- Third quarter revenues of $4.2

billion, EBIT of 9.5 percent of sales,

- GAAP1 net income of

6.9 percent of sales, Diluted EPS of $1.72

- Expects full year 2016 revenues to

be down 9 percent, unchanged

- Full year 2016 EBIT expected to be

11.3 percent of sales, compared to prior guidance of 11.6 to 12.2

percent

Cummins Inc. (NYSE: CMI) today reported results for the third

quarter of 2016.

Third quarter revenues of $4.2 billion decreased 9 percent from

the same quarter in 2015. Lower truck production in North America

and weak international demand for power generation equipment were

the most significant drivers of the decline in sales. Currency

negatively impacted revenues by approximately 2 percent compared to

last year, primarily due to a stronger US dollar.

Revenues in North America decreased 13 percent while

international sales declined by 3 percent. Within international

markets, higher revenues in China partially offset declines in the

Middle East and Africa.

Earnings before interest and taxes (EBIT) were $398 million in

the third quarter, or 9.5 percent of sales, and included a $99

million increase in an existing accrual for a loss contingency.

EBIT in the third quarter of 2015 was $577 million or 12.5 percent

of sales.

Net income attributable to Cummins was $289 million ($1.72 per

diluted share). The loss contingency charge, net of its impact on

compensation plans, reduced diluted earnings per share by 30 cents.

The tax rate in the third quarter of 2016 was 21.5 percent. Net

income in the third quarter of 2015 was $380 million ($2.14 per

diluted share).

“Due to the slow pace of growth in the global economy, we

continue to face weak demand in a number of our most important

markets,” said Cummins Chairman and CEO Tom Linebarger. “The

restructuring actions that we initiated in the fourth quarter of

2015, combined with strong execution on material cost reduction

initiatives, productivity gains and improvements in product quality

are all helping to mitigate the impact of weaker revenues. We are

on track to deliver our goal of 25% decremental EBIT margin for the

full year 2016, as a result of strong operational performance in

very challenging economic conditions. We have returned $1.3 billion

to shareholders so far this year, through a combination of

dividends and share repurchases, consistent with our plans to

return 75 percent of operating cash flow to shareholders in

2016."

Based on the current forecast, Cummins expects full year 2016

revenues to be down 9 percent, consistent with its prior guidance

of down between 8 and 10 percent. Full year EBIT is expected to be

11.3 percent of sales, down from the prior forecast of 11.6 to 12.2

percent. The reduction in EBIT guidance is primarily a result of an

increase in the expected costs of a loss contingency in the third

quarter. As disclosed in prior quarters, the loss contingency

relates to the costs of a campaign to remedy quality issues with

third party aftertreatment systems, which were sourced by one of

our OEM customers and are paired with our engines in the OEM

vehicle.

Other recent highlights:

- Cummins was recognized with the 2016

United States Overall Best Heavy-Duty Truck Engine Supplier

Leadership Award by Frost and Sullivan

- The Company announced that it will

partner with Peterbilt Motors Company, a division of PACCAR, to

develop and demonstrate technologies under the U.S. Department of

Energy Supertruck II program

- Cummins has been inducted into the

Billion Dollar Roundtable for its commitment to diversity and

inclusion

- The Company returned $1.3 billion to

shareholders so far this year, through a combination of dividends

and share repurchases

Third quarter 2016 detail (all comparisons to same period in

2015)

Engine Segment

- Sales - $1.9 billion, down 12

percent.

- Segment EBIT - $89 million, or 4.8

percent of sales, compared to $217 million or 10.3 percent of

sales

- Segment EBIT reflects a $99 million

increase in an existing accrual for a loss contingency

- On-highway revenues declined 13 percent

primarily due to lower heavy and medium-duty truck production in

North America

Distribution Segment

- Sales - $1.5 billion, down 3

percent

- Segment EBIT - $96 million, or 6.4

percent of sales, compared to $123 million or 7.9 percent of

sales

- Increased revenue from acquisitions was

more than offset by a 5 percent decline in organic sales and a 1

percent unfavorable impact from currency

Components Segment

- Sales - $1.1 billion, down 8

percent.

- Segment EBIT - $148 million , or 12.9

percent of sales, compared to $156 million or 12.6 percent of

sales

- Revenues in North America declined due

to lower medium and heavy-duty truck production, partially offset

by higher revenues in China

Power Systems Segment

- Sales - $856 million, down 13

percent

- Segment EBIT - $59 million, or 6.9

percent of sales, compared to $74 million, or 7.5 percent of

sales

- Revenues declined due to lower power

generation and industrial engine demand in Asia, the Middle East

and Africa

1 Generally Accepted Accounting Principles

About Cummins

Cummins Inc., a global power leader, is a corporation of

complementary business units that design, manufacture, distribute

and service diesel and natural gas engines and related

technologies, including fuel systems, controls, air handling,

filtration, emission solutions and electrical power generation

systems. Headquartered in Columbus, Indiana, (USA) Cummins

currently employs approximately 55,000 people worldwide and serves

customers in approximately 190 countries and territories through a

network of approximately 600 company-owned and independent

distributor locations and approximately 7,200 dealer locations.

Cummins earned $1.4 billion on sales of $19.1 billion in 2015.

Press releases can be found on the Web at www.cummins.com. Follow Cummins on Twitter at

www.twittter.com/cummins and on

YouTube at www.youtube.com/cummininc.

Forward-looking disclosure statement

Information provided in this release that is not purely

historical are forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements regarding our forecasts, guidance, preliminary results,

expectations, hopes, beliefs and intentions on strategies regarding

the future. These forward looking statements include, without

limitation, statements relating to our plans and expectations for

our revenues for the full year of 2016. Our actual future results

could differ materially from those projected in such

forward-looking statements because of a number of factors,

including, but not limited to: the adoption and implementation of

global emission standards; the price and availability of energy;

the pace of infrastructure development; increasing global

competition among our customers; general economic, business and

financing conditions; governmental action; changes in our

customers’ business strategies; competitor pricing activity;

expense volatility; labor relations; and other risks detailed from

time to time in our Securities and Exchange Commission filings,

including particularly in the Risk Factors section of our 2015

Annual Report on Form 10-K. Shareholders, potential investors and

other readers are urged to consider these factors carefully in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements. The

forward-looking statements made herein are made only as of the date

of this press release and we undertake no obligation to publicly

update any forward-looking statements, whether as a result of new

information, future events or otherwise. More detailed information

about factors that may affect our performance may be found in our

filings with the Securities and Exchange Commission, which are

available at http://www.sec.gov or at

http://www.cummins.com in the Investor

Relations section of our website.

Presentation of Non-GAAP Financial Information

This earnings release includes information that does not conform

to U.S. generally accepted accounting principles (GAAP) and are

considered non-GAAP measures. EBIT is a non-GAAP measure used in

this release, and is defined and reconciled to what management

believes to be the most comparable GAAP measure in a schedule

attached to this release. Cummins presents this information as it

believes it is useful to understanding the Company's operating

performance, and because EBIT is a measure used internally to

assess the performance of the operating units.

Webcast information

Cummins management will host a teleconference to discuss these

results today at 10 a.m. EDT. This teleconference will be

webcast and available on the Investor Relations section of the

Cummins website at www.cummins.com . Participants wishing to view

the visuals available with the audio are encouraged to sign-in a

few minutes prior to the start of the teleconference.

CUMMINS INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

INCOME(Unaudited) (a)

Three months ended In millions, except per share

amounts October 2, 2016 September

27, 2015 NET SALES $ 4,187 $ 4,620

Cost of sales

3,108 3,412

GROSS MARGIN

1,079 1,208

OPERATING EXPENSES AND INCOME Selling,

general and administrative expenses

513 530 Research,

development and engineering expenses

157 197 Equity, royalty

and interest income from investees

74 78 Loss contingency

99 — Other operating expense, net

— (2 )

OPERATING INCOME 384 557 Interest income

6 9

Interest expense

16 16 Other income, net

8 11

INCOME BEFORE INCOME TAXES 382 561 Income tax

expense

82 169

CONSOLIDATED NET INCOME

300 392 Less: Net income attributable to noncontrolling

interests

11 12

NET INCOME ATTRIBUTABLE TO

CUMMINS INC. $ 289 $ 380

EARNINGS PER COMMON SHARE ATTRIBUTABLE TO CUMMINS INC. Basic

$ 1.72 $ 2.15 Diluted

$ 1.72 $ 2.14

WEIGHTED AVERAGE SHARES OUTSTANDING Basic

167.8 177.0 Diluted

168.2 177.4

CASH

DIVIDENDS DECLARED PER COMMON SHARE $ 1.025 $

0.975 (a) Prepared on an unaudited basis in accordance with

accounting principles generally accepted in the United States of

America.

CUMMINS INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

INCOME(Unaudited) (a)

Nine months ended In millions, except per share

amounts October 2, 2016 September

27, 2015 NET SALES $ 13,006 $

14,344 Cost of sales

9,674 10,609

GROSS

MARGIN 3,332 3,735

OPERATING EXPENSES AND INCOME

Selling, general and administrative expenses

1,527 1,584

Research, development and engineering expenses

478 558

Equity, royalty and interest income from investees

234 240

Loss contingency

138 — Other operating expense, net

(2 ) (5 )

OPERATING INCOME 1,421 1,828

Interest income

18 20 Interest expense

51 47 Other

income, net

34 12

INCOME BEFORE INCOME

TAXES 1,422 1,813 Income tax expense

362

521

CONSOLIDATED NET INCOME 1,060 1,292 Less:

Net income attributable to noncontrolling interests

44

54

NET INCOME ATTRIBUTABLE TO CUMMINS INC.

$ 1,016 $ 1,238

EARNINGS PER

COMMON SHARE ATTRIBUTABLE TO CUMMINS INC. Basic

$

5.99 $ 6.92 Diluted

$ 5.99 $ 6.90

WEIGHTED AVERAGE SHARES OUTSTANDING Basic

169.5 178.9

Diluted

169.7 179.3

CASH DIVIDENDS DECLARED PER

COMMON SHARE $ 2.975 $ 2.535 (a) Prepared

on an unaudited basis in accordance with accounting principles

generally accepted in the United States of America.

CUMMINS INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(Unaudited) (a)

In millions, except par value October

2, 2016 December 31, 2015 ASSETS

Current assets Cash and cash equivalents

$ 1,251 $

1,711 Marketable securities

250 100 Total

cash, cash equivalents and marketable securities

1,501 1,811

Accounts and notes receivable, net

2,873 2,820 Inventories

2,820 2,707 Prepaid expenses and other current assets

600 609 Total current assets

7,794

7,947 Long-term assets Property, plant and equipment

7,460 7,322 Accumulated depreciation

(3,783 )

(3,577 ) Property, plant and equipment, net

3,677 3,745

Investments and advances related to equity method investees

1,077 975 Goodwill

482 482 Other intangible assets,

net

319 328 Pension assets

773 735 Other assets

1,014 922 Total assets

$ 15,136

$ 15,134

LIABILITIES Current

liabilities Accounts payable (principally trade)

$

1,781 $ 1,706 Loans payable

48 24 Commercial paper

273 — Accrued compensation, benefits and retirement costs

393 409 Current portion of accrued product warranty

333 359 Current portion of deferred revenue

460 403

Other accrued expenses

985 863 Current maturities of

long-term debt

35 39 Total current liabilities

4,308 3,803 Long-term liabilities Long-term

debt

1,593 1,576 Postretirement benefits other than pensions

326 349 Pensions

301 298 Other liabilities and

deferred revenue

1,344 1,358 Total liabilities

$ 7,872 $ 7,384

EQUITY

Cummins Inc. shareholders’ equity Common stock, $2.50 par value,

500 shares authorized, 222.4 and 222.4 shares issued

$

2,209 $ 2,178 Retained earnings

10,833 10,322

Treasury stock, at cost, 54.1 and 47.2 shares

(4,468

) (3,735 ) Common stock held by employee benefits trust, at

cost, 0.7 and 0.9 shares

(8 ) (11 ) Accumulated other

comprehensive loss

(1,632 ) (1,348 ) Total Cummins

Inc. shareholders’ equity

6,934 7,406 Noncontrolling

interests

330 344 Total equity

$

7,264 $ 7,750 Total liabilities and equity

$ 15,136 $ 15,134 (a) Prepared

on an unaudited basis in accordance with accounting principles

generally accepted in the United States of America.

CUMMINS INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited) (a)

Nine months ended In millions October

2, 2016 September 27, 2015 CASH

FLOWS FROM OPERATING ACTIVITIES Consolidated net income

$ 1,060 $ 1,292 Adjustments to reconcile consolidated

net income to net cash provided by operating activities

Restructuring payments

(53 ) — Loss contingency

138 — Depreciation and amortization

391 383 Gain on

fair value adjustment for consolidated investees

— (17 )

Deferred income taxes

60 (120 ) Equity in income of

investees, net of dividends

(94 ) (68 ) Pension

contributions in excess of expense

(92 ) (119 ) Other

post-retirement benefits payments in excess of expense

(16

) (18 ) Stock-based compensation expense

28 24

Translation and hedging activities

(39 ) 22 Changes

in current assets and liabilities, net of acquisitions Accounts and

notes receivable

(112 ) (163 ) Inventories

(150 ) (179 ) Other current assets

138 133

Accounts payable

97 (52 ) Accrued expenses

(279

) (153 ) Changes in other liabilities and deferred revenue

188 219 Other, net

45 (53 ) Net cash provided

by operating activities

1,310 1,131

CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures

(312 ) (393 ) Investments in internal use software

(42 ) (38 ) Investments in and advances to equity

investees

(29 ) (9 ) Acquisitions of businesses, net

of cash acquired

(1 ) (102 ) Investments in

marketable securities—acquisitions

(447 ) (175 )

Investments in marketable securities—liquidations

291 228

Cash flows from derivatives not designated as hedges

(64

) 17 Other, net

14 (5 ) Net cash used in

investing activities

(590 ) (477 )

CASH

FLOWS FROM FINANCING ACTIVITIES Proceeds from borrowings

111 24 Net borrowings of commercial paper

273 —

Payments on borrowings and capital lease obligations

(156

) (64 ) Net borrowings (payments) under short-term credit

agreements

25 (38 ) Distributions to noncontrolling

interests

(42 ) (35 ) Dividend payments on common

stock

(505 ) (452 ) Repurchases of common stock

(745 ) (650 ) Other, net

(2 ) —

Net cash used in financing activities

(1,041 ) (1,215

)

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH

EQUIVALENTS (139 ) (52 ) Net decrease in cash and

cash equivalents

(460 ) (613 ) Cash and cash

equivalents at beginning of year

1,711 2,301

CASH AND CASH EQUIVALENTS AT END OF PERIOD $

1,251 $ 1,688 (a) Prepared on an

unaudited basis in accordance with accounting principles generally

accepted in the United States of America.

CUMMINS INC. AND SUBSIDIARIESSEGMENT

INFORMATION(Unaudited)

As previously announced, beginning with the second quarter of

2016, we realigned certain of our reportable segments to be

consistent with changes to our organizational structure and how the

Chief Operating Decision Maker monitors the performance of our

segments. We reorganized our business to combine our Power

Generation segment and our high horsepower engine business to

create the new Power Systems segment. Our reportable operating

segments consist of Engine, Distribution, Components and Power

Systems. We began to report results for our new reporting structure

in the second quarter of 2016 and also reflected this change for

historical periods.

We allocate certain common costs and expenses, primarily

corporate functions, among segments. These include certain costs

and expenses of shared services, such as information technology,

human resources, legal, finance and supply chain

management. In addition to the reorganization noted above, we

reevaluated the allocation of these costs, considering the new

segment structure created in April 2016 and adjusted our allocation

methodology accordingly. The revised methodology, which is

based on a combination of relative segment sales and relative

service usage levels, is effective for the periods beginning after

January 1, 2016 and resulted in the revision of our segment

operating results, including segment earnings before interest,

income taxes and noncontrolling interests (EBIT), for all four

segments for the first quarter of 2016 with a greater share of

costs allocated to the Distribution and Components segments than in

previous years. Prior periods were not revised for the new

allocation methodology. These changes had no impact on our

consolidated results.

In millions Engine Distribution

Components

PowerSystems

Non-segment Items (1)

Total Three months ended October 2, 2016 External

sales

$ 1,357 $ 1,497 $

824 $ 509 $ — $

4,187 Intersegment sales

502 7

319 347 (1,175 ) —

Total sales

1,859 1,504 1,143

856 (1,175 ) 4,187 Depreciation and

amortization(2)

42 28 32 29 —

131 Research, development and engineering expenses

56

3 54 44 — 157 Equity, royalty

and interest income from investees

38 19 9

8 — 74 Loss contingency

99 —

— — — 99 Interest income

3

1 1 1 — 6 Segment EBIT

89

96 148 59 6 398 Segment

EBIT as a percentage of total sales

4.8 % 6.4

% 12.9 % 6.9 % 9.5

% Three months ended September 27, 2015

External sales $ 1,627 $ 1,543 $ 891 $ 559 $ — $ 4,620 Intersegment

sales 475 8 349 423 (1,255 ) —

Total sales 2,102 1,551 1,240 982 (1,255 ) 4,620 Depreciation and

amortization(2) 47 26 28 27 — 128 Research, development and

engineering expenses 73 2 65 57 — 197 Equity, royalty and interest

income from investees 33 19 9 17 — 78 Interest income 6 1 1 1 — 9

Segment EBIT 217 123 156 74 7 577 Segment EBIT as a

percentage of total sales 10.3 % 7.9 % 12.6 % 7.5 % 12.5 %

(1)

Includes intersegment sales, intersegment profit in inventory

eliminations and unallocated corporate expenses. There were no

significant unallocated corporate expenses for the three months

ended October 2, 2016 and September 27, 2015.

(2)

Depreciation and amortization as shown on

a segment basis excludes the amortization of debt discount and

deferred costs included in the Condensed Consolidated Statements of

Income as "Interest expense."

In millions Engine

Distribution Components

PowerSystems

Non-segmentItems

(1)

Total Nine months ended October 2, 2016

External sales

$ 4,350 $ 4,493 $

2,654 $ 1,509 $ — $

13,006 Intersegment sales

1,487 18

1,005 1,076 (3,586

) — Total sales

5,837 4,511

3,659 2,585 (3,586 ) 13,006

Depreciation and amortization(2)

121 86 95

87 — 389 Research, development and engineering

expenses

166 10 161 141 —

478 Equity, royalty and interest income from investees

120 56 29 29 — 234 Loss

contingency

138 — — — —

138 Interest income

8 3 3 4

— 18 Segment EBIT

492 270 501

195 15 1,473 Segment EBIT as a

percentage of total sales

8.4 % 6.0 %

13.7 % 7.5 % 11.3 %

Nine months ended September 27, 2015 External sales $

5,150 $ 4,499 $ 2,839 $ 1,856 $ — $ 14,344 Intersegment sales 1,422

23 1,097 1,225 (3,767 ) — Total

sales 6,572 4,522 3,936 3,081 (3,767 ) 14,344 Depreciation and

amortization(2) 140 78 82 81 — 381 Research, development and

engineering expenses 195 8 183 172 — 558 Equity, royalty and

interest income from investees 107 60 26 47 — 240 Interest income

10 3 3 4 — 20 Segment EBIT 695 324 574 302 (35 ) 1,860

Segment EBIT as a percentage of total sales 10.6 % 7.2 % 14.6 % 9.8

% 13.0 %

(1)

Includes intersegment sales, intersegment profit in inventory

eliminations and unallocated corporate expenses. There were no

significant unallocated corporate expenses for the nine months

ended October 2, 2016 and September 27, 2015.

(2)

Depreciation and amortization as shown on

a segment basis excludes the amortization of debt discount and

deferred costs included in the Condensed Consolidated Statements of

Income as "Interest expense." The amortization of debt discount and

deferred costs was $2 million for the nine months ended October 2,

2016 and September 27, 2015.

A reconciliation of our segment information to the corresponding

amounts in the Condensed Consolidated Statements of Income is shown

in the table below:

Three months ended Nine months ended

In millions October 2, 2016

September 27, 2015 October 2, 2016

September 27, 2015 Total segment EBIT

$

398 $ 577

$ 1,473 $ 1,860 Less: Interest

expense

16 16

51 47 Income

before income taxes

$ 382 $ 561

$ 1,422 $ 1,813

CUMMINS INC. AND SUBSIDIARIESSELECTED

FOOTNOTE DATA(Unaudited)

EQUITY, ROYALTY AND INTEREST INCOME FROM INVESTEES

Equity, royalty and interest income from investees included in

our Condensed Consolidated Statements of Income for the reporting

periods was as follows:

Three months ended Nine months ended

In millions October 2, 2016

September 27, 2015 October 2, 2016

September 27, 2015 Distribution

entities Komatsu Cummins Chile, Ltda.

$ 8 $ 8

$ 26 $ 23 North American distributors

7 9

18 27 All other distributors

1 1

2 2

Manufacturing entities Beijing Foton Cummins Engine Co.,

Ltd.

19 18

59 47 Chongqing Cummins Engine Company,

Ltd.

11 9

28 32 Dongfeng Cummins Engine Company, Ltd.

10 11

32 40 All other manufacturers

8

13

40 41 Cummins share of net income

64

69

205 212 Royalty and interest income

10 9

29 28 Equity, royalty and interest income from

investees

$ 74 $ 78

$ 234

$ 240

LOSS CONTINGENCY

In the fourth quarter of 2015, we disclosed the request by one

customer to participate in the design and bear the financial cost

of a field campaign (Campaign) associated with quality issues in

certain third party aftertreatment systems causing some of our

inter-related engines to fail in-use emission testing. We

established a reserve in the fourth quarter of 2015. In the second

quarter of 2016, we recoded an additional accrual of $39 million

based upon the Campaign design at the time. Additional in-use

emission testing performed in the third quarter of 2016 has

indicated that the Campaign should be expanded to include a larger

population of vehicles. Our third quarter results include an

additional accrual of $99 million to reflect the higher estimated

cost of the expanded Campaign. We have not reached a cost sharing

agreement with our customer related to this matter and our final

cost could differ from what we have recorded.

CUMMINS INC. AND

SUBSIDIARIESFINANCIAL MEASURES THAT SUPPLEMENT

GAAP(Unaudited)

Net income and diluted earnings per share (EPS) attributable

to Cummins Inc. excluding special items

We believe these are useful measures of our operating

performance for the periods presented as they illustrate our

operating performance without regard to special items including tax

adjustments. These measures are not in accordance with, or an

alternative for, accounting principles generally accepted in the

United States of America (GAAP) and may not be consistent with

measures used by other companies. It should be considered

supplemental data. The following table reconciles net income

attributable to Cummins Inc. to net income attributable to Cummins

Inc. excluding special items for the following periods:

Three months ended October 2, 2016

September 27, 2015 In millions Net

Income Diluted EPS Net Income

Diluted EPS Net income attributable to Cummins Inc.

$

289 $ 1.72 $ 380 $ 2.14 Add Loss contingency,

net (1)

50 0.30 — — Net income

attributable to Cummins Inc. excluding special items

$

339 $ 2.02 $ 380 $ 2.14

Nine months ended October 2,

2016 September 27, 2015 In millions Net

Income Diluted EPS Net Income

Diluted EPS Net income attributable to Cummins Inc.

$

1,016 $ 5.99 $ 1,238 $ 6.90 Add Loss

contingency, net (1)

$ 74 $ 0.44 — —

Less Tax benefit

— — 18 0.10 Net

income attributable to Cummins Inc. excluding special items

$ 1,090 $ 6.43 $ 1,220

$ 6.80

(1) The loss contingency is net of the

favorable variable compensation impact.

Earnings before interest, income taxes and noncontrolling

interests

We define EBIT as earnings before interest expense, income tax

expense and noncontrolling interests in income of consolidated

subsidiaries. We use EBIT to assess and measure the performance of

our operating segments and also as a component in measuring our

variable compensation programs. This measure is not in accordance

with, or an alternative for, GAAP and may not be consistent with

measures used by other companies. It should be considered

supplemental data. Below is a reconciliation of EBIT to “Net income

attributable to Cummins Inc.” for each of the applicable

periods:

Three months ended Nine months ended

In millions October 2, 2016 September 27,

2015 October 2, 2016 September 27, 2015

Earnings before interest expense and income taxes

$

398 $ 577

$ 1,473 $ 1,860

EBIT as a percentage of net sales

9.5 %

12.5 %

11.3 % 13.0 % Less Interest expense

16 16

51 47 Income tax expense

82 169

362 521 Consolidated net income

300 392

1,060 1,292

Less Net income attributable to noncontrolling interests

11 12

44 54 Net income

attributable to Cummins Inc.

$ 289 $ 380

$ 1,016 $ 1,238 Net

income attributable to Cummins Inc. as a percentage of net sales

6.9 % 8.2 %

7.8 % 8.6 %

CUMMINS INC. AND SUBSIDIARIESBUSINESS

UNIT SALES DATA(Unaudited)

Engine Segment Sales by Market and Unit Shipments by Engine

Classification

In the second quarter of 2016, in conjunction with the

reorganization of our segments, our Engine segment reorganized its

reporting structure as follows:

- Heavy-duty truck - We

manufacture diesel engines that range from 310 to 600 horsepower

serving global heavy-duty truck customers worldwide, primarily in

North America.

- Medium-duty truck and bus - We

manufacture diesel engines ranging from 200 to 450 horsepower

serving medium-duty truck and bus customers worldwide, with key

markets including North America, Latin America, Europe and Mexico.

We also provide diesel and natural gas engines for school buses,

transit buses and shuttle buses worldwide, with key markets

including North America, Europe, Latin America and Asia, and diesel

engines for Class A motor homes (RVs), primarily in North

America.

- Light-duty automotive (Pickup and

Light Commercial Vehicle (LCV)) - We manufacture 105 to 385

horsepower diesel engines, including engines for the pickup truck

market for Chrysler and Nissan in North America, and LCV markets in

Europe, Latin America and Asia.

- Off-highway - We provide diesel

engines that range from 60 to 755 horsepower to key global markets

including construction, mining, rail, defense, agriculture, marine,

and oil and gas equipment and also to the power generation business

for standby, mobile and distributed power generation solutions

throughout the world.

Sales for our Engine segment by market were as follows:

2016 In millions

Q1 Q2 Q3 Q4 YTD Heavy-duty truck

$ 631 $ 622

$ 625 $ — $ 1,878 Medium-duty truck and

bus 549 600

517 — 1,666 Light-duty automotive 433 394

345 — 1,172 Off-highway 363 386

372

— 1,121 Total sales $ 1,976 $ 2,002

$ 1,859 $ — $ 5,837

2015

In millions Q1 Q2 Q3 Q4

YTD Heavy-duty truck $ 757 $ 875 $ 784 $ 700 $ 3,116

Medium-duty truck and bus 608 674 585 640 2,507 Light-duty

automotive 381 354 339 401 1,475 Off-highway 399 422

394 357 1,572 Total sales $ 2,145 $ 2,325

$ 2,102 $ 2,098 $ 8,670

2014

In millions YTD Heavy-duty truck $ 3,072 Medium-duty

truck and bus 2,431 Light-duty automotive 1,567 Off-highway 1,897

Total sales $ 8,967

Unit shipments by engine classification (including unit

shipments to Power Systems and off-highway engine units included in

their respective classification) were as follows:

2016 Units

Q1 Q2 Q3 Q4 YTD Heavy-duty

19,700 20,700

20,100 — 60,500 Medium-duty 55,400 62,300

53,400 — 171,100 Light-duty 61,700 57,100

49,800 — 168,600 Total units 136,800

140,100

123,300 — 400,200

2015 Units Q1 Q2 Q3 Q4

YTD Heavy-duty 28,700 32,800 28,600 24,300 114,400

Medium-duty 61,200 66,600 59,600 59,700 247,100 Light-duty 51,200

53,400 47,800 56,900 209,300 Total

units 141,100 152,800 136,000 140,900

570,800

2014 Units YTD Heavy-duty

122,100 Medium-duty 266,800 Light-duty 204,400 Total units

593,300

Distribution Segment Sales by Product Line

2016 In millions

Q1 Q2 Q3 Q4 YTD Parts $ 648 $

642

$ 643 $ — $ 1,933 Service 299 297

299 —

895 Power generation 275 326

291 — 892 Engines 241

279

271 — 791 Total sales $ 1,463

$ 1,544

$ 1,504 $ — $

4,511

2015 In millions Q1 Q2

Q3 Q4 YTD Parts $ 573 $ 598 $ 604 $ 648 $

2,423 Service 284 307 301 330 1,222 Power generation 298 272 323

397 1,290 Engines 321 318 323 332 1,294

Total sales $ 1,476 $ 1,495 $ 1,551 $ 1,707

$ 6,229

Component Segment Sales by Business

2016 In millions

Q1 Q2 Q3 Q4 YTD Emission

solutions $ 607 $ 624

$ 540 $ — $ 1,771 Turbo

technologies 265 276

241 — 782 Filtration 252 262

244

— 758 Fuel systems 113 117

118 —

348 Total sales $ 1,237 $ 1,279

$ 1,143

$ — $ 3,659

2015 In millions

Q1 Q2 Q3 Q4 YTD Emission

solutions $ 613 $ 679 $ 607 $ 600 $ 2,499 Turbo technologies 301

307 266 267 1,141 Filtration 255 266 240 249 1,010 Fuel systems 130

145 127 120 522 Total sales $ 1,299

$ 1,397 $ 1,240 $ 1,236 $ 5,172

Power Systems Segment Sales by Product Line and Unit

Shipments by Engine Classification

In the second quarter of 2016, in conjunction with the

reorganization of our segments, our Power Systems segment

reorganized its reporting structure into the following product

lines:

- Power generation - We design,

manufacture, sell and support generators ranging from 2 kilowatts

to 3.5 megawatts, as well as paralleling systems and transfer

switches, for applications such as residential, commercial,

industrial, data centers, health care, telecommunications and waste

water treatment plants. We also provide turnkey solutions for

distributed generation and energy management applications using

natural gas or biogas as a fuel. We also serves global rental

accounts for diesel and gas generator sets.

- Industrial - We design,

manufacture, sell and support diesel and natural gas

high-horsepower engines up to 5,500 horsepower for a wide variety

of equipment in the mining, rail, defense, oil and gas, and

commercial marine applications throughout the world. Across these

markets, we have major customers in North America, Europe, Middle

East, Africa, China, Korea, Japan, Latin America, India, Russia,

Southeast Asia, South Pacific and Mexico.

- Generator technologies - We

design, manufacture, sell and support A/C generator/alternator

products for internal consumption and for external generator set

assemblers. Our products are sold under the Stamford, AVK and

Markon brands and range in output from 3 kilovolt-amperes (kVA) to

12,000 kVA.

Sales for our Power Systems segment by product line were as

follows:

2016 In millions

Q1 Q2 Q3 Q4 YTD Power generation

$ 520 $ 597

$ 545 $ — $ 1,662 Industrial 215 240

233 — 688 Generator technologies 73 84

78 — 235 Total sales $ 808 $ 921

$ 856 $ — $ 2,585

2015

In millions Q1 Q2 Q3 Q4

YTD Power generation $ 624 $ 710 $ 621 $ 615 $ 2,570

Industrial 280 295 275 287 1,137 Generator technologies 98

92 86 84 360 Total sales $ 1,002 $

1,097 $ 982 $ 986 $ 4,067

2014

In millions YTD Power generation $ 2,633 Industrial

1,331 Generator technologies 450 Total sales $ 4,414

High-horsepower unit shipments by engine classification were as

follows:

2016 Units

Q1 Q2 Q3 Q4 YTD Power generation

1,800 2,200

2,000 — 6,000 Industrial 1,000 1,100

1,000 — 3,100 Total units 2,800

3,300

3,000 — 9,100

2015

Units Q1 Q2 Q3 Q4 YTD

Power generation 2,200 2,500 2,000 1,900 8,600 Industrial 1,300

1,200 1,200 1,500 5,200 Total units

3,500 3,700 3,200 3,400 13,800

2014 Units YTD Power generation 8,700

Industrial 6,100 Total units 14,800

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161101005387/en/

Cummins Inc.Carole Casto, 317-610-2480Executive Director -

Corporate Communicationscarole.casto@cummins.com

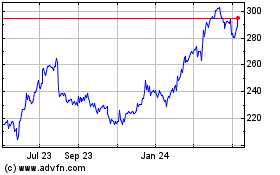

Cummins (NYSE:CMI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cummins (NYSE:CMI)

Historical Stock Chart

From Sep 2023 to Sep 2024