0001839341FALSECore Scientific, Inc./tx00018393412024-03-122024-03-120001839341us-gaap:CommonStockMember2024-03-122024-03-120001839341core:WarrantExercisePriceOf6.81PerShareMember2024-03-122024-03-120001839341core:WarrantExercisePriceOf0.01PerShareMember2024-03-122024-03-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 12, 2024

Core Scientific, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40046 | | 86-1243837 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

838 Walker Road, Suite 21-2105 Dover, Delaware | | 19904 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (512) 402-5233

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.00001 per share | CORZ | The Nasdaq Global Select Market |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $6.81 per share | CORZW | The Nasdaq Global Select Market |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $0.01 per share | CORZZ | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On March 12, 2024, the Company issued a press release announcing its financial results for the fourth fiscal quarter and full year ended December 31, 2023. A copy of the press release is furnished hereto as Exhibit 99.1 and is incorporated herein by reference.

On March 12, 2024, the Company also released a corporate presentation reporting such results. A copy of the presentation is furnished hereto as Exhibit 99.2 and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

The information contained in Item 2.02 is incorporated herein by reference.

The information in Items 2.02 and 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits:

| | | | | | | | |

| | | |

Exhibit

No. | | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Core Scientific, Inc. |

| | |

Dated: March 12, 2024 | | |

| | |

| By: | /s/ Todd M. DuChene |

| Name: | Todd M. DuChene |

| Title: | Chief Legal Officer and Chief Administrative Officer |

| | | | | | | | | | | |

press release | | | Exhibit 99.1

corescientific.com |

Core Scientific Announces Fiscal Fourth Quarter and Full Fiscal Year 2023 Results

Fiscal Year 2023 Highlights

•A total of 19,274 bitcoin earned in our data centers; 13,762 bitcoin by self-mining for our account, more than any other publicly listed miner in North America, and an estimated 5,512 for our hosting clients’ accounts

•Operated total hash rate of 23.2 EH/s, consisting of 16.9 EH/s self-mining and 6.3 EH/s hosting

•Owned and managed 724 megawatts of infrastructure, the largest owned infrastructure footprint among publicly listed miners in North America

•Improved average self-mining fleet energy efficiency to 27.94 joules per terahash

•Developed organic growth plan for more than 20 EH/s of new self-mining hash rate

AUSTIN, Texas, March 12, 2024 - Core Scientific, Inc. (NASDAQ: CORZ), a leader in bitcoin mining and digital infrastructure for emerging high-value compute, reported its financial results for the fiscal fourth quarter and year ended December 31, 2023.

Fiscal Fourth Quarter 2023 Compared to Fiscal Fourth Year 2022

•Total revenue of $141.9 million, an increase of $20.7 million

•Net loss of $195.7 million, an improvement of $239.2 million

•Adjusted EBITDA of $57.5 million, an increase of $51.2 million

Fiscal Year 2023 Financial Highlights Compared to Fiscal Year 2022

•Total revenue of $502.4 million, a decrease of $137.9 million

•Net loss of $246.5 million, an improvement of $1.90 billion

•Adjusted EBITDA of $170.0 million, an increase of $180.7 million

“In 2023, Core Scientific earned more self-mined bitcoin than any other listed miner in North America, positioning us for continued strong performance in 2024 based on current bitcoin prices and operating performance,” said Adam Sullivan, Core Scientific Chief Executive Officer. “We own and operate the largest bitcoin mining infrastructure in the industry in terms of operating megawatts, and we have demonstrated superior hash rate utilization. We have now emerged from our restructuring a stronger, more focused and more productive company with a plan for self-mining growth of more than 20 exahash.”

“We believe our growth plan and diversified platform give us the ability to refresh our fleet with more efficient miners, scale our business with favorable economics and position ourselves well for the upcoming halving and beyond,” Mr. Sullivan continued. “Coming off our strong operating performance in the fourth quarter, we have seen bitcoin prices rise and our self-mining operation continue to perform well as we are able to take advantage of excellent industry fundamentals.”

The Company has completed all 2024 payments for new bitcoin miners ordered for the current year and is accelerating the delivery and deployment of new Bitmain S21 miners. In addition, Core Scientific has improved financial results by rationalizing its hosting client base, instituting proceeds sharing contracts, reducing operating expenses and optimizing the location of miners in its data centers to increase profitability.

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 2 |

“Our strong momentum continued into 2024 as we recently announced the expansion of our hosting business with a strategic, long-term contract with CoreWeave, Inc., a leading specialized GPU cloud provider. While our continued focus remains squarely on bitcoin mining, this new contract broadens our revenue model to customers engaged in rapidly growing, high-performance computing supporting the rapid expansion of AI computing demands. More importantly, this contract enhances shareholder value,” added Mr. Sullivan. “We could not be more excited at this point in Core Scientific’s history, as we have secured a renewed opportunity to demonstrate the value of our platform and the strategic nature of our footprint to the future of high value compute.”

Fiscal Fourth Quarter 2023 Financial Results (Compared to Fiscal Fourth Quarter 2022)

Total revenue of $141.9 million in the fiscal fourth quarter of 2023 increased by $20.7 million, or 17%, from $121.3 million for the same period in the prior year. The increase in total revenue was driven primarily by a $37.7 million increase in digital asset mining revenue due to new miners deployed in 2023 and the increase in the price of bitcoin, partially offset by a $12.9 million decrease in hosting revenue due primarily to the termination of contracts for several customers in the portfolio with less profitable hosting rates, and a $4.2 million decrease in equipment sales driven by the Company’s exit from the equipment sales business.

Cost of revenue of $102.6 million in the fiscal fourth quarter of 2023 decreased by $65.9 million, or 39%, from $168.5 million for the same period in the prior year. As a percentage of total revenue, cost of revenue totaled 72% and 139% for the years ended December 31, 2023 and 2022, respectively. The decrease in cost of revenue was primarily attributable to $37.6 million of decreased depreciation expense driven by a fiscal 2022 non-cash impairment adjustment to the depreciable base for the deployed self-mining units, $23.7 million of lower power costs, and $3.1 million of lower equipment sales costs due to our exit from the equipment sales business in 2022.

Total operating expenses of $30.0 million in fiscal fourth quarter 2023 decreased $12.6 million from total operating expenses of $42.6 million for the fiscal fourth quarter 2022. This decrease was due primarily to a $10.0 million decrease in advisor fees, a $4.3 million reduction in professional fees primarily related to investments made to support public company compliance and $3.1 million of lower bad debt expense, partially offset by a $1.6 million increase in corporate taxes due primarily to increased property taxes.

Net loss of $195.7 million in the fiscal fourth quarter 2023 improved $239.2 million from a net loss of $434.8 million for the same period in the prior year. This decrease was driven primarily by a $531.4 million non-cash impairment charge to property, plant and equipment recognized in the fiscal fourth quarter 2022, partially offset by an increase in Reorganization items, net of $310.3 million.

Adjusted EBITDA improved to $57.5 million in the fiscal fourth quarter 2023 compared to $6.3 million in the fiscal fourth quarter of 2022, an improvement of $51.2 million. This increase was driven by a $23.7 million decrease in power costs, a $20.7 million increase in total revenue, and the elimination of $3.1 million of cost of revenue associated with equipment sales.

Fiscal Year 2023 Financial Results (Compared to Fiscal Year 2022)

Total revenue of $502.4 million in fiscal year 2023 decreased by $137.9 million, or 22%, from $640.3 million for the same period in the prior year. The decrease in total revenue was driven primarily by a $82.8 million decrease due to the Company’s exit from the equipment sales business in fiscal year 2022, a decrease of $47.6

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 3 |

million in hosting revenue due primarily to the termination of contracts for several customers in the portfolio with less profitable hosting rates, and $7.5 million decrease in digital asset mining revenue driven primarily by increased mining difficulty associated with the growth in the global Bitcoin network hash rate in fiscal year 2023 relative to fiscal year 2022, partially offset by the increase in the number of mining units deployed in our self-mining fleet.

Cost of revenue of $378.9 million in fiscal year 2023 decreased by $253.0 million, or 40%, from $631.9 million for the same period in the prior year. As a percentage of total revenue, cost of revenue totaled 75% and 99% for the years ended December 31, 2023 and 2022, respectively. The decrease in cost of revenue was primarily attributable to $128.1 million of decreased depreciation expense driven by a fiscal 2022 non-cash impairment adjustment to the depreciable base for the deployed self-mining units, $67.1 million of lower equipment sales costs due to our exit from the equipment sales business in 2022, $41.8 million of lower power costs, and lower stock-based compensation of $20.7 million as the prior year included accelerated vesting of awards, as well as a decrease in equity awards granted during fiscal year 2023.

Total operating expenses of $108.1 million in fiscal year 2023 decreased $144.9 million from total operating expenses of $253.0 million for the same period in fiscal 2022. This decrease was primarily driven by lower stock-based compensation of $103.1 million, as the prior year included accelerated vesting of awards and a decrease in equity awards granted during the current fiscal year, $14.1 million of lower professional fees primarily related to investments made to support public company compliance, $10.0 million of lower advisor fees in the prior year and a $9.0 million decrease in bad debt expense.

Net loss of $246.5 million in fiscal year 2023 decreased by $1.90 billion, or 89%, from a net loss of $2.15 billion for the same period in the prior year. The decrease in net loss was primarily due to non-cash impairments totaling $1.88 billion which included a $1.06 billion impairment of goodwill and other intangibles, a $590.7 million impairment of property, plant and equipment in fiscal year 2022, as well as a $226.9 million decrease in impairment of digital assets year over year, an improvement in gross margin of $115.1 million, lower operating expenses of $144.9 million, partially offset by bankruptcy-related reorganization expenses of $191.1 million in 2023.

Adjusted EBITDA of $170.0 million in fiscal year 2023 increased by $180.7 million from $(10.7) million for the same period in the prior year. The increase was driven by lower non-cash impairments on digital assets of $226.9 million, the elimination of $67.1 million of cost of revenue associated with equipment sales, a $41.8 million decrease in power costs, a $30.0 million reduction in operating expenses, partially offset by a $137.9 million decrease in total revenue and a decrease in gain from sales of digital assets of $40.4 million.

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 4 |

CONFERENCE CALL AND LIVE WEBCAST

In conjunction with this release, Core Scientific, Inc. will host a conference call today, Tuesday, March 12, 2024, at 4:30 pm Eastern Time that will be webcast live. Adam Sullivan, Chief Executive Officer, Denise Sterling, Chief Financial Officer and Steven A. Gitlin, Senior Vice President Investor Relations, will host the call.

Investors may dial into the call by using the following telephone numbers,: +1 833 470 1428 (U.S. toll free) and +1 404 975 4839 (U.S. local) and providing the Access Code 619354 five to ten minutes prior to the start time to allow for registration.

Investors with Internet access may listen to the live audio webcast via the Investor Relations page of the Core Scientific, Inc. website, http://investors.corescientific.com. Please allow 10 minutes prior to the call to download and install any necessary audio software. A replay of the audio webcast will be available for one year.

A supplementary investor presentation for the full fiscal year 2023 may be accessed at https://investors.corescientific.com/investors/events-and-presentations/default.aspx.

AUDIO REPLAY

An audio replay of the event will be archived on the Investor Relations section of the Company's website at http://investors.corescientific.com and via telephone by dialing +1 866 813 9403 (U.S. toll free), 1 (929) 458-6194 (U.S. local) or 44 (204) 525-0658 (international) and entering Access Code 426935.

ABOUT CORE SCIENTIFIC

Core Scientific is one of the largest bitcoin miners and hosting solutions providers for bitcoin mining in North America. Transforming energy into high value compute with superior efficiency at scale, we employ our own large fleet of computers (“miners”) to earn bitcoin for our own account and provide hosting services for large bitcoin mining customers at our seven operational data centers in Georgia (2), Kentucky (1), North Carolina (1), North Dakota (1) and Texas (2). We derive the majority of our revenue from earning bitcoin for our own account (“self-mining”). To learn more, visit www.corescientific.com.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding projections, estimates and forecasts of revenue and other financial and performance metrics, projections of market opportunity and expectations, the Company’s ability to scale and grow its business, source clean and renewable energy, the advantages and expected growth of the Company and the Company’s ability to source and retain talent. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All forward looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: our ability to earn digital assets profitably and to attract customers for our hosting capabilities; our ability to maintain our competitive position as digital asset networks experience increases in total network hash rate; our ability to raise additional capital to continue our expansion efforts or other operations; our need for significant electric power and the limited availability of power resources; the potential

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 5 |

failure in our critical systems, facilities or services we provide; the physical risks and regulatory changes relating to climate change; potential significant changes to the method of validating blockchain transactions; our vulnerability to physical security breaches, which could disrupt our operations; a potential slowdown in market and economic conditions, particularly those impacting the blockchain industry and the blockchain hosting market; the identification of material weaknesses in our internal control over financial reporting; price volatility of digital assets and bitcoin in particular; the “halving” of rewards available on the Bitcoin network, or the reduction of rewards on other networks, affecting our ability to generate revenue as our customers may not have an adequate incentive to continue mining and customers may cease mining operations altogether; the potential that insufficient awards from digital asset mining could disincentivize transaction processors from expending processing power on a particular network, which could negatively impact the utility of the network and further reduce the value of its digital assets; the requirements of our existing debt agreements for us to sell our digital assets earned from mining as they are received, preventing us from recognizing any gain from appreciation in the value of the digital assets we hold; potential changes in the interpretive positions of the SEC or its staff with respect to digital asset mining firms; the increasing likelihood that U.S. federal and state legislatures and regulatory agencies will enact laws and regulations to regulate digital assets and digital asset intermediaries; increasing scrutiny and changing expectations with respect to our ESG policies; the effectiveness of our compliance and risk management methods; the adequacy of our sources of recovery if the digital assets held by us are lost, stolen or destroyed due to third-party digital asset services; the effects of our emergence from bankruptcy on our financial results, business and business relationships; and our substantial level of indebtedness and our current liquidity constraints affecting our financial condition and ability to service our indebtedness. Any such forward-looking statements represent management’s estimates and beliefs as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change.

Although the Company believes that in making such forward-looking statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. The Company cannot assure you that the assumptions upon which these statements are based will prove to have been correct. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law.

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 6 |

Core Scientific, Inc. (Debtor-in-Possession)

Consolidated Balance Sheets

(in thousands, except par value)

(Unaudited)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| Assets |

| | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 50,409 | | | $ | 15,884 | |

| Restricted cash | 19,300 | | | 36,356 | |

| Accounts receivable, net of allowance of $— and $8,724, respectively | 1,001 | | | 234 | |

| Accounts receivable from related parties | — | | | 23 | |

| Digital assets | 2,284 | | | 724 | |

| Prepaid expenses and other current assets | 24,022 | | | 31,881 | |

| Total Current Assets | 97,016 | | | 85,102 | |

| Property, plant and equipment, net | 585,431 | | | 691,134 | |

| Operating lease right-of-use assets | 7,844 | | | 20,430 | |

| Intangible assets, net | 2,247 | | | 1,704 | |

| Other noncurrent assets | 19,618 | | | 9,316 | |

| Total Assets | $ | 712,156 | | | $ | 807,686 | |

| Liabilities and Stockholders’ Deficit | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 154,751 | | | $ | 53,641 | |

Accrued expenses and other current liabilities | 179,636 | | | 17,952 | |

| Operating lease liabilities, current portion | 77 | | | 769 | |

| Deferred revenue | 9,830 | | | 77,689 | |

| Deferred revenue from related parties | — | | | 496 | |

| Finance lease liabilities, current portion | 19,771 | | | — | |

| Notes payable, current portion | 124,358 | | | 36,242 | |

| Total Current Liabilities | 488,423 | | | 186,789 | |

| Finance lease liabilities, net of current portion | 35,745 | | | — | |

| Operating lease liabilities, net of current portion | 1,512 | | | 720 | |

| Notes payable, net of current portion | 684,082 | | | — | |

| Other noncurrent liabilities | — | | | 2,210 | |

| Total liabilities not subject to compromise | 1,209,762 | | | 189,719 | |

| Liabilities subject to compromise | 99,335 | | | 1,027,313 | |

| Total Liabilities | 1,309,097 | | | 1,217,032 | |

| | | |

| Commitments and contingencies | | | |

| Stockholders’ Deficit: | | | |

Common stock; $0.00001 par value; 10,000,000 and 10,000,000 shares authorized at December 31, 2023 and 2022, respectively; 386,883 and 375,225 shares issued and outstanding at December 31, 2023 and 2022, respectively | 36 | | | 36 | |

| Additional paid-in capital | 1,823,260 | | | 1,764,368 | |

| Accumulated deficit | (2,420,237) | | | (2,173,750) | |

| Total Stockholders’ Deficit | (596,941) | | | (409,346) | |

| Total Liabilities and Stockholders’ Deficit | $ | 712,156 | | | $ | 807,686 | |

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 7 |

Core Scientific, Inc. (Debtor-in-Possession)

Consolidated Statements of Operations

(in thousands, except per share amounts)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Hosting revenue from customers | $ | 29,760 | | | $ | 35,827 | | | $ | 102,005 | | | $ | 130,234 | |

Hosting revenue from related parties | — | | | 6,795 | | | 10,062 | | | 29,454 | |

Equipment sales to customers | — | | | — | | | — | | | 11,391 | |

Equipment sales to related parties | — | | | 4,169 | | | — | | | 71,438 | |

Digital asset mining revenue | 112,169 | | | 74,459 | | | 390,333 | | | 397,796 | |

Total revenue | 141,929 | | | 121,250 | | | 502,400 | | | 640,313 | |

| Cost of revenue: | | | | | | | |

| Cost of hosting services | 23,058 | | | 49,867 | | | 87,245 | | | 169,717 | |

| Cost of equipment sales | — | | | 3,121 | | | — | | | 67,114 | |

| Cost of digital asset mining | 79,571 | | | 115,506 | | | 291,696 | | | 395,082 | |

Total cost of revenue | 102,629 | | | 168,494 | | | 378,941 | | | 631,913 | |

Gross profit (loss) | 39,300 | | | (47,244) | | | 123,459 | | | 8,400 | |

| Gain from sales of digital assets | 1,535 | | | 19,291 | | | 3,893 | | | 44,298 | |

| Impairment of digital assets | (1,542) | | | (19,131) | | | (4,406) | | | (231,315) | |

| Change in fair value of derivative instruments | (3,918) | | | — | | | (3,918) | | | — | |

| Impairment of goodwill and other intangibles | — | | | — | | | — | | | (1,059,265) | |

| Impairment of property, plant and equipment | — | | | (531,414) | | | — | | | (590,673) | |

| Losses on exchange or disposal of property, plant and equipment | (1,442) | | | (14,968) | | | (1,956) | | | (28,025) | |

Operating expenses: | | | | | | | |

Research and development | 1,876 | | | 2,657 | | | 7,184 | | | 26,962 | |

Sales and marketing | 3,886 | | | 1,056 | | | 7,019 | | | 12,731 | |

General and administrative | 24,237 | | | 38,900 | | | 93,908 | | | 213,280 | |

Total operating expenses | 29,999 | | | 42,613 | | | 108,111 | | | 252,973 | |

Operating income (loss) | 3,934 | | | (636,079) | | | 8,961 | | | (2,109,553) | |

Non-operating expenses, net: | | | | | | | |

(Gain) loss on debt extinguishment | 1,070 | | | 287 | | | (20,065) | | | 287 | |

Interest expense, net | 83,921 | | | 22,092 | | | 86,238 | | | 96,826 | |

| Fair value adjustment on convertible notes | — | | | — | | | — | | | 186,853 | |

| Fair value adjustment on derivative warrant liabilities | — | | | (4,952) | | | — | | | (37,937) | |

| Reorganization items, net | 112,852 | | | (197,405) | | | 191,122 | | | (197,405) | |

Other non-operating (income) expenses, net | 1,448 | | | 235 | | | (2,530) | | | 5,232 | |

Total non-operating expense (income), net | 199,291 | | | (179,743) | | | 254,765 | | | 53,856 | |

Loss before income taxes | (195,357) | | | (456,336) | | | (245,804) | | | (2,163,409) | |

Income tax expense (benefit) | 336 | | | (21,489) | | | 683 | | | (17,091) | |

Net loss | (195,693) | | | (434,847) | | | (246,487) | | | (2,146,318) | |

Net loss per share: | | | | | | | |

Basic | $ | (0.51) | | | $ | (1.17) | | | $ | (0.65) | | | $ | (6.30) | |

Diluted | $ | (0.51) | | | $ | (1.17) | | | $ | (0.65) | | | $ | (6.30) | |

Weighted average shares outstanding: | | | | | | | |

Basic | 385,074 | | | 371,357 | | | 379,863 | | | 340,647 | |

Diluted | 385,074 | | | 371,357 | | | 379,863 | | | 340,647 | |

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 8 |

Core Scientific, Inc. (Debtor-in-Possession)

Segment Results

(in thousands, except percentages)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Hosting Segment | | | | | | | |

| Revenue: | | | | | | | |

| Hosting revenue | $ | 29,760 | | | $ | 42,622 | | | $ | 112,067 | | | $ | 159,688 | |

| Equipment sales | — | | | 4,169 | | | — | | | 82,829 | |

| Total revenue | 29,760 | | | 46,791 | | | 112,067 | | | 242,517 | |

| Cost of revenue: | | | | | | | |

| Cost of hosting services | 23,058 | | | 49,867 | | | $ | 87,245 | | | $ | 169,717 | |

| Cost of equipment sales | — | | | 3,121 | | | — | | | 67,114 | |

| Total cost of revenue | $ | 23,058 | | | $ | 52,988 | | | $ | 87,245 | | | $ | 236,831 | |

Gross profit (loss) | $ | 6,702 | | | $ | (6,197) | | | $ | 24,822 | | | $ | 5,686 | |

Gross margin1 | 23 | % | | (13) | % | | 22 | % | | 2 | % |

| Mining Segment |

| Digital asset mining revenue | $ | 112,169 | | | $ | 74,459 | | | $ | 390,333 | | | $ | 397,796 | |

| Total revenue | 112,169 | | | 74,459 | | | 390,333 | | | 397,796 | |

| Cost of revenue | 79,571 | | | 115,506 | | | 291,696 | | | 395,082 | |

Gross profit (loss) | $ | 32,598 | | | $ | (41,047) | | | $ | 98,637 | | | $ | 2,714 | |

| Gross margin1 | 29 | % | | (55) | % | | 25 | % | | 1 | % |

| Consolidated | | | | | | | |

| Consolidated total revenue | $ | 141,929 | | | $ | 121,250 | | | $ | 502,400 | | | $ | 640,313 | |

| Consolidated cost of revenue | $ | 102,629 | | | $ | 168,494 | | | $ | 378,941 | | | $ | 631,913 | |

Consolidated gross profit (loss) | $ | 39,300 | | | $ | (47,244) | | | $ | 123,459 | | | $ | 8,400 | |

Consolidated gross margin1 | 28 | % | | (39) | % | | 25 | % | | 1 | % |

1 Gross margin is calculated as gross profit as a percentage of total revenue.

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 9 |

Core Scientific, Inc. and Subsidiaries

Non-GAAP Financial Measures

(Unaudited)

Adjusted EBITDA is a non-GAAP financial measure defined as our net income or (loss), adjusted to eliminate the effect of (i) interest income, interest expense, and other income (expense), net; (ii) provision for income taxes; (iii) depreciation and amortization; (iv) stock-based compensation expense; (v) restructuring charges; (vi) Reorganization items, net; (vii) unrealized changes in fair value of derivative instruments; and (viii) certain additional non-cash or non-recurring items, that do not reflect the performance of our ongoing business operations. For additional information, including the reconciliation of net income (loss) to Adjusted EBITDA, please refer to the table below. We believe Adjusted EBITDA is an important measure because it allows management, investors, and our Board of Directors to evaluate and compare our operating results, including our return on capital and operating efficiencies, from period-to-period by making the adjustments described above. In addition, it provides useful information to investors and others in understanding and evaluating our results of operations, as well as provides a useful measure for period-to-period comparisons of our business, as it removes the effect of net interest expense, taxes, certain non-cash items, variable charges, and timing differences. Moreover, we have included Adjusted EBITDA in this earnings release because it is a key measurement used by our management internally to make operating decisions, including those related to operating expenses, evaluate performance, and perform strategic and financial planning.

The above items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature or because the amount and timing of these items are not related to the current results of our core business operations which renders evaluation of our current performance, comparisons of performance between periods and comparisons of our current performance with our competitors less meaningful. However, you should be aware that when evaluating Adjusted EBITDA, we may incur future expenses similar to those excluded when calculating this measure. Our presentation of this measure should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items. Further, this non-GAAP financial measure should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). We compensate for these limitations by relying primarily on GAAP results and using Adjusted EBITDA on a supplemental basis. Our computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies because not all companies calculate this measure in the same fashion. You should review the reconciliation of net loss to Adjusted EBITDA below and not rely on any single financial measure to evaluate our business.

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 10 |

The following table reconciles the non-GAAP financial measure to the most directly comparable U.S. GAAP financial performance measure, which is net loss, for the periods presented (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 20221,2 |

Reconciliation of Net loss to Adjusted EBITDA | (Unaudited) |

Net loss | $ | (195,693) | | | $ | (434,847) | | | $ | (246,487) | | | $ | (2,146,318) | |

| Adjustments: | | | | | | | |

| Interest expense, net | 83,921 | | | 22,092 | | | 86,238 | | | 96,826 | |

| Income tax expense (benefit) | 336 | | | (21,489) | | | 683 | | | (17,091) | |

| Depreciation and amortization | 31,203 | | | 68,715 | | | 96,003 | | | 225,259 | |

| Amortization of operating lease right-of-use assets | (261) | | | 410 | | | 442 | | | 834 | |

| (Gain) loss on debt extinguishment | 1,070 | | | 287 | | | (20,065) | | | 287 | |

Stock-based compensation expense3 | 17,478 | | | 16,346 | | | 58,892 | | | 182,894 | |

| Fair value adjustment on derivative warrant liabilities | — | | | (4,952) | | | — | | | (37,937) | |

| Fair value adjustment on convertible notes | — | | | — | | | — | | | 186,853 | |

| Impairment of goodwill and other intangibles | — | | | — | | | — | | | 1,059,265 | |

| Impairment of property, plant and equipment | — | | | 531,414 | | | — | | | 590,673 | |

| Losses on exchange or disposal of property, plant and equipment | 1,442 | | | 14,968 | | | 1,956 | | | 28,025 | |

| Gain on sale of intangible assets | — | | | — | | | — | | | (5,904) | |

| Cash restructuring charges | — | | | — | | | — | | | 1,320 | |

| Reorganization items, net | 112,852 | | | (197,405) | | | 191,122 | | | (197,405) | |

| Fair value adjustment on acquired vendor liability | — | | | — | | | — | | | 9,498 | |

| Equity line of credit expenses | — | | | 237 | | | — | | | 1,668 | |

| Unrealized change in fair value of derivative instruments | 2,262 | | | — | | | 2,262 | | | — | |

| Other non-operating (income) expenses, net | 1,448 | | | 235 | | | (2,530) | | | 5,232 | |

| Other items | 1,474 | | | 10,300 | | | 1,474 | | | 5,276 | |

| Adjusted EBITDA | $ | 57,532 | | | $ | 6,311 | | | $ | 169,990 | | | $ | (10,745) | |

1 Certain prior year amounts have been reclassified for consistency with the current year presentation.

2 Previously, the Company had held the bitcoin it earned as an investment for long-term appreciation. This strategy was outside our primary operations and the results of impairments and realized gains and losses had been excluded from adjusted EBITDA. With our current strategy of monetizing our bitcoin revenue soon after earning it and changes in accounting standards, Management is no longer excluding these amounts from its Adjusted EBITDA.

3 Includes $1.0 million of stock-based compensation that was provided in severance as part of restructuring charges incurred during the year ended December 31, 2022.

| | | | | | | | |

| | Core Scientific, Inc. Fiscal Year 2023 Earnings Release - 11 |

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Please follow us on:

https://www.linkedin.com/company/corescientific/

https://twitter.com/core_scientific

CONTACTS

Investors:

ir@corescientific.com

Media:

press@corescientific.com

1 MAR 12, 2024 Fiscal Fourth Quarter and Full Year 2023 Earnings Presentation MARCH 12, 2024 Adam Sullivan, CEO Denise Sterling, CFO

2 MAR 12, 2024 This presentation contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding projections, estimates and forecasts of revenue and other financial and performance metrics, projections of market opportunity and expectations, the Company’s ability to scale and grow its business, source clean and renewable energy, the advantages and expected growth of the Company and the Company’s ability to source and retain talent. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All forward looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: our ability to earn digital assets profitably and to attract customers for our hosting capabilities; our ability to maintain our competitive position as digital asset networks experience increases in total network hash rate; our ability to raise additional capital to continue our expansion efforts or other operations; our need for significant electric power and the limited availability of power resources; the potential failure in our critical systems, facilities or services we provide; the physical risks and regulatory changes relating to climate change; potential significant changes to the method of validating blockchain transactions; our vulnerability to physical security breaches, which could disrupt our operations; a potential slowdown in market and economic conditions, particularly those impacting the blockchain industry and the blockchain hosting market; the identification of material weaknesses in our internal control over financial reporting; price volatility of digital assets and bitcoin in particular; the “halving” of rewards available on the Bitcoin network, or the reduction of rewards on other networks, affecting our ability to generate revenue as our customers may not have an adequate incentive to continue mining and customers may cease mining operations altogether; the potential that insufficient awards from digital asset mining could disincentivize transaction processors from expending processing power on a particular network, which could negatively impact the utility of the network and further reduce the value of its digital assets; the requirements of our existing debt agreements for us to sell our digital assets earned from mining as they are received, preventing us from recognizing any gain from appreciation in the value of the digital assets we hold; potential changes in the interpretive positions of the SEC or its staff with respect to digital asset mining firms; the increasing likelihood that U.S. federal and state legislatures and regulatory agencies will enact laws and regulations to regulate digital assets and digital asset intermediaries; increasing scrutiny and changing expectations with respect to our ESG policies; the effectiveness of our compliance and risk management methods; the adequacy of our sources of recovery if the digital assets held by us are lost, stolen or destroyed due to third-party digital asset services; the effects of our emergence from bankruptcy on our financial results, business and business relationships; and our substantial level of indebtedness and our current liquidity constraints affecting our financial condition and ability to service our indebtedness. Any such forward-looking statements represent management’s estimates and beliefs as of the date of this presentation. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. Year over year comparisons are based on the combined results of Core Scientific and its acquired entities. Although the Company believes that in making such forward-looking statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. The Company cannot assure you that the assumptions upon which these statements are based will prove to have been correct. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law. Non-GAAP Financial Measures This presentation also contains non-GAAP financial measures as defined by the SEC rules, including Adjusted EBITDA and adjusted earnings (loss) per diluted share. The Company believes that these non- GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company's financial condition and results of operations. The Company's management uses certain of these non-GAAP measures to compare the Company's performance to that of prior periods for trend analyses and for budgeting and planning purposes. The Company urges investors not to rely on any single financial measure to evaluate its business. Forward-looking statements

3 MAR 12, 2024 2,045 2,157 1,760 3,452 5,168 4,928 4,621 7,391 3,260 3,205 2,786 3,536 2,295 4,123 3,197 4,143 12,852 3,806 5,536 6,626 2,159 Leading the industry in North American bitcoin mining. All bitcoin production and Hashrate data from company press releases; data as of December 31, 2023. Represents self-mined BTC and excludes customer mined BTC RI OT MARATHON I RI S ENERGY HUT 8 HI VE CL EAN SPARK BI TFARMS ARGO 5,000 10,000 15,000 20,000 25,000 30,000 35,000 2021 2022 2023 5,769 14,438 13,762CORE SCI ENTI FI C

4 MAR 12, 2024 Core Scientific 2023 Snapshot Strategic • 724 MW of owned, energized infrastructure • Additional 372 MW of partially completed infrastructure • Positioned to support other forms of high-value compute • Pathway to de-lever balance sheet • Organic self-mining growth plan for 20+ more EH/s Operational • Earned 13,762 self-mined bitcoin • 16.9 EH/s self-mining energized hash rate • ~158,000 company-owned bitcoin miners • Improved self-mining fleet efficiency to 27.94 J/TH by 12/31/23 • 6.3 EH/s energized hosted hash rate • Consistently higher hash rate utilization than peer group average1 Financial • $502 million revenue • $(247) million net loss – includes $191 million bankruptcy-related expenses • $170 million adjusted EBITDA • $14,982 cash cost per self-mined bitcoin2 • Planned operating cash flow sufficient to fund debt service and capex through 2024 1 See slide 8 for comparisons and additional detail 2 See slide 18 for additional detail

5 MAR 12, 2024MAR 12, 2024 Core Scientific transforms energy into high- value compute with superior efficiency at scale

6 MAR 12, 2024MAR 12, 2024 Denton, TX 125 MW1 Calvert City, KY 150 MW Dalton, GA 145 MW Marble, NC 104 MW Pecos, TX (Cottonwood) 50 MW2 Grand Forks, ND 100 MW 724 Megawatts Largest Owned Infrastructure Capacity 2023 Average Power Cost $0.044/kWh Dalton, GA 50 MW 1 72 MW expansion planned for 2024 2 300 MW expansion planned for 2025-2027

7 MAR 12, 2024 Restructuring positioned Core Scientific for success Stronger balance sheet & pathway to de-lever further Improved hosting business performance, fewer customers, better margin Rigor and discipline in capital allocation, organic growth funded from operating cashflow Reduced operating expenses, implemented hedging strategy on power to manage downside risk Positioned Company for successful emergence, paid off DIP financing, over- subscribed Equity Rights Offering

8 MAR 12, 2024 Source: Monthly Production Updates. As of February 29, 2024 “Group” consists of Argo, Bitdeer, BitFarms, Cipher, CleanSpark, Hive, Hut 8, Iris Energy, Marathon, Riot, Terawulf “Scaled Miners” consists of CleanSpark, Marathon, Riot Se lf- m in ed B itc oi n pe r T wo -M on th A ve ra ge En er gi ze d Ha sh R at e Ca pa ci ty 80.83 85.98 72.88 88.48 68.9 68.13 64.12 64.12 60.47 62.97 73.33 57.86 47.63 76.43 75.28 70.7 80.41 62.99 65.73 60.83 60.21 58.43 60.9 64.93 50.46 43.33 79.75 78.99 64.71 76.1 56.16 61.06 55.23 55.53 55.94 56.07 66.29 47.19 37.87 30 40 50 60 70 80 90 100 FEB '23 MAR '23 APR '23 MAY '23 JUN '23 JUL '23 AUG '23 SEP '23 OCT '23 NOV '23 DEC '23 JAN '24 FEB '24 Hash Rate Utilization: Bitcoin Mined per Energized Exahash Core Scientific Group Average (Excluding Core) Scaled Miners Average (Excluding Core) Consistently higher hash rate utilization than peer averages

9 MAR 12, 2024 Deploying new bitcoin miners Upgraded proprietary firmware Optimized fleet performance Implemented power hedging Conducted scenario planning Preparations for the halving • Expands hash rate • Increases energy efficiency • Improves machine profitability • Manages fleet • Extends miner life • Improves performance & productivity (over/ underclocking) • Reallocated miners to different sites based on miner efficiency vs. local power rates • Enhances productivity and profitability through location optimization • Protect against upward power price volatility • Established processes and metrics • Developed detailed plans for various halving-driven hash price assumptions • Defines responses to different scenarios

10 MAR 12, 2024 High-performance computing hosting Why Core Scientific? Benefits to Core Scientific CoreWeave Contract Highlights • Hosted GPUs from 2019 to 2022 • More than 300 MW of infrastructure near large cities – low latency • Majority of data center operations team and its leaders come from the data center industry • Upgrading Austin, TX data center formerly housing HP • Providing up to 16 MW infrastructure • Total revenue more than $100 million over multi-year period • Stable, recurring cash flow • Diversifies customer base and revenue mix • Further differentiates Core Scientific business model from bitcoin mining peers

11 MAR 12, 2024 Financial summary

12 MAR 12, 2024 (Unaudited) 2023 Revenue Mix (In Millions, Unaudited) Revenue by Segment Segment analysis 76% 24% Self-Mining Hosting $398 $390 $160 $112 $83 2022 2023 Self-Mining Hosting Equipment Sales (Unaudited) Gross Margin by Segment 1% 2% 25% 22% Self-Mining Hosting 2022 2023

13 MAR 12, 2024 Self-mining fleet composition (as of 12/31/23) Antminer S19 13% Antminer S19 Pro & S19j Pro 71% Antminer S19j XP 16%S19j XP (21.5 J/TH) S19 (34.2 J/TH) S19 Pro and S19j Pro (29.5 J/TH)

14 MAR 12, 2024 Debt at emergence (Jan 24, 2024) ($ in millions) Outstanding Principal Amount New Delayed Draw Term Loan $61 New Secured Notes 150 Miner Equipment Loans 53 Other Debt 84 Total Non-Convertible Debt $348 New Secured Convertible Notes 260 Total Debt $608

15 MAR 12, 2024 Post-emergence debt Terms Exit Delayed Draw Term Loan New Secured Notes New Secured Convertible Notes Miner Equipment Debt (Election 2) Facility Size $80 million ($40 million roll- up, $40 million new money, $19 million undrawn) $150 million $260 million $53 million Interest Rate 9.0% cash 12.5% cash 6.0% cash / 6.0% PIK1 or 10.0% cash 3.0% cash / 10.0% PIK for 2 years, 10.0% cash thereafter Maturity 3 years 4 years 5 years 5 years Conversion (if applicable) N/A N/A Optional: $5.83 / Share Mandatory: $7.79 / Share N/A 1 PIK interest payable in Core Scientific common shares.

16 MAR 12, 2024 Pathway to de-levering balance sheet Conversion/ Exercise/ Trigger Price Shares (M) Debt ($M) Cash ($M) Notes Actual - 177 $ 608 $ 83 Actual issued and outstanding share count as of March 7, 2024 Convertible Notes1 $ 5.83 45 $ (260) - Mandatory conversion at $7.79 Tranche 1 Warrants2 $ 6.81 98 $ (348) $ 322 Total proceeds of $670M, a portion of which to be used to pay down debt Tranche 2 Warrants $ 8.72 82 - - Penny warrants, executable at/above trigger price Proforma - 402 - $ 405 1 Voluntary conversion price $5.83; mandatory conversion price $7.79 based on VWAP of CORZ stock over 20 consecutive trading days 2 Tranche 1 (cash) warrant exercise price of $6.81 – actual exercises may continue over range of share prices; 50% of proceeds required to pay down exit facility and new secured notes

17 MAR 12, 2024 31 19 13 7 24 20 16 4 350 150 5 5640 45 48 42 23 2024 2025 2026 2027 2028 2029 Interest New Delayed Draw Term Loan New Secured Notes New Secured Convertible Notes (if not converted) Miner Equipment Loans Other Debt Debt service $71 million in 2024; amortization of principal weighted heavily to 2027 - 2029 71 64 90 125 189 354 (in $millions) 1 Represents 6.0% cash / 6.0% PIK; PIK interest payable in new Core Scientific common shares 1

18 MAR 12, 2024 Cash Cost Per Bitcoin1 Cash-Based Hash Cost2 Power Cost $ 12,528 3.33¢ Operational Cost3 $ 2,454 0.65¢ Cash to Mine a BTC $ 14,982 3.98¢ 1 Represents our direct, cash costs of power and facilities operations based on our self-mining/hosting mix as of 12/31/23 divided by total bitcoin self-mined in 2023 of 13,762. Future changes in power cost, operational cost or self-mining/hosting mix could change the cost to mine. 2 Represents the cash expenses of power and facilities operations cost divided by our self-mining fleet hash rate, in terahash. 3 Includes personnel and related costs, software, telecommunications, security, etc. Amount excludes stock-based compensation and depreciation Cost to self-mine1 a bitcoin in 2023

19 MAR 12, 2024 Well positioned for continued market leadership Earned more bitcoin than any other company in 2021-2023 $502 million in 2023 revenue Own 724 MW of infrastructure - total of 25.2 EH/s1 Diversifying hosting customer base into high- performance computing Well positioned for halving Plan for de- levering balance sheet Sufficient cash generation to support expected growth Multi-year growth plan for more than 20 EH/s 1 Includes self-mining and hosting hash rate as of February 29, 2024

Thank you! Investor Relations (737) 931-1351 ir@corescientific.com Corescientific.com Leader in bitcoin mining and digital infrastructure for emerging high- value compute

21 MAR 12, 2024 Appendix

22 MAR 12, 2024 Selected quarterly financial results (unaudited) (dollars in thousands) Q1 2023 Q2 2023 Q3 2023 Q4 2023 FY 2023 FY 2022 FY 2023 vs 2022 Total revenue: Hosting revenue $ 22,629 $ 23,435 $ 20,766 $ 19,663 $ 86,493 $ 159,688 $ (73,195) Proceeds sharing - 6,395 9,083 10,096 25,574 - 25,574 Equipment sales - - - - - 82,829 (82,829) Digital asset mining income 98,026 97,082 83,056 112,169 390,333 397,796 (7,463) Total revenue 120,654 126,913 112,904 141,929 502,400 640,313 (137,913) Cost of revenue 88,873 89,954 97,486 102,628 378,941 631,913 (252,972) Gross profit 31,781 36,959 15,419 39,300 123,460 8,400 115,059 Gross Margin 26% 29% 14% 28% 25% 1% (Gain)/Loss on legal settlements - 85 (85) - - - - (Gain)/Loss from sales and impairment of digital assets $ (8) $ 197 $ 318 $ 7 $ 514 $ 187,018 $ (186,504) Impairment on goodwill $ - $ - $ - $ - $ - $ 1,649,938 $ (1,649,938) Loss on exchange or disposal of PP&E $ - $ 174 $ 340 $ 1,443 $ 1,956 $ 28,025 $ (26,069) Operating expenses: Research and development $ 973 $ 1,273 $ 1,918 $ 1,683 $ 5,846 $ 4,869 $ 978 Sales and marketing $ 503 $ 545 $ 524 $ 518 $ 2,090 $ 3,329 $ (1,240) General and administrative $ 11,035 $ 12,529 $ 11,005 $ 11,764 $ 46,333 $ 88,686 $ (42,353) Stock-based compensation $ 11,676 $ 12,772 $ 13,359 $ 16,035 $ 53,842 $ 156,089 $ (102,247) Total operating expenses 24,187 27,120 26,806 29,999 108,111 252,973 (144,861) Operating Income (Loss) 7,603 9,383 (11,960) 7,852 12,878 (2,109,553) 2,122,432 Non-operating (income) expense, net: (Gain) Loss on debt extinguishment (20,761) - (373) 1,069 (20,065) 287 (20,352) Hedging Instruments, net - - - 3,918 3,918 - 3,918 Reorganization items, net 31,559 18,370 28,341 112,852 191,122 (197,405) 388,527 Interest expense (income), net 157 (36) 2,196 83,921 86,238 96,826 (10,587) Other non-operating (income) expenses, net (3,068) 181 (1,090) 1,447 (2,531) 154,148 (156,679) Total non-operating (income) expense, net 7,886 18,515 29,073 203,207 258,682 53,855 204,827 Income (loss) before income taxes (283) (9,132) (41,033) (195,355) (245,803) (2,163,714) 1,917,911 Income tax (benefit) expense 104 129 114 337 683 (17,091) 17,774 Net income (loss) $ (388) $ (9,260) $ (41,147) $ (195,692) $ (246,487) $ (2,146,318) $ 1,899,832

23 MAR 12, 2024 Adjusted EBITDA reconciliation (dollars in thousands) Q1 2023 Q2 2023 Q3 2023 Q4 2023 FY 2023 FY 2022 FY 2023 vs 2022 Net Income (Loss) $ (388) $ (9,260) $(41,147) $ (195,692) $ (246,487) $ (2,146,318) $ 1,899,832 Adjustments: (Gain) Loss on Debt Extinguishment (20,761) - (373) 1,069 (20,065) 287 (20,352) Non-cash and other items (3,068) 181 (1,090) 3,709 (268) 154,148 (154,416) Reorganization Items 31,559 18,370 28,341 112,852 191,122 (197,405) 388,527 Interest Expense, Net 157 (36) 2,196 83,921 86,238 96,826 (10,587) Income Tax Expense (Benefit) 104 129 114 337 683 (17,091) 17,774 Depreciation and Amortization 20,462 20,841 24,602 31,571 97,477 225,825 (128,348) Stock-Based Compensation Expense 12,273 14,280 14,861 17,478 58,892 181,868 (122,976) Legal Settlement - 85 (85) - - - - Goodwill Impairment - - - - - 1,054,759 (1,054,759) Intangible Impairment - - - - - 4,506 (4,506) PP&E Impairment - - - - - 590,673 (590,673) Restructuring Charge - 225 (225) - - 12,319 (12,319) Operating Lease-Right-of-Use Assets 195 13,074 (12,566) (261) 442 834 (392) Fixed Asset Gain (Loss) - 174 340 1,443 1,956 28,025 (26,069) Adjusted EBITDA $ 40,533 $ 58,063 $ 14,967 $ 56,428 $ 169,991 $ (10,745) $ 180,736

v3.24.0.1

Cover

|

Mar. 12, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 12, 2024

|

| Entity Registrant Name |

Core Scientific, Inc./tx

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40046

|

| Entity Tax Identification Number |

86-1243837

|

| Entity Address, Address Line One |

838 Walker Road

|

| Entity Address, Address Line Two |

Suite 21-2105

|

| Entity Address, City or Town |

Dover

|

| Entity Address, State or Province |

DE

|

| Entity Address, Postal Zip Code |

19904

|

| City Area Code |

512

|

| Local Phone Number |

402-5233

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001839341

|

| Amendment Flag |

false

|

| Common stock, par value $0.00001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.00001 per share

|

| Trading Symbol |

CORZ

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $6.81 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $6.81 per share

|

| Trading Symbol |

CORZW

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $0.01 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $0.01 per share

|

| Trading Symbol |

CORZZ

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=core_WarrantExercisePriceOf6.81PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=core_WarrantExercisePriceOf0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

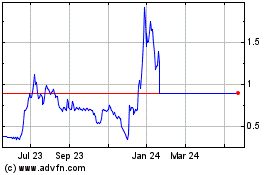

Core Scientific (PK) (USOTC:CORZQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Core Scientific (PK) (USOTC:CORZQ)

Historical Stock Chart

From Apr 2023 to Apr 2024