Experian Fiscal Year Pretax Profit, Revenue Rose; 2022 Seen Stronger

May 19 2021 - 2:52AM

Dow Jones News

By Sabela Ojea

Experian PLC reported Wednesday a rise in pretax profit linked

to a reduction in net finance costs for fiscal 2021 and said that

it expects to see significant revenue growth for the current

financial year.

The consumer-credit reporting agency posted a pretax profit for

the year ended March 31 of $1.08 billion after cutting net finance

costs by $130 million. This compares with a profit of $942 million

for the same period a year earlier.

Revenue rose to $5.37 billion from $5.18 billion for the

year-earlier period.

The FTSE 100 listed company said it achieved total revenue

growth of 7% for the whole year, as well as organic revenue growth

of 4%.

Regarding its fourth-quarter organic revenue growth, Experian

said that it saw growth of 5%, at the top end of its guidance

range. Experian also expects to benefit from growth in the current

financial year, seeing organic revenue growth in the range of 7% to

9% and total revenue growth in the range of 11% to 13%.

The board has declared an unchanged total dividend of 47.0 U.S.

cents a share.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

May 19, 2021 02:37 ET (06:37 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

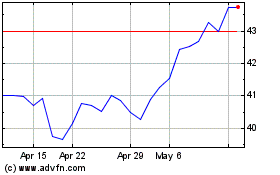

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Apr 2024 to May 2024

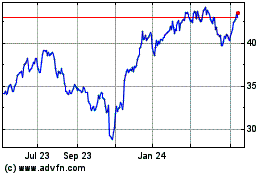

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From May 2023 to May 2024