Webster Bank and Standard Register Sign Multi-Year Customer Communications Services Agreement

February 11 2015 - 9:00AM

Business Wire

Standard Register (NYSE: SR), a leading provider of workflow,

content and analytics, announced today the signing of a

multi-million dollar agreement with Webster Bank. Under the

agreement, Standard Register renewed its contract through 2018 to

provide enterprise print management and promotional marketing

programs and expanded the relationship to include electronic bill

presentment and payment (EBPP) services.

The EBPP solution, provided in partnership with Transactis,

allows Webster Bank to offer its business, government and

commercial banking clients a highly-customizable, feature-rich

solution that enables the secure distribution of electronic bills

and invoices and accepts payments via the web, voice, phone and

mobile. The EBPP platform will enhance Webster’s Payment-Link®

product and meet the diverse and challenging billing and payment

needs of businesses in all industries. The solution can support a

variety of website integration methods and enables the bank’s

clients to offer a low cost online bill pay solution to their

customers while facilitating payments through credit cards, debit

cards and the Automated Clearing House (ACH) network.

“By providing a complete, configurable solution, we’re enabling

our business, government and commercial banking clients to offer

their customers a robust payment platform without a lengthy

implementation timeline,” said Phil Picillo, Senior Vice President

and Director of Treasury & Payment Solutions for Webster Bank.

“In this way, Standard Register and Transactis are helping our

customers compete in their chosen markets. It’s just one of the

innovative ways that Webster Bank is bringing new value to its

clients."

Since 2008, Standard Register has managed a full range of

technology-enabled communications for the personal, business and

commercial/institutional banking groups at Webster Bank, including

traditional document management, statements, customer notices,

point-of-sale material and promotional marketing. The new EBPP

solution will be introduced in the first quarter of 2015.

“Transactis is the ideal partner for us because they share our

commitment to delivering a highly configurable, total solution,”

said Courtney Allen, senior vice president and general manager of

marketing for Standard Register’s Integrated Communications

business unit. “They surround industry-leading software with robust

customer service, implementation and support to help banks take

their solution out to the market.”

“We are proud to join forces with Standard Register, a trusted

partner of Webster Bank, to improve and simplify the accounts

receivable process for their customers,” stated Bil Manes, chief

strategy officer at Transactis. “Through our partnership, Standard

Register is enabling a new capability that will allow Webster Bank

to expand its commercial banking relationships while consolidating

its supplier base.”

About Standard Register

Standard Register (NYSE:SR) is trusted by the world’s leading

companies to advance their reputations and add value to their

operations by aligning communications with corporate brand

standards. Providing market-specific insights and a compelling

portfolio of workflow, content and analytics solutions to address

the changing business landscape in healthcare, financial services,

manufacturing, transportation and retail markets, Standard Register

is the recognized leader in the management and execution of

mission-critical communications. More information is available at

http://www.standardregister.com.

About Webster Bank

Webster Financial Corporation is the holding company for Webster

Bank. With $22 billion in assets, Webster provides business and

consumer banking, mortgages, private banking, trust and investment

services through 165 banking offices; 311 ATMs; telephone banking;

mobile banking; and the Internet. Webster Bank owns the asset based

lending firm Webster Business Credit Corporation; the equipment

finance firm Webster Capital Finance Corporation; and provides

health savings account trustee and administrative services through

HSA Bank, a division of Webster Bank. Member FDIC and equal housing

lender. For more information about Webster, including past press

releases and the latest annual report, visit the Webster website at

www.websterbank.com or follow us on LinkedIn

http://linkedin.com/company/webster-bank and Twitter

https://twitter.com/WebsterBank.

About Transactis

Transactis transforms traditional paper billing and payment

processing by enabling businesses of all sizes to replace paper

bills, statements, invoices, payments and documents with efficient

and cost effective digital alternatives. Transactis goes to market

exclusively with resellers (financial institutions, technology

companies, print and business process outsourcers) to provide their

business customers with secure, configurable, white-label,

industry-leading SaaS solutions. More than a technology provider to

resellers – Transactis is a full service business partner,

delivering a broad and deep suite of unmatched sales, marketing,

technical and operational support, empowering our resellers to more

successfully serve their clients. The Transactis team includes

executives, board members and advisors who are seasoned industry

experts with decades of experience in the billing and payments

industry. Transactis meets the strictest regulatory and compliance

requirements including HIPAA, SSAE 16, PCI Level 1, and SOC 2.

Transactis investors include Metamorphic Ventures, ff Venture

Capital, StarVest Partners, Harland Clarke and Safeguard

Scientifics (NYSE:SFE). For more information, please visit

www.transactis.com

Standard RegisterInvestor and media contact:Carol Merry,

614-383-1624carol.merry@fahlgren.com

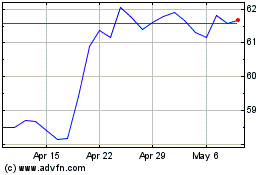

Spire (NYSE:SR)

Historical Stock Chart

From Aug 2024 to Sep 2024

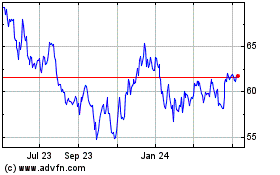

Spire (NYSE:SR)

Historical Stock Chart

From Sep 2023 to Sep 2024