TIDMZTF

RNS Number : 9536U

Zotefoams PLC

04 August 2015

Tuesday 4 August 2015

Zotefoams plc

Interim Results for the Six Months Ended 30 June 2015

Zotefoams plc ("Zotefoams", or "the Group" or "the Company"), a

world leader in cellular material technology, today announces its

interim results for the six months ended 30 June 2015.

Highlights

-- Total Revenue(1) increased by 8% to a record GBP26.6m

-- MuCell Extrusion revenue growth of 39%

-- High-Performance Products revenue growth of 23%

-- Gross margin excluding exceptional items(2) of 29.8% (2014:27.3%)

-- Operating profit excluding exceptional items increased 20% in constant currency(3)

-- 47% increase in Cash generated from Operations to GBP5.0m (2014:GBP3.4m)

-- All business units have strong forward order books

-- Investment in global manufacturing capacity in Kentucky, USA proceeding to plan

-- Interim dividend increased by 3% to 1.80 pence

Financial highlights

Six months Six months Change Change

ended 30 ended 30 in constant

June 2015 June 2014 currency

GBPm GBPm % %

Total Revenue 26.63 24.70 8 10

Group Revenue 26.49 24.65 7 10

Gross Profit excluding exceptional

items 7.94 6.73 18 20

Operating Profit excluding

exceptional items 3.17 3.00 6 20

Adjusted profit(4) before

tax excluding exceptional

items 3.19 3.02 6 19

Profit before tax excluding

exceptional items 3.02 2.87 5 20

Profit before tax 3.02 1.61 88

Basic eps excluding exceptional

items (p) 5.5 5.8 (5)

Basic eps (p) 5.5 3.2 72

Interim dividend (p) 1.80 1.75 3

Commenting on the results, Nigel Howard, Chairman said:

"I am delighted to report a rise of 8% in Total Revenue to a

record GBP26.6m for the first half of the year. Zotefoams has

delivered growth in all business segments. MuCell Extrusion LLC

('MEL') sales have grown by 39%, High-Performance Products grew by

23% and Polyolefin sales increased by 5%. Total Revenue increased

by 10% in constant currency.

Zotefoams continues to maintain a consistent strategy and

approach. We enter the second half of the year with strong order

books and a portfolio of products to deliver further organic

growth. We remain mindful of economic uncertainty and the impact of

foreign exchange in particular, but are confident in the long-term

prospects for the business."

(1) Total Revenue consolidates all external sales made by joint

ventures as well as those made by Zotefoams plc and its

subsidiaries.

(2) In 2014 the non-cash impairment charge made following the

decision to curtail manufacturing activity on the microZOTE(R)

extrusion line was treated as an exceptional item.

(3) Estimated impact of restating 2015 at 2014 average foreign

currency exchange rates, including the restatement of gains/losses

on maturing forward exchange hedges in the period at 2014 average

rates which increases the profit impact by GBP0.25m. Balance sheet

foreign exchange translation differences have not been

restated.

(4) Before amortisation of acquired intangible assets.

Enquiries:

Zotefoams plc Tel Today: 0203-727-1000

David Stirling, Managing Director Thereafter: 0208-664-1600

Clifford Hurst, Finance Director

FTI Consulting 0203-727-1000

Victoria Foster Mitchell/Simon

Conway

About Zotefoams plc

Zotefoams plc (LSE - ZTF) is a world leader in cellular material

technology. Using a unique manufacturing process with

environmentally friendly nitrogen expansion, Zotefoams produces

lightweight foams in Croydon, UK and Kentucky, USA for diverse

markets worldwide. Zotefoams also owns and licenses patented

MuCell(R) microcellular foam technology from a base in

Massachusetts, USA to customers worldwide and sells T-Tubes(R)

advanced insulation systems made from its patented ZOTEK(R)

fluoropolymer foams.

www.zotefoams.com

CHAIRMAN'S STATEMENT

In the first six months of 2015 Total Revenue increased by 8% to

a record GBP26.63m (2014: 24.70m), delivering a rise of 18% in

Gross Profit to GBP7.94m (2014: GBP6.73m before exceptional items).

Group revenue increased by 7% to GBP26.49m (2014: GBP24.65m) and

profit before tax and exceptional items rose to GBP3.02m (2014:

GBP2.87m). Basic earnings per share were 5.5p (2014: 3.2p after

exceptional items). The Directors have decided to increase the

interim dividend by 3% to 1.80p per share (2014: 1.75p) reflecting

the Board's continued confidence in the Group's future.

Macroeconomic Environment

As a predominantly UK-based exporter Zotefoams has approximately

80% of sales denominated in US Dollars and Euros. With most costs

incurred in Sterling, other than our main raw materials which are

denominated in Euros and some staff and operational costs which are

in US Dollars, movements in foreign exchange rates can have a

significant impact on our results. The average Euro rate was

1.38:GBP1 for the first six months of 2015 (equivalent 2014 rate

1.22:GBP1) and US Dollar rate was 1.53:GBP1 (equivalent 2014 rate

1.67:GBP1). The period end closing exchange rates, and in

particular the movement between the period opening and closing

rates, generated a non-cash translational loss of GBP0.44m in the

period (2014: GBP0.29m), which is reported as an administration

expense.

In constant currency, Total Revenue would have increased by 10%

to GBP27.15m and we estimate profit before tax and exceptional

items would have increased by 20% to GBP3.44m.

Financial and operational review

Polyolefin Foams

Overall sales volumes of Azote(R) polyolefin foams increased by

7% compared with the first six months of 2014. Price and product

mix were at similar levels to last year and the increase in sales

volume delivered constant currency sales growth of 8%. Adverse

currency movements in the Euro, partially offset by a more

favourable US Dollar rate, reduced the reported Total Revenue

growth to 5%. Group Revenue, which excludes the mark-up on sales

made by our Azote Asia Limited joint venture, increased by 4%.

In constant currency, growth in Total Revenue in the UK was 6%

and in Continental Europe was 10% while North America was

relatively flat. Azote Asia Limited delivered constant currency

growth of 33% and now accounts for 7% of polyolefin foams

sales.

Prices for our main raw material, low density polyethylene

('LDPE'), fell rapidly in the early part of the year due to lower

oil prices. However from March, prices began to increase as

European demand outstripped available supply and, although overall

prices are at a similar average level to the same period in 2014,

the current price is approximately 20% above the average price for

the first half of last year. LDPE is priced in Euros which offers a

natural hedge against our Euro-denominated sales and the Sterling

cost of LDPE is currently at a similar level to the average cost

for the first half of 2014.

Operating profit in Polyolefin foams before exceptional items

increased by 20% to GBP4.08m (2014: GBP3.41m) driven by the

increase in sales volumes.

High-Performance Products ('HPP')

I am pleased to report that HPP sales increased by 23% to

GBP3.39m (2014: GBP2.76m), consolidating the very strong 53% growth

delivered in the previous 12 months. HPP now represents 13% of

Total Revenue. Segment operating profit increased to GBP0.67m

(2014: GBP0.53m) as sales growth was offset somewhat by additional

development and sales and marketing expenditure.

The HPP segment comprises four main product lines based on our

unique technology. North America is currently the largest market,

where our fire-retardant ZOTEK(R) F fluoropolymer foams are

specified for aviation use and growth is driven by new

applications, increased adoption of existing uses and an increasing

number of aircraft being built. Encouragingly sales of ZOTEK(R) F

outside the North American market more than doubled, again mainly

in aviation, benefitting from our investment in people and market

development over the past few years. New projects in our speciality

ZOTEK(R) Peba foams for kinetic-energy management and ZOTEK(R) N

nylon foams, which exhibit high temperature resistance, delivered

moderate gains in the first six months of this year, although we

are very encouraged that these will further develop our market

presence particularly in sports and automotive in the medium

term.

Revenue from T-Tubes(R) insulation products, which more than

doubled last year, declined in the first six months of this year

due to the timing of projects, with some larger installations

scheduled for the latter part of this year and into 2016. The main

markets for these insulation products are in clean-rooms for

pharmaceutical, biotech and semiconductor manufacture in Asia. Our

joint venture with King Lai Group, announced in March this year, to

manufacture insulation products from our ZOTEK(R) high-performance

foams in China is progressing well and expected to be operational

from October this year. We have begun the process of hiring

additional staff in China and in Thailand where a wholly owned

Zotefoams' entity will be responsible for all sales outside of

China.

MuCell Extrusion LLC ('MEL')

MEL licenses microcellular foam technology and sells related

machinery. Sales increased by 39% to GBP1.01m (2014: GBP0.72m)

mainly as a result of equipment sales which increased 88% to

GBP0.52m (2014: GBP0.28m). MEL is an early stage growth business

and currently represents 4% of Group revenues with licensees mainly

in consumer packaging utilising our technology to reduce the

material content of their products.

Licensees have now converted 64 extrusion lines to use MuCell

technology, an increase of 12 lines in the installed base during

the six month period with orders for a further 18 units on hand at

30 June 2015. This compares favourably with 20 lines converted in

the whole of 2014. As our technology becomes better understood, and

the cost and environmental benefits are demonstrated by an

increasing number of users, we expect the rate of adoption to

increase. In the six months to 30 June 2015, contribution net of

commissions to third parties increased by 33% and, consistent with

our growth strategy for this business, we invested in excess of

this into future development. Sales and development costs, which

are mainly salaries and technology enhancements, increased by

approximately 41% as we respond to increasing levels of interest

from our target markets. MEL offers a strong platform for future

growth and in the period reported an operating loss before

amortisation costs of GBP0.22m (2014: GBP0.14m).

Distribution and Administration

Costs of distribution and administration are either incurred

directly or allocated to each business unit according to management

estimates. The main elements of administrative expenses are

technical development, finance and administration, and information

systems as well as the cost (or benefit) of foreign exchange hedges

maturing in the period and non-cash foreign exchange translation

expenses. Administrative costs excluding the impact of foreign

exchange hedges and translation were GBP2.49m (2014: GBP2.04m) with

the main increase resulting from IT and recruitment costs. We

estimate the increase in underlying costs on a like-for-like basis,

adjusted for timing differences, to be approximately 10% as we

invest for future growth.

Tax and Cash Flow

Zotefoams' estimated effective tax rate for the period was 20.5%

(2014: 20.5%), which is similar to the UK corporation tax rate for

the period. Cash generated from operations was GBP5.00m (2014:

GBP3.40m). Capital expenditure was GBP3.20m, GBP1.47m higher than

depreciation and amortisation, which together with tax and dividend

payments reduced net funds (cash less bank overdrafts and other

bank borrowings) by GBP0.56m from GBP2.42m at 31 December 2014 to

GBP1.86m.

Pensions

The April 2014 triennial actuarial valuation, on a Statutory

Funding Objective basis, calculated a deficit for the Pension

Scheme of GBP2.50m. As a result of this, the Company has agreed

with the Trustees to make contributions to the Scheme of GBP41,000

per month until April 2020 to eliminate this deficit and in

addition pay the ongoing Scheme expenses of GBP14,000 per month.

This will be reviewed following the next actuarial valuation which

is scheduled for April 2017.

Capital Expenditure

Zotefoams is investing significantly for future growth. Our

largest project is extending our existing facility in Kentucky, USA

and installing extrusion and high-pressure gassing processes to

deliver approximately 20% additional global capacity for block

foams. The total investment of USD $22m, of which $4.5m is an

extension to existing buildings and infrastructure, is proceeding

to plan and is anticipated to be operational in approximately 12

months' time. We continue to invest in our Croydon, UK facility

increasing production capacity and capability, mainly in speciality

extrusion, high-pressure gassing services and Group IT systems.

Planned capital investment in China, where our Kunshan ZOTEK

King Lai joint venture is located, is not expected to be material

to the Group.

Employees and Talent Management

Talent management is becoming increasingly important as

Zotefoams grows and evolves. The opportunities we have, in new

products, markets and geographies, require we identify and develop

the right people to define and deliver to our potential. Over the

past six months we have redefined our approach to talent management

to meet the needs of the business and this is being developed as a

core business practice.

On behalf of the Board, I would like to thank all of our

employees for their continued contribution to Zotefoams in the

period.

Dividend

Reflecting the Board's continued confidence in the Group's

future, the Directors have increased the interim dividend by 3% to

1.80 pence per share (2014: 1.75 pence). The dividend will be paid

on 8 October 2015 to shareholders on the Company's register at the

close of business on 11 September 2015.

Risks and uncertainties

Zotefoams' business and share price may be affected by a number

of risks, not all of which are within our control. The process

Zotefoams has in place for identifying, assessing and managing

risks is set out in the Company statement of Principal Risks and

Uncertainties on pages 18 to 21 of the 2014 Annual Report and

Accounts. The specific principal risks (which could impact

Zotefoams' sales, profits and reputation) and relevant mitigating

factors, as currently identified by Zotefoams' risk management

process, have not changed significantly since the publication of

the last Annual Report and detailed explanations of these can be

found in the 2014 Annual Report. Broadly, these risks include

operational disruption, supply chain disruption, technological

change and competitor activity, pension liabilities, foreign

exchange, macro-economic factors, financing, commercial, IT and

people.

Current Trading and Prospects

In our Azote(R) Polyolefin foams business we have good forward

visibility across all geographic regions and expect sales volume

growth to exceed that experienced in the first six months of 2015.

Indications are that the price of LDPE, which has risen sharply in

recent months, may not sustain this momentum, although on average

it is likely that prices in the second half of 2015 will be above

those in the first six months and therefore dampen Polyolefin foam

margins in the short term. In our HPP business, orders plus

invoiced sales for ZOTEK(R) technical foams currently exceed 2014

sales and in T-Tubes(R) insulation products we anticipate growth

from a second-half weighted pipeline of bids. MEL's level of

activity and current order book also provide leading indicators of

strong future growth justifying our continued investment in this

business. Supporting growth potential beyond 2015 we will invest

further in resources during the second half of this year,

increasing sales and administration, including technical, costs in

the short term. Foreign exchange rates are currently unfavourable

for our business and, if they remain at the current levels, we

expect second half sales to be adversely impacted by approximately

3% compared to exchange rates for the same period in 2014.

Outlook

In the first half of 2015 we delivered an 8% increase in Total

Revenue, 18% increase in Gross Profit before exceptional items and

demonstrated confidence in the future of our business with

investment in sales, development and technical resource. Zotefoams

is also committed to some significant capital investments to

support our medium and longer-term growth potential. We enter the

second half of the year with a strong order book and high levels of

activity in all business segments. Zotefoams continues to maintain

a consistent strategy and approach while being mindful of economic

uncertainty and the impact of foreign exchange in particular. We

therefore remain confident in the long-term prospects for the

business.

N G Howard

Chairman

3 August 2015

ZOTEK(R), Azote(R) and microZOTE(R) are registered trademarks of

Zotefoams plc. T-Tubes(R) is a registered trademark of UFP

Technologies Inc. MuCell(R) is a registered trademark of Trexel

Inc.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors confirm that this consolidated interim financial

information has been prepared in accordance with IAS 34 as adopted

by the European Union and that the interim management report

includes a fair review of the information required by DTR 4.2.7 and

DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

consolidated interim financial statements, and a description of the

principal risks and uncertainties for the remaining six months of

the financial year; and

-- material related-party transactions in the first six months and any material changes in the related-party transactions described in the last annual report.

The directors of Zotefoams plc are listed in the Zotefoams plc

Annual Report for 31 December 2014. A list of current directors is

maintained on the Zotefoams plc website: www.zotefoams.com

The maintenance and integrity of the Zotefoams plc website is

the responsibility of the directors; the work carried out by the

auditors does not involve consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred to the financial statements since they were

initially presented on the website.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

By order of the Board:

N G Howard C G Hurst

Chairman Finance Director

3 August 2015 3 August 2015

CONDENSED CONSOLIDATED INCOME STATEMENT FOR THE SIX MONTHS ENDED

30 JUNE 2015

Six Six months Six months Six months ended Year ended 31 Year ended Year ended 31

months ended 30 June ended 30 30 June 2014 December 2014 31 December December 2014

ended 30 2014 June 2014 2014

June

2015

Pre-exceptional Exceptional Post-exceptional Pre-exceptional Exceptional Post-exceptional

items items (see items items items (see items

note 7) note 7)

(unaudited) (unaudited) (unaudited) (audited) (audited) (audited)

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ----- --------- ---------------- ------------- ----------------- ---------------- ------------- -----------------

Total Revenue 6 26,630 24,698 24,698 49,081 - 49,081

Adjustment for

JV sales (141) (50) - (50) (136) - (136)

---------------- ----- --------- ---------------- ------------- ----------------- ---------------- ------------- -----------------

Group Revenue 6 26,489 24,648 - 24,648 48,945 - 48,945

Cost of sales (18,545) (17,915) (1,265) (19,180) (36,103) (1,265) (37,368)

---------------- ----- --------- ---------------- ------------- ----------------- ---------------- ------------- -----------------

Gross profit 7,944 6,733 (1,265) 5,468 12,842 (1,265) 11,577

Distribution

costs (1,832) (1,723) - (1,723) (3,442) - (3,442)

Administrative

expenses (2,939) (2,011) - (2,011) (3,829) - (3,829)

---------------- ----- --------- ---------------- ------------- ----------------- ---------------- ------------- -----------------

Operating

profit 6 3,173 2,999 (1,265) 1,734 5,571 (1,265) 4,306

Finance income 2 1 - 1 2 - 2

Finance costs (153) (110) - (110) (235) - (235)

Share of loss

from JVs (5) (19) - (19) (64) - (64)

---------------- ----- --------- ---------------- ------------- ----------------- ---------------- ------------- -----------------

Profit before

tax 3,017 2,871 (1,265) 1,606 5,274 (1,265) 4,009

Taxation 8 (618) (583) 253 (330) (926) 253 (673)

---------------- ----- --------- ---------------- ------------- ----------------- ---------------- ------------- -----------------

Profit for the

period 2,399 2,288 (1,012) 1,276 4,348 (1,012) 3,336

---------------- ----- --------- ---------------- ------------- ----------------- ---------------- ------------- -----------------

Attributable

to:

Equity holders

of the Parent 2,399 2,288 1,276 4,348 (1,012) 3,336

Earnings per

share:

Basic (p) 10 5.5 5.8 3.2 10.7 - 8.2

Diluted (p) 10 5.4 5.7 3.2 10.5 - 8.1

The notes below form part of these financial statements.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE

SIX MONTHS ENDED 30 JUNE 2015

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------------------------------------- ------------- ------------- -------------

Profit for the period 2,399 1,276 3,336

--------------------------------------------- ------------- ------------- -------------

Other comprehensive (expense)/income

Items that will not be reclassified

to profit or loss

Foreign exchange translation (losses)/gains

on investment in foreign subsidiaries

and joint ventures (190) (269) 669

Actuarial losses on defined benefit

schemes - - (2,334)

Tax relating to items that will

not be reclassified - - 467

--------------------------------------------- ------------- ------------- -------------

Total items that will not be reclassified

to profit or loss (190) (269) (1,198)

--------------------------------------------- ------------- ------------- -------------

Items that may be classified subsequently

to profit or loss

Effective portion of changes in

fair value of cash flow hedges

net of recycling 604 (28) (394)

Tax relating to items that may

be reclassified (121) 6 79

Total items that may be classified

subsequently to profit or loss 483 (22) (315)

--------------------------------------------- ------------- ------------- -------------

Other comprehensive income/(expense)

for the period, net of tax 293 (291) (1,513)

--------------------------------------------- ------------- ------------- -------------

Total comprehensive income for

the period 2,692 985 1,823

--------------------------------------------- ------------- ------------- -------------

Attributable to equity holders

of the Parent 2,692 985 1,823

--------------------------------------------- ------------- ------------- -------------

The notes below form part of these financial statements.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30

JUNE 2015

30 June 30 June 31 December

2015 2014 2014

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

--------------------------------------- ------------- ------------- ------------

Non-current assets

Property, plant and equipment 29,781 28,559 28,561

Investments in JVs 338 219 174

Intangible assets 6,791 4,643 6,851

Deferred tax assets 458 474 502

--------------------------------------- ------------- ------------- ------------

Total non-current assets 37,368 33,895 36,088

--------------------------------------- ------------- ------------- ------------

Current assets

Inventories 8,487 8,509 9,218

Trade and other receivables 14,884 13,067 13,437

Cash and cash equivalents 4,020 454 4,628

--------------------------------------- ------------- ------------- ------------

Total current assets 27,391 22,030 27,283

--------------------------------------- ------------- ------------- ------------

Total assets 64,759 55,925 63,371

--------------------------------------- ------------- ------------- ------------

Current liabilities

Interest-bearing loans and borrowings (726) (709) (718)

Tax payable (481) (655) (385)

Bank overdraft (313) (2,156) -

Trade and other payables (6,876) (6,765) (6,715)

--------------------------------------- ------------- ------------- ------------

Total current liabilities (8,396) (10,285) (7,818)

--------------------------------------- ------------- ------------- ------------

Non-current liabilities

Interest-bearing loans and borrowings (1,125) (1,851) (1,489)

Employee benefits (5,912) (4,047) (6,132)

Deferred tax liabilities (857) (1,067) (698)

--------------------------------------- ------------- ------------- ------------

Total non-current liabilities (7,894) (6,965) (8,319)

--------------------------------------- ------------- ------------- ------------

Total liabilities (16,290) (17,250) (16,137)

--------------------------------------- ------------- ------------- ------------

Total net assets 48,469 38,675 47,234

--------------------------------------- ------------- ------------- ------------

Equity

Issued share capital 2,191 1,992 2,191

Own shares held (9) (18) (17)

Share premium 24,340 16,090 24,340

Capital redemption reserve 15 15 15

Translation reserve 637 (111) 827

Hedging reserve 455 217 (149)

Retained earnings 20,840 20,490 20,027

----------------------------------- --------- --------- ---------

Total equity attributable to

the equity holders of the Parent 48,469 38,675 47,234

----------------------------------- --------- --------- ---------

The notes below form part of these financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE SIX

MONTHS ENDED 30 JUNE 2015

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

------------------------------------------- ------------- ------------- -------------

Cash flows from operating activities:

Profit for the period 2,399 1,276 3,336

Adjustments for:

Depreciation, amortisation and impairment 1,733 3,035 4,669

Finance income (2) (1) (2)

Finance costs 153 110 235

Loss from joint venture 5 19 64

Equity-settled share-based payments 136 86 138

Taxation 618 330 673

------------------------------------------- ------------- ------------- -------------

Operating profit before changes in

working capital and provisions 5,042 4,855 9,113

Increase in trade and other receivables (1,045) (2,183) (2,398)

Decrease/(increase) in inventories 765 (538) (1,249)

Increase in trade and other payables 560 1,599 1,171

Employee benefit contributions (330) (330) (660)

------------------------------------------- ------------- ------------- -------------

Cash generated from operations 4,992 3,403 5,977

Interest paid (45) (13) (55)

Tax paid (365) (336) (868)

------------------------------------------- ------------- ------------- -------------

Net cash from operating activities 4,582 3,054 5,054

------------------------------------------- ------------- ------------- -------------

Interest received 2 1 2

Investment in joint ventures (169) (238) (238)

Acquisition of intangible assets (300) (6) (1,606)

Acquisition of property, plant and

equipment (2,898) (4,608) (5,967)

------------------------------------------- ------------- ------------- -------------

Net cash used in investing activities (3,365) (4,851) (7,809)

------------------------------------------- ------------- ------------- -------------

Proceeds from issue of share capital 10 3 8,453

Repurchase of own shares (4) - (19)

Repayment of borrowings (383) (512) (865)

Dividends paid (1,615) (1,421) (2,112)

------------------------------------------- ------------- ------------- -------------

Net cash (used)/generated in financing

activities (1,992) (1,930) 5,457

------------------------------------------- ------------- ------------- -------------

Net (decrease)/increase in cash and

cash equivalents (775) (3,727) 2,702

Cash and cash equivalents at 1 January 4,628 1,957 1,957

Effect of exchange rate fluctuations

on cash held (146) 68 (31)

------------------------------------------- ------------- ------------- -------------

Cash and cash equivalents at the

end of period 3,707 (1,702) 4,628

------------------------------------------- ------------- ------------- -------------

Cash and cash equivalents comprise cash at bank, short-term

highly liquid investments with a maturity date of less than three

months and bank overdrafts.

The notes below form part of these financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE

SIX MONTHS ENDED 30 JUNE 2015

Share Own shares Share Capital Translation Hedging Retained Total

capital held premium redemption reserve reserve earnings equity

GBP000 reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Balance at 1 January

2015 2,191 (17) 24,340 15 827 (149) 20,027 47,234

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Foreign exchange

translation loss

on investment in

foreign subsidiaries

and joint ventures - - - - (190) - - (190)

Effective portion

of changes in fair

value of cash flow

hedges net of

recycling - - - - - 604 - 604

Tax relating to

effective portion

of changes in fair

value of cash flow

hedges net of

recycling - - - - - - (121) (121)

Profit for the

period - - - - - - 2,399 2,399

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Total comprehensive

(loss)/income for

the period - - - - (190) 604 2,278 2,692

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Transactions with

owners of the Parent

Shares issued - 10 - - - - - 10

Shares acquired - (2) - - - - (2) (4)

Equity-settled

share-based payment

transactions net

of tax - - - - - - 152 152

Dividends paid - - - - - - (1,615) (1,615)

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Total transactions

with owners of

the Parent - 8 - - - - (1,465) (1,457)

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Balance at 30 June

2015 (unaudited) 2,191 (9) 24,340 15 637 455 20,840 48,469

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

During the six months period ended 30 June 2015, 82,239 shares

vested and were issued from the Zotefoams Employee Benefit Trust

('EBT') following the exercise of these options.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE

SIX MONTHS ENDED 30 JUNE 2014

Share Own shares Share Capital Translation Hedging Retained Total

capital held premium redemption reserve reserve earnings equity

GBP000 reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Balance at 1 January

2014 1,992 (21) 16,090 15 158 245 20,535 39,014

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Foreign exchange

translation loss

on investment

in foreign

subsidiaries

and joint ventures - - - - (269) - - (269)

Effective portion

of changes in

fair value of

cash flow hedges

net of recycling - - - - - (28) - (28)

Tax relating to

effective portion

of changes in

fair value of

cash flow hedges

net of recycling - - - - - - 6 6

Profit for the

period - - - - - - 1,276 1,276

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Total comprehensive

(loss)/income

for the period - - - - (269) (28) 1,282 985

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Transactions with

owners of the

Parent

Shares issued - 3 - - - - - 3

Equity-settled

share-based payment

transactions net

of tax - - - - - - 94 94

Dividends paid - - - - - - (1,421) (1,421)

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Total transactions

with owners of

the Parent - 3 - - - - (1,327) (1,324)

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

Balance at 30

June 2014

(unaudited) 1,992 (18) 16,090 15 (111) 217 20,490 38,675

---------------------- --------- ----------- --------- ------------ ------------ --------- ---------- --------

The notes below form part of these financial statements.

NOTES TO THE INTERIM FINANCIAL STATEMENTS FOR THE SIX MONTHS

ENDED 30 JUNE 2015

1. GENERAL INFORMATION

The Company is a public limited liability company incorporated

and domiciled in the UK. The address of the registered office is

675 Mitcham Road, Croydon, CR9 3AL. The Group is principally

engaged in manufacturing and selling cellular materials and,

through MuCell Extrusion LLC ('MEL'), licensing microcellular foam

technology and supplying related equipment. The Group has

manufacturing sites in the UK and the USA and sells into worldwide

markets. The Company is listed on the London Stock Exchange and is

registered in England and Wales with Company Number 2714645.

2. BASIS OF PREPARATION

This condensed set of consolidated interim financial statements

has been prepared in accordance with IAS 34 Interim Financial

Reporting as adopted by the EU.

As required by the Disclosure and Transparency Rules of the

Financial Conduct Authority, the condensed set of consolidated

interim financial statements has been prepared applying the

accounting policies and presentation that were applied in the

preparation of the Group's published consolidated financial

statements for the year ended 31 December 2014. Those consolidated

financial statements were prepared in accordance with IFRSs as

adopted by the EU.

This condensed set of consolidated interim financial statements

has been reviewed, but not audited, and was approved for issue on 3

August 2015. This condensed set of consolidated interim financial

statements does not comprise statutory accounts within the meaning

of Section 434 of the Companies Act 2006. Statutory accounts for

the year ended 31 December 2014 were approved by the Board of

Directors on 16 March 2015 and delivered to the Registrar of

Companies. The Independent Audit on those accounts was unqualified,

did not contain an emphasis of matter paragraph and did not contain

any statement under Section 498 of the Companies Act 2006.

There were no significant changes to the pension scheme or

significant changes to market conditions during the period and

therefore the Company did not update its actuarial valuation during

this period. The Income Statement charge is based on the set of

assumptions laid out in the consolidated financial statements for

the year ended 31 December 2014.

Forward-looking statements

Certain statements in this condensed set of consolidated interim

financial statements are forward-looking. Although the Group

believes that the expectations reflected in these forward-looking

statements are reasonable, we can give no assurance that these

expectations will prove to be correct. Because these statements

involve risks and uncertainties, actual results may differ

materially from those expressed or implied by these forward-looking

statements.

We undertake no obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise.

Going Concern

After making enquiries, the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. The Group

therefore continues to adopt the going concern basis of accounting

in preparing its condensed consolidated interim financial

statements.

3. ACCOUNTING POLICIES

The accounting policies adopted are consistent with those of the

Group's published consolidated financial statements for the year

ended 31 December 2014, as described in those consolidated

financial statements with the exception of tax which is accrued

based on an estimated tax rate that would be applicable to

estimated annual earnings.

Joint ventures

Joint ventures are jointly controlled entities whose activities

the Group has the power to control jointly, established by

contractual agreement. The consolidated financial statements

include the Group's share of the total recognised income and

expense and changes in equity of joint ventures on an equity

accounted basis, from the date that joint control or significant

influence respectively commences until the date that it ceases.

Joint ventures are recorded at cost as adjusted for

post-acquisition changes in the Group's share of net assets of the

entity including goodwill net of accumulated impairment loss. When

the Group's share of losses exceeds the carrying amount of the

joint venture, the carrying amount is reduced to GBPnil and

recognition of further losses is discontinued except to the extent

that the Group has incurred legal or constructive obligations or

made payments on behalf of the joint venture or associate.

4. CYCLICAL NATURE OF BUSINESS

Zotefoams generally makes more profit in the first six months of

the year. This cyclical nature of the business can be attributed to

a number of factors, namely:

-- Reduced polyolefin sales in the second half of the year due

to customer holiday periods and factory shutdowns in August and

December.

-- Timing of maintenance/servicing cost which is concentrated around shutdown periods.

However, the Group is also subject to a number of other factors

such as customer demand, growth of new products or markets and

changes to the MEL licence portfolio which can affect this

underlying cyclicality.

5. ESTIMATES

The preparation of condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and

expenses. The estimates and associated assumptions are based on

historical experience and various other factors that are believed

to be reasonable under the circumstances, the results for which

form the basis of making the judgements about carrying values of

assets and liabilities that are not readily available from other

sources. Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements as at and for the year ended 31

December 2014.

6. SEGMENT REPORTING

The Group manufactures and sells high-performance foams and

licenses related technology for specialist markets worldwide.

Zotefoams' activities are categorised as follows:

-- Polyolefins: these foams are made from olefinic homopolymer

and copolymer resin. The most common resin used is low density

polyethylene ('LDPE').

-- High-Performance Products (HPP): these foams exhibit

high-performance on certain key properties, such as improved

chemical, flammability or temperature performance, due to the

resins on which they are based. Turnover in the segment is

currently mainly derived from our ZOTEK(R) F foams and T-Tubes(R)

insulation both made from PVDF fluoropolymer. Other commercially

launched products are foams made from polyamide (nylon) and

polyether block amide ('PEBA').

-- MEL: licenses microcellular foam technology and sells related machinery.

Due to our unique manufacturing technology Zotefoams can produce

polyolefin foams with superior performance to other manufacturers.

Our strategy is to use the capabilities of our technology to

produce foams from other materials in addition to polyolefins.

There were no significant transactions within the period between

reportable segments.

Polyolefins HPP MEL Consolidated

Six months ended 30 June GBP000 GBP000 GBP000 GBP000

2015 (unaudited)

Total Revenue* 22,228 3,394 1,008 26,630

Adjustment for joint

venture sales (141) - - (141)

---------------------------- ------------ -------- -------- -------------

Group revenue 22,087 3,394 1,008 26,489

Segment profit/(loss)

before amortisation 4,102 670 (221) 4,551

Amortisation of acquired

intangible assets (24) - (153) (177)

---------------------------- ------------ -------- -------- -------------

Segment profit/(loss) 4,078 670 (374) 4,374

Foreign exchange losses - - - (444)

Unallocated central costs - - - (757)

---------------------------- ------------ -------- -------- -------------

Operating profit before

exceptional items 3,173

---------------------------- ------------ -------- -------- -------------

Polyolefins HPP MEL Consolidated

Six months ended 30 June GBP000 GBP000 GBP000 GBP000

2014 (unaudited) Restated Restated Restated Restated

** ** ** **

Total Revenue* 21,217 2,757 724 24,698

Adjustment for joint

venture sales (50) - - (50)

---------------------------- ------------ ---------- ---------- -------------

Group revenue 21,167 2,757 724 24,648

Segment profit/(loss)

before amortisation 3,410 528 (139) 3,799

Amortisation of acquired

intangible assets - - (149) (149)

---------------------------- ------------ ---------- ---------- -------------

Segment profit/(loss) 3,410 528 (288) 3,650

Foreign exchange gains - - 24

Unallocated central costs - - - (675)

---------------------------- ------------ ---------- ---------- -------------

Operating profit before

exceptional items 2,999

---------------------------- ------------ ---------- ---------- -------------

* Total Revenue consolidates all external sales made by the

joint ventures as well as those made by Zotefoams plc and its

subsidiaries.

** Previously the HPP business result included direct costs and

an allocation of Research and Development and manufacturing

overhead but not a share of indirect administration costs. As the

HPP business has grown the result has been restated to reflect

better HPP's use of indirect resource. Central Group costs have

also been excluded from the business segments as these are

non-business specific.

7. EXCEPTIONAL ITEM

On 27 June 2014 the Company made the decision to curtail

manufacturing activity on its microZOTE(R) extrusion line within

its Polyolefin business segment. This resulted in a non-cash

impairment charge as follows:

Six months Six months

ended ended

30 June 30 June 2014

2015 GBP000

GBP000

------------------------ ------------ --------------

Fixed asset impairment - 1,175

Inventory impairment - 90

------------------------ ------------ --------------

- 1,265

------------------------------------- --------------

8. TAXATION

Six months Six months

ended ended

30 June 30 June

2015 2014

GBP000 GBP000

--------------------- ----------- -----------

Current tax:

UK corporation tax 454 475

Foreign tax 7 10

--------------------- ----------- -----------

461 485

Deferred tax 157 (155)

--------------------- ----------- -----------

618 330

--------------------- ----------- -----------

The Group's consolidated effective tax rate for the six months

ended 30 June 2015 was 20.5% (2014: 20.5%)

Tax is accrued based on an estimated tax rate that would be

applicable to estimated annual earnings.

9. DIVIDENDS

Six months Six months

ended ended

30 June 30 June

2015 2014

GBP000 GBP000

----------------------------------------------- ----------- -----------

Final dividend for the year ended 31 December

2014 of 3.7p

(2013: 3.6p) per share 1,615 1,421

----------------------------------------------- ----------- -----------

The final dividend for the year ended 31 December 2014 was paid

on 27 May 2015.

10. EARNINGS PER SHARE

The calculation of the basic and diluted earnings per share is

based on the following data:

Six months Six months

ended ended

30 June 30 June

2015 2014

GBP000 GBP000

----------------------------------------------- ----------- -----------

Earnings

Earnings for the purpose of basic earnings

per share pre-exceptional items being net

profit attributable to equity holders of

the parent pre-exceptional items 2,399 2,288

Earnings for the purposes of diluted earnings

per share pre-exceptional items 2,399 2,288

Earnings for the purpose of basic earnings

per share being net profit attributable

to equity holders of the parent 2,399 1,276

Earnings for the purposes of diluted earnings

per share 2,399 1,276

----------------------------------------------- ----------- -----------

Number of shares Number Number

----------------------------------------------- ------------- -------------

Weighted average number of ordinary shares

for the purposes of basic earnings per share 43,549,103 39,444,150

Effect of dilutive potential ordinary shares:

Share options and Long-Term Incentive Plans 598,840 660,253

----------------------------------------------- ------------- -------------

Weighted average number of ordinary shares

for the purposes of diluted earnings per

share 44,147,943 40,104,403

----------------------------------------------- ------------- -------------

11. FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT

The Group's activities expose it to a variety of financial risks

including credit risk, interest rate risk, liquidity risk and

foreign currency risk.

The condensed interim financial statements do not include all

financial risk management information and disclosures required in

the annual financial statements; they should be read in conjunction

with the Group's annual financial statements as at 31 December

2014. There have been no changes in any risk management policies

since the year end.

Fair value estimation

The table below analyses financial instruments carried at fair

value, by valuation method. The different levels have been defined

as follows:

-- Quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1).

-- Inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (that

is, as prices) or indirectly (that is, derived from prices) (Level

2).

-- Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs) (Level

3).

The following table presents the Group's financial instruments

that are measured at fair value at 30 June 2015.

Level 1 Level 2 Level 3 Total

GBP000 GBP000 GBP000 GBP000

Assets

Forward exchange contracts - 456 - 456

Total assets - 456 - 456

---------------------------- --------- -------- -------- -------

Liabilities

Forward exchange contracts - - - -

Total liabilities - - - -

---------------------------- --------- -------- -------- -------

The following table presents the Group's financial instruments

that are measured at fair value at 30 June 2014.

Level 1 Level 2 Level 3 Total

GBP000 GBP000 GBP000 GBP000

Assets

Forward exchange contracts - 216 - 216

Total assets - 216 - 216

---------------------------- --------- -------- -------- -------

Liabilities

Forward exchange contracts - - - -

Total liabilities - - - -

---------------------------- --------- -------- -------- -------

The forward exchange contracts have been fair valued using

forward exchange rates that are quoted in an active market.

Group's valuation process

The Group's finance department performs the valuation of forward

exchange contracts required for financial reporting purposes. This

is reported to the Audit Committee.

The results of the valuation processes are included in the

Group's monthly reporting to the directors which include all

members of the Audit Committee.

Fair value of financial assets and liabilities measured at

amortised cost

The fair value of borrowings is as follows:

30 June 2015 30 June 2014

GBP000 GBP000

Current 711 687

Non-current 1,115 1,826

Total 1,826 2,513

The fair value of the following financial assets and liabilities

approximate their carrying amount:

-- Trade and other receivables

-- Other current financial assets

-- Cash and cash equivalents

-- Trade and other payables

-- Other current liabilities

12. RELATED PARTY TRANSACTIONS

There were no material related party transactions for the

periods ended 30 June 2015 and 30 June 2014.

Independent review report to Zotefoams plc

Report on the condensed consolidated interim financial

statements

Our conclusion

We have reviewed the condensed consolidated interim financial

statements, defined below, in the Interim Results of Zotefoams plc

for the six months ended 30 June 2015. Based on our review, nothing

has come to our attention that causes us to believe that the

condensed consolidated interim financial statements are not

prepared, in all material respects, in accordance with

International Accounting Standard 34 as adopted by the European

Union and the Disclosure and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

This conclusion is to be read in the context of what we say in

the remainder of this report.

What we have reviewed

The condensed consolidated interim financial statements, which

are prepared by Zotefoams plc, comprise:

-- the condensed consolidated statement of financial position as at 30 June 2015;

-- the condensed consolidated income statement and statement of

comprehensive income for the period then ended;

-- the condensed consolidated statement of cash flows for the period then ended;

-- the condensed consolidated statement of changes in equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

As disclosed in note 2, the financial reporting framework that

has been applied in the preparation of the full annual financial

statements of the Group is applicable law and International

Financial Reporting Standards (IFRSs) as adopted by the European

Union.

The condensed consolidated interim financial statements included

in the Interim Results have been prepared in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and the Disclosure and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

What a review of condensed consolidated financial statements

involves

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK and

Ireland) and, consequently, does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

We have read the other information contained in the Interim

Results and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed consolidated interim financial statements.

Responsibilities for the condensed consolidated interim

financial statements and the review

Our responsibilities and those of the directors

The Interim Results, including the condensed consolidated

interim financial statements, is the responsibility of, and has

been approved by, the directors. The directors are responsible for

preparing the Interim Results in accordance with the Disclosure and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

Our responsibility is to express to the company a conclusion on

the condensed consolidated interim financial statements in the

Interim Results based on our review. This report, including the

conclusion, has been prepared for and only for the company for the

purpose of complying with the Disclosure and Transparency Rules of

the Financial Conduct Authority and for no other purpose. We do

not, in giving this conclusion, accept or assume responsibility for

any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

PricewaterhouseCoopers LLP

Chartered Accountants

3 August 2015

Gatwick

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UOOBRVAAWRAR

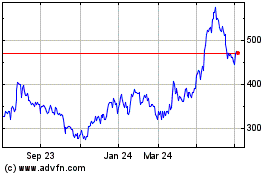

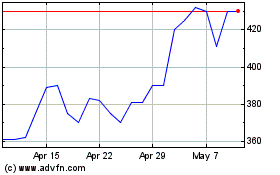

Zotefoams (LSE:ZTF)

Historical Stock Chart

From Aug 2024 to Sep 2024

Zotefoams (LSE:ZTF)

Historical Stock Chart

From Sep 2023 to Sep 2024