UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

| | |

Date of Report (Date of Earliest Event Reported): | | February 29, 2016 |

________________________

HALOZYME THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

________________________

|

| | | |

Delaware | 001-32335 | | 88-0488686 |

(State or other jurisdiction of incorporation) | (Commission File Number) | | (IRS Employer Identification No.) |

|

| |

11388 Sorrento Valley Road, San Diego, California | 92121 |

(Address of principal executive offices) | (Zip Code) |

|

| | |

Registrant’s telephone number, including area code: | | (858) 794-8889 |

Not Applicable

(Former name or former address, if changed since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On February 29, 2016, Halozyme Therapeutics, Inc. issued a press release to report its financial results for the fourth quarter and the full year ended December 31, 2015. A copy of the press release is attached as Exhibit 99.1, which is furnished under Item 2.02 of this report and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

|

| |

Exhibit No. | Description |

| |

99.1 | Press release dated February 29, 2016 |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | HALOZYME THERAPEUTICS, INC. |

| | | | |

February 29, 2016 | | By: | | /s/ Laurie D. Stelzer |

| | Name: | | Laurie D. Stelzer |

| | Title: | | Senior Vice President and Chief Financial Officer |

Exhibit Index

|

| | |

| | |

Exhibit No. | | Description |

| | |

99.1 | | Press release dated February 29, 2016 |

Exhibit 99.1

Contacts:

Jim Mazzola

858-704-8122

ir@halozyme.com

Chris Burton

858-704-8352

ir@halozyme.com

HALOZYME REPORTS FOURTH QUARTER AND FULL YEAR 2015

FINANCIAL RESULTS

- Investigational device exemption submitted to FDA, on track for first patient dosing in March in Phase 3 Study of metastatic pancreatic cancer patients -

- Growing momentum in ENHANZE™ franchise with recent signing of Lilly collaboration and first dosing in clinical trials with Janssen’s Daratumumab, AbbVie’s HUMIRA® and Pfizer’s Rivipansel and Bococizumab -

- Full year revenue of $135.1 million compared to $75.3 million in prior year, Royalty Revenue of $31 million increased 229 percent from prior year -

SAN DIEGO, February 29, 2016 - Halozyme Therapeutics, Inc. (NASDAQ: HALO) today reported financial results for the fourth quarter and full year ended December 31, 2015, which included a fourth quarter increase in royalty revenue of 136 percent from the prior year period and net income of $4.3 million, or $0.03 per share, compared to a net loss in the fourth quarter of 2014 of $5.3 million, or $0.04 per share. For the full year, total revenue increased 79 percent to $135.1 million compared to $75.3 million in the prior year.

“We closed 2015 with record progress across both pillars of our strategy and enter 2016 with strong momentum,” said Dr. Helen Torley, president and chief executive officer. “In our oncology pillar, an investigational device exemption was submitted to the FDA earlier this month by our partner Ventana for the PEGPH20 companion diagnostic test. We remain on track to dose the first patient in March in our Phase 3 study in pancreatic cancer patients. We are also continuing to evaluate the dose of PEGPH20 in our lung and gastric cancer trials and are preparing for the initiation of the breast cancer trial with our clinical partner Eisai.

“At the same time, our ENHANZE™ platform continues to generate more value than any other time in company history. With royalty revenue growth in the fourth quarter, a newly signed licensing and collaboration agreement with Eli Lilly and four co-formulated products in the clinic, our ENHANZE platform remains a clear differentiator in any market environment.”

Fourth Quarter 2015 Highlights and Subsequent Events include:

| |

• | Submitting an investigational device exemption to the FDA for the companion diagnostic test developed with Ventana to prospectively identify patients with high levels of hyaluronan, or HA. |

| |

• | Remaining on track to dose first patient in HALO-301 | Pancreatic study in March 2016, a Phase 3 study to explore PEGPH20 with gemcitabine and ABRAXANE® (nab-paclitaxel) in metastatic pancreatic cancer patients at approximately 200 sites in 20 countries located in North America, Europe, South America and Asia Pacific. |

| |

• | Closing enrollment in HALO-202 | Pancreatic study with 133 patients in Stage 2 (total 279 patients enrolled), the company remains blinded to the efficacy results and continues to project mature progression-free survival data and overall response rate data in the fourth quarter of 2016. |

| |

• | Continuing to explore the pan-tumor potential of PEGPH20, the company made progress towards identifying the maximum tolerated dose of PEGPH20 in its phase 1b/2 PRIMAL study of PEGPH20 plus docetaxel in lung cancer patients, and Phase 1b study of PEGPH20 plus KEYTRUDA® (pembrolizumab) in lung and gastric cancer patients. In addition, Halozyme expects to initiate the study of PEGPH20 plus eribulin in HER2 negative breast cancer patients through a clinical collaboration with Eisai in the second quarter of 2016. |

| |

• | Signing the company’s sixth collaboration and licensing agreement for Halozyme’s proprietary ENHANZE™ technology platform with Eli Lilly for up to five targets, each with potential milestone payments of $160 million. The agreement resulted in a $25 million upfront license fee to Halozyme that was recorded in the fourth quarter. |

| |

• | Earlier this month, dosing the first subject in Pfizer’s Phase 1 clinical trial evaluating the safety, tolerability and pharmacokinetics of bococizumab, an investigational PCSK9 inhibitor developed by Pfizer, Inc. using Halozyme’s ENHANZE™ platform. The initiation of the clinical trial triggered a $1 million milestone payment to Halozyme under the collaboration and license agreement between Halozyme and Pfizer entered into in 2012. |

| |

• | In January, dosing the first subject in AbbVie’s Phase 1 clinical trial evaluating the safety and pharmacokinetics of adalimumab (HUMIRA®) with Halozyme’s ENHANZE™ platform, resulting in a $5 million milestone payment under the collaboration and license agreement between Halozyme and AbbVie entered into in June of 2015. |

| |

• | In the fourth quarter, dosing the first subjects in Pfizer’s Phase 1 clinical trial of rivipansel and Janssen’s Phase 1b clinical trial of daratumumab with Halozyme’s ENHANZE™ platform. |

Fourth Quarter and Full Year 2015 Financial Highlights

| |

• | Revenue for the fourth quarter was $52.2 million, compared to $30.4 million for the fourth quarter of 2014, driven primarily by the upfront license fee from Eli Lilly and royalties from partner sales of Herceptin® SC, MabThera® SC and HyQvia®. Revenue for the quarter included $9.5 million in royalties, $9.3 million in sales of bulk rHuPH20 for use in manufacturing collaboration products and $4.3 million in HYLENEX® recombinant (hyaluronidase human injection) product sales. Revenue for the full year was $135.1 million compared to $75.3 million in the previous year. |

| |

• | Research and development expenses for the fourth quarter were $27.7 million, compared to $19.7 million for the fourth quarter of 2014. The planned increases were primarily due to expenses for preclinical and clinical support of PEGPH20. |

| |

• | Selling, general and administrative expenses for the fourth quarter were $10.6 million, compared to $8.4 million for the fourth quarter of 2014. The increase was primarily due to an increase in personnel expenses, including stock compensation, for the period. |

| |

• | Net income for the fourth quarter was $4.3 million, or $0.03 per share, compared to a net loss in the fourth quarter of 2014 of $5.3 million, or $0.04 per share. The net loss for the full year totaled $32.2 million, or $0.25 per share, compared to a net loss of $68.4 million, or $0.56 per share, for 2014. |

| |

• | Cash, cash equivalents and marketable securities were $108.3 million at Dec. 31, compared to $123.7 million at Sept. 30, 2015. Net cash burn during 2015 was approximately $27.3 million. |

Financial Outlook for 2016

For the full year 2016, the company maintains its previously announced guidance of:

| |

• | Net revenues to be in the range of $110 million to $125 million; |

| |

• | Operating expenses to be in the range of $240 million to $260 million; |

| |

• | Cash Flow to be in the range of $35 million to $55 million; and |

| |

• | Year-end cash balance of $140 million to $160 million. |

Webcast and Conference Call

Halozyme will webcast its Quarterly Update Conference Call for the fourth quarter and full year 2015 today, Monday, February 29 at 4:30 p.m. ET/1:30 p.m. PT. Dr. Helen Torley, president and chief executive officer, will lead the call. The call will be webcast live through the “Investors” section of Halozyme’s corporate website and a recording will be made available following the close of the call. To access the webcast and additional documents related to the call, please visit http://www.halozyme.com approximately fifteen minutes prior to the call to register, download and install any necessary audio software. For those without access to the Internet, the live call may be accessed by phone by calling (877) 410-5657 (domestic callers) or (334) 323-7224 (international callers) using passcode 769890. A telephone replay will be available shortly after the call by dialing (877) 919-4059 (domestic callers) or (334) 323-0140 (international callers) using replay passcode 11528439.

About Halozyme

Halozyme Therapeutics is a biotechnology company focused on developing and commercializing novel oncology therapies that target the tumor microenvironment. Halozyme’s lead proprietary program, investigational drug PEGPH20, applies a unique approach to targeting solid tumors, allowing increased access of co-administered cancer drug therapies to the tumor in animal models. PEGPH20 is currently in development for metastatic pancreatic cancer, non-small cell lung cancer, gastric cancer, metastatic breast cancer and has potential across additional cancers in combination with different types of cancer therapies. In addition to its proprietary product portfolio, Halozyme has established value-driving partnerships with leading pharmaceutical companies including Roche, Baxalta, Pfizer, Janssen, AbbVie and Lilly for its ENHANZE™ drug delivery platform. Halozyme is headquartered in San Diego. For more information visit www.halozyme.com.

Safe Harbor Statement

In addition to historical information, the statements set forth above include forward-looking statements (including, without limitation, statements concerning the Company’s future expectations and plans for growth in 2016, the development and commercialization of product candidates and the potential benefits and attributes of such product candidates and expected financial outlook for 2016) that involve risk and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements are typically, but not always, identified through use of the words “believe,” “enable,” “may,” “will,” “could,” “intends,” “estimate,” “anticipate,” “plan,” “predict,” “probable,” “potential,” “possible,” “should,” “continue,” and other words of similar meaning. Actual results could differ materially from the expectations contained in forward-looking statements as a result of several factors, including unexpected expenditures and costs, unexpected fluctuations or changes in revenues, including revenues from collaborators, unexpected results or delays in development of product candidates and regulatory review, regulatory approval requirements, unexpected adverse events and competitive conditions. These and other factors that may result in differences are discussed in greater detail in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 29, 2016.

Halozyme Therapeutics, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues: | | | | | | | |

Product sales, net | $ | 13,579 |

| | $ | 10,144 |

| | $ | 46,082 |

| | $ | 37,823 |

|

Revenues under collaborative agreements | 29,104 |

| | 16,190 |

| | 58,000 |

| | 28,086 |

|

Royalties | 9,544 |

| | 4,043 |

| | 30,975 |

| | 9,425 |

|

Total revenues | 52,227 |

| | 30,377 |

| | 135,057 |

| | 75,334 |

|

| | | | | | | |

Operating expenses: | | | | | | | |

Cost of product sales | 8,427 |

| | 6,147 |

| | 29,245 |

| | 22,732 |

|

Research and development | 27,746 |

| | 19,728 |

| | 93,236 |

| | 79,696 |

|

Selling, general and administrative | 10,589 |

| | 8,353 |

| | 40,028 |

| | 35,942 |

|

Total operating expenses | 46,762 |

| | 34,228 |

| | 162,509 |

| | 138,370 |

|

| | | | | | | |

Operating income (loss) | 5,465 |

| | (3,851 | ) | | (27,452 | ) | | (63,036 | ) |

| | | | | | | |

Other income (expense): | | | | | | | |

Investment and other income, net | 155 |

| | (45 | ) | | 422 |

| | 242 |

|

Interest expense | (1,302 | ) | | (1,378 | ) | | (5,201 | ) | | (5,581 | ) |

Net income (loss) | $ | 4,318 |

| | $ | (5,274 | ) | | $ | (32,231 | ) | | $ | (68,375 | ) |

| | | | | | | |

Net income (loss) per share: | | | | | | | |

Basic net income (loss) per share | $ | 0.03 |

| | $ | (0.04 | ) | | $ | (0.25 | ) | | $ | (0.56 | ) |

Diluted net income (loss) per share | $ | 0.03 |

| | $ | (0.04 | ) | | $ | (0.25 | ) | | $ | (0.56 | ) |

| | | | | | | |

Shares used in computing basic net income (loss) per share: | 127,197 |

| | 124,272 |

| | 126,704 |

| | 122,690 |

|

Shares used in computing diluted net income (loss) per share: | 129,248 |

| | 124,272 |

| | 126,704 |

| | 122,690 |

|

Halozyme Therapeutics, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

|

| | | | | | | |

| December 31,

2015 | | December 31,

2014 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 43,292 |

| | $ | 61,389 |

|

Marketable securities, available-for-sale | 65,047 |

| | 74,234 |

|

Accounts receivable, net | 32,410 |

| | 9,149 |

|

Inventories | 9,489 |

| | 6,406 |

|

Prepaid expenses and other assets | 21,534 |

| | 10,143 |

|

Total current assets | 171,772 |

| | 161,321 |

|

Property and equipment, net | 3,943 |

| | 2,951 |

|

Prepaid expenses and other assets | 5,574 |

| | 1,205 |

|

Restricted cash | 500 |

| | 500 |

|

Total assets | $ | 181,789 |

| | $ | 165,977 |

|

| | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 4,499 |

| | $ | 3,003 |

|

Accrued expenses | 26,792 |

| | 13,961 |

|

Deferred revenue, current portion | 9,304 |

| | 7,367 |

|

Current portion of long-term debt, net | 21,862 |

| | — |

|

Total current liabilities | 62,457 |

| | 24,331 |

|

| | | |

Deferred revenue, net of current portion | 43,919 |

| | 47,267 |

|

Long-term debt, net | 27,971 |

| | 49,860 |

|

Other long-term liabilities | 4,443 |

| | 3,167 |

|

| | | |

Stockholders’ equity: | | | |

Common stock | 128 |

| | 126 |

|

Additional paid-in capital | 525,628 |

| | 491,694 |

|

Accumulated other comprehensive loss | (99 | ) | | (41 | ) |

Accumulated deficit | (482,658 | ) | | (450,427 | ) |

Total stockholders’ equity | 42,999 |

| | 41,352 |

|

Total liabilities and stockholders’ equity | $ | 181,789 |

| | $ | 165,977 |

|

###

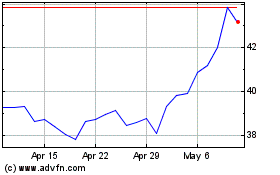

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Aug 2024 to Sep 2024

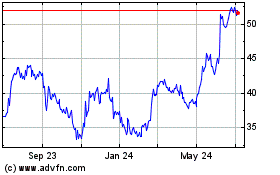

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Sep 2023 to Sep 2024