TIDMAEP

RNS Number : 7869O

Anglo-Eastern Plantations PLC

23 August 2017

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Announcement of interim results for six months ended 30 June

2017

Anglo-Eastern Plantations Plc, and its subsidiaries are a major

producer of palm oil and rubber with plantations across Indonesia

and Malaysia amounting to some 128,400 hectares, has today released

its results for the six months ended 30 June 2017.

Financial Highlights

2017 2016 2016

6 months 6 months 12 months

to 30 to 30 to 31

June June December

$m $m $m

(unaudited) (unaudited (audited)

& restated)

Revenue 146.9 86.0 246.2

Profit before tax

- before biological

assets ("BA") movement 31.8 14.0 57.5

- after biological

assets movement 31.6 17.3 60.8

Earnings per share 46.24cts 14.99cts 82.16cts

before BA movement

Earnings per share 45.97cts 20.29cts 87.58cts

after BA movement

Total net assets 470.6 420.0 445.3

Enquiries:

Anglo-Eastern Plantations

Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Panmure Gordon

Andrew Godber +44 (0)20 7886 2500

Chairman's Interim Statement

I am pleased to present the interim results for the Group for

the six months to 30 June 2017.

The revenue for the six months to 30 June was $146.9 million,

71% higher than $86.0 million for the first six months of 2016. In

the same period the Group gross profit rose to $34.9 million from

$18.5 million. Overall the profit before tax for the first half of

2017 improved by 83% to $31.6 million from $17.3 million for the

corresponding period. Higher crop production and purchase of

external crops as well as higher Crude Palm Oil ("CPO") prices

lifted the profit of the Group.

Fresh Fruit Bunches ("FFB") production for the first half of

2017 was 15% higher at 436,900mt compared to 378,400mt in the same

period last year. The increase in production was due to the strong

recovery of FFB production especially in Riau and Kalimantan

regions post El-Nino weather disruption. The Group continued to buy

more external crops to maximise the utilization of its mills.

Bought-in crops increased by 84% to 486,300mt from 264,500mt.

Operational and financial performance

For the six months ended 30 June 2017, the gross profit margin

increased to 24% from 22% as the Group benefited from higher CPO

prices and a higher contribution from the purchase of external

crop.

CPO price ex-Rotterdam averaged $740/mt for the first six months

of 2017, 11% higher than $668/mt over the same period in 2016.

The amendments to IAS 16 and the amendments to IAS 41, which

came into effect on 1 January 2016, require Biological Assets that

meet the definition of bearer plants to be accounted for as

Property, Plant and Equipment in accordance with IAS 16. This was

adopted in the prior year interim and annual financial statements

for the first time and required retrospective application. The

prior year interim financial statements have been restated to

reflect the changes made in the annual financial statements which

were subject to audit. The details of the changes are disclosed in

Note 2 - Prior period's restatement.

Profit after tax for the six months ended 30 June 2017 was $23.3

million, 112% higher than $11.0 million for the first six months of

2016.

The resulting earnings per share for the period improved by 127%

to 45.97cts (1H 2016: 20.29cts).

The Group's balance sheet remains reasonably strong and cash

flow remains healthy. Net assets at 30 June 2017 were $470.6

million compared to $445.3 million at 31 December 2016. The

increase in net assets was attributed to increase in profit for the

first half of 2017.

As at 30 June 2017 the Group's total cash balance was $123.0

million (1H 2016: $93.0 million) with total borrowings of $31.2

million (1H 2016: $35.6 million), giving a net cash position of

$91.8 million, compared to $57.4 million as at 30 June 2016.

Operating costs

The operating costs per hectare for the Indonesian operations

were higher in the first half of 2017 compared to the same period

in 2016 mainly due to an increase in wages, fuel, transportation

costs and depreciation. Higher operating costs were also partly

attributed to a 1% increase in matured areas for the corresponding

period.

Production and Sales

2017 2016 2016

6 months 6 months Year

to 30

June to 30 June to 31 December

mt mt mt

Oil palm production

FFB

- all estates 436,900 378,400 897,700

- bought-in or processed

for third parties 486,300 264,500 813,700

Saleable CPO 187,400 134,100 353,100

Saleable palm kernels 44,900 30,500 81,500

Oil palm sales

CPO 192,900 130,400 345,000

Palm kernels 45,600 29,300 79,900

FFB sold outside 11,000 12,100 24,300

Rubber production 397 371 868

The Group's six mills processed a total of 912,200mt in FFB for

the first half of 2017, a 45% increase compared to 630,800mt for

the same period last year. The higher throughput was due to both

higher internal crops production and external purchases.

Overall CPO produced for the first half of 2017 was higher by

40% at 187,400mt from 134,100mt.

The Group continues to reduce its overall carbon footprint as

the two biogas plants in Bengkulu and Kalimantan are in full

operation. The biogas plant in Bengkulu with a capacity to generate

2 megawatts of electrical power will sell the surplus power to the

regional grid from the beginning of third quarter of 2017. While

the biogas plant in North Sumatera with a capacity of 1 megawatt

has sold over 3,000 MWh of surplus electricity to the National Grid

since January this year.

Commodity prices

Although the CPO price for first half of 2017 averaged $740/mt,

11% higher than last year (1H 2016: $668/mt), the price has

gradually trended downwards from the start of the year at $795/mt

to close at $645/mt on 30 June 2017. A higher CPO production for

the second half of the year amid strong competition from bumper

soybean production will likely hurt and depress the CPO price for

the remainder of the year.

Rubber price averaged $1,849/mt, 56% higher than 2016 (1H 2016:

$1,188/mt).

Development

The Group's planted areas at 30 June 2017 comprised:

Total Mature Immature

ha ha Ha

North Sumatera 19,049 14,884 4,165

Bengkulu 16,943 16,943 -

Riau 4,873 4,873 -

South Sumatera 5,778 5,037 741

Kalimantan 13,844 9,679 4,165

Bangka 703 236 467

Plasma 2,706 1,417 1,289

------- ------- ---------

Indonesia 63,896 53,069 10,827

Malaysia 3,696 3,460 236

------- ------- ---------

Total: 30 June 2017 67,592 56,529 11,063

------- ------- ---------

Total: 31 December

2016 66,674 54,217 12,457

------- ------- ---------

Total: 30 June 2016 65,561 55,842 9,719

------- ------- ---------

The Group's new planting for the first six months of 2017

totalled 781ha compared to 518ha for the same corresponding period

last year. The slower than anticipated rate of new planting is due

to protracted land compensation negotiations and also the dry

condition which was not conducive for planting.

The Group remains optimistic that planting will pick up in the

second half of 2017. The Group's total landholding comprises some

128,400ha, of which the planted area stands around 67,592ha (1H

2016: 65,561ha).

Significant capital expenditure is expected in the replanting of

over 1,700ha of old palms in North Sumatera which started in June

2017.

Dividend

As in previous years no interim dividend has been declared. The

Board is mindful that given the anticipated further capital

commitments the level of dividend needs to be balanced against the

planned expenditure. A final dividend of 3.0 pence per share in

respect of the year to 31 December 2016 was paid on 14 July

2017.

Outlook

The upside of the CPO price is limited as the industry heads

into its peak production cycle in the third quarter of 2017. The

demand of CPO from price-sensitive markets may however pick-up as

CPO price discount to soybean oil has widened.

The Board looks forward to reporting further progress in its

next trading update.

Others

I am pleased to advise that after an absence of one year, AEP

with effect from 1 June 2017, has been included in the FTSE Small

Cap and FTSE All Share-Index. This may potentially lead to greater

liquidity as index related funds re-weight their holding.

Principal risks and uncertainties

The directors believe the potential impact of Britain's vote to

leave the European Union, better known as Brexit, on the Group is

limited. Other than maintaining its corporate presence and listing

in United Kingdom ("UK"), all plantation and mill operations

together with marketing are primarily based in Indonesia. Unless

Brexit causes a worldwide recession which significantly reduces the

consumption of CPO, the principal risks and uncertainties have

broadly remained the same since the publication of the annual

report for the year ended 31 December 2016.

A more detailed explanation of the risks relevant to the Group

is on pages 18 to 22 and from pages 87 to 91 of the 2016 annual

report which is available at www.angloeastern.co.uk.

The information communicated in this announcement is inside

information for the purposes of Article 7 of Market Abuse

Regulation 596/2014.

Madam Lim Siew Kim

Chairman

23 August 2017

Responsibility Statements

We confirm that to the best of our knowledge:

a) The unaudited interim financial statements have been prepared

in accordance with IAS34: Interim Financial Reporting as adopted by

the European Union;

b) The Chairman's statement includes a fair review of the

information required by DTR 4.2.7R (an indication of important

events during the first six months and a description of the

principal risks and uncertainties for the remaining six months of

the year); and

c) The interim financial statements include a fair review of the

information required by DTR 4.2.8R (material related party

transactions in the six months ended 30 June 2017 and any material

changes in the related party transactions described in the last

Annual Report) of the Disclosure and Transparency Rules of the

United Kingdom Financial Services Authority.

By order of the Board

Dato' John Lim Ewe Chuan

Executive Director, Corporate Finance and Corporate Affairs

23 August 2017

Condensed Consolidated Income Statement

2017 2016 2016

6 months to 30 June 6 months to 30 June Year to 31 December

(unaudited) (unaudited & restated) (audited)

--------------------------------- ------------------------------- ---------------------------------

Notes Result Result Result

Continuing before before before

operations BA BA BA BA BA BA

movement movement Total movement movement Total movement movement Total

$000 $000 $000 $000 $000 $000 $000 $000 $000

----------------- ------ ---------- --------- ---------- --------- --------- --------- ---------- --------- ----------

Revenue 146,870 - 146,870 86,044 - 86,044 246,210 - 246,210

Cost of sales (111,826) (181) (112,007) (70,815) 3,288 (67,527) (184,337) 3,383 (180,954)

----------------- ------ ---------- --------- ---------- --------- --------- --------- ---------- --------- ----------

Gross profit 35,044 (181) 34,863 15,229 3,288 18,517 61,873 3,383 65,256

Administration

expenses (3,269) - (3,269) (3,355) - (3,355) (6,653) - (6,653)

Impairment

losses (1,596) - (1,596) (1,722) - (1,722) (2,740) - (2,740)

----------------- ------ ---------- --------- ---------- --------- --------- --------- ---------- --------- ----------

Operating profit 30,179 (181) 29,998 10,152 3,288 13,440 52,480 3,383 55,863

Exchange gains 156 - 156 1,244 - 1,244 845 - 845

Finance income 2,390 - 2,390 3,406 - 3,406 5,881 - 5,881

Finance expense 4 (913) - (913) (835) - (835) (1,743) - (1,743)

----------------- ------ ---------- --------- ---------- --------- --------- --------- ---------- --------- ----------

Profit before

tax 31,812 (181) 31,631 13,967 3,288 17,255 57,463 3,383 60,846

Tax expense 6 (8,394) 45 (8,349) (5,472) (820) (6,292) (16,021) (844) (16,865)

----------------- ------ ---------- --------- ---------- --------- --------- --------- ---------- --------- ----------

Profit for the

period 23,418 (136) 23,282 8,495 2,468 10,963 41,442 2,539 43,981

----------------- ------ ---------- --------- ---------- --------- --------- --------- ---------- --------- ----------

Attributable

to:

- Owners of the

parent 18,328 (109) 18,219 5,940 2,104 8,044 32,563 2,150 34,713

-

Non-controlling

interests 5,090 (27) 5,063 2,555 364 2,919 8,879 389 9,268

----------------- ------ ---------- --------- ---------- --------- --------- --------- ---------- --------- ----------

23,418 (136) 23,282 8,495 2,468 10,963 41,442 2,539 43,981

----------------- ------ ---------- --------- ---------- --------- --------- --------- ---------- --------- ----------

Earnings per

share for

profit

attributable

to the owners

of the parent

during the

period

- basic 8 45.97cts 20.29cts 87.58cts

- diluted 8 45.93cts 20.29cts 87.58cts

Condensed Consolidated Statement of Comprehensive Income

2017 2016 2016

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited &

(unaudited) restated) (audited)

$000 $000 $000

-------------------------------------------------- ------------ ------------- ---------------

Profit for the period 23,282 10,963 43,981

--------------------------------------------------- ------------ ------------- ---------------

Other comprehensive income

Items may be reclassified to profit

or loss:

Gain on exchange translation of

foreign operations 4,606 18,950 8,860

--------------------------------------------------- ------------ ------------- ---------------

Net other comprehensive income

may be reclassified to profit or

loss 4,606 18,950 8,860

--------------------------------------------------- ------------ ------------- ---------------

Items not to be reclassified to

profit or loss:

Unrealised (loss) / gain on revaluation

of leasehold land, net of tax (795) (1,126) 1,752

Remeasurement of retirement benefits

plan, net of tax - - (567)

--------------------------------------------------- ------------ ------------- ---------------

Net other comprehensive (expense)

/ income not being reclassified

to profit or loss (795) (1,126) 1,185

--------------------------------------------------- ------------ ------------- ---------------

Total other comprehensive income

for the period, net of tax 3,811 17,824 10,045

Total comprehensive income for

the period 27,093 28,787 54,026

Attributable to:

- Owners of the parent 21,049 22,155 43,099

- Non-controlling interests 6,044 6,632 10,927

--------------------------------------------------- ------------ ------------- ---------------

27,093 28,787 54,026

-------------------------------------------------- ------------ ------------- ---------------

Condensed Consolidated Statement of Financial Position

2017 2016 2016

as at 30 June as at 30 June as at 31 December

(unaudited

(unaudited) & restated) (audited)

$000 $000 $000

-------------------------------- --- --------------- -------------- ------------------

Non-current assets

Property, plant and equipment 361,270 355,030 356,790

Receivables 5,248 3,565 3,891

Deferred tax assets 15,883 11,235 13,451

-------------------------------- --- --------------- -------------- ------------------

382,401 369,830 374,132

-------------------------------- --- --------------- -------------- ------------------

Current assets

Inventories 8,257 8,147 9,219

Tax receivables 33,664 22,856 26,695

Biological assets 6,995 7,195 7,107

Trade and other receivables 8,903 8,460 5,767

Cash and cash equivalents 123,041 92,994 118,176

-------------------------------- --- --------------- -------------- ------------------

180,860 139,652 166,964

-------------------------------- --- --------------- -------------- ------------------

Current liabilities

Loans and borrowings (7,234) (4,391) (6,203)

Trade and other payables (15,459) (14,508) (16,054)

Tax liabilities (7,500) (3,690) (8,974)

Dividend payables (1,515) (1,003) -

-------------------------------- --- --------------- -------------- ------------------

(31,708) (23,592) (31,231)

-------------------------------- --- --------------- -------------- ------------------

Net current assets 149,152 116,060 135,733

-------------------------------- --- --------------- -------------- ------------------

Non-current liabilities

Loans and borrowings (24,000) (31,234) (27,875)

Deferred tax liabilities (29,688) (29,393) (30,063)

Retirement benefits - net

liabilities (7,257) (5,241) (6,666)

-------------------------------- --- --------------- -------------- ------------------

(60,945) (65,868) (64,604)

-------------------------------- --- --------------- -------------- ------------------

Net assets 470,608 420,022 445,261

-------------------------------- --- --------------- -------------- ------------------

Issued capital and reserves

attributable to owners of

the parent

Share capital 15,504 15,504 15,504

Treasury shares (1,171) (1,171) (1,171)

Share premium 23,935 23,935 23,935

Capital redemption reserve 1,087 1,087 1,087

Revaluation reserves 60,322 58,583 61,038

Exchange reserves (216,024) (211,874) (219,570)

Retained earnings 498,992 456,103 482,288

-------------------------------- --- --------------- -------------- ------------------

382,645 342,167 363,111

Non-controlling interests 87,963 77,855 82,150

-------------------------------- --- --------------- -------------- ------------------

Total equity 470,608 420,022 445,261

-------------------------------- --- --------------- -------------- ------------------

Condensed Consolidated Statement of Changes in Equity

Attributable to owners of the parent

-----------------------------------------------------------------------------------------------

Capital Foreign Non-controlling

Share Treasury Share redemption Revaluation exchange Retained interests Total

capital shares premium reserve reserves reserves earnings Total equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- ---------

Balance at 31 December

2015 15,504 (1,171) 23,935 1,087 59,594 (234,490) 504,892 369,351 82,607 451,958

Restatement (note

2) - - - - (22) 7,516 (55,830) (48,336) (9,009) (57,345)

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Balance at 31 December

2015 after restatement 15,504 (1,171) 23,935 1,087 59,572 (226,974) 449,062 321,015 73,598 394,613

---------------------------------------------------------- ---------- ---------- --------- ---------------- -----------

Items of other comprehensive

income:

* Unrealised gain on revaluation of leasehold land,

net

of tax - - - - 1,466 - - 1,466 286 1,752

* Remeasurement of retirement benefits plan, net of

tax - - - - - - (484) (484) (83) (567)

* Gain on exchange translation of foreign operations - - - - - 7,404 - 7,404 1,456 8,860

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total other comprehensive

income / (expense) - - - - 1,466 7,404 (484) 8,386 1,659 10,045

Profit for the year - - - - - - 34,713 34,713 9,268 43,981

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total comprehensive

income for the year - - - - 1,466 7,404 34,229 43,099 10,927 54,026

Dividends paid - - - - - - (1,003) (1,003) (2,375) (3,378)

----------------------------------------------------------

Balance at 31 December

2016 15,504 (1,171) 23,935 1,087 61,038 (219,570) 482,288 363,111 82,150 445,261

--------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Items of other comprehensive

income:

* Unrealised loss on revaluation of leasehold land,

net

of tax - - - - (716) - - (716) (79) (795)

* Gain on exchange translation of foreign operations - - - - - 3,546 - 3,546 1,060 4,606

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total other comprehensive

(expense) / income - - - - (716) 3,546 - 2,830 981 3,811

Profit for the period - - - - - - 18,219 18,219 5,063 23,282

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total comprehensive

(expense) / income

for the period - - - - (716) 3,546 18,219 21,049 6,044 27,093

Dividend payable - - - - - - (1,515) (1,515) (231) (1,746)

Balance at 30 June

2017 15,504 (1,171) 23,935 1,087 60,322 (216,024) 498,992 382,645 87,963 470,608

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Attributable to owners of the parent

-----------------------------------------------------------------------------------------------

Capital Foreign Non-controlling

Share Treasury Share redemption Revaluation exchange Retained interests Total

capital shares premium reserve reserves reserves earnings Total Equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- ---------

Balance at 31 December

2015 15,504 (1,171) 23,935 1,087 59,594 (234,490) 504,892 369,351 82,607 451,958

Restatement (note

2) - - - - (22) 7,516 (55,830) (48,336) (9,009) (57,345)

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Balance at 31 December

2015 after restatement 15,504 (1,171) 23,935 1,087 59,572 (226,974) 449,062 321,015 73,598 394,613

Items of other comprehensive

income:

* Unrealised loss on revaluation of leasehold land,

net

of tax - - - - (989) - - (989) (137) (1,126)

* Gain on exchange translation of foreign operations - - - - - 15,100 - 15,100 3,850 18,950

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total other comprehensive

(expense) / income - - - - (989) 15,100 - 14,111 3,713 17,824

Profit for the period - - - - - - 8,044 8,044 2,919 10,963

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Total comprehensive

(expense) / income

for the period - - - - (989) 15,100 8,044 22,155 6,632 28,787

Dividends payable - - - - - - (1,003) (1,003) (2,375) (3,378)

Balance at 30 June

2016 after restatement 15,504 (1,171) 23,935 1,087 58,583 (211,874) 456,103 342,167 77,855 420,022

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- --------- ---------------- -----------

Condensed Consolidated Statement of Cash Flows

2017 2016 2016

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited

(unaudited) & restated) (audited)

$000 $000 $000

--------------------------------- ------------ ------------- ---------------

Cash flows from operating

activities

Profit before tax 31,631 17,255 60,846

Adjustments for:

Biological assets

movement 181 (3,288) (3,383)

Gain on disposal of

property, plant and

equipment (7) (2) (13)

Depreciation 8,050 7,516 15,677

Retirement benefits

provisions 680 502 1,700

Net finance income (1,477) (2,571) (4,138)

Unrealised gain in

foreign exchange (156) (1,244) (845)

Property, plant and

equipment written

off 88 54 731

Impairment losses 1,596 1,722 2,740

Operating cash flow

before changes in

working capital 40,586 19,944 73,315

Decrease / (Increase)

in inventories 1,044 (1,140) (2,353)

Increase in non-current,

trade and other receivables (4,597) (3,888) (1,460)

Decrease in trade

and other payables (734) (3,630) (1,749)

--------------------------------- ------------ ------------- ---------------

Cash inflow from operations 36,299 11,286 67,753

Interest paid (913) (835) (1,743)

Retirement benefits

paid (148) - (250)

Overseas tax paid (19,350) (15,689) (27,133)

--------------------------------- ------------ ------------- ---------------

Net cash from / (used

in) operations 15,888 (5,238) 38,627

--------------------------------- ------------ ------------- ---------------

Investing activities

Property, plant and

equipment

- purchases (11,628) (13,366) (30,484)

- sales 81 58 931

Interest received 2,390 3,406 5,881

Net cash used in investing

activities (9,157) (9,902) (23,672)

--------------------------------- ------------ ------------- ---------------

Financing activities

Dividends paid by

Company - (1,003) (1,003)

Dividends paid to

non-controlling interests (202) (1,372) (2,375)

Drawdown of long term

loans - 1,250 1,250

Repayment of existing

long term loans (2,844) (250) (1,797)

Net cash used in financing

activities (3,046) (1,375) (3,925)

------------------------------- -------- --------- ------------

Increase / (Decrease)

in cash and cash equivalents 3,685 (16,515) 11,030

Cash and cash equivalents

At beginning of period 118,176 104,614 104,614

Foreign exchange 1,180 4,895 2,532

------------------------------- -------- --------- ------------

At end of period 123,041 92,994 118,176

------------------------------- -------- --------- ------------

Comprising:

Cash at end of period 123,041 92,994 118,176

------------------------------- -------- --------- ------------

Notes to the interim statements

1. Basis of preparation of interim financial statements

These interim consolidated financial statements have been

prepared in accordance with IAS 34, "Interim Financial Reporting",

as adopted by the European Union. They do not include all

disclosures that would otherwise be required in a complete set of

financial statements and should be read in conjunction with the

2016 Annual Report. The financial information for the half years

ended 30 June 2017 and 30 June 2016 does not constitute statutory

accounts within the meaning of Section 434(3) of the Companies Act

2006 and has been neither audited nor reviewed pursuant to guidance

issued by the Auditing Practices Board.

Basis of preparation

The annual financial statements of Anglo-Eastern Plantations Plc

are prepared in accordance with IFRSs as adopted by the European

Union. The comparative financial information for the year ended 31

December 2016 included within this report does not constitute the

full statutory accounts for that period. The statutory Annual

Report and Financial Statements for 2016 have been filed with the

Registrar of Companies. The Independent Auditors' Report on the

Annual Report and Financial Statements for 2016 was unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006.

Changes in accounting standards

The same accounting policies, presentation and methods of

computation are followed in these condensed consolidated financial

statements as were applied in the Group's latest annual audited

financial statements.

After making enquiries, the directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue operations for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

financial statements.

2. Prior period's restatement

The amendments to IAS 16 and the amendments to IAS 41, which

came into effect on 1 January 2016, require Biological Assets that

meet the definition of bearer plants to be accounted for as

Property, Plant and Equipment in accordance with IAS 16. This was

adopted in the prior year interim and annual financial statements

for the first time and required retrospective application. The

prior year interim financial statements have been restated to

reflect the changes made in the annual financial statements which

were subject to audit.

The effects of the restatements are summarised as follows:

2016 2015

6 months to Year to 31

30 June December

(unaudited (audited &

& restated) restated)

$000 $000

Impact on condensed

consolidated income

statement

Profit / (Loss) for

the period before

restatement 14,002 (13,429)

----------------------------- ------------- -----------

Effect of change in

restatement:

Cost of sales (480) (6,787)

Biological assets

movement - 63,389

Administration expenses (17) 196

Impairment losses (1,722) (12,470)

Tax expense (820) (15,847)

----------------------------- ------------- -----------

(3,039) 28,481

Profit for the period

after restatement 10,963 15,052

----------------------------- ------------- -----------

2016 2015

6 months to Year to 31

30 June December

(unaudited (audited &

& restated) restated)

Impact on earnings

per share

Basic EPS before BA

movement (4.09)cts (43.50)cts

Basic EPS after BA

movement (7.09)cts 62.24cts

Diluted EPS before

BA movement (4.09)cts (43.52)cts

Diluted EPS after

BA movement (7.09)cts 62.22cts

2016 2015

6 months to Year to 31

30 June December

(unaudited (audited &

& restated) restated)

$000 $000

Impact on condensed

consolidated statement

of comprehensive income

Other comprehensive

income / (expense)

for the period before

restatement 16,696 (50,585)

---------------------------------- ------------- -----------

Effect of change in

restatement:

Unrealised gain on

revaluation of leasehold

land 390 -

Loss on exchange translation

of foreign operations 1,136 8,858

Deferred tax on revaluation (398) (40)

---------------------------------- ------------- -----------

1,128 8,818

---------------------------------- ------------- -----------

Other comprehensive

income / (expense)

for the period after

restatement 17,824 (41,767)

---------------------------------- ------------- -----------

Restated

Balance balance

as reported at

30 June Effect 30 June

2016 of restatement 2016

$000 $000 $000

Impact on condensed

consolidated statement

of financial position

Property, plant and

equipment 329,788 25,242 355,030

Deferred tax (16,506) (1,652) (18,158)

Revaluation reserves (58,587) 4 (58,583)

Exchange reserves 211,615 259 211,874

Retained earnings (433,069) (23,034) (456,103)

Non-controlling interests (77,036) (819) (77,855)

Restated

Balance balance

as reported at

31 December Effect 31 December

2015 of restatement 2015

$000 $000 $000

Impact on condensed

consolidated statement

of financial position

Non-current assets

- Biological assets 179,010 (179,010) -

Property, plant and

equipment 219,990 116,454 336,444

Deferred tax (20,911) 1,538 (19,373)

Current assets - Biological

assets - 3,673 3,673

Revaluation reserves (59,594) 22 (59,572)

Exchange reserves 234,490 (7,516) 226,974

Retained earnings (504,892) 55,830 (449,062)

Non-controlling interests (82,607) 9,009 (73,598)

3. Foreign exchange

2017 2016 2016

6 months 6 months Year

to 30 to 30

June June to 31 December

(unaudited) (unaudited) (audited)

Average exchange rates

Rp : $ 13,331 13,420 13,307

$ : GBP 1.26 1.43 1.35

RM : $ 4.39 4.10 4.14

Closing exchange rates

Rp : $ 13,319 13,180 13,436

$ : GBP 1.30 1.34 1.23

RM : $ 4.29 4.03 4.49

4. Finance expense

2017 2016 2016

6 months 6 months Year

to 30 to 30

June June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Payable 913 835 1,743

------------ ------------ ---------------

5. Segment information

North South Total

Sumatera Bengkulu Sumatera Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2017

(unaudited)

Total sales revenue

(all external)

* CPO, palm kernel

and FFB 46,827 51,956 - 25,930 51 18,083 142,847 1,588 - 144,435

* Rubber 745 - - - - - 745 - - 745

* Shell nuts 373 365 2 434 - 8 1,182 - - 1,182

* Biomass products 451 57 - - - - 508 - - 508

Total revenue 48,396 52,378 2 26,364 51 18,091 145,282 1,588 - 146,870

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ --------

Profit / (loss)

before tax 10,414 13,319 (1,921) 7,351 (293) 3,237 32,107 288 (583) 31,812

BA movement 131 (17) (41) (167) (1) (62) (157) (24) - (181)

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ --------

Profit / (loss)

for the period

before

tax per

consolidated

income statement 10,545 13,302 (1,962) 7,184 (294) 3,175 31,950 264 (583) 31,631

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ --------

Depreciation (1,959) (2,026) (1,356) (461) (79) (1,875) (7,756) (294) - (8,050)

Impairment losses - - 446 - (110) (1,932) (1,596) - - (1,596)

Inter-segment

transactions 2,559 (1,058) (402) (304) (40) (831) (76) 46 30 -

Income tax (4,448) (2,918) 1,906 (2,517) 86 (214) (8,105) (102) (142) (8,349)

Total assets 182,406 140,227 57,161 36,290 11,913 107,376 535,373 22,334 5,554 563,261

Non-current assets 104,221 75,796 55,473 20,108 11,699 97,809 365,106 16,717 578 382,401

Non-current assets

- additions 3,353 1,171 997 368 222 5,495 11,606 22 - 11,628

North South Total

Sumatera Bengkulu Sumatera Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2016

(unaudited & restated)

Total sales revenue

(all external)

* CPO, palm kernel

and FFB 33,302 30,876 1 11,771 5 7,526 83,481 1,637 - 85,118

* Rubber 441 - - - - - 441 - - 441

* Shell nuts 90 252 - 27 - 9 378 - - 378

* Biomass products 107 - - - - - 107 - - 107

Total revenue 33,940 31,128 1 11,798 5 7,535 84,407 1,637 - 86,044

--------- --------- --------- -------- ------- ----------- ---------- --------- -------- --------

Profit / (loss)

before tax 8,205 6,434 (2,730) 2,974 (281) (1,315) 13,287 65 615 13,967

BA movement 1,142 1,533 50 441 - 40 3,206 82 - 3,288

--------- --------- --------- -------- ------- ----------- ---------- --------- -------- --------

Profit / (loss)

for the period

before

tax per

consolidated

income statement 9,347 7,967 (2,680) 3,415 (281) (1,275) 16,493 147 615 17,255

--------- --------- --------- -------- ------- ----------- ---------- --------- -------- --------

Depreciation (1,951) (1,939) (1,228) (439) (32) (1,597) (7,166) (330) - (7,516)

Impairment losses - - 201 - (165) (1,758) (1,722) - - (1,722)

Inter-segment

transactions 1,683 (1,060) (384) (305) - (637) (703) 673 30 -

Income tax (4,101) (1,692) 1,622 (1,397) 25 663 (4,880) (135) (1,277) (6,292)

Total assets 163,970 112,878 52,434 38,341 11,720 102,167 481,510 23,277 4,695 509,482

Non-current assets 100,264 73,974 50,706 20,138 11,499 94,255 350,836 18,416 578 369,830

Non-current assets

- additions 3,353 1,576 1,228 525 254 6,399 13,335 31 - 13,366

North South Total

Sumatera Bengkulu Sumatera Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

Year to 31 December 2016

(audited)

Total sales revenue

(all external)

* CPO, palm kernel

and FFB 88,465 86,564 3 40,169 27 24,342 239,570 3,450 - 243,020

* Rubber 1,149 - - - - - 1,149 - - 1,149

* Shell nuts 628 736 1 205 - 147 1,717 - - 1,717

* Biomass products 324 - - - - - 324 - - 324

Total revenue 90,566 87,300 4 40,374 27 24,489 242,760 3,450 - 246,210

--------- --------- --------- -------- ------- ----------- ---------- --------- -------- ---------

Profit / (loss)

before tax 23,219 24,785 (4,695) 12,861 (602) 1,623 57,191 296 (24) 57,463

BA movement 628 1,421 144 653 2 431 3,279 104 - 3,383

--------- --------- --------- -------- ------- ----------- ---------- --------- -------- ---------

Profit / (loss)

for the period

before

tax per

consolidated

income statement 23,847 26,206 (4,551) 13,514 (600) 2,054 60,470 400 (24) 60,846

--------- --------- --------- -------- ------- ----------- ---------- --------- -------- ---------

Depreciation (4,029) (4,096) (2,505) (898) (85) (3,414) (15,027) (650) - (15,677)

Impairment losses - - 693 - (335) (3,098) (2,740) - - (2,740)

Inter-segment

transactions 3,828 (2,117) (767) (609) - (1,334) (999) 604 395 -

Income tax (9,275) (5,744) 3,410 (4,531) 90 644 (15,406) (81) (1,378) (16,865)

Total assets 175,332 129,428 54,280 41,887 11,732 103,906 516,565 20,944 3,587 541,096

Non-current assets 101,843 76,048 52,862 20,044 11,520 94,974 357,291 16,263 578 374,132

Non-current assets

- additions 7,956 5,544 2,638 857 657 12,771 30,423 61 - 30,484

In the 6 months to 30 June 2017, revenues from 4 customers of

the Indonesian segment represent approximately $78.5m (1H 2016:

$47.6m) of the Group's total revenues. In the year of 2016,

revenues from 4 customers of the Indonesian segment represent

approximately $114.1m of the Group's total revenues. An analysis of

these revenues is provided below. Although Customer 1 to 2 are over

10% of the Group's total revenue, there is no over reliance on

these Customers as tenders are performed on a monthly basis. Two of

the top four customers are the same as in the year to 31 December

2016.

2017 2016 2016

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$m % $m % $m %

Major Customers

Customer 1 28.2 19.2 16.9 19.6 39.1 15.9

Customer 2 23.3 15.9 13.6 15.8 27.0 11.0

Customer 3 14.6 9.9 10.7 12.4 24.2 9.9

Customer 4 12.4 8.4 6.4 7.5 23.8 9.7

------------------ --------- --------- ---------- -------- -------- --------

Total 78.5 53.4 47.6 55.3 114.1 46.5

------------------ --------- --------- ---------- -------- -------- --------

6. Tax expense

2017 2016 2016

6 months 6 months Year

to 30 to 30

June June to 31 December

(unaudited

(unaudited) & restated) (audited)

$000 $000 $000

Foreign corporation

tax - current year 11,049 7,963 20,438

Foreign corporation

tax - prior year - - (30)

Deferred tax adjustment

- current year (2,700) (1,671) (3,543)

8,349 6,292 16,865

------------ ------------- ---------------

7. Dividend

The final and only dividend in respect of 2016, amounting to

3.0p per share, or $1,515,140 was paid on 14 July 2017 (2015: 1.75p

per share, or $1,002,785, paid on 11 July 2016). As in previous

years no interim dividend has been declared.

8. Earnings per ordinary share (EPS)

2017 2016 2016

6 months 6 months Year

to 30 to 30

June June to 31 December

(unaudited

(unaudited) & restated) (audited)

$000 $000 $000

Profit for the year

attributable to owners

of the Company before

BA movement 18,328 5,940 32,563

BA movement (109) 2,104 2,150

------------ ------------- ---------------

Earnings used in basic

and diluted EPS 18,219 8,044 34,713

------------ ------------- ---------------

Number Number Number

'000 '000 '000

Weighted average number

of shares in issue in

period

- used in basic EPS 39,636 39,636 39,636

- dilutive effect of

outstanding share options 33 - -

------------ ------------- ---------------

- used in diluted EPS 39,669 39,636 39,636

------------ ------------- ---------------

Basic EPS before BA

movement 46.24cts 14.99cts 82.16cts

Basic EPS after BA movement 45.97cts 20.29cts 87.58cts

Dilutive EPS before

BA movement 46.20cts 14.99cts 82.16cts

Dilutive EPS after BA

movement 45.93cts 20.29cts 87.58cts

9. Fair value measurement of financial instruments

The carrying amounts and fair values of the financial

instruments which are not recognised at fair value in the Statement

of Financial Position are exhibited below:

2017 2016 2016

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Carrying Fair Carrying Fair Carrying Fair

amount value amount value amount value

$000 $000 $000 $000 $000 $000

Non-current

receivables

Due from non-controlling

interests 578 424 578 424 578 424

Due from cooperatives

under Plasma

scheme 4,670 4,394 2,987 2,843 3,313 2,973

5,248 4,818 3,565 3,267 3,891 3,397

--------- ------- ------------ ------- --------- -------

Borrowings

due after

one year

Long term

loan 24,000 23,349 31,234 31,387 27,875 27,208

--------- ------- ------------ ------- --------- -------

Financial instruments not measured at fair value includes cash

and cash equivalents, trade and other receivables, trade and other

payables, and borrowings due within one year.

Due to their short-term nature, the carrying value of cash and

cash equivalents, trade and other receivables, trade and other

payables and borrowings due within one year approximates their fair

value.

All non-current receivables and long term loan are classified as

Level 3 in the fair value hierarchy.

The valuation techniques and significant unobservable inputs

used in determining the fair value measurement of non-current

receivables and borrowings due after one year, as well as the

inter-relationship between key unobservable inputs and fair value,

are set out in the table below:

Item Valuation approach Inputs Inter-relationship

used between key

unobservable

inputs and

fair value

----------------- ---------------------- --------- --------------------

Non-current receivables

Due from Based on cash Discount The higher

non-controlling flows discounted rate the discount

interests using current rate, the

lending rate lower the

of 6% (1H 2016 fair value

and 2016: 6%)

Due from Based on cash Discount The higher

cooperatives flows discounted rate the discount

under Plasma using an estimated rate, the

scheme current lending lower the

rate of 5.56% fair value

(1H 2016: 5.57%,

2016: 5.56%)

Borrowings due after one year

Long term Based on cash Discount The higher

loan flows discounted rate the discount

using an estimated rate, the

current lending lower the

rate of 5.56% fair value

(1H 2016: 5.57%,

2016: 5.56%)

10. Report and financial information

Copies of the interim report for the Group for the period ended

30 June 2017 are available on the AEP website at

www.angloeastern.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFLITVIVFID

(END) Dow Jones Newswires

August 23, 2017 12:00 ET (16:00 GMT)

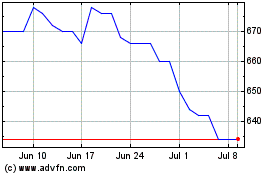

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Apr 2023 to Apr 2024