TIDMFLK

RNS Number : 9211K

Fletcher King PLC

13 July 2017

FLETCHER KING PLC

Preliminary Results for the Year Ending 30(th) April 2017

Highlights

-- Revenue for the year of GBP4,094,000 (2016: GBP4,633,000)

-- Profit before tax of GBP738,000 (2016: GBP1,355,000)

-- Profit after tax of GBP579,000 (2016: GBP1,060,000)

-- Basic and diluted earnings per share of 6.29p (2016: 11.51p)

-- Final dividend of 3.00p per share. An interim dividend of

1.00p per share was paid and therefore the total ordinary dividend

for the year will be 4.00p per share (2016: 10.00p)

Commenting on the results, David Fletcher, chairman of Fletcher

King Plc said:

"We are pleased with the results for the year. In particular,

our second half turned out better than we expected largely due to a

higher volume of sales post Brexit than anticipated. All

departments performed well during the year and some significant

rating appeals were settled despite the Valuation Office continuing

to procrastinate on listing appeals. Valuations were steady and

asset management enjoyed a better than average year.

We have again started the year with a significant volume of

potential sales and are hopeful that at least one of our current

SHIPS schemes will be let and sold, most likely in the second

half.

Brexit uncertainty and the outcome of the General Election will

undoubtedly continue to influence the market and it is impossible

at this stage to estimate that impact. Uncertainty is never

positive and we expect transactions will prove more difficult to

complete. However, this may produce interesting buying

opportunities for SHIPS and other clients."

For further information, please call:

David Fletcher/ Peter Bailey, Fletcher King 020 7493 8400

James Caithie, Cairn Financial Advisers LLP 020 7213 0880

CHAIRMAN'S STATEMENT

Results

Revenue for the year was GBP4,094,000 (2016: GBP4,633,000).

Profit on disposal of property investment was GBPnil (2016:

GBP593,000). Profit before tax was GBP738,000 (2016:

GBP1,355,000).

The board is proposing a final dividend of 3.00p per share. The

final dividend is subject to shareholder approval at the AGM and

will be paid on 6 October 2017 to those shareholders on the

register at the close of business on 8 September 2017. With the

interim dividend of 1.00p per share (2016:1.00p) the dividend for

the year will amount to 4.00p per share (2016: 10.00p per

share).

The Commercial Property Market

The unexpected EU Referendum result in June 2016 has brought

significant uncertainty to the market. However, after initial

market turmoil, demand for commercial investment property remained

reasonably strong and we transacted a higher level of sales than

anticipated at very competitive prices, particularly for industrial

investments. Only in the case of Central London sales were prices

at marginally below Brexit levels. It was noticeable that although

there were fewer buyers in the market there was still competitive

bidding for the majority of our sales.

The letting market was by contrast more influenced by the

uncertainties and Central London office rents have generally fallen

by circa 5% to 10% and demand is definitely somewhat muted.

Business Overview

We are pleased with the results for the year. In particular, our

second half turned out better than we expected largely due to a

higher volume of sales post Brexit than anticipated. All

departments performed well during the year and some significant

rating appeals were settled despite the Valuation Office continuing

to procrastinate on listing appeals. Valuations were steady and

asset management enjoyed a better than average year.

Outlook

We have again started the year with a significant volume of

potential sales and are hopeful that at least one of our current

SHIPS properties will be let and sold, most likely in the second

half.

Brexit uncertainty and the outcome of the General Election will

undoubtedly continue to influence the market and it is impossible

at this stage to estimate that impact. Uncertainty is never

positive and we expect transactions will prove more difficult to

complete. However, this may produce interesting buying

opportunities for SHIPS and other clients.

It is very difficult to forecast what might happen in the coming

year but we have a strong balance sheet, very loyal clients and

hard working staff so we are well placed for the challenges

ahead.

DAVID FLETCHER

CHAIRMAN

13 July 2017

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30 April 2017

Note 2017 2016

GBP000 GBP000

Revenue 4,094 4,633

Employee benefits expense (2,129) (2,640)

Depreciation expense (34) (34)

Other operating expenses (1,214) (1,230)

-------- --------

Operating profit 717 729

Profit on disposal of available

for sale investments - 593

Income from investments 12 22

Finance income 9 11

-------- --------

Profit before taxation 738 1,355

Taxation (159) (295)

-------- --------

Profit and total comprehensive

income for the year attributable

to equity shareholders 579 1,060

Basic and diluted earnings

per share 3 6.29p 11.51p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 April 2017

2017 2016

GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 16 50

Available-for-sale investments 1,588 1,274

Deferred tax assets 16 18

------- -------

1,620 1,342

------- -------

Current assets

Trade and other receivables 1,495 871

Cash and cash equivalents 2,733 2,846

------- -------

4,228 3,717

------- -------

Total assets 5,848 5,059

------- -------

Liabilities

Current liabilities

Trade and other payables 568 346

Current taxation liabilities 97 282

Other payables 883 526

------- -------

1,548 1,154

------- -------

Total liabilities 1,548 1,154

------- -------

Shareholders' equity

Share capital 921 921

Share premium 140 140

Retained Earnings 3,239 2,844

------- -------

Total shareholders' equity 4,300 3,905

------- -------

Total equity and liabilities 5,848 5,059

------- -------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 30 April 2017

2017 2016

GBP000 GBP000

Cash flows from operating

activities

Profit before taxation

from continuing operations 738 1,355

Adjustments for:

Depreciation expense 34 34

Profit on disposal of available

for sale investments - 593

Income from investments (12) (22)

Finance income (9) (11)

------- --------

Cash flows from operating

activities before

movement in working capital 751 763

Decrease in trade and other

receivables (624) 284

Decrease in trade and other

payables 579 (291)

------- --------

Cash generated from operations 706 756

Taxation paid (342) (91)

------- --------

Net cash flows from operating

activities 364 665

------- --------

Cash flows from investing

activities

Purchase of investments (314) (1,274)

Sale of investments - 1,468

Finance income 9 11

Income from investments 12 22

------- --------

Net cash flows from investing

activities (293) 227

------- --------

Cash flows from financing

activities

Dividends paid to shareholders (184) (898)

------- --------

Net cash flows from financing

activities (184) (898)

------- --------

Net decrease in cash and

cash equivalents (113) (6)

Cash and cash equivalents

at start of year 2,846 2,852

------- --------

Cash and cash equivalents

at end of year 2,733 2,846

------- --------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 April 2017

Note Share Share Retained TOTAL

capital premium Earnings EQUITY

GBP000 GBP000 GBP000 GBP000

Balance at 1 May 2015 921 140 2,682 3,743

Total comprehensive

income for the year - - 1,060 1,060

Equity dividends paid 2 - - (898) (898)

Balance at 30 April

2016 921 140 2,844 3,905

Total comprehensive

income for the year - - 579 579

Equity dividends paid 2 - - (184) (184)

Balance at 30 April

2017 921 140 3,239 4,300

---------- ---------- ----------- ---------

NOTES

1. Basis of preparation

The financial information set out above, which has been prepared

on the basis of the accounting policies as set out in the prior

year's accounts, does not comprise the company's statutory

financial statements for the year ended 30 April 2017. While the

financial information included in this preliminary announcement has

been prepared in accordance with the recognition and measurement

criteria of International Financial Reporting Standards (IFRSs) as

adopted by the European Union, this announcement does not itself

contain sufficient information to comply with IFRSs. Statutory

financial statements for the previous financial year ended 30 April

2016 have been delivered to the Registrar of Companies. The

auditors' report on those financial statements was unqualified and

did not contain any statement under section 498(2) or (3) of the

Companies Act 2006 and did not include references to any matters to

which the auditor drew attention by way of emphasis. The statutory

accounts for the year ended 30 April 2017 have not yet been

delivered to the Registrar of Companies, nor have the auditors yet

reported on them.

2. Dividends

Year ended 30 April 2017 2016

GBP000 GBP000

Equity dividends on ordinary

shares:

Declared and paid during year

Ordinary final dividend for the

year ended 30 April 2016: 1.00p

per share (2015: 0.75p) 92 69

Special dividend for the year

ended 30 April 2017: GBPnil (2016:

8.00p per share

Interim dividend for the year - 737

ended 30 April 2017: 1.00p per

share (2016: 1.00p) 92 92

------- -------

184 898

------- -------

Proposed ordinary final dividend

for the year ended

30 April 2017: 3.00p per share 276

-------

3. Earnings per share

2017 2016

No No

Weighted average number of shares

for basic and diluted earnings

per share 9,209,779 9,209,779

----------

GBP000 GBP000

Earnings for basic and diluted

earnings per share 579 1,060

Basic and diluted earnings per

share 6.29p 11.51p

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR RTMPTMBBBBIR

(END) Dow Jones Newswires

July 13, 2017 02:00 ET (06:00 GMT)

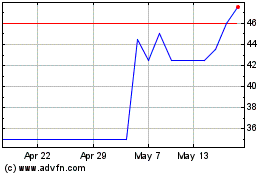

Fletcher King (LSE:FLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

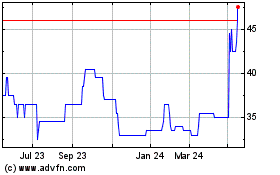

Fletcher King (LSE:FLK)

Historical Stock Chart

From Apr 2023 to Apr 2024