Amended Current Report Filing (8-k/a)

February 17 2017 - 11:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 27, 2017

OLD POINT FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

|

Virginia

|

|

000-12896

|

|

54-1265373

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

1 West Mellen Street

Hampton, Virginia 23663

(Address of principal executive offices) (Zip Code)

(757)728-1200

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ]Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

|

|

This amended report on Form 8-K updates and amends the prior Form 8-K filed on January 27, 2017.

On January 27, 2017 Old Point Financial Corporation (the Company) issued a press release reporting its earnings and financial results for the year ended December 31, 2016. Subsequent to the issuance of the press release, the Company was notified by its employee benefits administrator that the premiums paid by the Company were in excess of actual medical claims paid, which resulted in an overpayment by the Company of $286 thousand for 2016. Also subsequent to the issuance of the press release, the Company received updated information on the collectibility of a problem loan. Based on this updated information, the Company increased its provision for loan losses by $80 thousand.

As a result of these subsequent events, the Company reduced its salaries and employee benefits expense by $286 thousand and increased its provision for loan losses by $80 thousand for the year ended December 31, 2016. Net income increased $128 thousand to $3.8 million or $0.77 per diluted share, compared to the results previously reported. On the revised balance sheet as of December 31, 2016, net loans decreased $80 thousand, while total assets and total stockholders' equity both increased $129 thousand when compared to the previously reported results.

Based on the above changes to 2016 data, a copy of the revised consolidated balance sheets as of December 31, 2016 and 2015 and the revised consolidated statements of income for the years ended December 31, 2016 and 2015 are furnished as Exhibit 99.1

and incorporated by reference into this Item 2.02.

|

Item 9.01 Financial Statements and Exhibits.

|

(d)

|

Exhibits

|

|

|

Exhibit 99.1 Consolidated balance sheets as of December 31, 2016 and 2015 and consolidated statements of income for the years ended December 31, 2016 and 2015

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Old Point Financial Corporation

|

|

|

|

|

|

Registrant

|

|

|

|

|

|

|

|

|

|

Date: February 17, 2017

|

|

/s/ Robert F. Shuford, Sr.

|

|

|

|

|

|

Robert F. Shuford, Sr.

|

|

|

|

|

|

Chairman of the Board

|

|

|

|

|

|

President & Chief Executive Officer

|

|

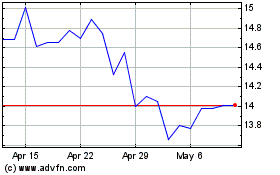

Old Point Financial (NASDAQ:OPOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

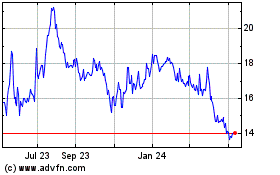

Old Point Financial (NASDAQ:OPOF)

Historical Stock Chart

From Apr 2023 to Apr 2024