Amec PLC

04/10/2006

AMEC plc (AMEC), the project management and services provider announced upbeat full year results last month. With management focusing time and capital on high growth areas, we are confident that further earnings growth will be forthcoming as progress with last year's strategic restructuring continues. AMEC plc (AMEC), the project management and services provider announced upbeat full year results last month. With management focusing time and capital on high growth areas, we are confident that further earnings growth will be forthcoming as progress with last year's strategic restructuring continues.

Despite the poor performance of the construction business in the UK, AMEC was still able to increase turnover a respectable 6 percent to £4,943 million. Adjusted pre-tax profits did marginally better by growing 7 percent to £124 million. Solid gains from work in Iraq and the Oil and Gas division were the main drivers.

Within these headline figures, the Engineering and Technical Services (ETS) group, which is AMEC's largest division, generated solid 16 and 18 percent growth in sales and earnings. Europe and Environmental services performed particularly well with the latter enjoying record levels of business.

We are even more optimistic regarding the group's nuclear services business. We believe AMEC Nuclear is poised to grow significantly over the next several years. An alliance with the UK Atomic Energy Authority and America's CH2M HILL has further reinforced this view.

AMEC's Oil and Gas division performed even better than the ETS group. Last year's turnover increased 20 percent to £1,406 million, while profits improved a healthy 25 percent to £64 million on the back of buoyant market conditions and the acquisition of Paragon.

The laggard within AMEC is without question the Project Solutions division. Declining sales and profits were the direct reflection of AMEC's decision to exit several non-performing segments. In the future, Project Solutions will focus on the successful Public Private Partnerships business and renewable energy.

The sale of Amec Spie is progressing well. We are encouraged to learn that interest in the group is high indicating AMEC should get a full price for the business. Upon the completion of the sale, management confirmed that the remaining business would then be separated into two - one focused on energy and process industries, and the other UK infrastructure.

As a result, the fast growing energy business will benefit from the re-rating it receives once uncoupled from the UK infrastructure division. Meanwhile, infrastructure will gain from the attention required of a business in a turnaround situation. The sale of AMEC Spie should allow for a more immediate benefit as surplus cash could be returned via a special dividend.

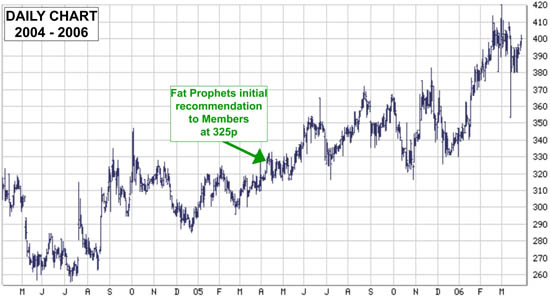

Amec Plc (AMEC) Stock Chart:

|