1,830 times the $5,237 annual pay of its

median employee. The company said its typical worker was an

equipment operator at a supply-chain facility in Honduras. Four of

five employees work at similar sites, mostly in Central America,

the Caribbean and Asia, Hanesbrands said.

Spokesman Matt Hall said the company provided the extra detail

because it is one of the few U.S. publicly traded apparel companies

to own a majority of its international supply chain instead of

outsourcing the garment work to third parties -- which means many

company employees live in lower-cost countries.

"We wanted to give some context as to how the pay ratio would be

calculated," he said.

The size of overseas workforces is a hot-button issue for many

U.S. companies due to political sensitivities around offshoring

American jobs to developing countries.

Between 2000 and 2015, the most recent year that Commerce

Department data is available, American multinationals hired 4.3

million people in the U.S. but added even more jobs -- 6.2 million

-- overseas. In total, U.S. multinationals in 2015 employed 28.3

million people domestically and 14.1 million abroad.

A number of companies don't disclose their U.S. head counts. One

is International Business Machines Corp., which stopped reporting

the size of its U.S. workforce in 2010 and didn't shed any more

light on the geographic makeup of its workforce when it disclosed

its CEO-pay ratio earlier this year. Chief Executive Ginni Rometty

earned $18.6 million, or 341 times the $54,491 that IBM's median

employee earned.

Some companies reporting their overseas head counts say the

expansion of their workforce abroad isn't about shipping jobs to

low-cost countries, but rather about employing workers closer to

customers.

Kellogg reported that CEO Steven Cahillane, who took the helm in

the fall, made $7.3 million on an annualized basis, or 183 times

the $40,163 pay of its median worker. The company didn't disclose

where that worker was located.

More than half of Kellogg's employee base is outside the U.S.

because it sells food in more than 180 countries, spokeswoman Kris

Charles said. A majority of Kellogg's sales still come from the

U.S., according to earnings reports, but as cereal sales in its

home market have slumped in recent years, it has shed hundreds of

American jobs..

--Theo Francis contributed to this article.

Write to Vanessa Fuhrmans at vanessa.fuhrmans@wsj.com

(END) Dow Jones Newswires

April 11, 2018 08:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

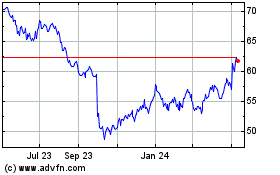

Kellanova (NYSE:K)

Historical Stock Chart

From Mar 2024 to Apr 2024

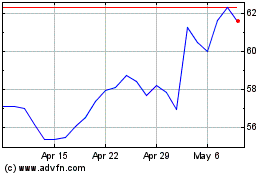

Kellanova (NYSE:K)

Historical Stock Chart

From Apr 2023 to Apr 2024