TIDMNOKIA

Nokia Corporation

Interim report

29 October 2020 at 08:00 (CET +1)

Nokia Corporation Interim Report for Q3 and January-September 2020

Solid margin and free cash flow; net sales decline primarily due to

services

-- Continued improvements in our Mobile Access portfolio; reducing product

costs and improving product performance; commitment to invest in R&D to

drive product leadership

-- 7% year-on-year decrease in net sales, largely driven by lower services

within Mobile Access, consistent with our expectation for lower network

deployment services

-- Strong year-on-year growth in Nokia Enterprise

-- Continued margin expansion year-on-year, primarily driven by Mobile

Access and Optical Networks

-- Positive operating profit, on a reported basis, in Q3 and first nine

months of 2020

-- Solid free cash flow in Q3 and the first nine months of 2020

-- Adjusted 2020 outlook midpoints for non-IFRS EPS to EUR 0.23 (from EUR

0.25) and operating margin to 9.0% (from 9.5%), with the new midpoints

and ranges within the previously provided outlook ranges

-- Provided new outlook for 2021 non-IFRS operating margin of 7-10%

-- Long term outlook to be provided latest at the Capital Markets Day on

March 18, 2021

This is a summary of the Nokia Corporation Interim Report for Q3 and

January-September 2020 published today. The complete Interim Report for

Q3 and January-September 2020 with tables is available at

https://www.globenewswire.com/Tracker?data=XPamBNLwnKNl3BEKUNYJTX0CC4JMvJL021VFHQy5bfkzgDSwSbuAjicQt7Kg-Bj6PX3QaF48ID84mBhPlshAZdkj-RSoco_QNQuwFMryH2U=

www.nokia.com/financials. Investors should not rely on summaries of our

financial reports only, but should review the complete financial reports

with tables.

PEKKA LUNDMARK, PRESIDENT AND CEO, ON Q3 2020 RESULTS

In my first quarter as CEO of Nokia, I have seen both opportunities and

challenges. As our solid Q3 results demonstrate, we are making good

progress in many parts of our business. Profitability was up on a

year-on-year basis, we had the fifth consecutive quarter of solid free

cash flow, Nokia Enterprise maintained its double-digit growth, and we

continued to strengthen the competitiveness and cost position of our

mobile radio products.

When I look ahead, however, the good progress we have made is not

enough. Our financial performance in 2021 is expected to be challenging,

and more change is needed. We have lost share at one large North

American customer, see some margin pressure in that market, and believe

we need to further increase R&D investments to ensure leadership in 5G.

In fact, we have decided that we will invest whatever it takes to win in

5G. Our customers are counting on us and we will be there for them.

We announced separately today some important changes to our operating

model. The goal of this new model is to better align with the needs of

our customers, and through that improve our performance and create

shareholder value. The changes announced today mark a shift from

end-to-end as a strategic principle to a more focused approach with each

business group having a distinct role in our overall strategy.

Each of the four new business groups will have P&L responsibility and

ownership of creating a path to becoming one of the market leaders in

their respective sector. The changes optimize our operating model for

better accountability and transparency, increased simplicity and

cost-efficiency.

We plan to share more details about our strategy in December and at a

Capital Markets Day in March. A more rigorous approach to capital

allocation will be key to our strategic direction. As a technology

company we will invest to win in those segments where we choose to

compete.

Equally important is our view of the future, where we see an opportunity

to lead in "network-as-a-service" business models for telecom operators

and enterprise customers. This change offers a broad opportunity for

Nokia to provide a trusted, software-led and cloud-based network

capability that can be rapidly integrated, deployed, and self-managed as

a complete service, allowing us to move up the value chain and provide

additional "network plus" value-adding services. This vision will take

time to become a reality, but Nokia is well positioned to win given our

deep experience in delivering carrier-grade network performance and

extensive work with webscale companies and enterprises.

I have no doubt that the potential of Nokia is substantial, even if

delivering on that promise will take time. We expect to stabilize our

financial performance in 2021 and deliver progressive improvement

towards our long-term goal after that. We intend to provide an update on

long-term outlook at the latest on Capital Markets Day. I am confident

that with the right strategy, focus, and operating model we will be

successful. Today, we embark on that journey.

NOKIA FINANCIAL RESULTS

Constant Constant

EUR million (except YoY currency YoY currency

for EPS in EUR) Q3'20 Q3'19 change YoY change Q1-Q3'20 Q1-Q3'19 change YoY change

---------------------- ----- ----- ------ ----------- -------- -------- ------ -----------

Net sales 5 294 5 686 (7)% (3)% 15 299 16 412 (7)% (6)%

Networks 4 112 4 434 (7)% (3)% 11 825 12 770 (7)% (6)%

Nokia Software 585 677 (14)% (10)% 1 795 1 898 (5)% (4)%

Nokia Technologies 331 358 (8)% (8)% 1 020 1 112 (8)% (8)%

Group Common and

Other 275 236 17% 16% 691 720 (4)% (5)%

Non-IFRS

exclusions (1) (2) (2) (29)

Eliminations (9) (17) (29) (58)

Gross profit 1 976 1 969 0% 5 760 5 614 3%

Operating

profit/(loss) 350 264 33% 444 (318)

Networks 263 128 105% 431 (7)

Nokia Software 87 156 (44)% 246 286 (14)%

Nokia Technologies 274 294 (7)% 846 919 (8)%

Group Common and

Other (138) (100) (499) (329)

Non-IFRS

exclusions (136) (214) (581) (1 187)

Operating margin % 6.6% 4.6% 200bps 2.9% (1.9)% 480bps

Net sales (non-IFRS) 5 294 5 688 (7)% (3)% 15 301 16 441 (7)% (6)%

Gross profit

(non-IFRS) 1 981 2 006 (1)% 5 785 5 765 0%

Operating profit

(non-IFRS) 486 478 2% 1 025 869 18%

Operating margin %

(non-IFRS) 9.2% 8.4% 80bps 6.7% 5.3% 140bps

----- ----- ------ -------- -------- ------

Financial income and

expenses (73) (98) (26)% (134) (326) (59)%

Income taxes (74) (80) (124) 108

Profit/(loss) for the

period 203 87 133% 187 (545)

EPS, diluted 0.04 0.01 300% 0.03 (0.10)

Financial income and

expenses (non-IFRS) (78) (113) (31)% (172) (291) (41)%

Income taxes

(non-IFRS) (103) (101) 2% (202) (161) 25%

Profit for the period

(non-IFRS) 305 267 14% 653 409 60%

EPS, diluted

(non-IFRS) 0.05 0.05 0% 0.11 0.07 57%

----- ----- ------ -------- -------- ------

The financial information in this report is unaudited. Non-IFRS results

exclude costs related to the acquisition of Alcatel-Lucent and related

integration, goodwill impairment charges, intangible asset amortization

and other purchase price fair value adjustments, restructuring and

associated charges and certain other items that may not be indicative of

Nokia's underlying business performance. For details, please refer to

note 2, "Non-IFRS to reported reconciliation", in the notes to the

Financial statement information included in Nokia Corporation Interim

Report for Q3 and January-September 2020. Change in net sales at

constant currency excludes the effect of changes in exchange rates in

comparison to euro, our reporting currency. For more information on

currency exposures, please refer to note 1, "Basis of Preparation", in

the "Financial statement information" section included in Nokia

Corporation Interim Report for Q3 and January-September 2020.

-- Both non-IFRS and reported net sales in Q3 2020 were EUR 5.3bn, compared

to EUR 5.7bn in Q3 2019. On a constant currency basis, both non-IFRS and

reported net sales decreased 3%, primarily due to services within Mobile

Access. The services-related declines in Q3 2020 were primarily driven by

lower levels of network deployment services, consistent with our

expectation, as disclosed in our Outlook section of the Report for Q2 and

Half Year 2020. In Nokia Enterprise, we continued to make great progress

and delivered 15% year-on-year growth in net sales.

-- The impact of COVID-19 on Nokia's financial performance and financial

position was primarily related to factory closures, resulting in a net

sales impact of approximately EUR 200 million in the first nine months of

2020, with the majority of these net sales expected to be shifted to

future periods, rather than being lost. At the end of Q3 2020, we were no

longer experiencing factory closures related to COVID-19. In addition,

COVID-19 has affected our operational costs, and we now expect a

temporary benefit of approximately EUR 250 million due to lower travel

and personnel expenses related to COVID-19 in full year 2020.

-- In Q3 2020, non-IFRS gross margin was 37.4% (reported 37.3%) and non-IFRS

operating margin was 9.2% (reported 6.6%). During the period, Nokia

continued to deliver improvements in gross margin and operating margin.

-- In Networks, gross profit and operating profit increased, driven

primarily by improved performance in Mobile Access and Optical Networks.

In Mobile Access, we continued to drive improvements in our portfolio by

strengthening our roadmaps, reducing product costs and improving our

product performance. In Optical Networks, our significantly improved

year-on-year results were due to a particularly strong Q3 2020, which

benefitted from pent-up demand, following the easing of temporary supply

chain constraints related to COVID-19.

-- Non-IFRS diluted EPS in Q3 2020 was EUR 0.05, compared to EUR 0.05 in Q3

2019, primarily driven by continued progress related to our cost savings

program and a net positive fluctuation in financial income and expenses,

partially offset by a net negative fluctuation in other operating income

and expense, higher investments in 5G R&D to accelerate our product

roadmaps and cost competitiveness in Mobile Access and lower gross

profit.

-- Reported diluted EPS in the first nine months of 2020 was EUR 0.03,

compared to negative EUR 0.10 in the first nine months of 2019. The

change was primarily driven by lower amortization of acquired intangible

assets, continued progress related to our cost savings program, a net

positive fluctuation in financial income and expenses and lower costs

related to network equipment swaps, partially offset by higher

investments in 5G R&D to accelerate our product roadmaps and cost

competitiveness in Mobile Access and a net negative fluctuation in other

operating income and expense.

-- Q3 2020 was the fifth quarter in a row of solid free cash flow. We

established a program in Q1 2019 to focus on free cash flow. Since

establishing this program, reduced working capital has been a significant

source of cash, principally because of lower net sales and, to a lesser

extent, improved execution. During Q3 2020, net cash increased by

approximately EUR 0.3 billion, resulting in an end-of-quarter net cash

balance of approximately EUR 1.9 billion. During Q3 2020, total cash

increased by approximately EUR 0.1 billion, resulting in an

end-of-quarter total cash balance of approximately EUR 7.6 billion.

COVID-19

The COVID-19 pandemic has made vividly clear the critical importance of

connectivity to keep society functioning. We believe we have a resilient

customer base, and we feel a sense of duty to our customers and the

communities they serve.

We believe the impact of COVID-19 on Nokia's financial performance and

financial position has so far been primarily related to factory

closures. Due to significant uncertainties and risks in estimating the

impact of customer-related delivery and implementation challenges, we

are now focusing our COVID-19 disclosure on the impact of factory

closures, which have had a net sales impact of approximately EUR 200

million in the first nine months of 2020, with the majority of these net

sales expected to be shifted to future periods, rather than being lost.

At the end of Q3 2020, we were no longer experiencing factory closures

related to COVID-19. The EUR 200 million of negative impact in the first

nine months of 2020 relates primarily to Alcatel Submarine Networks

within Group Common and Other, which experienced temporary factory

closures that impacted Q1 2020 and Q2 2020.

COVID-19 also affected our operational costs (for example, temporary

lower travel), capital expenditures (temporary delays), cash outflows

related to taxes (tax relief), and net working capital (for example,

lower inventories due to temporary disruptions). In full year 2020, we

now expect a temporary benefit of approximately EUR 250 million due to

lower travel and personnel expenses related to COVID-19, of which

approximately EUR 150 million is expected to benefit operating expenses

and approximately EUR 100 million is expected to benefit cost of sales.

Potential risks and uncertainties continue to exist related to the scope

and duration of the COVID-19 impact and the pace and shape of the

economic recovery following the pandemic.

During the COVID-19 pandemic, we have continued to advance our 5G

roadmap and product evolution, as planned, and we believe that our

COVID-19 mitigation actions in R&D have been successful. We believe we

remain on track with our plans to drive progressive improvement over the

course of 2020.

Health and safety

Naturally, Nokia's first focus during the COVID-19 pandemic is to our

employees. We have in place strict protocols for Nokia facilities and

provided clear advice to our employees about how they can mitigate the

risks of COVID-19 in situations where they have to go about critical

work.

We have taken a range of steps, including banning international travel

for Nokia employees, except for strictly-defined 'critical' reasons;

closing all our facilities to all visitors, with the exception of people

engaged in essential maintenance and services, and asking our staff to

work from home wherever possible. We started implementing these measures

in some regions already in January and have updated guidance as the

situation has developed.

As the overwhelming majority of Nokia employees continue working

remotely, we are providing guidance on how staff can maintain a healthy

work-life balance and look after their physical and mental well-being.

Supporting the essential services our customers provide

The products and services that we provide have never been more critical

in enabling the world to continue to function in an orderly way. We

continue to work closely with all our customers, to ensure that the

changing needs and requirements at this time are well understood and

that we respond appropriately to them.

In Q3 2020, connectivity continued to bring together people isolated

from each other by the COVID-19 pandemic. Remote working and schooling,

robust delivery of basic services and smart deliveries are just some

examples that have been enabled by our connectivity solutions. Our

shared value project with UNICEF in Kenya continued in Q3 2020 with the

first schools connected in September using our Fixed Wireless Access

solution, FastMile. The work started in early 2018. The current COVID-19

pandemic has underlined the importance of connectivity to enable digital

learning and inclusion.

Nokia has a global manufacturing footprint designed for optimized global

supply, and to mitigate against risks such as local disruptive events,

transportation capacity problems, and political risks. Our supply

network consists of 25 factories around the globe and six hubs for

customer fulfillment. As a result, at the Nokia level, we are not

dependent on one location or entity. We have also established a global

command center to manage the supply chain challenges arising from the

outbreak; and we are ready to activate relevant business continuity

plans should the situation in any part of our organization require this.

Impact on asset valuations

COVID-19 has affected the valuations of certain assets, including

investments in non-publicly quoted assets through Nokia's venture fund

investments and pension plans, the valuation of which is inherently

challenging in fast-moving market conditions. In Q3 2020, the valuation

uncertainty has decreased compared to Q2 2020 but still remains elevated

(for details, please refer to note 5 "Pensions and other post-employment

benefits" and note 8 "Fair value of financial instruments") in the

"Financial statement information" section included in Nokia Corporation

interim report for Q3 and January-September 2020).

In relation to its financial statements as of September 30, 2020, Nokia

has also considered the indicators of impairment of goodwill and other

intangible assets, recoverability of deferred tax assets, valuation of

inventories, and collectability of trade receivables and contract

assets. Based on these assessments, COVID-19 is currently not expected

to have long-term effects on Nokia's financial performance that would

require adjustments to the carrying amounts of goodwill and other

intangible assets or deferred tax assets. Also, Nokia has not identified

any material increase in the amount of bad debt or need to adjust the

valuation of inventories.

Doing our part to fight the pandemic

We also feel another sense of duty -- to the societies where Nokia

operates. As a global company, we have a duty to be part of the global

fight against this pandemic. In Q3 2020, we also continued our support

for the mHealth program with UNICEF in Indonesia where their real-time

big data and artificial intelligence platform is allowing policymakers

and citizens to understand the levels of physical distancing, movement

and mobility at the village level. As a result of the insights from the

platform, UNICEF Indonesia has been able to materially assist in the

formation of evidence-based policy to fight COVID-19, ensuring a lower

disease burden and a brighter future in Indonesia.

These actions demonstrate our strong commitment to supporting global

efforts to end the pandemic and overcoming the disruption and challenges

we currently face.

OUTLOOK

Full Year 2020

Non-IFRS diluted earnings EUR 0.23 plus or minus 3 cents (adjusted from

per share EUR 0.25 plus or minus 5 cents)

-------------------------- --------------------------------------------------

Non-IFRS operating margin 9.0% plus or minus 1.0 percentage points (adjusted

from 9.5% plus or minus 1.5 percentage points)

Recurring free cash EUR 600 million plus or minus EUR 250 million

flow(1) (adjusted from clearly positive)

(1) Free cash flow = net cash from/(used in) operating activities -

capital expenditures + proceeds from sale of property, plant and

equipment and intangible assets -- purchase of non-current financial

investments + proceeds from sale of non-current financial investments.

Full Year 2021

Non-IFRS operating margin 7 - 10% (new)

Long term

Nokia intends to provide a long term outlook, latest at Capital Markets

Day on March 18, 2021 (This is in comparison to our previous long term

outlook for 12-14% non-IFRS operating margin in 3 to 5 years.) Due to

ongoing work related to our strategy and new operating model, we believe

it would be premature to provide a long-term outlook.

Dividend

Long term (3 to 5 years) annual dividend distribution target: an earnings-based

growing dividend of approximately 40% to 70% of non-IFRS diluted EPS,

taking into account Nokia's cash position and expected cash flow. The

annual distribution would be paid as quarterly dividends.

KEY DRIVERS OF NOKIA'S OUTLOOK

Networks and Nokia Software are expected to be influenced by factors

including:

-- Our expectation that we will underperform our primary addressable market,

which is expected to decline on a constant currency basis in full year

2020, excluding China (This is in comparison to our earlier commentary to

slightly underperform our primary addressable market, which is expected

to be flattish on a constant currency basis, excluding China). We lowered

our expectations regarding network deployment services within Mobile

Access, and we lowered our expectations for our primary addressable

market, excluding China, due to the impact of COVID-19;

-- Our expectation for operating profit seasonality in 2020 to be similar to

2019, with the majority of operating profit to be generated in the fourth

quarter. Due to our strong free cash flow performance in the first nine

months of 2020, we no longer expect our free cash flow seasonality in

2020 to be similar to 2019;

-- Potential risks and uncertainties related to the scope and duration of

the COVID-19 impact and the pace and shape of the economic recovery

following the pandemic;

-- Competitive intensity, which is particularly impacting Mobile Access and

is expected to continue at a high level in full year 2020, as some

competitors seek to take share in the early stage of 5G;

-- Our expectation that we will accelerate our product roadmaps and cost

competitiveness through additional 5G investments in 2020, thereby

enabling us to drive product cost reductions and maintain the necessary

scale to be competitive;

-- Our expectation that we will drive improvements in automation and

productivity through additional digitalization investments in 2020;

-- Customer demand could weaken and risk could increase further in India,

after the country's Supreme Court upheld a ruling that telecoms companies

must pay retroactive license and spectrum fees;

-- Opportunities and risks in North America following the completion of a

merger, and, more broadly, the potential for temporary capital

expenditure constraints due to potential mergers or acquisitions by our

customers;

-- The timing of completions and acceptances of certain projects;

-- Some customers are reassessing their vendors in light of security

concerns, creating near-term pressure to invest in order to secure

long-term benefits;

-- Our expectation that we will improve our R&D productivity and reduce

support function costs through the successful execution of our cost

savings program, which is explained in more detail in the Cost savings

program section of Nokia Corporation interim report for Q3 and

January-September;

-- Our product and regional mix, including the impact of the high cost level

associated with our first generation 5G products; and

-- Macroeconomic, industry and competitive dynamics.

Nokia Technologies is expected to be influenced by factors including:

-- The timing and value of new and existing patent licensing agreements with

smartphone vendors, automotive companies and consumer electronics

companies;

-- Results in brand and technology licensing;

-- Costs to protect and enforce our intellectual property rights; and

-- The regulatory landscape.

Additionally, our outlook is based on the following assumptions:

-- Nokia's outlook for recurring free cash flow in 2020 is expected to be

supported by an improvement in net working capital performance and

improved operational results, partially offset by a more substantial

difference in 2020 between profit and free cash flow in Nokia

Technologies;

-- In 2020 and 2021, Nokia expects the free cash flow performance of Nokia

Technologies to be approximately EUR 600 million lower than its operating

profit, primarily due to certain major prepayments we received from

certain licensees in 2014 and 2017 (new);

-- Non-IFRS financial income and expenses are expected to be an expense of

approximately EUR 250 million in full year 2020 and EUR 300 million over

the longer-term. (This is in comparison to earlier commentary for an

expense of EUR 300 million in full year 2020 and per annum over the

longer-term). Our updated commentary is primarily due to our expectation

for lower costs related to the sale of receivables and improved FX

results driven by lower expected hedging costs;

-- Non-IFRS income taxes are expected at a rate of approximately 26% in full

year 2020 and approximately 25% over the longer-term, subject to the

absolute level of profits, regional profit mix and changes to our

operating model;

-- Cash outflows related to income taxes are expected to be approximately

EUR 350 million in full year 2020 and approximately EUR 400 million per

annum over the longer term until our US or Finnish deferred tax assets

are fully utilized (This is in comparison to earlier commentary for EUR

400 million in full year 2020 and EUR 450 million per annum over the

longer term.) Our updated commentary is primarily due to our expectation

for lower cash taxes in 2020, driven by COVID-19-related tax reliefs and

delayed timing of certain tax outflows; and uncertainty related to timing

of certain expected cash tax outflows over the longer term; and

-- Capital expenditures are expected to be approximately EUR 500 million in

full year 2020. (This is in comparison to earlier commentary for EUR 550

million in full year 2020 and EUR 600 million over the longer-term.) We

are not currently providing longer-term assumptions for capital

expenditures, and our updated full year 2020 commentary is primarily due

to temporary delays related to COVID-19.

ANALYST CONFERENCE CALL

Nokia's analyst conference call will begin on October 29, 2020 at 3 p.m.

Finnish time. A link to the webcast of the conference call will be

available at

https://www.globenewswire.com/Tracker?data=XPamBNLwnKNl3BEKUNYJTX0CC4JMvJL021VFHQy5bfnvHiKtkSXQWBrMsTeJA1xZL2FioION4BsTg7fOleQmmRH9g8k1XBq1TorDWiQrMoWfuTL3WpA4pGOJ4K5CodgrGnFz4fZl5sdAieB4KbHTXfT-eRJajYxzDG1I6HMPxHwmvxxlLnSZvva89fCBDclfI74LS31pqfM8sM1FDDqv1oEPazpvLz8zs_I4Rj36tl_PH5dOtVntxA9C4g8ZYZZWZuobXnYpeYWF6xb2U0tDGA==

www.nokia.com/financials. Media representatives can listen in via the

link, or call +1-412-717-9224.

Media Inquiries:

Nokia Communications

Tel. +358 10 448 4900

Email:

https://www.globenewswire.com/Tracker?data=ItnweZTz0Hf6K2ZSQyaicEwKl0-QJXnQe5ugEGZ3x0rFzD2WC9WBeCpzqdKoc1SFKQ_sZjsBbLLtxEnC4T0heGKq9UKCSfD7H5yFtVlPC9E=

press.services@nokia.com

Katja Antila, Head of Media Relations

Investor Inquiries:

Nokia Investor Relations

Tel. +358 40 803 4080

Email:

https://www.globenewswire.com/Tracker?data=-PuNZIwt8fW3mLJSzE1kFT2mXfUGlxHZ3pc-XyB5n2K2CAw1lWSLwxPwMMP0863btx3yV2M-ARR9liGYxnek9Po4f7-CVlBD8ZVNZg15LFa91IV7Mj8eHwrZEp877swq

investor.relations@nokia.com

About Nokia

We create the technology to connect the world. Only Nokia offers a

comprehensive portfolio of network equipment, software, services and

licensing opportunities across the globe. With our commitment to

innovation, driven by the award-winning Nokia Bell Labs, we are a leader

in the development and deployment of 5G networks.

Our communications service provider customers support more than 6.4

billion subscriptions with our radio networks, and our enterprise

customers have deployed over 1,300 industrial networks worldwide.

Adhering to the highest ethical standards, we transform how people live,

work and communicate. For our latest updates, please visit us online

www.nokia.com and follow us on Twitter @nokia.

RISKS AND FORWARD-LOOKING STATEMENTS

It should be noted that Nokia and its businesses are exposed to various

risks and uncertainties and certain statements herein that are not

historical facts are forward-looking statements. These forward-looking

statements reflect Nokia's current expectations and views of future

developments and include statements regarding: A) expectations, plans or

benefits related to our strategies, growth management and operational

key performance indicators; B) expectations, plans or benefits related

to future performance of our businesses (including the expected impact,

timing and duration of that impact of COVID-19 on our businesses, our

supply chain and our customers' businesses) and any future dividends

including timing and qualitative and quantitative thresholds associated

therewith; C) expectations and targets regarding financial performance,

cash generation, results, the timing of receivables, operating expenses,

taxes, currency exchange rates, hedging, cost savings, product cost

reductions and competitiveness, as well as results of operations

including targeted synergies, better commercial management and those

results related to market share, prices, net sales, income and margins;

D) expectations, plans or benefits related to changes in organizational

and operational structure; E) expectations regarding competition within

our market, market developments, general economic conditions and

structural and legal change globally and in national and regional

markets, such as China; F) our ability to integrate acquired businesses

into our operations and achieve the targeted business plans and benefits,

including targeted benefits, synergies, cost savings and efficiencies;

G) expectations, plans or benefits related to any future collaboration

or to business collaboration agreements or patent license agreements or

arbitration awards, including income to be received under any

collaboration or partnership, agreement or award; H) timing of the

deliveries of our products and services, including our short term and

longer term expectations around the rollout of 5G, investment

requirements with such rollout, and our ability to capitalize on such

rollout; I) expectations and targets regarding collaboration and

partnering arrangements, joint ventures or the creation of joint

ventures, and the related administrative, legal, regulatory and other

conditions, as well as our expected customer reach; J) outcome of

pending and threatened litigation, arbitration, disputes, regulatory

proceedings or investigations by authorities; K) expectations regarding

restructurings, investments, capital structure optimization efforts,

uses of proceeds from transactions, acquisitions and divestments and our

ability to achieve the financial and operational targets set in

connection with any such restructurings, investments, capital structure

optimization efforts, divestments and acquisitions, including our

current cost savings program; L) expectations, plans or benefits related

to future capital expenditures, reduction of support function costs,

temporary incremental expenditures or other R&D expenditures to develop

or rollout software and other new products, including 5G, ReefShark and

increased digitalization; M) expectations regarding our customers'

future actions, including our customers' capital expenditure constraints

and our ability to satisfy customer's needs and retain their business;

and N) statements preceded by or including "believe", "expect",

"expectations", "deliver", "maintain", "strengthen", "target",

"estimate", "plan", "intend", "assumption", "focus", "continue",

"should", "will" or similar expressions. These forward-looking

statements are subject to a number of risks and uncertainties, many of

which are beyond our control, which could cause our actual results to

differ materially from such statements. These statements are based on

management's best assumptions and beliefs in light of the information

currently available to them. These forward-looking statements are only

predictions based upon our current expectations and views of future

events and developments and are subject to risks and uncertainties that

are difficult to predict because they relate to events and depend on

circumstances that will occur in the future. Factors, including risks

and uncertainties that could cause these differences include, but are

not limited to: 1) our strategy is subject to various risks and

uncertainties and we may be unable to successfully implement our

strategic plans, sustain or improve the operational and financial

performance of our business groups, correctly identify or successfully

pursue business opportunities or otherwise grow our business; 2) general

economic and market conditions, general public health conditions

(including its impact on our supply chains) and other developments in

the economies where we operate, including the timeline for the

deployment of 5G and our ability to successfully capitalize on that

deployment; 3) competition and our ability to effectively and profitably

invest in existing and new high-quality products, services, upgrades and

technologies and bring them to market in a timely manner; 4) our

dependence on the development of the industries in which we operate,

including the cyclicality and variability of the information technology

and telecommunications industries and our own R&D capabilities and

investments; 5) our dependence on a limited number of customers and

large multi-year agreements, as well as external events impacting our

customers including mergers and acquisitions and the possibility of our

customers awarding business to our competitors; 6) our ability to

maintain our existing sources of intellectual property-related revenue

through our intellectual property, including through licensing,

establishing new sources of revenue and protecting our intellectual

property from infringement; 7) our ability to manage and improve our

financial and operating performance, cost savings, competitiveness and

synergies generally, expectations and timing around our ability to

recognize any net sales and our ability to implement changes to our

organizational and operational structure efficiently; 8) our global

business and exposure to regulatory, political or other developments in

various countries or regions, including emerging markets and the

associated risks in relation to tax matters and exchange controls, among

others; 9) our ability to achieve the anticipated benefits, synergies,

cost savings and efficiencies of acquisitions; 10) exchange rate

fluctuations, as well as hedging activities; 11) our ability to

successfully realize the expectations, plans or benefits related to any

future collaboration or business collaboration agreements and patent

license agreements or arbitration awards, including income to be

received under any collaboration, partnership, agreement or arbitration

award; 12) Nokia Technologies' ability to protect its IPR and to

maintain and establish new sources of patent, brand and technology

licensing income and IPR-related revenues, particularly in the

smartphone market, which may not materialize as planned, 13) our

dependence on IPR technologies, including those that we have developed

and those that are licensed to us, and the risk of associated

IPR-related legal claims, licensing costs and restrictions on use; 14)

our exposure to direct and indirect regulation, including economic or

trade policies, and the reliability of our governance, internal controls

and compliance processes to prevent regulatory penalties in our business

or in our joint ventures; 15) our reliance on third-party solutions for

data storage and service distribution, which expose us to risks relating

to security, regulation and cybersecurity breaches; 16) inefficiencies,

breaches, malfunctions or disruptions of information technology systems,

or our customers' security concerns; 17) our exposure to various legal

frameworks regulating corruption, fraud, trade policies, and other risk

areas, and the possibility of proceedings or investigations that result

in fines, penalties or sanctions; 18) adverse developments with respect

to customer financing or extended payment terms we provide to customers;

19) the potential complex tax issues, tax disputes and tax obligations

we may face in various jurisdictions, including the risk of obligations

to pay additional taxes; 20) our actual or anticipated performance,

among other factors, which could reduce our ability to utilize deferred

tax assets; 21) our ability to retain, motivate, develop and recruit

appropriately skilled employees; 22) disruptions to our manufacturing,

service creation, delivery, logistics and supply chain processes, and

the risks related to our production sites; 23) the impact of litigation,

arbitration, agreement-related disputes or product liability allegations

associated with our business; 24) our ability to re-establish investment

grade rating or maintain our credit ratings; 25) our ability to achieve

targeted benefits from, or successfully implement planned transactions,

as well as the liabilities related thereto; 26) our involvement in joint

ventures and jointly-managed companies; 27) the carrying amount of our

goodwill may not be recoverable; 28) uncertainty related to the amount

of dividends and equity return (if any) we are able to distribute to

shareholders for each financial period; 29) pension costs, employee

fund-related costs, and healthcare costs; 30) our ability to

successfully complete and capitalize on our order backlogs and continue

converting our sales pipeline into net sales; 31) risks related to

undersea infrastructure; and 32) the scope and duration of the COVID-19

impact on the global economy and financial markets as well as our

customers, supply chain, product development, service delivery, other

operations and our financial, tax, pension and other assets, and the

shape of the economic recovery following the pandemic as well as the

risk factors specified in our 2019 annual report on Form 20-F published

on March 5, 2020 under "Operating and financial review and

prospects-Risk factors" as supplemented by the form 6-K published on

April 30, 2020 under the header "Risk Factors" and in our other filings

or documents furnished with the U.S. Securities and Exchange Commission.

Other unknown or unpredictable factors or underlying assumptions

subsequently proven to be incorrect could cause actual results to differ

materially from those in the forward-looking statements. We do not

undertake any obligation to publicly update or revise forward-looking

statements, whether as a result of new information, future events or

otherwise, except to the extent legally required.

Attachment

-- Nokia_ results_2020_Q3

https://ml-eu.globenewswire.com/Resource/Download/41cd8e58-6650-4158-a9d3-351acd69b13c

(END) Dow Jones Newswires

October 29, 2020 02:15 ET (06:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

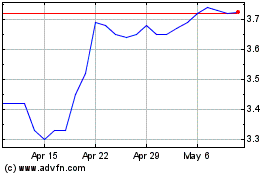

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024