U.S. Socks Tick Higher After Jobless Claims Fall

July 09 2020 - 10:06AM

Dow Jones News

By Caitlin Ostroff

U.S. stocks opened higher Thursday after fresh labor market data

showed new unemployment claims continued to trend lower.

The S&P 500 added 0.2% shortly after the opening bell. The

Dow Jones Industrial Average was almost flat and the Nasdaq

Composite gained 0.8%.

New figures showed that 1.3 million Americans filed for

unemployment benefits through the week ended July 4. Weekly claims

have fallen from their April highs but had held steady near 1.5

million in prior weeks, leading some economists to worry that the

U.S. economic recovery is stalling.

Shares in Walgreens Boots Alliance fell 6.7% after it reported a

drop in quarterly sales, largely due to declining traffic in U.K.

stores.

Investors have remained focused on the prospects for economic

recovery, supported by central banks and governments around the

world, and have looked past a rising number of coronavirus cases in

the U.S.

The U.S. reported more than 58,000 new cases Wednesday,

according to data compiled by Johns Hopkins University, down

slightly from the previous day.

"There's got to be some underlying concerns about the recent

rise in Covid-19 cases in some countries and particularly in the

U.S. The markets have managed to shrug this off," said Rhys

Herbert, senior economist at Lloyds Banking Group.

The yield on the 10-year U.S. Treasury was nearly flat at

0.651%, from 0.652% Wednesday.

Stock indexes in Europe pushed higher, with the pan-continental

Stoxx Europe 600 gaining 0.4%. Shares in German software company

SAP SE rose after it reported better-than-expected preliminary

figures for the second quarter.

Analysts expect U.S. shares could move higher if investors

holding on to cash see better economic data. In China, individual

traders have supported the market's recent rise.

China's stock market zoomed ahead for the eighth day in a row,

leading Asian indexes higher, while stocks in the rest of the world

wavered.

The Shanghai Composite rose 1.4% Thursday, extending a winning

streak that is now the longest since January 2018. The index is up

15% since the start of July as individual investors bet on a strong

economic recovery. Japan's Nikkei 225 Index was up 0.4% and Hong

Kong's Hang Seng rose 0.3%.

"The day traders are actually a sizable part of the market,"

said Altaf Kassam, head of investment strategy for State Street

Global Advisors in Europe. He said the traders were looking at

signals of the government's support for the economy: "If anywhere

has had a V-shaped recovery, it's China."

China's currency continued to strengthen Thursday, trading for

less than 7 yuan to the dollar for the first time since the worst

of the coronavirus-related market panic in March.

Gold slipped less than 0.1% to $1,819.50 a troy ounce after

reaching its highest level since September 2011.

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

July 09, 2020 09:51 ET (13:51 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

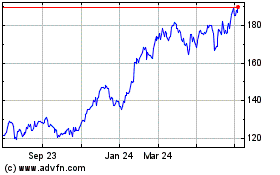

Sap (TG:SAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

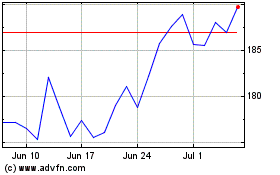

Sap (TG:SAP)

Historical Stock Chart

From Apr 2023 to Apr 2024