Prime Rate Plus Corp.: Begins Trading Under New Symbol

May 07 2009 - 11:38AM

Marketwired Canada

Prime Rate Plus Corp. ("the Company") announced a name change to Canadian Banc

Recovery Corp on April 21, 2009. The Company also announced a symbol change.

Effective today, the Preferred Share will change from PPL.PR.A to BK.PR.A and

the Class A Share will change from PPL to BK. All other features and attributes

of the Company and the applicable shares remain unchanged.

The Company invests in the common shares of the big six Canadian Banks: Bank of

Montreal, Canadian Imperial Bank of Commerce, National Bank of Canada, Royal

Bank of Canada, Bank of Nova Scotia, and Toronto-Dominion Bank. The portfolio is

actively managed with each bank generally accounting for between 5-20% of the

portfolio. The Canadian Chartered Banks have been among the best performing

banks throughout this economic downturn. The more conservative nature, better

lending standards and stronger capital bases of the Canadian banks should allow

for a strong recovery.

The Company offers investors two securities based on the underlying bank

portfolio and both offer distributions whose rates float based on the prevailing

prime interest rate in Canada.

Preferred Shares

- floating rate dividend set at 0.75% above Canadian Prime subject to a minimum

of 5% and a maximum of 7%

- current asset coverage of 160% based on $10 par value and a net asset value of

$16.00

- current yield to maturity of 9.5%, assuming a minimum dividend of 50 cents per

annum and share price of $8.50 with repayment of the $10 par value

- ability for dividend increases if Canadian Prime rate increases above 4.25%

(currently set at 2.25% as of April 21, 2009)

Class A Shares

- leveraged participation in value of underlying Canadian bank portfolio

- floating rate dividend set at 2% above Canadian Prime subject to a minimum of

5% and a maximum of 10% (and subject to a minimum net asset value of $15)

- potential for dividend increases from a rising Canadian Prime interest rate

- potential for additional returns from the Company's limited option income

writing program

- a 10% increase in the underlying net asset value would increase the value

attributable to the capital shares by over 26% based on the April 15, 2009 net

asset value.

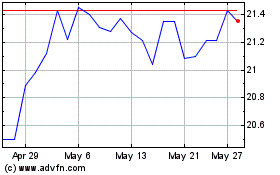

Pembina Pipeline (TSX:PPL.PR.A)

Historical Stock Chart

From May 2024 to Jun 2024

Pembina Pipeline (TSX:PPL.PR.A)

Historical Stock Chart

From Jun 2023 to Jun 2024