Utilities Look to Green Hydrogen to Cut Carbon Emissions

September 05 2020 - 5:59AM

Dow Jones News

By Katherine Blunt | Photographs by Dan Krauss for The Wall Street Journal

U.S. utilities are increasingly exploring the use of what is

called green hydrogen made from wind and solar energy to reduce

emissions from power plants and pipelines.

The early investments by companies including NextEra Energy Inc.

and Dominion Energy Inc. are expected to help commercialize a

costly technology that has been slow to develop despite its ability

to provide a steady source of carbon-free power. Utilities and

policy makers are beginning to view the technology as necessary to

support ambitious renewable-energy goals.

The Los Angeles Department of Water and Power, the nation's

largest municipal utility, is spearheading a $1.9 billion effort to

convert a coal-fired power plant in Utah to run on natural gas and

hydrogen produced with excess wind and solar power. The plant,

which serves numerous small utilities and electric cooperatives,

has long been one of Southern California's most significant power

sources.

The gas turbines, slated for completion in 2025, will initially

burn a 30% hydrogen fuel mix. Within two decades, they are expected

to run entirely on hydrogen to comply with a California law that

requires the state's electricity supplies to be carbon-free by

2045.

"From a cost perspective, it doesn't compete with natural gas at

this point," said Paul Schultz, director of external energy

resources for LADWP. But he said the utility considers the

conversion a long-term investment in changes that lawmakers and

regulators are requiring.

And the price of green hydrogen is expected to become more

competitive in coming years.

"The costs are going to go one direction, and that's down," said

Craig Wagstaff, Dominion Energy's senior vice president for Western

gas distribution. "It's just a question of how far down they're

going to go."

Hydrogen, which is used in a range of industries, is most often

produced from coal or natural gas through carbon-emitting

processes. The production of green hydrogen, on the other hand,

eliminates those emissions by using renewable energy to strip

hydrogen atoms from water molecules through a process called

electrolysis. Currently, only 1% of the hydrogen produced is green

hydrogen.

A relatively small number of electrolyzers were deployed

globally through 2019. Many more are expected to be in use by 2025

as companies look for ways to cut emissions from power and gas

supplies, transportation and other sectors, according to a report

by research firm Wood Mackenzie.

In June, German engineering firm Apex Energy Teterow GmbH

completed a green-hydrogen plant with a two-megawatt electrolysis

system located near the Baltic Sea.

Growth in green-hydrogen production has been slow in part

because it typically costs three to six times as much as hydrogen

derived from fossil fuels, said Dan Hahn, who leads the global

energy-providers practice for research firm Guidehouse. He expects

costs could fall significantly within the next decade as production

technology develops and policies are implemented that favor green

hydrogen over that derived from fossil fuels.

"We think that even in the next two to three years, costs will

decrease because of the investments that are being made in the

market," Mr. Hahn said.

Juno Beach, Fla.-based NextEra, the nation's largest owner of

wind and solar farms, earlier this year announced plans to invest

$65 million in a project that will use excess solar energy to

produce hydrogen for use in a Florida natural-gas plant. The

20-megawatt electrolysis system, expected to be online in 2023,

will be used to replace a portion of the natural gas in one of the

plant's three gas turbines.

"What makes us really excited about hydrogen...is that it has

the potential to supplement significant deployment of renewables,"

Chief Financial Officer Rebecca Kujawa said in a recent earnings

call. NextEra declined to elaborate on its plans.

Dominion Energy, a Richmond, Va.-based company that provides

electricity or natural gas to about seven million customers in 20

states, is planning to blend hydrogen into its gas-distribution

system to reduce methane and carbon emissions. It is aiming to test

a 5% blend at one of its training sites early next year, with the

intent to incorporate it more widely and eventually increase the

percentage of hydrogen in the system.

Eventually, the company sees potential in using excess wind and

solar power to produce its own hydrogen for power plants and

pipelines as it pushes for net-zero emissions by 2050.

Write to Katherine Blunt at Katherine.Blunt@wsj.com

(END) Dow Jones Newswires

September 05, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

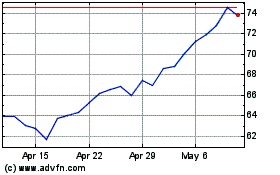

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Apr 2023 to Apr 2024