Stocks Fall on Global Growth Concerns

October 21 2015 - 5:50AM

Dow Jones News

Global stocks mostly fell Wednesday amid continuing concerns

over global growth.

The Stoxx Europe 600 was down 0.5% in early trade after a late

sharp fall in Chinese stocks. Shares in European basic resources

companies led the declines in Europe, falling 2.0%.

Futures markets pointed to small opening gains for the Dow Jones

Industrial Average and the S&P 500. Changes in futures aren't

necessarily reflected in market moves after the opening bell.

Stock markets have been volatile since fears emerged over global

growth after China weakened its currency in August. The Dow Jones

Industrial Average and the Stoxx Europe 600 are both up around 4%

this month, but are still down around 4% and 10% from three months

ago, respectively.

Data released Monday showed the Chinese economy grew 6.9% in the

third quarter. While the figure was better than expected, it marked

the slowest rate of expansion since 2009.

In Europe, mining stocks, which are sensitive to Chinese demand,

posted some of largest declines Wednesday. Shares in Anglo American

fell 4.2%, while ArcelorMittal was down 3.0%.

Shares in Credit Suisse fell 4.1% after the Swiss banking giant

announced plans to launch a $6.3 billion capital increase.

Stocks in Asia were mixed. The Shanghai Composite Index closed

down 3.1% following a steep decline toward the end of the

session.

Craig Erlam, a strategist at Oanda, attributed the fall to

investors taking profits after a recent rally in Chinese

shares.

"It wouldn't be surprising if sentiment among these traders is

still very fragile making them more susceptible to panic selling"

following the sharp falls in the stock market earlier this year, he

said.

Japan's Nikkei 225 gained 1.9%. Below-forecast Japanese export

data released Wednesday added to expectations for more stimulus

from the Bank of Japan at its policy meeting next week, which

investors think should boost stock markets.

Australia's S&P/ASX 200 was up 0.2% after falling in the

previous session. Hong Kong's Hang Seng Index was closed for a

holiday.

The moves followed a lackluster session on Wall Street on

Tuesday. U.S. stocks ended slightly lower, weighed down by a fall

in health-care shares and a 14th consecutive drop in quarterly

revenue from International Business Machines.

On Wednesday, with little on the economic calendar, earnings are

likely to continue to be in focus with reports due from Coca-Cola,

General Motors, Abbott Laboratories and eBay.

In currencies, the euro was up 0.2% against the dollar at

$1.1372 ahead of Thursday's European Central Bank monetary policy

meeting. Investors are waiting to see if the ECB will expand its

€60 billion ($68 billion) a month bond-buying program, known as

quantitative easing, amid persistently weak inflation.

The dollar was flat against the yen at $119.8430.

Brent crude was down 1.4% at $48.04 a barrel. The Energy

Information Administration's weekly U.S. petroleum status report is

due later in the day.

In commodities, gold was down 0.2% at $1175.40 a troy ounce.

Write to Riva Gold at riva.gold@wsj.com and Christopher Whittall

at christopher.whittall@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 21, 2015 05:35 ET (09:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

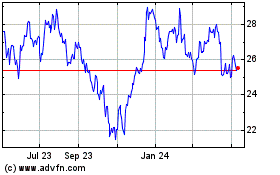

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Aug 2024 to Sep 2024

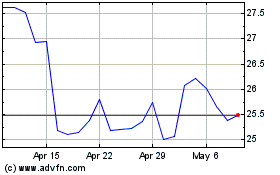

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Sep 2023 to Sep 2024