2nd UPDATE: Sherritt To Buy Controlling Stake In Indonesian Nickel Project

December 01 2010 - 1:16PM

Dow Jones News

Sherritt International Corp. (S.T) said Wednesday it will

acquire a controlling stake in the Sulawesi nickel project in

Indonesia from Rio Tinto Ltd. (RIO) for an undisclosed amount.

Sherritt, a Toronto-based diversified international mining

company, will become the project's operator. The company said it

plans to use its expertise in nickel laterite mining to exploit

Sulawesi, which is considered one of the largest undeveloped nickel

projects in the world.

For Rio Tinto, the sale represents a pulling back from its first

ambitious estimate made in 2008 that the development of Sulawesi

would allow it to enter the nickel market and be among the world's

top 10 producers within a decade.

Instead, Rio Tinto spokesman Tony Shaffer said the company will

focus on its smaller Eagle nickel project in Michigan, which is

expected to producer 16,000 metric tons a year.

Rio says Sulawesi contains 162 million tonnes of nickel, and a

first mine could yield 46,000 metric tons a year and eventually

expand to more than 100,000 metric tons a year.

However, Sulawesi's nickel is embedded in laterite rock, which

is more difficult and expensive to process.

"Rio Tinto has been considering next steps for its Sulawesi

Nickel project for some time and has concluded that bringing in a

partner on an earn-in basis is the best way of developing it," Rio

Tinto said in a statement. "Sherritt is a very good partner for Rio

Tinto. It has two active laterite mining and processing projects

which make it ideally placed to lead this project."

After the Indonesian government uses an option to acquire a 20%

interest in the project, Sherritt would have controlling interest

and a 46% economic interest, with Rio Tinto maintaining a 34%

economic interest.

A Rio Tinto executive has been quoted in Indonesian media as

saying the project will cost $2 billion to develop. Shaffer said no

official cost estimate has been released.

BMO Capital Markets analyst Tony Robson noted that Sulawesi has

been under consideration since 1999 and warned investors to expect

delays. "Development would take at least seven years to potential

first production, based on the challenges of laterite projects

generally and potential regulatory delays in Indonesia," Robson

wrote in a note to clients.

Sherritt, which has operations across the world including in

Canada, Cuba and Madagascar, said it has executed an earn-in and

shareholders agreement in connection with the deal and has also

committed to fund $110 million toward producing a feasibility study

from which a development decision will be made.

Sherritt shares rose 2% to C$8.03 in recent trading on the

Toronto Stock Exchange.

-By Edward Welsch, Dow Jones Newswires; 403-471-3855;

edward.welsch@dowjones.com

(Carolyn King contributed to this article.)

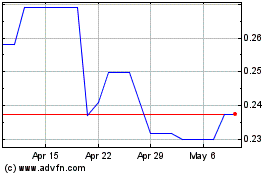

Sherritt (PK) (USOTC:SHERF)

Historical Stock Chart

From Mar 2024 to Apr 2024

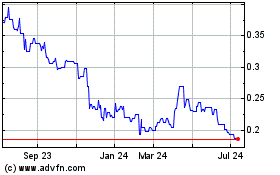

Sherritt (PK) (USOTC:SHERF)

Historical Stock Chart

From Apr 2023 to Apr 2024