Visa to Pay $5.3 Billion For Fintech Startup Plaid -- WSJ

January 14 2020 - 3:02AM

Dow Jones News

By Cara Lombardo and AnnaMaria Andriotis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 14, 2020).

Visa Inc. said Monday it would buy Plaid Inc. for $5.3 billion,

as part of an effort by the card giant to tap into consumers'

growing use of financial-technology apps and noncard payments.

More consumers over the past decade have been using

financial-services apps to manage their savings and spending, and

Plaid sits in the middle of those relationships, providing software

that gives the apps access to financial accounts. Venmo, PayPal

Holdings Inc.'s money-transfer service, is one of privately held

Plaid's biggest customers.

Visa is the largest U.S. card network, handling $3.4 trillion of

credit, debit and prepaid-card transactions in the first nine

months of 2019, according to the Nilson Report. Its clients are

largely comprised of banks that issue credit and debit cards, but

the company is looking to expand its presence in the burgeoning

field of electronic payments, where trillions of dollars are sent

by wire transfer or between bank accounts globally each year.

On an investor conference call following the Monday

announcement, Visa Chief Executive Al Kelly said the acquisition

would help expand the company's access to financial-technology

firms while accelerating its movement outside of cards. The deal

was reported earlier Monday by The Wall Street Journal.

Visa last year acquired control of Earthport, which provides

cross-border payment services to banks and businesses, after rival

Mastercard Inc. also made an offer for the company. Before that,

Mastercard bought payment-technology firm Vocalink, which enables

the movement of payments between bank accounts.

These moves are essentially a way for the giant networks to

diversify, preparing for the possibility that noncard-payment forms

could one day replace their cards.

Card networks are concerned that consumer payments could move

away from debit and credit cards to bank accounts, essentially

allowing consumers to pay for products directly out of their bank

accounts while bypassing so-called card rails altogether.

Bank-account payments also offer a way into business-to-business

payments, a sector in which card companies have been trying to play

a bigger role because it is viewed as untapped compared with

consumer payments.

The deal could also help Visa address banks' concerns about

security as more new players like Plaid gain access to their

customers' information. It could boost Plaid's standing with banks

that have been wary of the services it offers and clashed with

fintech firms over their use of Plaid to access bank-customer

account data.

Visa is paying a significant premium over Plaid's valuation of

roughly $2.65 billion in a 2018 funding round, though the purchase

price still represents a rounding error for a company with a market

value of some $420 billion.

Both Visa and Mastercard had invested in Plaid as part of the

$250 million funding round.

Plaid was founded in 2012 by Zach Perret, who is its current

chief executive, and William Hockey. Its other investors include

venture-capital firms Andreessen Horowitz LLC and Kleiner

Perkins.

Write to Cara Lombardo at cara.lombardo@wsj.com and AnnaMaria

Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

January 14, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

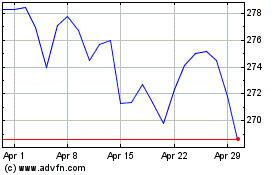

Visa (NYSE:V)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visa (NYSE:V)

Historical Stock Chart

From Apr 2023 to Apr 2024