TIDMSHOE

RNS Number : 7147Q

Shoe Zone PLC

23 June 2020

23 June 2020

Shoe Zone plc

Interim Results

Shoe Zone plc ("Shoe Zone", the "Company" or the "Group") is

pleased to announce its Interim Results for the six months to 4

April 2020.

Financial Update

-- Revenue of GBP68.9m (2019 H1: GBP73.0m)

-- Year to February revenue growth of 2.6%

-- Statutory profit before tax of GBP(2.5)m (2019 H1: GBP1.0m)

-- Net cash of GBP3.6m (2019 H1: GBP3.3m) inclusive of the

immediate measures taken to maintain cash balances at the end of

March.

-- Statutory earnings per share of (4.1)p (2019 H1: 1.65p)

-- No interim dividend to be paid (2019 H1: 3.5p per share)

-- Operating from 47 Big Box locations at period end

contributing GBP9.4m (2019: GBP5.5m) revenue in H1

-- Digital sales increased by 31.9% to GBP6.5m (2019 H1:

GBP5.0m) achieving profit contribution of GBP1.9m (2019 H1:

GBP1.5m)

-- Over 1.4 million engaged users on Shoezone.com database

COVID-19 Update

-- All retail stores closed on 24 March 2020.

-- 416 stores in England, Northern Ireland and ROI re-opened by

15 June 2020 in line with the government guidelines.

-- Wales will open on 28 June and Scotland will start to open on 29 June.

-- Digital team and the Distribution Centre continued to operate throughout

-- Immediate action was taken to reduce cash outflows including

negotiations with landlords and suppliers, cancellation of final

dividend, furloughing the majority of employees and utilising

government tax deferment schemes.

-- CBILS loan of GBP15m secured of which GBP10m has been drawn down to date.

-- Additional financial impacts post the balance sheet date not

included in the Interim Results are GBP0.9m write down of Freehold

Asset values and GBP0.3m redundancy costs incurred as a result of a

Head Office rationalisation programme. The total impact of these is

GBP1.2m.

-- A review of the viability of all stores continues post exit from lockdown.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014. Upon the publication of this

announcement via regulatory news service this inside information is

now considered to be in the public domain.

For further information, please call:

Shoe Zone plc Tel: via 0116 222

Anthony Smith (Chief Executive) 3000

Jonathan Fearn (Chief Financial Officer)

Finncap (Nominated Advisor and Broker) Tel: +44 (0)20 7220

Matt Goode (Corporate Finance) 0500

Hannah Boros (Corporate Finance)

Alice Lane (ECM)

Chief Executive's Statement

Introduction

The Group operates from a portfolio of around 470 stores and a

comprehensive digital proposition enabling it to provide a truly

multi-channel shopping experience to its customers.

Financial Summary

In the six months to 4 April 2020, the Group generated revenues

of GBP68.9m (2019 H1: GBP73.0m) and Profit before Tax of GBP(2.7)m

(2019 H1: GBP1.0m) on a pre-IFRS 16 basis. The implementation of

IFRS16 during the period has increased Statutory Profit before Tax

by GBP0.2m resulting in Statutory Profit before Tax of GBP(2.5)m. A

reconciliation of the Income statement is shown below:

Pre-IFRS16 Impact Statutory

of IFRS16 Profit

GBP'000 GBP'000 GBP'000

Revenue 68,944 - 68,944

Cost of sales (61,554) 292 (61,262)

---------- ---------- ---------

Gross profit 7,390 292 7,682

Administration & Distribution Costs (9,999) 799 (9,200)

Profit from operations (2,609) 1,091 (1,518)

Financing costs (77) (933) (1,010)

Profit before taxation (2,686) 158 (2,528)

Taxation 510 (30) 480

---------- ---------- ---------

Profit attributable to equity holders

of the parent (2,176) 128 (2,048)

========== ========== =========

The reduction in revenue and profit performance over prior year

reflects the early impact of COVID-19. During the period we

experienced both disruption in the supply chain and a fall in

consumer spending in March resulting in the subsequent closure of

retail stores from the 24(th) March 2020. Prior to this, the five

months to February showed a year on year increase in revenue of

2.6%.

The group ended the period with net cash balance of GBP3.6m

(2019: GBP3.3m). This increase in cash balance has only been

achieved through the emergency measures put in place during March

to restrict cash outflows. These include cancelation of the 2019

final dividend (GBP4m), management of payments to suppliers and

engagement with landlords to delay and renegotiate monthly and

quarterly rents. Capital expenditure for the period was GBP2.2m

compared to GBP3.2m prior year. Management continues to monitor all

costs closely and these remain tightly controlled.

Dividend

Cash conservation continues to be the focus for the business as

we emerge from lockdown and therefore no interim dividend will be

paid (2019 H1: 3.5p per share). On 29 April 2020, the Group

announced the cancellation of its previous dividend policy.

Strategy Update

At the beginning of 2020 we announced an updated strategy to

focus on Big Box expansion; Digital growth and Town Centre renewal.

We also announced a renewed focus on streamlining business

processes and reducing Head Office costs.

The company has made good progress in all of these areas in H1

2020:

-- We ended the period with 47 Big Box stores, (2019: 26 stores)

an increase in store numbers of 81%. The Big Box portfolio

generated GBP9.4m (2019: GBP5.5m) of total turnover for the first

six months. One store was converted from High Street to Hybrid

format in the period.

-- Digital has returned to strong growth showing revenue growth

of 31.9% to GBP6.5m (2019: GBP5.0m). Contribution has grown by

17.7% to GBP1.7m (2019 H1: GBP1.5m). Email collections and active

database growth continues to be a key lever in digital performance.

As at the period end, the database had 1,444,000 active users

(2019: 501,000), an increase of 188%.

-- Overall store numbers were 490 (2019: 495) at period end.

-- Immediate action has been taken to review and streamline the

Head Office functions and the new rationalised structure is now in

place.

COVID-19 Update and Outlook

Following closure of all our stores on 24 March 2020, we

continued to sell via our website, www.shoezone.com and via other

online partners. Digital performance has delivered high sales

growth since lock down increasing from around 6.5% of total company

sales to 17% of previously forecasted sales for the lockdown

period. This has been driven by a very aggressive Buy One Get One

Free (BOGOF) promotion on all stock to generate cash as quickly as

possible. Although this has been now been amended to BOGOF on

selected lines only it continues to have a significant impact on

ongoing digital gross margin levels.

We opened all England, Northern Ireland and the Republic of

Ireland stores by the 15 June and the Welsh and Scottish stores

will open as soon as government guidance allows. We have

implemented all published COVID-19 guidelines in stores and head

office to ensure the safety of our colleagues and customers. This

includes Perspex screens being retrofitted to tills, distance

markings on the floor and limits on the number of customers

dependent on store size.

COVID-19 will continue to have an unprecedented impact on the UK

economy and the retail industry. Whilst the group has taken all

possible steps to ensure that the business will survive through the

crisis and continue into the future, the impact is likely to

continue to be felt for several years.

As a result of this and following an extensive review of the

store portfolio Shoe Zone has closed an additional 20 stores during

lockdown and will only open 470 when permitted. The Group has also

taken immediate action to reduce costs at Head Office and pause all

areas of discretionary spend. Negotiations with landlords have also

been accelerated and supplier orders reduced, cancelled or deferred

as far as possible.

The Head Office rationalisation programme has meant an

additional GBP0.3m has been incurred in redundancy payments after

the balance sheet date. We have also undertaken a review of

freehold values held resulting in a write down of GBP0.9m, giving

an additional COVID-19 impact, not included in the first half

results of GBP1.2m.

Cash remains the key focus for the business and as stated on the

29 April 2020, the immediate focus will be on rebuilding cash

balances to a higher level than previously carried and repaying the

debt taken on as part of the CBILS scheme whilst fulfilling other

statutory obligations. The Board remain confident that the Group's

current level of funding will be sufficient to secure the future of

the business, assuming that sales return to a high proportion of

previous sales during the next year.

The Board would like to thank all of the Shoe Zone team and its

business partners for their hard work and support in the first half

of the financial year and during the current COVID-19 period.

Unaudited consolidated income statement

Note 26 weeks 26 weeks 53 weeks

ended 4 ended 30 ended 5

April March October

2020 2019 2019

IFRS16 IAS17 IAS17

GBP'000 GBP'000 GBP'000

Revenue 2 68,944 72,995 162,047

Cost of sales (61,262) (63,453) (136,965)

-------- --------- ---------

Gross profit 7,682 9,542 25,082

Administration expenses (6,273) (5,508) (12,081)

Distribution costs (2,927) (2,987) (6,154)

--------

Profit from operations (1,518) 1,047 6,847

Finance income (1) 56 44

Finance expense (1,009) (87) (192)

-------- --------- ---------

Profit before taxation (2,528) 1,016 6,699

Taxation 4 480 (193) (985)

-------- --------- ---------

Profit attributable to equity holders

of the parent 5 (2,048) 823 5,714

======== ========= =========

Earnings per share - basic and

diluted 5(4.1)p 1.65p 11.43p

====== ============= ======

Unaudited consolidated statement of total comprehensive

income

26 weeks ended 4 April 26 weeks ended 30 March 53 weeks

2020 2019 ended 5 October

2019

GBP'000 GBP'000 GBP'000

Profit for the period (2,048) 823 5,714

---------------------- ----------------------- ----------------

Items that will not be reclassified

subsequently to the income statement

Remeasurement gains and losses on defined

benefit pension scheme (642) (611) (4,177)

Movement in deferred tax on pension schemes 94 340 707

IFRS 16 Opening balances (3,242) - -

Cash flow hedges

Fair value movements in other comprehensive

income (2,431) (4,082) (826)

Cash flow hedges recognised in inventories 2,868 1,930 1,474

Tax on cash flow hedges (74) 180 (126)

----------------------

Other comprehensive (expense) / income for

the period (3,427) (2,243) (2,948)

---------------------- ----------------------- ----------------

Total comprehensive (expense) / income for

the period

attributable to equity holders of the parent (5,475) (1,420) 2,766

====================== ======================= ================

Unaudited consolidated statement of financial position

Notes 26 weeks 26 weeks 53 weeks

ended 04 ended 30 ended

April March 5 October

2020 2019 2019

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 22,669 22,762 22,143

Right of use assets 53,456 - -

Deferred tax asset 1,597 736 1,677

--------- --------- ----------

Total non-current assets 77,722 23,498 23,820

--------- --------- ----------

Current assets

Inventories 25,727 27,576 28,511

Trade and other receivables 4,978 5,775 6,078

Derivative financial assets 3 2,751 1,500 2,726

Corporation tax asset - - -

Cash and cash equivalents 3,571 3,311 11,417

--------- --------- ----------

Total current assets 37,027 38,162 48,732

--------- --------- ----------

Total assets 114,749 61,660 72,552

--------- --------- ----------

Current liabilities

Trade and other payables (31,167) (21,988) (27,429)

Provisions for liabilities and charges (573) (268) (715)

Derivative financial liability 3 - - -

Corporation tax liability - (118) (440)

Total current liabilities (31,740) (22,374) (28,584)

--------- --------- ----------

Non-current liabilities

Trade and other payables (46,521) (1,913) (2,432)

Provisions for liabilities and charges (581) (420) (370)

Employee benefit liability (9,952) (7,959) (9,736)

Total non-current liabilities (57,054) (10,292) (12,538)

Total liabilities (88,794) (32,666) (41,122)

--------- --------- ----------

Net assets 25,955 28,994 31,430

========= ========= ==========

Equity attributable to equity holders of the company

Called up share capital 500 500 500

Share premium reserve 2,662 2,662 2,662

Cash flow hedge reserve 2,008 882 1,645

Retained earnings 20,785 24,950 26,623

--------- --------- ----------

Total equity and reserves 25,955 28,994 31,430

========= ========= ==========

Unaudited consolidated statement of changes in equity

Share Share Cash Retained Total

capital premium flow earnings

hedge

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 29 September 2018 500 2,662 1,123 34,129 38,414

Profit for the period - - - 823 823

Defined benefit pension movements - - - (611) (611)

Cash flow hedge movements - - (421) - (421)

Deferred tax on other comprehensive

income - - 180 (1,391) (1,211)

----------- ---------------- ---------------- --------- -------

Total comprehensive income

for the period - - (241) (1,179) (1,420)

----------- ---------------- ---------------- --------- -------

Dividends paid during the

period - - - (8,000) (8,000)

----------- ---------------- ---------------- --------- -------

Total contributions by and

distributions to owners - - - (8,000) (8,000)

----------- ---------------- ---------------- --------- -------

At 30 March 2019 500 2,662 882 24,950 28,994

----------- ---------------- ---------------- --------- -------

At 29 September 2018 500 2,662 1,123 34,129 38,414

Profit for the period - - - 5,714 5,714

Defined benefit pension movements - - - (4,177) (4,177)

Cash flow hedge movements - - 648 - 648

Deferred tax on other comprehensive

income - - (126) 707 581

----------- ---------------- ---------------- --------- -------

Total comprehensive income

for the period - - 522 2,244 2,766

----------- ---------------- ---------------- --------- -------

Dividends paid during the

period - - - (9,750) (9,750)

----------- ---------------- ---------------- --------- -------

Total contributions by and

distributions to owners - - - (9,750) (9,750)

----------- ---------------- ---------------- --------- -------

At 5 October 2019 500 2,662 1,645 26,623 31,430

----------- ---------------- ---------------- --------- -------

Profit for the period - - - (2,048) (2,048)

Defined benefit pension movements - - - (642) (642)

Cash flow hedge movements - - 437 - 437

Right of use assets opening

movement - - - (3,242) (3,242)

Deferred tax on other comprehensive

income - - (74) 94 20

----------- ---------------- ---------------- --------- -------

Total comprehensive income

for the period - - 363 (5,838) (5,475)

----------- ---------------- ---------------- --------- -------

Dividends paid during the - - - - -

period

----------- ---------------- ---------------- --------- -------

Total contributions by and - - - - -

distributions to owners

----------- ---------------- ---------------- --------- -------

At 4 April 2020 500 2,662 2,008 20,785 25,955

=========== ================ ================ ========= =======

Unaudited consolidated statement of cash flows

26 weeks 26 weeks 53 weeks

ended 4 ended 30 ended 5

April March October

2020 2019 2019

GBP'000 GBP'000 GBP'000

Operating activities

Profit after taxation (2,048) 823 5,714

Corporation tax (480) 193 985

Finance income (8) (56) (44)

Finance expense 1,018 87 192

Depreciation of property, plant and equipment 1,573 1,473 3,258

Fixed asset impairment and loss on disposal of property, plant and equipment 66 31 3,034

Amortisation of right of use assets 9,722 - -

Pension contributions paid (417) (415) (890)

9,426 2,136 12,249

Decrease / (increase) in trade and other receivables 1,324 430 157

Increase in foreign exchange contract - - 30

(Increase) / decrease in inventories 3,196 (239) (1,451)

(Decrease) / increase in trade and other payables (17,857) (3,011) 3,150

Increase in provisions 110 131 83

-------- --------- --------

(13,227) (2,689) 1,969

Cash generated from operations (3,802) (553) 14,218

Income taxes paid (1,888) (627) (1,488)

-------- --------- --------

Net cash flows from operating activities (5,689) (1,180) 12,730

-------- --------- --------

Investing activities

Purchase of property, plant and equipment (2,165) (3,248) (7,290)

Sale of property, plant and equipment - - -

Interest received 8 56 44

-------- --------- --------

Net cash used in investing activities (2,157) (3,192) (7,246)

-------- --------- --------

Financing activities

Dividends paid during the year 0 (8,000) (9,750)

Net cash used in financing activities 0 (8,000) (9,750)

-------- --------- --------

Net decrease in cash and cash equivalents (7,846) (12,372) (4,266)

Cash and cash equivalents at beginning of period 11,417 15,683 15,683

-------- --------- --------

Cash and cash equivalents at end of period 3,571 3,311 11,417

======== ========= ========

Notes to the financial statements for the 26 weeks ended 4 April

2020

Basis of preparation

The consolidated interim financial statements of the Group for

the 26 weeks ended 4 April 2020, which are unaudited, have been

prepared in accordance with the same accounting policies,

presentation and methods of computation followed in the condensed

set of financial statements as applied in the group's latest annual

audited financial statements. A copy of those accounts has been

delivered to the Registrar of Companies.

The financial information for the 26 weeks ended 4 April 2020,

contained in this interim report, does not constitute the full

statutory accounts for that period. The Independent Auditors'

Report on the Annual Report and Financial Statements for 2019 was

unqualified, did not draw attention to any matters by way of

emphasis, and did not contain a statement under 498(2) or 498(3) of

the Companies Act 2006.

The consolidated interim financial statements have neither been

audited nor reviewed pursuant to guidance issued by the Auditing

Practices Board.

The condensed consolidated interim financial statements have

been prepared on a going concern basis and under the historical

cost convention, as modified by the revaluation of derivative

financial instruments to fair value.

The condensed consolidated interim financial statements are

presented in sterling and have been rounded to the nearest thousand

(GBP'000).

The preparation of financial information in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual events ultimately may differ from those

estimates.

1. Accounting policies

In preparing these interim financial statements, the significant

judgements made by management in applying the group's accounting

policies and the key sources of estimation uncertainty were the

same as those applied to the consolidated financial statements

reported in the latest annual audited financial statements for the

53 weeks ended 5 October 2019.

Going Concern

At the balance sheet date the company had a good cash balance

and a strong net current asset position. At the time of signing

these accounts, the directors have considered the effect of the

Coronavirus on the going concern position, and consider that this

does indicate that the company will continue to trade for a period

of at least 12 months from the date of publishing these accounts

due to the banking facilities available to it and the UK Government

support available to businesses during this difficult time.

The financial forecasts prepared by the Directors show that the

company will be able to operate within the facilities available to

it.

On that basis, the directors have prepared these financial

statements on a going concern basis.

Events after the period end

Subsequent to the period end, the Coronavirus pandemic has

resulted in a long period of lockdown and closure of non-essential

retail. At this stage the directors continue to assess the impact

this may have on the company and although there is a high level of

uncertainty about the extent and the timeframe of the virus on the

global economy, they believe the company is strongly positioned to

handle any downturn that may occur in the retail sector.

To date, the directors have undertaken a review of Freehold

values held on the balance sheet resulting in a reduction of

carrying value from GBP4.7m to GBP3.8m. This write down of GBP0.9m

will be included in the full year results.

The head office rationalisation programme has resulted in

redundancy payments of GBP0.3m paid post balance sheet. Again these

will be included in the full year results. A review of the

viability of all stores continues post exit from lockdown.

2. Segmental information

The group complies with IFRS 8 'Operating Segments', which

determines and presents operating segments based on information

provided to the chief operating decision-maker. The chief decision

maker has been identified as the management team including the

Chief Executive Officer and Chief Financial Officer. The Board

considers that each store is an operating segment but there is only

one reporting segment as the stores qualify for aggregation, as

defined under IFRS 8.

04 30 05

April March October

2020 2019 2019

GBP'000 GBP'000 GBP'000

External revenue by location of customers:

United Kingdom 67,342 71,257 158,209

Republic of Ireland 1,602 1,738 3,517

Other - - 321

------- ------- --------

68,944 72,995 162,047

======= ======= ========

There are no customers with turnover in excess of 10% of total

turnover

04 30 05

April March October

2020 2019 2019

GBP'000 GBP'000 GBP'000

Non-current assets by location:

United Kingdom 22,650 22,744 22,124

Other 19 18 19

------- ------- --------

22,669 22,762 22,143

======= ======= ========

Notes to the financial statements for the 26 weeks ended 4 April

2020 (continued)

3. Derivative financial instruments

At the balance sheet date, details of the forward foreign

exchange contracts that the group has committed to are as

follows:

04 30 05

April March October

2020 2019 2019

GBP'000 GBP'000 GBP'000

Derivative financial assets

Derivatives not designated as hedging

instruments 332 437 744

Derivatives designated as hedging

instruments 2,419 1,063 1,982

------- ------- --------

2,751 1,500 2,726

======= ======= ========

4. Taxation

The taxation charge for the 26 weeks ended 04 April 2020 is

based on the estimated effective tax rate for the full year of 19%

(2019:19%).

5. Earnings per share

04 30 05

April March October

2020 2019 2019

GBP'000 GBP'000 GBP'000

Profit for the period and earnings

used in basic and diluted earnings

per share (2,048) 823 5,714

Earnings per share - basic and diluted (4.1)p 1.65p 11.43p

======= ======= ========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAXKAASSEEFA

(END) Dow Jones Newswires

June 23, 2020 02:00 ET (06:00 GMT)

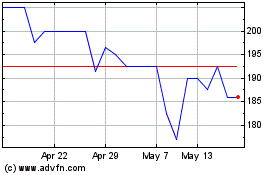

Shoe Zone (LSE:SHOE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shoe Zone (LSE:SHOE)

Historical Stock Chart

From Apr 2023 to Apr 2024