TIDMAFCR

10 December 2014

African Consolidated Resources plc

("AFCR" or the "Company")

Placing and Subscription of up to 318,418,000 New Ordinary Shares at a

price 0.5 pence per share

Details of Proposed Acquisition

Capital Reorganisation

Grant of Conversion Rights

Change of Name to Vast Resources plc

Notice of General Meeting

African Consolidated Resources plc, the AIM listed resource and

development company, is pleased to announce that it has raised GBP1.59m

(approximately $2.50m) via a Placing of and Subscription for New

Ordinary Shares, conditional on Shareholder approval for the issue of

sufficient New Ordinary Shares and the Capital Reorganisation required

to effect the Placing and Subscription, to be sought at the General

Meeting to be convened for 11.00 a.m. on 30 December 2014 at the offices

of Daniel Stewart & Company plc, Becket House, 36 Old Jewry, London EC2R

8DD.

The General Meeting will also be asked to consider and, if thought fit,

approve, inter alia, the issue of New Ordinary Shares to satisfy the

grant of Conversion Rights, a change in the Company's name to Vast

Resources plc and the replacement of the Company's existing allotment

authorities and the disapplication of pre-emption rights up until the

next Annual General Meeting.

Capitalised terms in this announcement carry the same meaning as those

ascribed to them in the circular, which will shortly be sent to

Shareholders (the "Circular") and which will also be available on the

Company's website at www.afcrplc.com.

The Placing and the Subscription

Further to the announcement on 4 December 2014 of its interim results

for the six months ended 30 September 2014 (the "Interim Results"), the

Company has conditionally raised GBP1.59m (approximately $2.50m)

via the Placing and the Subscription at a price of 0.5p per New Ordinary

Share. The Placing and the Subscription are not underwritten.

As disclosed in the Interim Results, the Company has been advancing

discussions regarding a number of opportunities in Romania and has

already secured a $1.0 million loan from Grayfox Investments (Pvt) Ltd,

on the terms announced on 17 October 2014, to advance this aim.

The purpose of the Placing and Subscription is to provide additional

funds for furthering these opportunities in Romania.

Romanian Opportunities

The Company has been investigating opportunities in Romania since late

2012 and, as announced on 21 May 2013, has had a period of effective

exclusivity in order to carry out due diligence and evaluation of the

entire polymetallic mineral interests, which include copper and gold, of

the Romanian State mining company Remin SA ("Remin"). Discussions with

Remin are ongoing regarding future opportunities.

Romania

The Carpathian Mountains in Romania have a significant mineralisation

footprint which has been well established since Roman times. Since the

breakup of the Soviet Union, and in particular since Romania's admission

to the European Union ("EU") on 1 January 2007, the Romanian mining

industry has been largely inactive as a result of state aid being

withdrawn from it, in line with EU rules. Because of the work that the

Company has now carried out in the country over a two year period,

considerable knowledge has been acquired by the Company, both with

regard to the specific mining opportunities and the business culture of

the country. The Board believes that as a result the Company now has a

significant 'first mover advantage'.

Romania has low sovereign risk, an established mining culture and a

pro-mining government, including a highly skilled but relatively low

cost residential workforce. It has an excellent power and transport

infrastructure to support development and a strategic location, with

access to Europe, the Middle East and Africa. Geologically it has, in

the Directors' opinion, the potential for significant new discoveries.

Mineral Mining and Baita Bihor

As an example of possibilities outside the Remin discussions, a specific

near term opportunity to undertake the proposed acquisition of the Baita

Bihor mine (the "Proposed Acquisition") has arisen, in which the Company

has obtained an option to acquire a 68 per cent. interest in Mineral

Mining, subject to the completion of due diligence to AFCR's

satisfaction. The Directors believe, subject to the completion of due

diligence, that Mineral Mining is the 100 per cent. owner of a

well-developed polymetallic underground mine, Baita Bihor, and its

associated mining rights.

Mineral Mining is currently the subject of insolvency proceedings in

Romania, which are expected to be concluded shortly. Once such

proceedings have been completed, it is anticipated that title to the

Baita Bihor mining licence will be confirmed.

Baita Bihor is located in the Apuseni Mountains, Transylvania, an area

which hosts Romania's largest polymetallic and uranium mines, 50km NW

from Romania's largest Au-Cu mine, Rosia Montana (>10Moz Au) and also

52km NW of Rosia Poiena, which contains over one billion tonnes of

porphyry copper ore.

Baita Bihor is a skarn deposit comprising several veins in calcareous

sediments in eight distinct pipes. It is estimated, by the Company, to

contain 1,800,000 tonnes of polymetallic ore (gold, silver, copper, zinc,

lead, tungsten and molybdenum) at 6% copper equivalent or 10g/tonne gold

equivalent, at current prices, (estimated in accordance with the Russian

Reserves and Resources Reporting System) within the licensed area. It

has unmeasured resources in other pipes and substantial exploration

upside. Due to lack of capital investment and modernisation the mine

became uneconomic and was put on care and maintenance in 2013. Plant

and equipment for the mine are in place but require some rehabilitation.

Resource estimation has been calculated, by AFCR, on two different grade

assumption bases - the 'AFCR Model' and the 'Production Model'. The

AFCR Model is based on official records which show an in situ resource

based on the Russian Reserves and Resource Reporting System of 1.8

million tonnes at 2.19% Cu, 128g/t Ag, 3.46% Zn, 3.07% Pb and 1.41g/t

Au. Mine laboratory records and underground inspections with a Niton

XRF cross correlate. The Production Model grades are back calculated

from actual historical production records but are thought to produce

conservative results on account of known inefficiencies in previous

production methods.

Included in this resource is a 400,000 tonne

copper/silver/zinc/lead/gold/tungsten/molybdenum ore body identified

within the current mine workings (non JORC but conservative estimations

by AFCR geologists) which is ready to mine.

Two high level financial models have been prepared for Baita Bihor (both

on a 100 per cent. basis), one on the AFCR Model grade basis reduced to

take account of processing losses and one on the Production Model grade

basis, to demonstrate possible results over the life of the mine on the

basis of a production rate of 10,000 tonnes per month.

Ore modelled using AFCR Model compared to Production Model provides the

following indications:

AFCR Model Production Model

Ore Resource tonnage 1,8m tonnes 1,8m tonnes

Production rate 10,000 tpm 10,000 tpm

Life of Mine 15 yrs 15 yrs

Capex over life of Mine: $40.4m $40.4m

Startup, retire debt to end 2014 $3.3m $3.3m

Upgrading to design capacity $3.6m $3.6m

Development deeper levels $15m $15m

Closure $5m $5m

Stay in business capital $13.5m $13.5m

Revenue discount on LME $ 15% 15%

Peak cash flow per annum after

tax $14.7m pa over 11 yrs $7.6m pa over 12 yrs

Cash flow NPV 0% $217m $101m

NPV 10% $100m $41m

Opex $81/tonne $81/tonne

IRR 563% 92%

Financial models using geological AFCR 'industrial' (diluted) head grade

vs production figures. Note in the Production Model, Ag head grades have

been dropped from a back-calculated 264 g/t to the AFCR Model of 109 g/t

as Ag assays are problematical. Au $1,250/Oz. Ag $20/Oz, Cu $3/lb

($6700/t) Pb & Zn $0.90/lb

Further information concerning the Baita Bihor mine is appended to this

announcement.

An 85 per cent. equity interest in Mineral Mining is beneficially owned

by AFCR's Romanian senior management and other AFCR group employees, led

by the President and Executive Director of the Company's Romanian

subsidiary African Consolidated Resources Srl ("AFCR Romania"), Mr.

Andrew Prelea (the "AP Group"). The members of the AP Group include,

inter alios, Mr. Andrew Prelea (50 per cent. beneficial interest), Mr.

Mike Kellow, a former Director of the Company and currently director of

exploration for AFCR (30 per cent. beneficial interest) and Mr. Roy

Tucker, Finance Director of the Company (10 Per cent. beneficial

interest). The shares of Mineral Mining are currently registered in the

name of AFCR Romania which holds them on trust for the AP Group.

The Company has an option to acquire 68 per cent. of Mineral Mining,

leaving the AP Group interested in 17 per cent of the equity. It is the

Board's opinion that the remaining 15 per cent. of the equity of Mineral

Mining, which will initially be retained by Mr. Dong Quosheng and Mr. Ni

Jin Ming its former owners (the "Former Owners"), could be acquired in

the future, on favourable terms and in the same ratio of ownership

between AFCR and the AP Group as in the Proposed Acquisition.

Due to the way in which the AP Group has brought the opportunity to the

Company, initially funding diligence work when AFCR had decided that it

did not wish to pursue the Proposed Acquisition, it will neither be

required to fund the acquisition of its interest in Mineral Mining, nor

the initial development costs.

It is expected that following completion of the Proposed Acquisition,

equity owned by the AP Group will revert to its individual participants.

Due to the participation of Mr. Roy Tucker, Mr. Andrew Prelea and Mr.

Mike Kellow in the AP Group, the Proposed Acquisition will be deemed a

related party transaction under the AIM Rules and the independent

directors of the Company for these purposes (being all of the Directors

except for Mr. Roy Tucker) will be required to consult with Strand

Hanson, as the Company's Nominated Adviser, and opine that the Proposed

Acquisition is fair and reasonable insofar as Shareholders are

concerned.

Should it complete, the Proposed Acquisition will be deemed a

substantial transaction under the AIM Rules and all the information

required by Schedule Four to the AIM Rules will be included in the

announcement to be made at that time.

In order to consummate the Proposed Acquisition, AFCR would have to pay

up to $3.6 million which would be applied as follows:

$,000

Retire existing debt in the Company (EUR900,000)* 1,224

A payment on account of obligation to the Former Owners

(EUR250,000) 340

Improve mine infrastructure, ventilation and floatation

circuits, plus develop incline shaft to access next

level 1,468

Operational overhead (3 months pre-production) 367

Pre-acquisition costs (including due diligence) 200

3,599

* This figure is being audited and is believed by management to be

substantially lower

This expenditure is expected to result, within four months from

deployment of funds, in commencement of production at a rate of 5,600

tpm and within a further two months, a production rate of 10,000 tpm.

There will likely be future costs after positive net cash flow has been

achieved which might be funded from cash flow from existing operations

or debt or both. It is estimated as follows:

$,000

Balance due to the Former Owners (EUR950,000)* 1,292

Exploration costs 1,333

Mine development to deeper levels 934

3,559

* Based on currently available information, the Board is confident that

this payment will only become payable out of future operating cash flows

from Baita Bihor.

It is anticipated that this further expenditure would sustain production

at a rate of 120,000 tpa and provide the basis for further expansion at

Baita Bihor.

It is believed by the Directors that the funds used to upgrade mine

infrastructure, ventilation and floatation circuits will:

-- improve plant recoveries from the previous 65 per cent. or worse;

-- upgrade float circuit to capture wolfram and molybdenum by-products that

are not currently included in the concentrate sales;

-- upgrade the 1970s vintage ore-loaders, which are expected to cause a

current bottleneck;

-- improve ventilation and hoisting for safety and productivity; and

-- reduce production costs per tonne.

The Company emphasises that due diligence is yet to be completed and the

Placing proceeds will not therefore necessarily be applied to the

Proposed Acquisition. In the event that it does not complete, the funds

may instead be applied towards other opportunities in Romania.

The Capital Reorganisation

As the Issue Price is lower than the nominal value of the Company's

Existing Ordinary Shares it is proposed to subdivide each Existing

Ordinary Share into one New Ordinary Share of 0.1p each and one deferred

share of 0.9p each. The Deferred Shares will have very limited rights

and be effectively valueless, with the result that the New Ordinary

Shares will effectively have the same rights as the Existing Ordinary

Shares. The Capital Reorganisation is necessary in order to complete

the Placing and Subscription at the Issue Price.

Change of Name

In order to take account of the change in the Company's geographical

focus, it is proposed that its name be changed to Vast Resources plc.

Related Party Transaction

The Directors and their associates have, in aggregate, subscribed for

76,819,400 New Ordinary Shares in the Placing and Subscription. Due to

their participation in the Subscription and the Placing these are deemed

to constitute a related party transaction in accordance with the AIM

Rules and the independent director of the Company for these purposes

(being Mr. Eric Diack) having consulted with Strand Hanson, as the

Company's Nominated Adviser, considers that the Placing and Subscription

are fair and reasonable insofar as Shareholders are concerned.

The General Meeting

The General Meeting is to be held at the offices of at the offices of

Daniel Stewart & Company plc, Becket House, 36 Old Jewry, London EC2R

8DD at 11.00 a.m. on 30 December 2014. Full details of the Resolutions

are included in the Circular and accompanying Notice of General Meeting.

Directors' Recommendation

For the reasons set out above, the Board considers that the Placing and

Subscription, the Capital Reorganisation and the change of the Company's

name are in the best interests of the Company and its Shareholders as a

whole.

Accordingly, the Board recommends that Shareholders vote in favour of

the Resolutions at the General Meeting as the Directors each intend to

do in respect of their own shareholdings of in aggregate 29,295,892

Ordinary Shares, representing approximately 3.39 per cent. of the issued

Ordinary Shares at the date of this announcement.

**ENDS**

Roy Pitchford, Chief Executive Officer, said:

"Following the successful funding of the Pickstone-Peerless Mine in

Zimbabwe, the mine development opportunities available to AFCR in

Romania provide the company with expansion and growth possibilities.

The Baita Bihor Mine is targeted to process a similar monthly tonnage as

Pickstone-Peerless, but is a multi-metal mine with a higher equivalent

grade sourced from underground instead of by open-cast mining methods.

It would therefore be a significant step up in terms of mining and

processing. AFCR is therefore fortunate that it has very good local

Romanian mining expertise available to meet this challenge.

"On the basis that the Proposed Acquisition completes, the funding from

the Placing would enable AFCR to start its first mining operation in

Romania, which in turn would be expected to provide the base for the

development of the very much larger mines that are part of the Remin

Group. Baita Bihor would complement the development of the

Pickstone-Peerless Mine in Zimbabwe and would be a further step in the

process of transforming AFCR from an exploration company to a mining

company. AFCR looks forward to having two operating mines in H2 2015"."

For further information, please contact:

African Consolidated Resources plc www.afcrplc.com

Roy Tucker (Finance Director) +44 (0) 1622 816918

Roy Pitchford (Chief Executive Officer) +44 (0) 7920 189012

+263 (0) 7721 69833

+40 (0) 7411 11900 / +44 (0) 7793 909985

Strand Hanson Limited - Financial & Nominated Adviser www.strandhanson.co.uk

James Spinney +44 (0) 20 7409 3494

Ritchie Balmer

James Bellman

Daniel Stewart and Company - Broker www.danielstewart.co.uk

Martin Lampshire +44 (0) 20 7776 6550

Colin Rowbury

St Brides Media & Finance Ltd www.stbridesmedia.co.uk

Susie Geliher +44 (0) 20 7236 1177

Review by a qualified person

This announcement has been reviewed by Mr. Mike Kellow BSc, and by Mr.

Vasile Pop.

Mr Kellow, Director of Exploration for AFCR, has reviewed this

announcement in his capacity as a qualified person under the AIM Rules.

Mr Kellow is a member of the Australian Institute of Geologists and has

34 years' experience of in the metals and mining industry.

Mr Pop has been certified, since 1988, by the Attestation Commission of

the Romanian National Agency for Mineral Resources (ANRM) as fulfilling

all the criteria to qualify as an expert with technical and professional

skills for groundworks, geological, technical and techno-economical

documentation for mining activity, geological research and exploitation

of mineral resources.

Further Information on Baita Bihor Mine

-- Official records show an in situ Resource (based on the Russian Reserves

& Resources Reporting System) of 1.8m tonnes at 2.19% Cu, 128g/t Ag,

3.46% Zn, 3.07% Pb and 1.41g/t Au. Mine laboratory records and

underground inspections with a Niton XRF analyser cross-correlate very

closely

-- Polymetallic mix equates to a copper equivalent grade of 6% or a gold

equivalent grade of over 10g/t

-- 400,000 tonne copper-silver-zinc-lead-gold-tungsten-molybdenum ore body

identified within the current mine workings on the Antonio 1 and Antonio

2 skarn pipes (non-JORC but conservative estimations by AFCR and Mineral

Mining Geologists) - ready to mine

-- A molybdenum orebody exists on the Blidar Fault, about 150m west of Shaft

1 - it has been mined out to level 18 (bottom of mine) but below that

depth it is untouched, but is not included in Ore Reserves or cash flow

models

-- Below are the in-house grades and flotation recovery factors together

with back calculations of grades from actual production records

* AFCR ore reserve grades (based on official records on the Russian

Reserves & Resources Reporting System) vs production figures. Head

grade is diluted or 'industrial grade' presented to the concentrator.

Recovered grade is that achieved after flotation losses.

Management has reason to suspect that inefficiencies and incorrect

recording of value of past metal production render the calculation of

recovered grade in the concentrate back calculations very conservative.

Confirmation of in-situ grades throughout the mine will be a critical

task for future planning of mining and exploration. Once these grades

are established, a reconciliation against production can be instigated,

applying factors for ore loss, dilution and flotation recovery.

-- Considerable exploration potential within the mine and in satellite

targets in licence area

-- Depth potential below the deepest Level 18 has only been drill tested for

about 90m - it is not yet certain how deep the skarn mineralisation will

persist before being cut off by an underlying granite intrusion - see

below

-- The branching skarn geometry suggests the mine is currently in the

shallow upper levels of the system and the deep roots could persist for

at least several hundred metres - a previous Russian drill hole in the

1970s indicated +350m from base of mine to granite

-- Orebody is zoned vertically with Au-Ag caps and Pb-Zn being richer at

upper levels

-- Copper grades increase with depth from 0.8% Cu near surface to >2% Cu

below Level 18, with spectacular Ag and Au grades (200-2,000g/t and 1-4

g/t respectively) associated with copper on thin veined contacts with the

host dolomite

-- Antonio 2 pipe lies approximately 300m north of Antonio 1, both have good

access from drives (galleries) down to Level 18 at Antonio 1 and Level 15

at Antonio 2

-- Postulated that the Antonio 1 and 2 pipes may merge at depth forming a

substantially larger orebody representing a priority drilling target

-- Rights to mine polymetallic minerals (Cu, Pb, Zn, Ag, Au), molybdenum,

bismuth, wolfram, boron, and wollastonite on exploitation licence LE

999/1999 until 2019, renewable thereafter in 5 year periods

-- A processing plant comprising crushing, milling and flotation circuits to

produce Cu, Pb, Zn and Mo concentrates with Au and Ag credits - current

design capacity is 20,000 tonnes per month

-- A tailings dam in good operational order for waste disposal, current

tonnage approximately 4.6Mt with all appropriate environmental approvals

-- Underground mining infrastructure at Antonio 1 including three access

shafts, and active mine levels 16-18 (base of mine)

-- Access above those levels is shared with state and private groups who

have sub-permits to mine limestone and dolomites

-- Above-ground infrastructure including railway and rail wagons

-- Current mining is at mine levels 16-18 at depths from 260m to 350m from

surface

-- Ore is loaded from mine face into 1m3 rail cars

-- Electric hoist to surface

-- 3 silos holding 250 tonnes at surface

-- Rail cars of 3m3 move ore 1km to concentrate plant

-- Concentrate plant crushes and floats ore to a concentrate of 26% Cu,

10g/t Au, and 800-1,000 g/t Ag, plus separate Zn and Lead concentrates

with high Ag (2,000 g/t)

-- Concentrate transported by rail or truck for export

-- Production costs before closure have been stated by Mineral Mining at

$45/tonne, with overheads running at approximately EUR80,000 per month

-- Using OPEX figures from comparable Australian underground mines, the

models herein are calculated at a base case of $81/t

-- Romanian labour costs are at least five times lower than Australia, so

the OPEX estimates are considered conservative

OPEX is broken down into:

OPEX $/tonnes

Mining $56.00

Processing $15.00

Overheads $10.00

Total OPEX $81.00

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: African Consolidated Resources Plc via Globenewswire

HUG#1878976

http://www.acrplc.com/

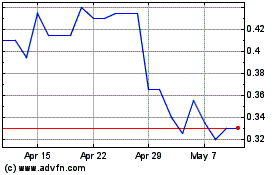

Vast Resources (LSE:VAST)

Historical Stock Chart

From Aug 2024 to Sep 2024

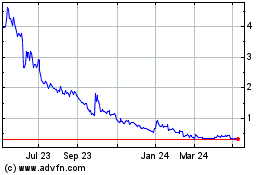

Vast Resources (LSE:VAST)

Historical Stock Chart

From Sep 2023 to Sep 2024