TIDMGMR

RNS Number : 8092S

Gaming Realms PLC

27 June 2018

27 June 2018

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Gaming Realms plc

("Gaming Realms" or the "Company" or, together with its

subsidiaries, the "Group")

Proposed sale of UK Real Money Casino brands and business

and

Notice of General Meeting

Gaming Realms plc (GMR.L), the developer, publisher and licensor

of mobile real money and social games, announces that the Company

has entered into an agreement, conditional upon shareholder

approval, to sell a 70% stake in most of its UK online casino B2C

business to River UK Casino Limited ("River UK Casino", a

subsidiary of River iGaming plc, a company listed on the Merkur

Market of the Oslo Bors ("River iGaming")) for a total cash

consideration of up to GBP23.1 million (the "Transaction").

Transaction highlights:

-- River UK Casino is a newly incorporated company, established by River iGaming plc to acquire

certain of the Company's UK online casino B2C brands, being

Pocket Fruity, Spin Genie, Britain's Got Talent Games, X Factor

Games and associated business (the "Business")

-- Following the completion of the Transaction, River iGaming

will hold 70% of the issued share capital of River UK Casino, with

Gaming Realms holding the remaining 30%

-- River UK Casino has entered into a five year B2B platform and

content agreement with the Company on normal commercial terms,

which Gaming Realms expects to generate approximately GBP1 million

of annual revenue for the Group

-- The total consideration payable in cash to the Company for

70% of the Business will be up to GBP23.1 million, comprising:

o a minimum payment of GBP8.4 million (of which GBP4.2 million

is payable on completion and GBP4.2 million payable concurrently

with the earnout payment); and

o a further maximum cash payment of GBP14.7 million on an

earn-out basis , payable no later than 31 August 2019 (based on 70%

of 5.5 times River UK Casino's EBIT for the 12 months to 30 June

2019 minus the GBP8.4 million minimum payment)

-- For the year ended 31 December 2017, the Business delivered

GBP13.9 million of net gaming revenue and adjusted profit before

tax and interest (but after central costs) of GBP2.2 million, which

the Company's directors (the "Directors" or the "Board") believe

will be significantly higher for the 12 months to 30 June 2019. In

order to deliver the maximum earn-out for Gaming Realms, the

Business would need to generate EBIT of GBP6 million in the 12

months to 30 June 2019

-- Gaming Realms' retained interest in River UK Casino is

subject to a mutual put and call option arrangement which can be

exercised no later than 31 October 2020 (based on an uncapped

valuation of 5.5 times River UK Casino's EBIT for the 12 months to

30 June 2020)

-- River iGaming and the Company will jointly provide a working

capital loan facility of GBP3 million (GBP2.1 million from River

iGaming and GBP0.9 million from the Company) to River UK Casino to

fund investment in marketing for the Business until at least 30

June 2019 repayable no later than 30 June 2020

-- The current management team of the Business will run River UK

Casino until at least 30 June 2020

-- The Group will retain Slingo.com and the Slingo brands

Strategic rationale

-- The sale is in line with the Company's strategy of focusing

its resources on international licensing and content development

and will pivot the Group to a B2B business, with the revenue

generated from River UK Casino becoming a significant source of

income for the Group's B2B platform

-- This decision to focus on licensing has shown early success

and the Board believes this will provide the Company with longer

term, consistent higher margin revenues. The recent agreements

signed with major gaming and media companies illustrate the

creativity of the Company's content

-- Further, with the reduction in funding the B2C business

(principally, staff and advertising costs), in the longer term this

pivot to a B2B business is expected to result in improved

margins

-- The Board intends to use the first GBP4.2 million of sale

proceeds for the continued development of new gaming content and

platform enhancements, as well as providing a loan of GBP0.9

million to fund River UK Casino's marketing budget as set out

above. The Board will be reviewing options for the balance of the

proceeds above the first GBP4.2 million including returning cash to

shareholders

Commenting on the proposed sale, Patrick Southon, CEO of Gaming

Realms, said:

"We are delighted to announce this agreement with River iGaming.

We believe that this sale will be transformational for Gaming

Realms as it will enable us to focus more of our resources on

international licensing and the development of new gaming content,

placing us in a stronger position to drive further profitable

growth in the future."

Notice of General Meeting

The sale is conditional on receiving certain third party

consents and the passing of a resolution (the "Resolution") to be

proposed at a general meeting to be held at 11.00 a.m. on

Wednesday, 18 July 2018 at the offices of Memery Crystal LLP, 165

Fleet St, London EC4A 2DY (the "General Meeting").

A circular, which will provide further details of the proposed

sale, will be sent to shareholders and be available on the

Company's website on or before Monday, 2 July 2018.

Intentions to vote in favour

The Directors have irrevocably agreed to vote in favour of the

resolution to be proposed at the General Meeting in respect of

their own beneficial holdings. The Board has also received letters

of intent or irrevocable commitments to vote in favour of the

resolution from certain other Shareholders.

Details are as follows:

Number of Ordinary Percentage of

Shares Current Issued

Share Capital

Letters of intent 35,534,697 12.5%

------------------- ----------------

Board Irrevocable commitments 48,734,052 17.1%

------------------- ----------------

Other Irrevocable commitments 40,145,046 14.1%

------------------- ----------------

Total 124,413,795 43.7%

------------------- ----------------

As at 26 June 2018 (being the latest practicable date prior to

the publication of this notice), 284,428,747 ordinary shares in the

Company ("Ordinary Shares") were in issue (no Ordinary Shares were

held in treasury). Accordingly, the total number of voting rights

of the Company as at 26 June 2018 was 284,428,747.

Enquiries:

Gaming Realms plc 0845 123 3773

Patrick Southon, CEO

Mark Segal, CFO

Akur Limited (Financial Adviser) 020 7493 3631

David Shapton

Matthew Smith

Alexander Bergqvist

Peel Hunt LLP (Nominated Adviser and

Broker) 020 7418 8900

Dan Webster

George Sellar

Nicole McDougall

Yellow Jersey (PR Adviser) 07747 788 221

Charles Goodwin

Georgia Colkin

Abena Affum

About Gaming Realms

Gaming Realms creates and publishes innovative real money and

social games for mobile, with operations in the UK, U.S. and

Canada. Through its market leading mobile platform and unique IP

and brands, Gaming Realms is bringing together media, entertainment

and gaming assets in new game formats. The Gaming Realms management

team includes accomplished entrepreneurs and experienced executives

from a wide range of leading gaming and media companies.

Disclaimer

The Transaction described in this document is conditional on

receiving certain third party consents and the Resolution being

passed by shareholders at the General Meeting to be held at 11.00

a.m. on Wednesday, 18 July 2018 at the offices of Memery Crystal

LLP, 165 Fleet St, London EC4A 2DY for the purpose of considering

and, if thought fit, passing the Resolution.

Akur Limited ("Akur"), which is authorised and regulated in the

United Kingdom by the Financial Conduct Authority ("FCA"), is

acting exclusively for the Company and for no-one else in

connection with the matters set out in this announcement. Akur will

not regard any other person (whether or not a recipient of this

announcement) as its client in relation to the Transaction and will

not be responsible to anyone other than the Company for providing

the protections afforded to its clients or for providing advice in

relation to the Transaction or any transaction or arrangement

referred to in this announcement.

Peel Hunt LLP ("Peel Hunt"), which is authorised and regulated

in the United Kingdom by the FCA, is acting exclusively for the

Company and for no one else in relation to the matters set out in

this announcement. Peel Hunt will not regard any other person

(whether or not a recipient of this announcement) as its client in

relation to the Transaction and will not be responsible to anyone

other than the Company for providing the protections afforded to

its clients or for providing any advice in relation to the

Transaction or any transaction or arrangement referred to in this

announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed on Akur or Peel Hunt by FSMA or the regulatory

regime established thereunder, neither Akur nor Peel Hunt makes any

representation express or implied in relation to, or accepts any

responsibility whatsoever for, the contents of this announcement or

any other statement made or purported to be made by it or on its

behalf in connection with the Transaction. Both Akur and Peel Hunt

(and their affiliates) accordingly, to the fullest extent

permissible by law, disclaim all and any responsibility or

liability (save for any statutory liability) whether arising in

tort, contract or otherwise which it might have in respect of the

contents of this announcement or any other statement made or

purported to be made by it or on its behalf in connection with the

Transaction.

This document does not constitute an offer or constitute any

part of an offer to the public within the meaning of sections 85

and 102B of FSMA, the Companies Act 2006 or otherwise. Accordingly,

this announcement does not constitute a prospectus under the

prospectus rules published by the FCA and has not been and will not

be approved by or filed with the FCA or approved or filed with any

other authority which could be a competent authority for the

purposes of the Prospectus Directive.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCSEAFIWFASESM

(END) Dow Jones Newswires

June 27, 2018 11:10 ET (15:10 GMT)

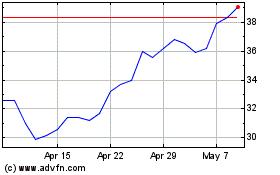

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gaming Realms (LSE:GMR)

Historical Stock Chart

From Apr 2023 to Apr 2024