Carnival PLC Update on Debt Funding and Other Matters

March 16 2020 - 9:15AM

UK Regulatory

TIDMCCL

UPDATE ON DEBT FUNDING AND OTHER MATTERS

MIAMI (March 16, 2020) - Carnival Corporation & plc (NYSE/LSE: CCL;

NYSE: CUK) announce that its joint current report on Form 8-K was filed with

the U.S. Securities and Exchange Commission on March 16, 2020 disclosing the

following matters.

Facility Agreement

As previously disclosed, in August 2019, Carnival Corporation, Carnival plc and

certain of their subsidiaries (collectively, the "Corporation") became party to

an amended and restated five-year (with two one-year extension options) $1.7

billion, EUR1.0 billion and GBP150 million multi-currency revolving credit

agreement (the "Facility Agreement") with a syndicate of financial institutions

(the "Lenders").

On March 13, 2020, Carnival Corporation provided notice to the Lenders to

borrow approximately $3 billion under the Facility Agreement for a period of

six months. As of this borrowing, Carnival Corporation will have fully drawn

down the Facility Agreement. The Corporation borrowed under the Facility

Agreement in order to increase its cash position and preserve financial

flexibility in light of current uncertainty in the global markets resulting

from the COVID-19 outbreak. The proceeds from the Facility Agreement

borrowings will be available to be used for working capital, general corporate

or other purposes.

Other Matters

Due to the spread and recent developments, including growing port restrictions

around the world, related to the COVID-19 outbreak, the Corporation previously

announced a voluntary and temporary pause of its fleet cruise operations by its

continental Europe and North American brands. Subsequently, the Corporation

implemented a temporary pause of its global fleet cruise operations across all

brands. Each brand has separately announced the duration of its pause.

Significant events affecting travel, including COVID-19, typically have an

impact on booking patterns, with the full extent of the impact generally

determined by the length of time the event influences travel decisions. The

Corporation believes the ongoing effects of COVID-19 on its operations and

global bookings will have a material negative impact on its financial results

and liquidity. The Corporation is taking additional actions to improve its

liquidity, including capital expenditure and expense reductions, and pursuing

additional financing. Given the uncertainty of the situation, the Corporation

is currently unable to provide an earnings forecast, however we expect results

of operations for the fiscal year ending November 30, 2020 to result in a net

loss.

A copy of the joint current report on Form 8-K has been submitted to the

National Storage Mechanism and will shortly be available for inspection at

http://www.morningstar.co.uk/uk/NSM. A copy of the joint current report on Form

8-K is also available on the Carnival Corporation & plc website at

wwww.carnivalcorp.com or www.carnivalplc.com.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

END

(END) Dow Jones Newswires

March 16, 2020 09:15 ET (13:15 GMT)

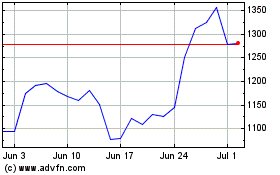

Carnival (LSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

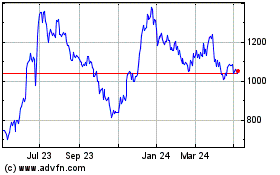

Carnival (LSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024