ATH Resources plc Trading Update (9886N)

October 05 2012 - 2:00AM

UK Regulatory

TIDMATH

RNS Number : 9886N

ATH Resources plc

05 October 2012

5 October 2012

ATH Resources plc

("ATH" or the "Company" or the "Group")

Trading Update

ATH Resources plc (AIM: ATH), one of the UK's largest coal

producers, today issues the following trading update ahead of the

Group's preliminary results for the year ended 30 September

2012.

Current Trading

Sales volumes for the financial year ended 30 September 2012

were approximately 1.6 million tonnes (2011: 1.6 million tonnes).

Volumes in the second half of the year were broadly in line with

expectations following the reserve downgrade announced at Muir Dean

earlier this year. Average sales prices for the year increased by

around 14% to approximately GBP57 per tonne (2011: GBP50 per

tonne).

Production costs increased during the year due to higher mining

ratios and gas oil, which has risen in the last few weeks to return

to price levels similar to the end of last year. However, the Group

has maintained its focus on reducing cost elsewhere in the business

which has resulted in savings of around GBP3 million. Overall, the

Group expects performance before exceptional items to be close to

management expectations.

Despite weak coal prices and increased production costs the

Group has remained cash generative, delivering a reduction in net

debt of GBP9.5 million to GBP22.0 million (2011: GBP31.5

million).

Review

International coal prices are at a level some 30% below that of

the beginning of the financial year, and commodity markets continue

to forecast that future prices will not stage any meaningful

recovery in the medium term. Accordingly the Group is undertaking a

full review of its anticipated future operations and performance

together with the associated working capital requirement. As part

of this review it will assess the appropriateness of its accounting

policies as well as the carrying value of Group assets. It is

expected that this will result in significant non-cash write

downs.

Banking Facilities

As previously announced, the Group's existing banking facilities

with its lenders, which were entered into in September 2011, are

scheduled to expire in May 2013.

During the year, the Group has met in full the planned

reductions in its facilities from GBP23.5 million to currently

GBP18 million, although it will require an increase in this level

to meet its operational requirements from December onwards. Whilst

there is no certainty that adequate facilities can be secured,

positive progress has been made towards agreeing new banking

facilities with the Group's existing lenders based upon a revised

mining plan that concentrates on existing sites and extensions

only, with significantly lower levels of investment in new

development projects for as long as current coal prices persist.

Given this restriction in future investment, the Board also needs

to seek the agreement of other key stakeholders of the Group.

The Board will provide an update to the market on progress as

appropriate.

Coal reserve update

On 26 September 2012, Dumfries and Galloway Council approved

planning permission of the Rigg North site, subject to certain

conditions, which added 1.0 million tonnes to permitted reserves. A

planning application has been lodged with Fife Council in respect

of Muir Dean Revised (0.8 million tonnes) with a decision expected

later this year. Year end proved and probable reserves will be 2.5

million tonnes (2011: 5.0 million tonnes) and 3.5 million tonnes

(2011: 2.8 million tonnes) respectively. During the next 12 months

it is expected that new applications totalling around 0.75 million

tonnes will enter the planning system.

Carbon Reduction Commitment ("CRC") Scheme

The Board remains of the view that the electricity consumption

of its 12 kilometre conveyor should be exempt from the CRC Scheme

and its application for a judicial review hearing has now been

accepted. No date has yet been set but the Board anticipates a

hearing date early in 2013. As previously announced, the potential

impact to the Group, if it fails to win exemption from the CRC

Scheme, would be an increase in costs by a further GBP1.1 million

per annum for each of the three years from April 2011. The Board

will provide an update on progress as appropriate.

Outlook

The Board anticipates that trading conditions will remain

challenging given the current weakness in the coal market and

consequently, production volumes will be lower and will remain so

for the foreseeable future. The Group has a mixture of fixed and

floating priced supply contracts which means future revenues and

profitability will remain susceptible to movements in international

coal prices.

The immediate focus of the Board is to secure the support of all

stakeholders to a refinancing plan that concentrates on coal

production from existing sites and extensions, with capital

expenditure in respect of new site development kept to a minimum.

The Board is currently undertaking a review on how best to attract

the investment required to develop these future sites.

-End-

Contacts and enquiries:

ATH Resources plc

David Port, Non Executive Chairman Tel: +44 (0) 7836 693798

Alistair Black, Chief Executive Tel: +44 (0) 1302 760 462

www.ath.co.uk

Seymour Pierce Limited Tel: +44 (0) 207 107 8000

Stewart Dickson (Nominated Adviser) www.seymourpierce.com

Richard Redmayne / Katie Ratner (Broker)

Hudson Sandler Tel: +44 (0) 207 796 4133

Andrew Leach / Charlie Jack / Katie Matthews www.hudsonsandler.com

The information in this report relating to exploration results,

mineral resources or mineral reserves is based on information

compiled by Mr. Peter Morgan, a full-time employee of the Group,

who is a Fellow of the Institute of Materials, Minerals and Mining.

Mr. Morgan has sufficient experience which is relevant to the style

of mineralisation and type of deposit under consideration. He has

reviewed and consents to the inclusion in the report of the matters

based on his information in the form and context in which it

appears. A glossary of terms is available on our website -

www.ath.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTMMMGGVDRGZZM

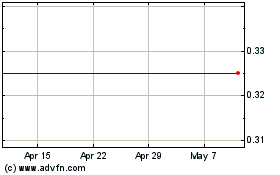

ATH Resources (LSE:ATH)

Historical Stock Chart

From Apr 2024 to May 2024

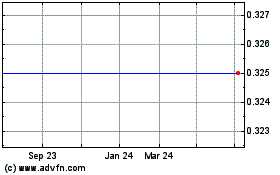

ATH Resources (LSE:ATH)

Historical Stock Chart

From May 2023 to May 2024