Current Report Filing (8-k)

August 05 2020 - 6:11AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): July 30, 2020

Transportation

and Logistics Systems, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

001-34970

|

|

26-3106763

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

5500

Military Trail, Suite 22-357

Jupiter,

Florida 33458

(Address

of Principal Executive Offices)

(833)

764-1443

(Issuer’s

telephone number)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $0.001

|

|

TLSS

|

|

OTC

US

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Forward

Looking Statements

Statements

in this report regarding Transportation and Logistics Systems, Inc. (the “Company”) and/or its wholly-owned

subsidiaries, Prime EFS LLC (“Prime EFS”) and ShypDirect, LLC (“ShypDirect”), that are not

historical facts are forward-looking statements and are subject to risks and uncertainties that could cause actual future events

or results to differ materially from such statements. Any such forward-looking statements, including, but not limited to, financial

guidance, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that do not directly or exclusively relate to historical facts. In some cases, you can identify

forward-looking statements by terms such as “may,” “will,” “should,” “could,”

“would,” “expects,” “plans,” “anticipates,” “intend,” “plan,”

“goal,” “seek,” “strategy,” “future,” “likely,” “believes,”

“estimates,” “projects,” “forecasts,” “predicts,” “potential,” or

the negative of those terms, and similar expressions and comparable terminology. These include, but are not limited to, statements

relating to future events or our future financial and operating results, plans, objectives, expectations and intentions. Although

we believe that the expectations reflected in these forward-looking statements are reasonable, these expectations may not be achieved.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they represent our intentions,

plans, expectations, assumptions and beliefs about future events and are subject to known and unknown risks, uncertainties and

other factors outside of our control that could cause our actual results, performance or achievement to differ materially from

those expressed or implied by these forward-looking statements. In addition to the risks described above, these risks and uncertainties

include: our ability to successfully execute our business strategies, including integration of acquisitions and the future acquisition

of other businesses to grow our Company; customers’ cancellation on short notice of master service agreements from which

we derive a significant portion of our revenue or our failure to renew such master service agreements on favorable terms or at

all; our ability to attract and retain key personnel and skilled labor to meet the requirements of our labor-intensive business

or labor difficulties which could have an effect on our ability to bid for and successfully complete contracts; the ultimate geographic

spread, duration and severity of the coronavirus outbreak and the effectiveness of actions taken, or actions that may be taken,

by governmental authorities to contain the outbreak or ameliorate its effects; our failure to compete effectively in our highly

competitive industry could reduce the number of new contracts awarded to us or adversely affect our market share and harm our

financial performance; our ability to adopt and master new technologies and adjust certain fixed costs and expenses to adapt to

our industry’s and customers’ evolving demands; our history of losses, deficiency in working capital and a stockholders’

deficit and our ability to achieve sustained profitability; material weaknesses in our internal control over financial reporting

and our ability to maintain effective controls over financial reporting in the future; our substantial indebtedness could adversely

affect our business, financial condition and results of operations and our ability to meet our payment obligations; the impact

of new or changed laws, regulations or other industry standards that could adversely affect our ability to conduct our business;

and changes in general market, economic, social and political conditions in the United States and global economies or financial

markets, including those resulting from natural or man-made disasters.

These

forward-looking statements represent our estimates and assumptions only as of the date of this report and, except as required

by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information,

future events or otherwise after the date of this report. Given these uncertainties, you should not place undue reliance on these

forward-looking statements and should consider various factors, including the risks described, among other places, in our most

recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q, as well as any amendments thereto, filed with the

Securities and Exchange Commission.

Item

1.02 Termination of a Material Definitive Agreement.

Prime

EFS

As

disclosed in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 filed with the Securities

and Exchange Commission on June 29, 2020, on June 19, 2020, Amazon Logistics, Inc. (“Amazon”) notified Prime

EFS, a wholly-owned subsidiary of Transportation and Logistics Systems, Inc. (the “Company”) in writing (the

“Prime EFS Termination Notice”), that Amazon does not intend to renew its Delivery Service Partner (DSP) Agreement

with Prime EFS when that agreement (the “In-Force Agreement”) expires. In the Prime EFS Termination Notice,

Amazon stated that the In-Force Agreement expires on September 30, 2020. Prime EFS believed on advice of counsel that Amazon’s

position misconstrued the expiration date under the In-Force Agreement. Prime EFS therefore filed an arbitration at the American

Arbitration Association (the “AAA”) seeking temporary, preliminary, and permanent injunctive relief prohibiting

Amazon from terminating the In-Force Agreement prior to March 31, 2021. However, in a ruling issued July 30, 2020, an arbitrator

appointed by the AAA affirmed the validity of Amazon’s construction of the In-Force Agreement and notice terminating that

agreement effective September 30, 2020. The Company concluded, on advice of counsel, that no court would suspend, vacate or modify

the July 30, 2020, ruling. As a result, the In-Force Agreement will expire as of September 30, 2020.

Approximately

67.8% of the Company’s approximately $32 million of revenue reported in its recent Form 10-K Annual Report for the

calendar year ended December 31, 2019, and approximately 56.7% of the Company’s approximately $8.6 million of revenue

reported in its Form 10-Q Quarterly Report for the three months ended March 31, 2020, was attributable to Prime EFS’s last-mile

DSP business with Amazon. While the termination of the Amazon last-mile business will have a material adverse impact on the Company’s

business in the 4th fiscal quarter of 2020 and thereafter (if the revenue attributable to the In-Force Agreement and Amazon last-mile

business cannot be replaced by then), the Company will continue to: (i) seek to expand its last-mile business with other non-Amazon

customers; (ii) explore other strategic relationships; and (iii) identify potential acquisition opportunities, while continuing

to execute our restructuring plan, commenced in February 2020. As previously disclosed, in 2020, we began making last-mile deliveries

for one of the largest carriers in the world.

ShypDirect

As disclosed in the Company’s Current

Report on Form 8-K, dated July 23, 2020, on July 17, 2020, Amazon notified ShypDirect, LLC (“ShypDirect”),

a wholly-owned subsidiary of the Company, that Amazon has elected to terminate the Amazon Relay Carrier Terms of Service (the

“Program Agreement”) between Amazon and ShypDirect effective as of November 14, 2020 (the “ShypDirect

Termination Notice”).

Amazon did not state a reason for the ShypDirect

Termination Notice. Under the Program Agreement, Amazon can terminate the agreement without a reason and solely for convenience

on 120 days’ notice.

On August 3, 2020, Amazon offered (the

“Aug. 3 Proposal”) to withdraw the ShypDirect Termination Notice and extend the term of the Program Agreement

to and including May 14, 2021, conditioned on Prime EFS executing, for nominal consideration, a separation agreement with

Amazon under which Prime EFS agrees to cooperate in an orderly transition of its Amazon last-mile delivery business to other service

providers, Prime EFS releases any and all claims it may have against Amazon, and Prime EFS covenants not to sue Amazon. On

August 4, 2020, the Company, Prime EFS and ShypDirect accepted the Aug. 3 Proposal.

Approximately 30.9% of the Company’s

approximately $31.5 million of revenue reported in its Form 10-K Annual Report for the calendar year ended December 31, 2019,

and approximately 41.2% of the Company’s approximately $8.6 million of revenue reported in its Form 10-Q Quarterly Report

for the three months ended March 31, 2020, was attributable to ShypDirect’s mid-mile and long-haul business with Amazon.

While a termination of the Amazon mid-mile and long-haul business effective May 14, 2021 will have a material adverse impact on

the Company’s business in 2nd fiscal quarter of 2021 and thereafter (if the revenue attributable to the Amazon

mid-mile and long-haul business cannot be replaced by then), the Company will continue to: (i) seek to replace its mid-mile and

long-haul business with other, non-Amazon, customers; (ii) explore other strategic relationships; and (iii) identify potential

acquisition opportunities, while continuing to execute our restructuring plan, commenced in February 2020.

Item

2.05 Costs Associated with Exit or Disposal Activities.

In

a ruling issued July 30, 2020, discussed above, an arbitrator appointed by the American Arbitration Association affirmed the validity

of Amazon’s notice terminating the In-Force Agreement effective September 30, 2020. The Company concluded, on advice of

counsel, that no court would suspend, vacate or modify that ruling. Therefore, on July 31, 2020, Prime EFS issued a Worker Adjustment

and Retraining Notification (“WARN”) Act notice (each, a “WARN Notice”) to all of its 390

employees at the following stations (each, a “Station”):

|

|

●

|

Amazon

Station DEW1, 2 Empire Blvd., Moonachie, NJ 07074;

|

|

|

|

|

|

|

●

|

Amazon

Station DEW2, 630 Sullivan Road, Elizabeth, NJ 07201;

|

|

|

|

|

|

|

●

|

Amazon

Station DEW4, 2251 Cabot Blvd. W, Langhorne, PA 19047; and

|

|

|

|

|

|

|

●

|

Amazon

Station DEW8, 281 Benigno Blvd., Bellmawr, NJ 08031.

|

Each

WARN Notice stated that, as of September 30, 2020, Prime EFS will no longer be performing services at the applicable Station.

Each Station is owned and operated by Amazon and it is Prime EFS’ understanding that the Stations will not close. As of

September 30, 2020, Prime EFS employees at each Station may be laid off if we cannot reassign them. If layoffs occur, they are

expected to begin and end on September 30, 2020.

At

this time, the Company is unable to estimate the costs, charges and cash expenditures that will be incurred as a result of the

potential layoffs. The Company will amend this Current Report on Form 8-K within four business days after it makes a determination

of such an estimate or range of estimates.

Item

8.01 Other Events.

On

July 24, 2020, Prime EFS terminated the employment of Frank Mazzola effective that day. Prime EFS and the Company have learned

that on July 27, 2020, Mr. Mazzola filed a Complaint and Jury Demand in the United States District Court for the Southern District

of New York in which he named as defendants Prime EFS, the Company, John Mercadante and Douglas Cerny. Mr. Mazzola alleges in

the Complaint that he had an employment agreement with Prime EFS and that Prime EFS breached the alleged employment agreement

through two alleged pay reductions and by terminating his employment. The Complaint contains eight counts: (1) breach of contract

against Prime EFS; (2) breach of the covenant of good faith and fair dealing against Prime EFS; (3) intentional misrepresentation

against Prime EFS, the Company and Mr. Mercadante; (4) negligent misrepresentation against Prime EFS, the Company and Mr. Mercadante;

(5) tortious interference with contract against the Company, Mr. Mercadante and Mr. Cerny; (6) tortious interference with prospective

economic advantage against the Company, Mr. Mercadante and Mr. Cerny; (7) conversion against all defendants; and (8) unjust enrichment

against all defendants. He seeks specific performance of the alleged employment agreement and damages of not less than $3 million.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Dated:

August 5, 2020

|

Transportation

and Logistics Systems, Inc.

|

|

|

|

|

|

|

By:

|

/s/

John Mercadante

|

|

|

Name:

|

John

Mercadante

|

|

|

Title:

|

Chief

Executive Officer

|

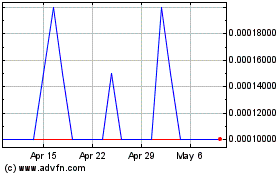

Transportation and Logis... (PK) (USOTC:TLSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Transportation and Logis... (PK) (USOTC:TLSS)

Historical Stock Chart

From Apr 2023 to Apr 2024