Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

December 14 2022 - 4:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 Or 15d-16 Of

The Securities Exchange Act Of 1934

For the month of December 2022

Commission File Number: 001-14950

ULTRAPAR HOLDINGS INC.

(Translation of Registrant’s Name into English)

Brigadeiro Luis Antonio Avenue, 1343, 9th Floor

São Paulo, SP, Brazil 01317-910

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ____X____ Form 40-F ________

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ________ No ____X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ________ No ____X____

ULTRAPAR HOLDINGS INC.

TABLE OF CONTENTS

ULTRAPAR PARTICIPAÇÕES S.A.

Investment plan for 2023

São Paulo, December 14, 2022 – Ultrapar Participações S.A. (B3: UGPA3; NYSE: UGP, “Ultrapar”) informs its investment plan for 2023, approved by the Board of Directors.

2023 Organic investment plan¹

¹ Net of disposals, excluding acquisitions

|

² Includes financing to clients, net of receipts

|

Ultrapar's investment plan for 2023 totals R$ 2,182 million, an amount greater than that invested in the last five years.

The portion of investments focused on expansion prioritizes investments for the continuity of growth of the businesses, through capacity expansions, optimization of points of sale, and efficiency and productivity gains.

Ipiranga's expansion investments will mainly be directed to the branding of service stations with higher levels of throughput and, to a lesser extent, the expansion of capacity and logistics infrastructure on existing bases.

At Ultragaz, expansion investments are mainly focused on continuously capturing new customers in the bulk segment, on revitalizing and opening points of sale, and on projects related to optimizing storage infrastructure and to energy diversification.

Ultracargo's investments will be focused on continuing the expansion of the IQI13 area in the Itaqui port (concession granted in 2021), on the grant of the Vila do Conde terminal (state of Pará), and on the acquisition of land for the construction of a railway branch in Santos.

The portion focused on maintenance will be directed to the sustaining of the businesses and includes mainly investments in maintenance of assets, safety, information technology (mainly systems at Ipiranga), and the renovation and remodeling of points of sale.

Rodrigo de Almeida Pizzinatto

Chief Financial and Investor Relations Officer

Ultrapar Participações S.A.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 14, 2022

|

ULTRAPAR HOLDINGS INC. |

|

By: /s/ Rodrigo de Almeida Pizzinatto

|

|

Name: Rodrigo de Almeida Pizzinatto

|

|

Title: Chief Financial and Investor Relations Officer

|

(Market announcement)

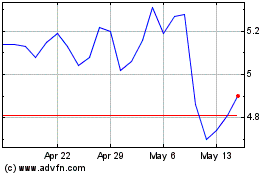

Ultrapar Participacoes (NYSE:UGP)

Historical Stock Chart

From Apr 2024 to May 2024

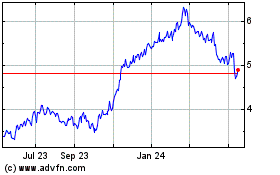

Ultrapar Participacoes (NYSE:UGP)

Historical Stock Chart

From May 2023 to May 2024