Current Report Filing (8-k)

March 22 2023 - 6:03AM

Edgar (US Regulatory)

0001614556

false

0001614556

2023-03-15

2023-03-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): March

15, 2023

Star Alliance International Corp.

(Exact name of small business issuer as specified

in its charter)

| Nevada |

333-197692 |

37-1757067 |

(State or other jurisdiction

of incorporation or organization) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| 5743

Corsa Avenue Suite 218, Westlake Village, CA 91362 |

| (Address of principal executive offices) |

| (833) 443-7827 |

| (Issuer’s telephone number) |

|

______________________________________________________

(Former name or former address, if changed since

last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| None |

N/A |

N/A |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

SECTION 1 – Registrant’s Business and Operations

| Item 1.01 |

Entry into a Material Definitive Agreement |

On March 15, 2023, Star Alliance International

Corp. (“Star”) entered into Common Stock Purchase Agreement (the “SPA”) and a Registration Rights Agreement (the

“RRA”) with Keystone Capital Partners, LLC (“Keystone”). Under the SPA, Star may issue a total of up to 75,000,000

shares of its common stock to Keystone pursuant to separate purchase notices to be delivered by Star to Keystone from time to time. Each

purchase notice delivered by Star to Keystone may be for not less than $20,000 and not more than $75,000 worth of Star’s common

stock, to be sold at a price per share equal to 85% of the average of the closing share prices for Star’s common stock for the 5

trading days preceding the purchase. In order for Star to issue a valid purchase notice to Keystone, the applicable purchase price must

be not less than $0.01 per share, at least 2 trading days must have passed since the last purchase notice, and Star must be in continuing

compliance with the terms, conditions, and covenants of the SPA. Under the SPA, Keystone’s beneficial ownership of Star’s

common stock is limited such that Keystone may not purchase shares of Star’s common stock to the extent that, immediately following

such purchase, Keystone would own more than 4.99% of Star’s total issued and outstanding common stock.

As additional consideration to Keystone under

the SPA, Star has agreed to issue Keystone commitment shares as follows: (i) 1,000,000 shares on the date the SPA was executed; (ii) 500,000

shares upon the effective date of registration statement discussed below; and (iii) additional common stock having a value of $75,000

upon Keystone having invested at least $500,000 in Star common stock under the SPA.

The RRA executed in connection with the SPA requires

Star to file a registration statement with the Securities and Exchange Commission covering Keystone’s re-sale of the common stock

to be purchased under the SPA as well as the commitment shares. The registration statement must be filed within 30 days of the signing

date of the SPA, and Star is required to diligently pursue effectiveness of the registration statement as more specifically set forth

in in the RRA. Effectiveness of the registration statement as required under the RRA is a condition to Star’s ability to deliver

purchase notices to Keystone under the SPA.

The SPA and the RRA contain numerous additional

terms, covenants, and conditions and should be reviewed in their entirety for additional information.

SECTION 9 – Financial Statements and

Exhibits

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Star Alliance International Corp.

/s/ Anthony L.

Anish

Anthony L. Anish

Chief Financial Officer

Date: March, 20, 2023

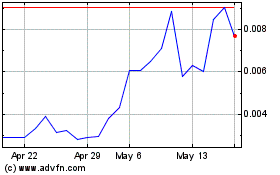

Star Alliance (PK) (USOTC:STAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

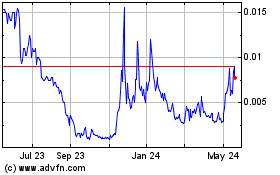

Star Alliance (PK) (USOTC:STAL)

Historical Stock Chart

From Jul 2023 to Jul 2024