American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, today reported results of operations for

the first quarter ended March 31, 2018. For the three months ended

June 30, 2018, we reported a net income applicable to common shares

of $5.6 million or ($0.35) per diluted loss per share compared to a

net loss applicable to common shares of $11.2 million or ($0.72)

per diluted loss per share for the same period ended 2017.

The Company maintained its overall focus on growing its

portfolio and is working on several strategic initiatives that we

previously announced earlier this year. Overall, management remains

very encouraged about the overall performance of the company;

especially tied to the quality of our assets in our portfolio, and

the new multifamily apartment projects under various stages of

development.

Revenues

Rental and other property revenues were $31.6 million for the

three months ended June 30, 2018 and 2017. The change by segment

was an increase in revenues in the apartment portfolio of

approximately $1.2 million, offset by a decrease in revenues in the

commercial portfolio of $1.2 million.

Expense

Property operating expenses were $15.5 million for the three

months ended June 30, 2018. This represents an increase of $0.1

million compared to the prior period operating expenses of $15.4

million. This increase is driven primarily by an increase in

property operating expenses in the apartment portfolio of $1.0

million offset by a decrease in operating expenses from our

commercial portfolio of $0.7 million and $0.2 million from the

other portfolio.

Depreciation and amortization expense was $6.5 million for the

three months ended June 30, 2018, as compared to $6.4 million in

the same period of 2017. This increase was due primarily to the

growth in our apartment portfolio, which resulted in a $0.1 million

increase in the expense year over year.

General and Administrative expense was $2.9 million for the

three months ended June 30, 2018. This represents an increase of

$1.0 million compared to the prior period expense of $1.9 million.

The increase is due to an increase in expense reimbursements

paid to our advisor of approximately $0.7 million and professional

fees for consulting, audit and tax services of approximately $0.3

million.

Other income (expense)

Mortgage and loan interest expense was $15.9 million for the

three months ended June 30, 2018. This represents a decrease of

$1.4 million compared to the prior period expense of $17.3 million.

The change by segment represents a decrease in the other portfolio

of $1.0 million, $0.5 million in the land portfolio and $0.2

million in the commercial portfolio offset by an increase of $0.3

million in the apartment portfolio. Within the other portfolio the

decrease is primarily due to $1.2 million of interest expense

savings related to maturing notes payable paid during the first

quarter of 2018.

Other income was $7.5 million for the three months ended June

30, 2018. This represents an increase of $7.6 million as compared

to prior period other expense of $0.1 million. The increase is the

result of insurance proceeds of approximately $6.6 million received

subsequent to the "as is" sale of a property damaged by a

hurricane, and other miscellaneous income of approximately $1.0

million.

Foreign currency transaction was a gain of $5.9 million for the

three months ended June 30, 2018. This represents an increase of

$9.3 million compared to prior period foreign currency transaction

loss of $3.4 million. The increase is the result of a gain in

foreign currency exchange as a result of the favorable exchange

rate between the Israel Shekels and the U.S. Dollar related to our

Bond program.

For the three months ended June 30, 2018, we sold a golf course

for a total sales price of $2.3 million and recorded no gain or

loss on the sale. For the same period in 2017, the Company recorded

a loss of approximately $0.5 million from the sale of 8.3 acres of

land for a sales price of $0.5 million.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers, and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

Three Months Ended Six Months

Ended June 30, June 30, 2018

2017 2018 2017 (dollars in

thousands, except per share amounts) Revenues: Rental

and other property revenues (including $208 and $199 for the three

months and $415 and $389 for the six months ended 2018 and 2017,

respectively, from related parties) $ 31,607 $ 31,587 $ 62,690 $

63,409

Expenses: Property operating expenses

(including $231 and $239 for the three months and $458 and 476 for

the six months ended 2018 and 2017, respectively, from related

parties) 15,550 15,429 29,974 31,693 Depreciation and amortization

6,504 6,409 12,895 12,739 General and administrative (including

$297 and $552 for the three months and $2,437 and $1,295 for the

six months ended 2018 and 2017, respectively, from related parties)

2,954 1,995 5,295 4,026 Net income fee to related party 53 77 106

137 Advisory fee to related party 2,929 2,849

5,885 5,508 Total operating

expenses 27,990 26,759 54,155

54,103 Net operating income 3,617 4,828 8,535

9,306

Other income (expenses): Interest income (including

$4,832 and $4,972 for the three months and $9,311 and $9,092 for

the six months ended 2018 and 2017, respectively, from related

parties) 4,882 5,059 9,991 9,852 Other income 7,537 (116 ) 9,438

1,327 Mortgage and loan interest (including $1,909 and $1,683 for

the three months and $3,708 and $3,195 for the six months ended

2018 and 2017, respectively, from related parties) (15,907 )

(17,347 ) (31,631 ) (34,143 ) Foreign currency transaction gain

(loss) 5,889 (3,425 ) 7,645 (3,747 ) Earnings from unconsolidated

subsidiaries and investees 277 153

597 208 Total other income (expenses)

2,678 (15,676 ) (3,960 ) (26,503

) Income (loss) before gain on land sales, non-controlling

interest, and taxes 6,295 (10,848 ) 4,575 (17,197 ) Gain (loss) on

land sales - (476 ) 1,335

(31 ) Net income (loss) from continuing operations before taxes

6,295 (11,324 ) 5,910

(17,228 ) Net income (loss) from continuing operations 6,295

(11,324 ) 5,910 (17,228 ) Net income (loss) 6,295 (11,324 ) 5,910

(17,228 ) Net (income) loss attributable to non-controlling

interest (441 ) 435 (716 ) 628

Net income (loss) attributable to American Realty Investors,

Inc. 5,854 (10,889 ) 5,194 (16,600 ) Preferred dividend requirement

(225 ) (275 ) (450 ) (550 ) Net income

(loss) applicable to common shares $ 5,629 $ (11,164 ) $

4,744 $ (17,150 )

Earnings per share - basic Net loss

from continuing operations $ 0.35 $ (0.72 ) $ 0.30 $

(1.11 )

Earnings per share - diluted Net income

(loss) from continuing operations $ 0.35 $ (0.72 ) $ 0.30

$ (1.11 ) Weighted average common shares used in

computing earnings per share 15,997,076 15,514,360 15,967,740

15,514,360 Weighted average common shares used in computing diluted

earnings per share 15,997,076 15,514,360 15,967,740 15,514,360

Amounts attributable to American Realty Investors,

Inc. Net income (loss) from continuing operations $ 5,854

$ (10,889 ) $ 5,194 $ (16,600 ) Net income (loss)

applicable to American Realty Investors, Inc. $ 5,854 $

(10,889 ) $ 5,194 $ (16,600 )

AMERICAN REALTY INVESTORS, INC.

CONSOLIDATED BALANCE SHEETS June 30, December

31, 2018 2017 (unaudited) (audited)

(dollars in thousands, except share and par value amounts)

Assets Real estate, at cost $ 1,147,612 $ 1,117,429 Real

estate subject to sales contracts at cost 46,262 48,234 Less

accumulated depreciation (183,630 ) (177,546 ) Total

real estate 1,010,244 988,117 Notes and interest receivable:

Performing (including $104,665 in 2018 and $99,410 in 2017 from

related parties) 142,277 127,865 Less allowance for estimated

losses (including $14,269 in 2018 and 2017 from related parties)

(15,770 ) (15,770 ) Total notes and interest

receivable 126,507 112,095 Cash and cash equivalents 28,116 42,920

Restricted cash 64,652 45,618 Investments in unconsolidated joint

ventures and investees 6,993 6,396 Receivable from related party

55,987 38,311 Other assets 56,605 63,263

Total assets $ 1,349,104 $ 1,296,720

Liabilities and Shareholders’ Equity Liabilities: Notes and

interest payable $ 921,461 $ 898,750 Notes related to real estate

held for sale 376 376 Notes related to real estate subject to sales

contracts - 1,957 Bond and interest payable 143,897 113,049

Deferred revenue (including $57,289 in 2018 and $56,887 in 2017 to

related parties) 78,548 77,332 Accounts payable and other

liabilities (including $9,764 in 2018 and $11,893 in 2017 to

related parties) 31,655 39,373 Total

liabilities 1,175,937 1,130,837 Shareholders’ equity:

Preferred stock, Series A: $2.00 par value, authorized 15,000,000

shares, issued and outstanding 1,800,614 and 2,000,614 shares in

2018 and 2017 (liquidation preference $10 per share), including

900,000 shares in 2018 and 2017 held by ARL. 1,805 2,205 Common

stock, $0.01 par value, 100,000,000 shares authorized; 16,412,861

shares issued and 15,997,076 outstanding as of 2018 and 15,930,145

shares issued and 15,514,360 outstanding as of 2017, including

140,000 shares held by TCI (consolidated) in 2018 and 2017. 164 159

Treasury stock at cost; 415,785 shares in 2018 and 2017, and

140,000 shares held by TCI (consolidated) as of 2018 and 2017

(6,395 ) (6,395 ) Paid-in capital 111,907 110,138 Retained earnings

11,161 5,967 Total American Realty

Investors, Inc. shareholders' equity 118,642 112,074

Non-controlling interest 54,525 53,809

Total shareholders' equity 173,167 165,883

Total liabilities and shareholders' equity $ 1,349,104

$ 1,296,720

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180814005733/en/

American Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@americanrealtyinvest.com

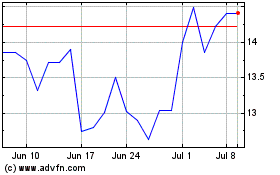

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

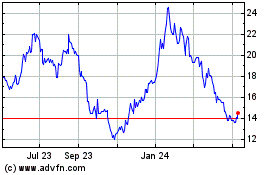

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024