Alumasc Group PLC Disposal of APC & Trading Update (4334R)

June 26 2015 - 12:34PM

UK Regulatory

TIDMALU

RNS Number : 4334R

Alumasc Group PLC

26 June 2015

26 June 2015

THE ALUMASC GROUP PLC ("Alumasc" or "the Group")

SALE OF ALUMASC PRECISION COMPONENTS AND TRADING UPDATE

Sale of Alumasc Precision Components ("APC")

In Autumn 2014, the Alumasc Board announced that the focus of

the Group's future strategic development would be to accelerate the

growth of its market-leading Building Products activities and, as a

consequence, it was seeking a buyer for APC, the larger of the

Group's two Engineering Products businesses.

Alumasc is pleased to announce that it has today completed the

sale of the trade and assets of APC to the Shield Group ("Shield")

for cash consideration of GBP5.8 million, paid at completion,

subject to completion accounts adjustments. The value of the gross

and net assets divested was approximately GBP9 million and GBP6.5

million, respectively. Prior to transaction costs, the sale will

result in the Group's net assets decreasing by approximately GBP0.5

million. Under the terms of the transaction, APC's legacy defined

benefit pension obligations will be retained by Alumasc.

For the year ended 30 June 2014, APC generated an operating loss

of GBP1.4 million. The business delivered an improved performance

in the first half of the current financial year. The expected

one-off costs associated with exiting the business and resolving

the customer claims referred to in Alumasc's interim results

announcement are expected to be circa GBP2 million, of which

approximately GBP1.5 million are cash costs.

The cash proceeds from the sale of APC will be used to support

the development of the Group's Building Products activities,

including the relocation, modernisation and expansion of its

Rainwater & Drainage business, currently located on the same

site as APC.

Like APC, Shield supplies precision engineered aluminium

components primarily to the off highway diesel and automotive

markets and the two businesses have certain customers in common.

APC's employees have transferred to Shield under TUPE and Shield

has indicated that it intends to invest in and develop the APC

business at its current factory near Kettering.

Trading Update

The trading performance elsewhere in the Alumasc Group in the

second half of the current financial year has been better than

management expected at the time of the interim results. All

business segments in the Building Products division have

contributed to this.

The outlook for the Group continues to improve and the Building

Products divisional order books currently stand at GBP23.7 million

(31 December 2014: GBP19.2 million). The order intake in the

current financial year to date has been over 20% ahead of the

equivalent period in the prior year.

Paul Hooper, Chief Executive of The Alumasc Group,

commented:

"We are delighted to have concluded the sale of APC to Shield, a

company we believe is better positioned than Alumasc to develop the

business and its service to customers.

The divestment of APC will be strongly earnings and cash flow

enhancing for Alumasc and will allow the Group to focus on its

strategic priority to drive the further profitable growth of its

continuing businesses."

ENDS

Enquiries:

The Alumasc Group plc

Paul Hooper (Chief Executive) Tel: 01536 383821

Andrew Magson (Group Finance Director) Tel: 01536 383844

Glenmill Partners

Simon Bloomfield Tel: 07771 758517

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAKKKADDSEFF

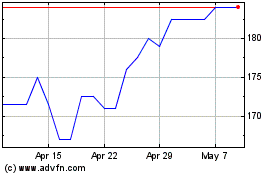

Alumasc (LSE:ALU)

Historical Stock Chart

From Aug 2024 to Sep 2024

Alumasc (LSE:ALU)

Historical Stock Chart

From Sep 2023 to Sep 2024