Carnival PLC Carnival Summary First Quarter Results and Other Matters

March 20 2020 - 3:00AM

UK Regulatory

TIDMCCL

CARNIVAL CORPORATION & PLC REPORTS SUMMARY FIRST QUARTER RESULTS

AND OTHER MATTERS

MIAMI (March 19, 2020) - Carnival Corporation & plc (the "Corporation") (NYSE/

LSE: CCL; NYSE: CUK) disclosed summary financial information for the quarter

ended February 29, 2020, in connection with previously disclosed financing

activities to improve its liquidity position.

First Quarter 2020 Summary Information

* U.S. GAAP net loss of $(781) million, or $(1.14) diluted EPS, for the first

quarter of 2020, compared to U.S. GAAP net income for the first quarter of

2019 of $336 million, or $0.48 diluted EPS. First quarter 2020 net loss

includes $932 million of goodwill and ship impairment charges, reduced by

net gains on ship sales.

* First quarter 2020 adjusted net income of $150 million, or $0.22 adjusted

EPS, compared to adjusted net income of $338 million, or $0.49 adjusted

EPS, for the first quarter of 2019. First quarter 2020 adjusted net income

excludes net charges of $932 million for the first quarter of 2020 and net

charges of $2 million for the first quarter of 2019.

* The impact of COVID-19 on the first quarter 2020 net loss is approximately

$0.23 per share, which includes cancelled voyages and other voyage

disruptions, and excludes the impairment charges described above. Other

previously disclosed voyage disruptions, noted during the Corporation's

December earnings conference call, also impacted first quarter 2020 results

by approximately $0.12 per share.

* Total revenues for the first quarter of 2020 were $4.8 billion, higher than

$4.7 billion in the prior year.

Outlook

For the first half of 2021, booking volumes since the Corporation's last

conference call in mid-December through March 1, 2020, have been running

slightly higher than the prior year. Also for the first half of 2021 and during

the two weeks ended March 15, 2020, the Corporation booked 546,000 Occupied

Lower Berth Days ("OLBD"), albeit considerably behind the prior year pace. As

of March 15, 2020, cumulative advanced bookings for the first half of 2021, are

slightly lower than the prior year.

Wave season started strong with booking volumes for the three weeks ending

January 26, 2020, running higher than the prior year for the remaining three

quarters of the year on a comparable basis. For the seven week period beginning

January 26, 2020 and ending March 15, 2020, booking volumes for the remainder

of the year were meaningfully behind the prior year on a comparable basis as a

result of the effects of COVID-19. As of March 15, 2020, cumulative advanced

bookings for the remainder of 2020, are meaningfully lower than the prior year

at prices that are considerably lower than the prior year on a comparable

basis, reflecting the impact of COVID-19.

The Corporation previously announced a voluntary, temporary pause of its global

fleet operations across all brands. The Corporation believes the ongoing

effects of COVID-19 on its operations and global bookings will have a material

negative impact on its financial results and liquidity. The Corporation also

believes the effects of COVID-19 on the shipyards where its ships are under

construction, will result in a delay in ship deliveries. The Corporation is

taking additional actions to improve its liquidity, including capital

expenditure and expense reductions, and pursuing additional financing. Given

the uncertainty of the situation, the Corporation is currently unable to

provide an earnings forecast, however it expects a net loss on both a U.S. GAAP

and adjusted basis for the fiscal year ending November 30, 2020.

Capital Resources

As of February 29, 2020, the Corporation had a total of $11.7 billion of

liquidity. This included $3.0 billion of immediate liquidity plus $2.8 billion

from four committed export credit facilities that are available to fund the

originally planned ship deliveries for the remainder of this year and $5.9

billion from committed export credit facilities that are available to fund ship

deliveries originally planned in 2021 and beyond. On March 13, 2020, the

Corporation fully drew down its $3.0 billion multi-currency revolving credit

agreement ("Facility Agreement"). The Corporation borrowed under the Facility

Agreement in order to increase its cash position and preserve financial

flexibility in light of current uncertainty in the global markets resulting

from the COVID-19 outbreak.

Substantially all of the Corporation's assets, with the exception of certain

ships with a net book value of approximately $6 billion as of February 29,

2020, are currently available to be pledged as collateral.

Explanations of Non-GAAP Financial Measures

We believe that gains and losses on ship sales, impairment charges,

restructuring costs and other gains and expenses are not part of our core

operating business and are not an indication of our future earnings

performance. Therefore, we believe it is more meaningful for these items to be

excluded from our net income (loss) and earnings per share and, accordingly, we

present adjusted net income and adjusted earnings per share excluding these

items.

Definitions

OLBDs represent the quantity of available lower berth days ("ALBD") that are

booked for sailing.

ALBD is a standard measure of passenger capacity for the period that is used to

approximate rate and capacity variances, based on consistently applied formulas

used to perform analyses to determine the main non-capacity driven factors that

cause cruise revenues and expenses to vary. ALBDs assume that each cabin

offered for sale accommodates two passengers and is computed by multiplying

passenger capacity by revenue-producing ship operating days in the period.

Cautionary Note Concerning Factors That May Affect Future Results

Carnival Corporation and Carnival plc and their respective subsidiaries are

referred to collectively in this document as "Carnival Corporation & plc,"

"our," "us" and "we." Some of the statements, estimates or projections

contained in this document are "forward-looking statements" that involve risks,

uncertainties and assumptions with respect to us, including some statements

concerning future results, outlooks, plans, goals and other events which have

not yet occurred. These statements are intended to qualify for the safe harbors

from liability provided by Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. All statements other than

statements of historical facts are statements that could be deemed

forward-looking. These statements are based on current expectations, estimates,

forecasts and projections about our business and the industry in which we

operate and the beliefs and assumptions of our management. We have tried,

whenever possible, to identify these statements by using words like "will,"

"may," "could," "should," "would," "believe," "depends," "expect," "goal,"

"anticipate," "forecast," "project," "future," "intend," "plan," "estimate,"

"target," "indicate," "outlook," and similar expressions of future intent or

the negative of such terms.

Forward-looking statements include those statements that relate to our outlook

and financial position including, but not limited to, statements regarding:

* Net revenue yields * Net cruise costs, excluding fuel per available

lower berth day

* Booking levels * Estimates of ship depreciable lives and residual

values

* Pricing and occupancy * Goodwill, ship and trademark fair values

* Interest, tax and fuel expenses * Liquidity

* Currency exchange rates * Adjusted earnings per share

Because forward-looking statements involve risks and uncertainties, there are

many factors that could cause our actual results, performance or achievements

to differ materially from those expressed or implied by our forward-looking

statements. This note contains important cautionary statements of the known

factors that we consider could materially affect the accuracy of our forward

looking statements and adversely affect our business, results of operations and

financial position. It is not possible to predict or identify all such risks.

There may be additional risks that we consider immaterial or which are unknown.

These factors include, but are not limited to, the following:

* COVID-19 has negatively impacted and may continue to impact the ability or

desire of people to travel, including on cruises, and may impact our

ability to obtain acceptable financing to fund any resulting shortfalls in

cash from operations.

* World events impacting the ability or desire of people to travel may lead

to a decline in demand for cruises

* Incidents concerning our ships, guests or the cruise vacation industry as

well as adverse weather conditions and other natural disasters may impact

the satisfaction of our guests and crew and lead to reputational damage

* Changes in and non-compliance with laws and regulations under which we

operate, such as those relating to health, environment, safety and

security, data privacy and protection, anti-corruption, economic sanctions,

trade protection and tax may lead to litigation, enforcement actions,

fines, penalties, and reputational damage

* Breaches in data security and lapses in data privacy as well as disruptions

and other damages to our principal offices, information technology

operations and system networks and failure to keep pace with developments

in technology may adversely impact our business operations, the

satisfaction of our guests and crew and lead to reputational damage

* Ability to recruit, develop and retain qualified shipboard personnel who

live away from home for extended periods of time may adversely impact our

business operations, guest services and satisfaction

* Increases in fuel prices, changes in the types of fuel consumed and

availability of fuel supply may adversely impact our scheduled itineraries

and costs

* Fluctuations in foreign currency exchange rates may adversely impact our

financial results

* Overcapacity and competition in the cruise and land-based vacation industry

may lead to a decline in our cruise sales, pricing and destination options

* Geographic regions in which we try to expand our business may be slow to

develop or ultimately not develop how we expect

* Inability to implement our shipbuilding programs and ship repairs,

maintenance and refurbishments may adversely impact our business operations

and the satisfaction of our guests

The ordering of the risk factors set forth above is not intended to reflect our

indication of priority or likelihood.

Forward-looking statements should not be relied upon as a prediction of actual

results. Subject to any continuing obligations under applicable law or any

relevant stock exchange rules, we expressly disclaim any obligation to

disseminate, after the date of this document, any updates or revisions to any

such forward-looking statements to reflect any change in expectations or

events, conditions or circumstances on which any such statements are based.

END

(END) Dow Jones Newswires

March 20, 2020 03:00 ET (07:00 GMT)

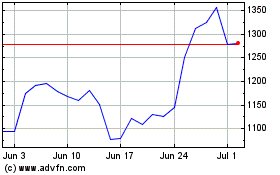

Carnival (LSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

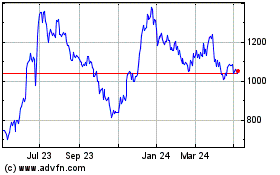

Carnival (LSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024