Current Report Filing (8-k)

August 02 2019 - 4:19PM

Edgar (US Regulatory)

MCKESSON CORP false 0000927653 0000927653 2019-07-31 2019-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 31, 2019

McKesson Corporation

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-13252

|

|

94-3207296

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

6555 State Hwy 161

Irving, TX 75039

(Address of Principal Executive Offices, and Zip Code)

(972)

446-4800

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communication pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communication pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock, $0.01 par value

|

|

MCK

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2

of the Securities Exchange Act of 1934 (17 CFR §

240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

On July 31, 2019, the following items were voted on at the 2019 Annual Meeting of Stockholders (“Annual Meeting”) of McKesson Corporation (“Company”). The stockholder votes on each item, as certified by the Inspector of Election, are shown below.

Item

1

. The Board of Directors’ nominees for directors, as listed in Company’s definitive proxy statement filed with the U.S. Securities and Exchange Commission on June 21, 2019 (“Proxy Statement”), were all elected to serve as directors. The votes were as follows:

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director Nominee

|

|

Votes For

|

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker

Non-Votes

|

|

|

Dominic J. Caruso

|

|

|

150,328,181

|

|

|

|

664,725

|

|

|

|

453,829

|

|

|

|

15,317,200

|

|

|

N. Anthony Coles, M.D.

|

|

|

128,160,810

|

|

|

|

22,835,254

|

|

|

|

450,672

|

|

|

|

15,317,199

|

|

|

M. Christine Jacobs

|

|

|

141,274,161

|

|

|

|

9,736,587

|

|

|

|

435,986

|

|

|

|

15,317,201

|

|

|

Donald R. Knauss

|

|

|

149,994,925

|

|

|

|

995,857

|

|

|

|

455,949

|

|

|

|

15,317,204

|

|

|

Marie L. Knowles

|

|

|

140,784,484

|

|

|

|

10,238,484

|

|

|

|

423,769

|

|

|

|

15,317,198

|

|

|

Bradley E. Lerman

|

|

|

133,735,983

|

|

|

|

17,250,081

|

|

|

|

460,670

|

|

|

|

15,317,201

|

|

|

Edward A. Mueller

|

|

|

131,196,367

|

|

|

|

19,803,011

|

|

|

|

447,355

|

|

|

|

15,317,202

|

|

|

Susan R. Salka

|

|

|

133,430,340

|

|

|

|

17,579,622

|

|

|

|

436,772

|

|

|

|

15,317,201

|

|

|

Brian S. Tyler

|

|

|

150,162,153

|

|

|

|

847,588

|

|

|

|

436,996

|

|

|

|

15,317,198

|

|

|

Kenneth E. Washington

|

|

|

150,390,774

|

|

|

|

593,109

|

|

|

|

462,853

|

|

|

|

15,317,199

|

|

Item

2

. The appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2020 was ratified, having received the following votes:

2

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker

Non-Votes

|

|

157,959,216

|

|

8,255,084

|

|

549,635

|

|

—

|

Item 3

. The proposal to approve, on an advisory basis, the compensation of the Company’s named executive officers was not approved, having received the following votes:

2

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker

Non-Votes

|

|

61,120,284

|

|

89,828,106

|

|

498,322

|

|

15,317,223

|

Item 4

. The stockholder-submitted proposal on disclosure of lobbying activities and expenditures was not approved, having received the following votes:

2

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker

Non-Votes

|

|

68,799,661

|

|

81,404,262

|

|

1,242,785

|

|

15,317,227

|

Item 5

. The stockholder-submitted proposal on 10% ownership threshold for calling special meeting of stockholders was not approved, having received the following votes:

2

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker

Non-Votes

|

|

62,120,524

|

|

88,874,669

|

|

451,064

|

|

15,317,678

|

Each of the items considered at the Annual Meeting is described in further detail in the Proxy Statement. No additional item was submitted at the Annual Meeting for stockholder action.

|

1

|

Under the Company’s majority voting standard, the election of a nominee required that the nominee receive a majority of the votes cast (that is, the number of votes cast “for” each nominee had to exceed the number of votes cast “against” such nominee). Therefore, abstentions and broker

non-votes

were required to be disregarded and had no effect on the vote results.

|

|

2

|

Approval of each proposal with this footnote designation required the affirmative vote of a majority of the shares present, in person or by proxy, and entitled to vote on the proposal at the Annual Meeting. Therefore, abstentions, which represented shares present and entitled to vote, had the same effect as a vote against the proposal. Broker

non-votes,

if any, were required to be disregarded and had no effect on the vote results.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 2, 2019

|

|

|

|

|

McKesson Corporation

|

|

|

|

|

|

By:

|

|

/s/ Lori A. Schechter

|

|

|

|

Lori A. Schechter

|

|

|

|

Executive Vice President, Chief Legal Officer

and General Counsel

|

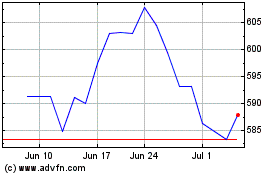

McKesson (NYSE:MCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

McKesson (NYSE:MCK)

Historical Stock Chart

From Apr 2023 to Apr 2024