Canadian Banc Corp. Extends Termination Date

March 02 2023 - 4:00PM

Canadian Banc Corp. (the “Company’) is pleased to announce it will

extend the termination date of the Company a further five year

period from December 1, 2023 to December 1, 2028.

The term extension allows holders of BK Class A

Shares (“Class A Shares”) to continue to receive ongoing exposure

to a portfolio consisting primarily of Canada’s six big banks, as

well as receiving targeted monthly distributions. Since inception

of the Company Class A shareholders have received monthly

distributions totaling $19.73 per share.

Holders of the BK.PR.A Preferred Shares

(“Preferred Shares”) are expected to continue to benefit from

cumulative preferential monthly distributions. The Preferred

shareholders have received a total of $9.37 per share since

inception.

The extension of the term of the Company is not

expected to be a taxable event and should enable shareholders to

defer potential capital gains tax liability that would have

otherwise been realized on the redemption of the Class A Shares or

Preferred Shares at the end of the term, until such time as such

shares are disposed of by shareholders.

In connection with the extension, the Company

will have the right to amend the rate of cumulative preferential

monthly dividends to be paid on the Preferred Shares for the five

year renewal period commencing December 1, 2023. Any change to the

Preferred Share dividend rate for the extended term will be based

on market yields for preferred shares with similar terms at such

time and will be announced no later than September 30, 2023.

In connection with the term extension, the

Company will offer a non-concurrent Special Retraction Right which

will allow existing shareholders to tender one or both classes of

Shares and receive a retraction price based on the November 30,

2023 net asset value per unit.

The Company invests in a portfolio that

primarily consists of six publicly traded Canadian Banks as

follows:

|

Bank of Montreal |

Canadian Imperial Bank of Commerce |

Royal Bank of Canada |

| The Bank of Nova Scotia |

National Bank of Canada |

The Toronto-Dominion Bank |

Commissions, trailing commissions, management

fees and expenses all may be associated with mutual fund

investments. Investors should read the prospectus before investing.

Mutual funds are not guaranteed, their values change frequently and

past performance may not be repeated. Please read the Company’s

publicly filed documents which are available at www.sedar.com.

Investor Relations:

1-877-478-2372 Local:

416-304-4443

www.canadianbanc.com

info@quadravest.com

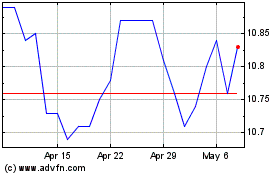

Canadian Banc (TSX:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

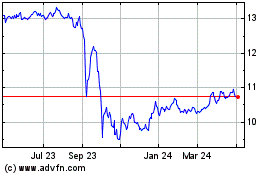

Canadian Banc (TSX:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024