Dominion Resources Warns of Lower Earnings in 2017

February 01 2017 - 8:52AM

Dow Jones News

By Joshua Jamerson

Dominion Resources Inc. said earnings are expected to fall this

year, hurt by import contract revenue at its Cove Point Terminal in

Maryland, among other causes.

Dominion expects full-year 2017 operating earnings in the range

of $3.40 to $3.90 a share, compared with full-year 2016 operating

earnings of $3.80 a share in 2016. Analysts polled by Thomson

Reuters expected $3.78 a share this year.

The company said lower revenue from import contracts at Cove

Point, a refueling outage and lower hedged power prices at its

Millstone power station in Connecticut, and a "step down" in solar

investment tax credits, are expected to hurt results this year.

Dominion Resources -- with about 26,000 megawatts of generation,

14,400 miles of natural gas transmission, gathering and storage

pipeline, and 6,500 miles of electric-transmission lines -- is a

producer and transporter of energy. Dominion Resources formed

Dominion Midstream Partners LP as a partnership to create a

portfolio of natural gas terminaling, processing, storage and

transportation assets.

Dominion Resources reported earnings of $457 million, or 73

cents a share, up from $357 million, or 60 cents a share, a year

prior. Operating revenue came in at $3.08 billion, up from $2.56

billion in the year-earlier period.

Dominion Midstream reported earnings of $36.5 million, up from

the year prior's $25.1 million. Operating revenue jumped 42% to

$117.5 million.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

February 01, 2017 08:37 ET (13:37 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

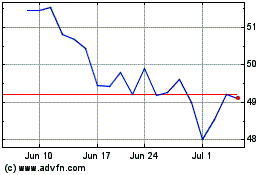

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2024 to May 2024

Dominion Energy (NYSE:D)

Historical Stock Chart

From May 2023 to May 2024