FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated February 6, 2018

BRASILAGRO – COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro – Brazilian Agricultural Real Estate Company

U

(Translation of Registrant’s Name)

1309 Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São Paulo 01452-002, Brazil

U

(Address of principal executive offices)

Julio Cesar de Toledo Piza Neto,

Chief Executive Officer and Investor Relations Officer,

Tel. +55 11 3035 5350, Fax +55 11 3035 5366, ri@brasil-agro.com

1309 Av.

Brigadeiro Faria Lima, 5

th

floor

São Paulo, São Paulo 01452-002, Brazil

U

(

Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

U

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

U

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

o

No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

For the quarter ended December 31, 2017

|

São Paulo, February 05, 2018 –

BrasilAgro (B3: AGRO3) (NYSE: LND),

the Brazilian leader in acquiring, developing and selling rural properties that offer high potential for price appreciation in Brazil, announces its consolidated results for the year and the quarter ended December 31, 2017. The consolidated quarterly information is prepared in accordance with International Financial Reporting Standards (IFRS).

|

|

Conference Call 2Q18

February 06, 2018

|

|

Portuguese with simultaneous English translation

2:00 p.m. (Brasília)

11:00 a.m. (NY)

Phone: +55 (11) 3127 4971 Phone: +1 516 300 1066

Password: BrasilAgro

|

|

www.brasil-agro.com

|

2

|

BRASILAGRO 2018

|

|

PRICE

|

CONTACTS

|

|

AGRO3: R$ 13.48

LND: US$ 4.04

|

+ 55 (11) 3035 5374

ri@brasil-agro.com

|

|

|

|

|

Gustavo Javier Lopez

IRO

|

|

|

|

Ana Paula Zerbinati Ribeiro

Thaís Lima

Investor Relations

|

|

www.brasil-agro.com

|

3

|

BRASILAGRO 2018

|

MESSAGE FROM MANAGEMENT

We closed the first half of the 2017/2018 harvest year (“6M18”) with the conclusion of the grains planting of 35,600 hectares in Brazil and Paraguay, including soybean and corn, totaling a planted area of 101,500 hectares, in addition to sugarcane, pasture and leased areas.

In November, we ended the 8

th

year of sugarcane supply, delivering 1.8 million tons, with a harvested area of 27,100 hectares, yield of 68.51 ton/ha and net margin of R$5.1 thousand/ha.

Weather conditions were good, enabling the good development of soybean and corn crops to date, maintaining our production estimates. Also regarding our operational activities, we closed 6M18 with 15,700 head of cattle.

With this operating performance, we reached a Net Income of R$31.6 million, an Adjusted EBITDA of R$59.2 million and Net Revenue of R$174.6 million. This result reflects the sale of

1.3 million

tons of agricultural products (soybean, corn and sugarcane) in the semester.

The granting of the Great Place to Work certification, recognizing BrasilAgro as an excellent working environment, was also an important achievement. This certificate seals all the work carried out on process improvement and training and development of people, which are the Company’s foundation.

In December 2017, we held the BrasilAgro Day, which brought together more than 60 investors and was attended by the Company's executive officers and entire operations team. The event addressed the outlook for the sector in the upcoming harvests and our plans for the coming years.

The macroeconomic scenario brings good prospects due to the reduction of interest rates, which promotes an injection of resources into the productive system, benefiting the agribusiness sector as a whole. We are aware and prepared to take advantage of the opportunities that may arise, as well as confident that the favorable scenario will help us reach our goals.

|

www.brasil-agro.com

|

4

|

BRASILAGRO 2018

|

OPERATING PERFORMANCE

Definitions:

2Q17 and 2Q18 – quarter ended December 31, 2016 and 2017, respectively | 2016/2017 Harvest Year – fiscal year started on July 01, 2016 and ended on June 30, 2017 | 2017/2018 Harvest Year – fiscal year started on July 01 and ended on June 30, 2018.

Operating Performance

On the date of this release, the Company’s property portfolio consisted of 225,877 hectares across six Brazilian states and Paraguay.

|

www.brasil-agro.com

|

5

|

BRASILAGRO 2018

|

Development of Areas

We are undergoing a process to transform approximately 2,000 hectares in Paraguay, representing an average growth of 32% in the portfolio transformation in the last 10 years.

Market Value of the Portfolio

In 2017, we hired the independent consulting firm Deloitte Touche Tohmatsu to conduct a market valuation of our properties. According to their appraisal, as of June 30, 2017, the market value of the portfolio was

R$1.4 billion

.

We internally appraise, on an annual basis, the market value of our farms. And on June 30, 2017, date of the appraisal, the market value of our portfolio was R$1.3 billion, an increase of 24.6% in relation to the previous year.

In order to estimate the market value of our farms, we considered for each property: (i) its level of development; (ii) soil quality and maturity; and (iii) agricultural aptitude and potential.

The table below shows the portfolio’s internal market valuation as of June 30, 2016 and 2017 and the independent market valuation performed by independent consulting firm Deloitte Touche Tohmatsu on June 30, 2017.

Agricultural Operations

|

www.brasil-agro.com

|

6

|

BRASILAGRO 2018

|

The table below shows the breakdown of the planted area by farm in the 17/18 Harvest:

|

Planted Area - Crop 17/18

|

Ratoon Cane

|

Cane Plant

|

Soybean

|

Corn

|

Corn - 2nd Crop

|

Pasture

|

Other

|

Total

|

|

Jatobá Farm

|

|

|

4,203

|

1,582

|

|

5,005

|

10,057

|

20,847

|

|

Alto Taquari Farm

|

3,070

|

437

|

|

|

|

|

176

|

3,683

|

|

Araucária Farm

|

2,949

|

473

|

|

|

|

|

255

|

3,677

|

|

Chaparral Farm

|

|

|

9,596

|

1,195

|

|

5,002

|

3,522

|

19,315

|

|

Preferência Farm

|

|

|

|

|

|

6,376

|

134

|

6,510

|

|

Partnership II Farm

|

|

|

7,452

|

|

|

|

|

7,452

|

|

Partnership III Farm

|

3,081

|

806

|

|

|

|

|

357

|

4,244

|

|

São José Farm and Partnership IV Farm

|

15,847

|

3,770

|

5,255

|

|

350

|

|

|

25,222

|

|

Palmeiras

|

|

|

5,300

|

996

|

|

3,262

|

967

|

10,525

|

|

Total

|

24,947

|

5,486

|

31,806

|

3,773

|

350

|

19,645

|

15,468

|

101,475

|

|

|

|

|

|

|

|

|

|

|

|

Planted area by crop (ha)

|

Crop 16/17

|

Crop 17/18

|

Harvest Participation 17/18 (%)

|

Change (%)

|

|

Grains

|

30,139

|

35,929

|

35.4%

|

19.2%

|

|

Soybean

|

22,549

|

31,806

|

31.3%

|

41.1%

|

|

Corn

|

7,590

|

4,123

|

4.1%

|

-45.7%

|

|

Sugarcane

|

29,698

|

30,433

|

30.0%

|

2.5%

|

|

Pasture

|

16,425

|

19,645

|

19.4%

|

19.6%

|

|

Others

|

12,611

|

15,468

|

15.2%

|

22.7%

|

|

Total

|

88,873

|

101,475

|

100.0%

|

14.2%

|

|

|

|

|

|

|

|

|

|

|

|

Area Planted by Land Ownership (ha)

|

Crop 16/17

|

Crop 17/18

|

Harvest Participation 17/18 (%)

|

Change (%)

|

|

Ownn Area

|

59,678

|

74,557

|

73.5%

|

24.9%

|

|

Operated by BrasilAgro

|

52,027

|

64,014

|

63.1%

|

23.0%

|

|

Leased to third parties

|

7,651

|

10,543

|

10.4%

|

37.8%

|

|

Leased area

|

29,195

|

26,918

|

26.5%

|

-7.8%

|

|

Total

|

88,873

|

101,475

|

100.0%

|

14.2%

|

GRAINS

We conclude the planting of grain crops in Brazil and Paraguay. So far, we have maintained our yield estimates, due to the good rainfall levels in the planting areas.

|

Productivity per culture (tons)

|

Crop 16/17

Realizad

|

Crop 17/18

Estimated

|

Change

(%)

|

Crop 17/18 Estimated

until Jan/18

|

Change

(%)

|

|

Soybean

|

65,057

|

82,020

|

26.1%

|

78,367

|

-4.5%

|

|

Corn

|

40,502

|

27,111

|

-33.1%

|

20,593

|

-24.0%

|

|

Corn - 2nd Crop

|

-

|

2,319

|

n.a.

|

2,730

|

17.7%

|

|

Total

|

105,559

|

111,450

|

5.6%

|

101,690

|

-8.8%

|

The reduction of the total production estimative of 8.8% in relation to the initial one, was due to the leasing of 1,200 hectares to third parties in Jatobá Farm, which reduced the area operated by the Compnay. The estimated yields, as mentioned above, remains the same.

SUGARCANE

The following table shows the sugarcane results appropriated in the sugarcane harvest year (April to November) and during the Company’s fiscal year:

|

www.brasil-agro.com

|

7

|

BRASILAGRO 2018

|

|

Year Crop Result - Sugarcane

|

2016

(01/apr a 31/dec)

|

2017

(01/apr a 31/dec)

|

Change

(%)

|

2017 Estimated

(01/apr a 30/nov)

|

Change

(%)

|

|

Tons Harvested

|

869,501

|

1,858,754

|

113.8%

|

1,660,174

|

12.0%

|

|

Hectares harvested

|

10,336

|

27,130

|

162.5%

|

25,977

|

4.4%

|

|

TCH - Harvest Tons per Hectares

|

84.12

|

68.51

|

-18.6%

|

63.91

|

7.2%

|

|

|

|

|

|

|

|

|

Accounting Year Result - Sugarcane

|

6M17

|

6M17

|

Change

(%)

|

|

Tons Harvested

|

539,221

|

1,378,554

|

155.7%

|

|

Hectares harvested

|

6,659

|

20,431

|

206.8%

|

|

TCH - Harvest Tons per Hectares

|

81.0

|

67.5

|

-16.7%

|

In November, we ended the 8

th

year of sugarcane supply in the Alto Taquari, Araucária, Parceria III and Parceria IV Farms, delivering 1.8 million tons, from April to November, the sugarcane harvest year.

We started the renewal of the cane field for the new sugarcane harvest and we will plant another 5,486 hectares in the farms in the Midwest region and in Maranhão.

The reduction of tons harvested per hectare is due to the sugarcane crop reform period in the areas harvested at the São José Farm. These areas were not being managed in accordance with the Company’s quality standards and thus are being reformed in order to improve their productivity and quality levels.

CATTLE RAISING

As of December 31, we had 15,740 head of cattle in the Preferência and Jatobá Farms and in Paraguay, distributed in 11,381 hectares of already active pasture in Brazil and 3,262 hectares of already active pasture in Paraguay.

|

Livestock

|

2Q18

|

Crop 17/18

Estimated

|

Change

(%)

|

|

Hectares

|

14,643

|

14,029

|

4.4%

|

|

Number of heads

|

15,740

|

15,799

|

-0.4%

|

|

Meat production (kg)

|

711,178

|

2,414,186

|

-70.5%

|

|

Weight Gain per Day

|

0.30

|

0.42

|

-28.6%

|

|

Weight Gain per hectare

|

48.57

|

172.09

|

-71.8%

|

OTHERS

In order to improve the Company’s results and mitigate operating risks, we leased 10,543 hectares to third parties in the state of Bahia and in the Midwest region, as a real estate strategy. The areas were leased to local farmers and the contracts have a term of up to five harvests.

In addition, we have 4,925 hectares of grasses cover crops and sorghum, in order to increase the organic matter and accelerate the maturation of the soil.

|

www.brasil-agro.com

|

8

|

BRASILAGRO 2018

|

FINANCIAL PERFORMANCE

The consolidated financial statements were prepared and are being presented in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board.

EBITDA and Adjusted EBITDA

EBITDA is calculated as gross profit adjusted by general, administrative, and selling expenses, other operating revenue and depreciation expenses. Adjusted EBITDA was calculated by excluding biological assets in progress (sugarcane and grains) and adjusting for the harvest’s derivative results and depreciation expenses, including depreciation of fixed assets of the farms and administrative installations, developed areas and permanent crops.

|

EBITDA (R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Gross Profit

|

28,221

|

7,828

|

260.5%

|

60,349

|

11,432

|

427.9%

|

|

Selling expenses

|

(1,353)

|

(210)

|

544.3%

|

(2,090)

|

(120)

|

1641.7%

|

|

General and administrative expenses

|

(7,165)

|

(6,221)

|

15.2%

|

(14,790)

|

(13,674)

|

8.2%

|

|

Other operating income/expenses, net

|

(723)

|

(3,006)

|

-75.9%

|

(1,244)

|

(5,617)

|

-77.9%

|

|

Depreciations and amortizations

|

9,880

|

1,158

|

753.2%

|

17,973

|

6,838

|

162.8%

|

|

EBITDA

|

28,860

|

(451)

|

n.a.

|

60,198

|

(1,141)

|

n.a.

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Gross Profit

|

28,221

|

7,828

|

260.5%

|

60,349

|

11,432

|

427.9%

|

|

Elimination of gains on biological assets (grains and sugarcane planted)

|

2,062

|

1,548

|

33.2%

|

3,008

|

2,981

|

0.9%

|

|

Selling expenses

|

(1,353)

|

(210)

|

544.3%

|

(2,090)

|

(120)

|

1641.7%

|

|

General and administrative expenses

|

(7,165)

|

(6,221)

|

15.2%

|

(14,790)

|

(13,674)

|

8.2%

|

|

Other operating income/expenses, net

|

(723)

|

(3,006)

|

-75.9%

|

(1,244)

|

(5,617)

|

-77.9%

|

|

Derivatives Results

|

(356)

|

1,173

|

n.a.

|

640

|

1,173

|

-45.5%

|

|

Adjusted Depreciations

1

|

4,768

|

2,238

|

113.0%

|

13,287

|

6,129

|

116.8%

|

|

EBITDA Cresca

2

|

(39)

|

(383)

|

-89.7%

|

(9)

|

(391)

|

-97.6%

|

|

Adjusted EBITDA

|

25,416

|

2,968

|

756.4%

|

59,152

|

1,914

|

2990.6%

|

|

1- Adjusted Depreciation includes depreciation of harvested grains and sugarcane.

|

|

2- The amounts refer to Cresca’s administrative expenses. The operating result in Paraguay is consolidated to BrasilAgro.

|

|

www.brasil-agro.com

|

9

|

BRASILAGRO 2018

|

Income Statement

Since March 2017, the results of the operation in Paraguay have been disclosed, consolidated with the results of the operation in Brazil.

NET REVENUE FROM SALES OF AGRICULTURAL PRODUCTS

|

Net Revenue (R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Total

|

47,838

|

17,592

|

171.9%

|

131,584

|

57,747

|

127.9%

|

|

Soybean

|

452

|

374

|

21.0%

|

6,595

|

6,219

|

6.0%

|

|

Corn

|

5,645

|

-

|

n.a.

|

8,399

|

320

|

2528.6%

|

|

Sugarcane

|

38,654

|

15,460

|

150.0%

|

112,182

|

48,948

|

129.2%

|

|

Livestock

|

2,149

|

-

|

n.a.

|

2,528

|

-

|

n.a.

|

|

Leasing

|

1,084

|

864

|

25.5%

|

1,923

|

818

|

135.2%

|

|

Services

|

-

|

(3)

|

-100.0%

|

-

|

26

|

-100.0%

|

|

Others

|

(146)

|

897

|

n.a.

|

(43)

|

1,417

|

n.a.

|

|

|

|

|

|

|

|

|

|

Tons

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Total

|

349,448

|

110,965

|

214.9%

|

1,250,243

|

519,038

|

140.9%

|

|

Soybean

|

188

|

155

|

21.1%

|

6,970

|

5,404

|

29.0%

|

|

Corn

|

13,712

|

-

|

n.a.

|

18,468

|

416

|

4339.4%

|

|

Sugarcane

|

335,495

|

110,807

|

202.8%

|

1,224,751

|

512,697

|

138.9%

|

|

Others

|

54

|

3

|

1708.7%

|

54

|

521

|

-89.6%

|

In 2Q18, the recorded net revenue from sales was R$47.8 million, an increase of R$30.2 million when compared to the previous year, as a result of the increase in volume sold during the period.

Net revenue from grains (soybean and corn) in 6M18 increased by 43.6% versus the same period of the previous year, from R$6.5 million, from the sale of 5,800 tons of grains, to R$14.9 million, from the sale of 25,400 tons.

Soybean revenue increased by 6.0% in 6M18 when compared to the previous year, from R$6.2 million, from the sale of 5,400 tons at R$1,150.88 per ton, to R$6.6 million, from the sale of 6,900 tons at R$946.18 per ton.

Corn revenue in 6M18 increased by R$8.0 million when compared to the previous year, from R$320 thousand from the sale of 416 tons at R$768.05 per ton to R$8.4 million, from the sale of 18,500 tons at R$454.77 per ton. Corn sold in 6M18 was produced in the last harvest and was stored as a sales strategy.

Sugarcane revenue in 6M18 increased by R$63.2 million when compared to the previous year, from R$48.9 million from the sale of 512,700 tons at R$95.47 per ton, to R$112.2 million from the sale of 1.2 million tons at R$91.60 per ton of sugarcane. The reduction in per-ton sugarcane price was due to the 1% reduction in the TRS (total recoverable sugar), which went from 146,62 kg/ton (0.668 R$/kg) in 6M17 to 145.43 kg/ton (0.669 R$/kg) in 6M18. The difference of 153,800 tons of sugarcane produced in relation to the total sold is the result of

leasing payment.

|

www.brasil-agro.com

|

10

|

BRASILAGRO 2018

|

Cattle-raising revenue totaled R$2.5 thousand in 6M18, resulting from the sale of 1,191 head of cattle in Brazil and Paraguay at R$4,57 per kg.

Leasing revenue reached R$1.9 million in 6M18 and reflects the third-party leases of Farms in the state of Bahia.

The amount recorded in other sales revenue was R$43 thousand in 6M18 due to the payment of taxes (FUNRURAL). During the same period of the previous year, we had other revenue in the amount of R$1.4 million, which came from the sale of inputs (seeds, fertilizers and byproducts) from areas that were not planted in the 2017/18 harvest year.

GAINS OR LOSSES OF AGRICULTURAL PRODUCTS AND BIOLOGICAL ASSETS

|

Biological Assets and Agricultural Products (R$ thousand)

|

Soybean

16/17

|

Corn(1)

16/17

|

Sugarcane

|

Cattle

|

Others

|

Gain / Loss in 12/31/2017

|

|

Gain and loss on agricultural products

|

-

|

640

|

41,836

|

-

|

(118)

|

42,357

|

|

Gain and loss on biological assets

|

3,656

|

(148)

|

(2,860)

|

(903)

|

-

|

(256)

|

|

Change on biological assets fair value

|

3,656

|

492

|

38,975

|

(903)

|

(118)

|

42,101

|

Gains or losses from the variation in the fair value of agricultural products are determined by the difference between their harvested volume at market value (net of selling expenses and taxes) and the production costs incurred (direct and indirect costs, leasing and depreciation).

Harvested agricultural products are measured at their value at the time of harvest considering the market price of the area of each farm.

Since July 1, 2016, biological assets corresponding to ratoons of sugarcane have been measured at cost less depreciation (Accounting Standard IAS 16), while planted cane will continue to be measured at fair value (Accounting Standard IAS 41).

|

Biological Assets (R$ thousand)

|

|

Gain / Loss in

12/31/2017

|

|

Area (hectares)

|

|

20,431

|

|

Prodution (Tons)

|

|

1,378,554

|

|

Productivity (Ton./ha)

|

|

67

|

|

Fair Value (R$)

|

|

107,104

|

|

Cost of production (R$)

|

|

(65,268)

|

|

Gain and loss on biological assets (R$)

|

|

41,836

|

Biological assets correspond to agricultural products in formation (not yet harvested) and cattle, measured at the net present value of the expected cash flow from these products. The calculation of fair value considers the best estimates in relation to sales prices, discount rates, direct and indirect costs, leasing, yields and selling expenses.

|

www.brasil-agro.com

|

11

|

BRASILAGRO 2018

|

Cattle biological assets are measured at fair value and controlled in accordance with two methodologies: 12 to 15-month calves and steers (heifers) are controlled and valued by head, while older animals are controlled by weight.

Fair value variation is impacted by variations between fair value and cost, as well as by fair value variations between the periods.

Gains or losses from the variation in the fair value of grains and sugarcane biological assets are determined by the difference between their fair value and their book value. Book value includes investments and costs effectively incurred until the moment of appraisal, as well as write-offs arising from the harvesting of the agricultural products.

The table below shows the results of the sugarcane harvest:

|

Year ended June 30, 2017

|

Crop 2016

|

Crop 2017

|

Total

|

|

Net Revenues

|

48,949

|

71,971

|

120,920

|

|

Cost of Sales

|

(43,420)

|

(74,455)

|

(117,875)

|

|

Gain (loss) of agriculture products

|

7,215.00

|

11,524

|

18,739

|

|

Profit (loss)

|

12,744

|

9,040

|

21,784

|

|

Tons harvested

|

535,103

|

480,200

|

1,015,303

|

|

|

|

|

|

|

Year ended December 31, 2017

|

Crop 2016

|

Crop 2017

|

Total

|

|

Net Revenues

|

-

|

112,182

|

112,182

|

|

Cost of Sales

|

-

|

(97,495)

|

(97,495)

|

|

Gain (loss) of agriculture products

|

-

|

38,975

|

38,975

|

|

Profit (loss)

|

-

|

53,662

|

53,662

|

|

Tons harvested

|

-

|

1,378,554

|

1,378,554

|

IMPAIRMENT (REVERSAL OF PROVISIONS OF THE RECOVERABLE AMOUNT OF AGRICULTURAL PRODUCTS, NET)

A provision to adjust inventories at the net realized value of agricultural products is constituted when the fair value of the inventory is higher than the realized value. The realization value is the sales price estimated during the normal course of business less estimated selling expenses.

On December 31, 2017, the recognized amount corresponded to a gain of R$913 thousand.

|

www.brasil-agro.com

|

12

|

BRASILAGRO 2018

|

COST OF PRODUCTION

|

(%)

|

Soybean

|

Corn

|

Sugarcane

|

Livestock

|

|

Variable costs

|

|

|

|

|

|

Seeds

|

15%

|

16%

|

0%

|

0%

|

|

Fertilizers

|

16%

|

23%

|

10%

|

1%

|

|

Defensive

|

19%

|

15%

|

6%

|

0%

|

|

Agricultural services

|

19%

|

16%

|

47%

|

0%

|

|

Fuels and Lubricants

|

4%

|

4%

|

8%

|

1%

|

|

Maintence of machines and instruments

|

0%

|

0%

|

0%

|

6%

|

|

Animal Feed

|

0%

|

0%

|

0%

|

9%

|

|

Others

|

3%

|

2%

|

2%

|

5%

|

|

Fixed costs

|

24%

|

24%

|

27%

|

78%

|

|

Labor

|

4%

|

2%

|

3%

|

11%

|

|

Depreciation and amortization

|

11%

|

12%

|

12%

|

66%

|

|

Leasing

|

6%

|

8%

|

10%

|

0%

|

|

Others

|

3%

|

2%

|

2%

|

1%

|

|

(R$ / thousand)

|

Crop16/17

Realized

|

Crop 17/18

Estimated

|

Change

|

|

Soybean

|

2,159

|

2,163

|

0.2%

|

|

Corn

|

2,397

|

2,164

|

-9.7%

|

|

Sugarcane

|

4,416

|

5,140

|

16.4%

|

The increase in the cost of production of sugarcane reflects the carrying out costs of the São José Farm, which did not occur in the previous harvest.

COST OF GOODS SOLD

|

(R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Total of cost of goods sold

|

(47,438)

|

(11,844)

|

300.5%

|

(114,249)

|

(51,287)

|

122.8%

|

|

Soybean

|

4

|

165

|

-97.3%

|

(5,978)

|

(5,546)

|

7.8%

|

|

Corn

|

(5,406)

|

32

|

n.a.

|

(8,326)

|

(178)

|

4579.6%

|

|

Sugarcane

|

(40,062)

|

(10,996)

|

264.3%

|

(97,495)

|

(43,420)

|

124.5%

|

|

Livestock

|

(2,218)

|

(12)

|

18352.1%

|

(2,629)

|

(57)

|

4510.8%

|

|

Others

|

244

|

(1,034)

|

n.a.

|

179

|

(2,087)

|

n.a.

|

Cost of goods sold (COGS) came to R$114.2 million in 6M18. Due to the fair value adjustments of agricultural products, period changes in costs are directly linked to the market price of commodities at the time of harvest.

Total soybean COGS increased by 7.8% in 6M18 when compared to the previous year, from R$5.5 million, from the sale of 5,400 tons at R$1,026.23 per ton, to R$5.9 million, from the sale of 6,900 tons at R$857.59 per ton. Total soybean COGS in 2Q18 and 2Q17 reflects the reversal of the provision for loss.

Total corn COGS increased by R$8.1 million in 6M18 versus the previous year, from R$178 thousand, from the sale of 416 tons at R$427.68 per ton, to R$8.3 million, from the sale of 18,500 tons at R$450,82 per ton.

|

www.brasil-agro.com

|

13

|

BRASILAGRO 2018

|

Total sugarcane COGS increased by R$54.0 million in 6M18 versus the previous year, from R$43.4 million, from the sale of 512,700 tons at R$84.69 per ton, to R$97.5 million, from the sale of 1.2 million tons at R$79.60 per ton of sugarcane.

Total cattle-raising COGS reached R$2.6 million in 6M18 and reflects the net result of animal death and birth during the period (R$0.1 million) and the sales cost of 1,191 head of cattle in Brazil and Paraguay at R$2,100.00 per head (R$2.5 million).

Other COGS in the amount of R$179 thousand in 6M18 mainly refers to the raw material inventory adjustment. In 6M17, other COGS in the amount of R$2.0 million refers to the sale of inputs (seeds, fertilizers and byproducts).

SELLING EXPENSES

|

(R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Selling expenses

|

(1,353)

|

(210)

|

543.4%

|

(2,090)

|

(120)

|

1636.7%

|

|

Freight

|

(66)

|

(11)

|

478.8%

|

(203)

|

(16)

|

1135.7%

|

|

Storage and Processing

|

(817)

|

(194)

|

321.5%

|

(1,443)

|

(374)

|

286.0%

|

|

Others

|

(470)

|

(5)

|

9297.9%

|

(444)

|

270

|

n.a.

|

In 6M18 we recorded R$2.0 million in selling expenses. This result is due to the increase in freight, reflected by the increase in grain sales during the period.

The increase in storage and processing expenses in 6M18 is due to the increase in storage expenses for grain inventory from the 2016/17 harvest.

Other selling expenses refer to the loss for doubtful debtors (PDD).

GENERAL AND ADMINISTRATIVE EXPENSES

|

(R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

General and administrative expenses

|

(7,165)

|

(6,221)

|

15.2%

|

(14,790)

|

(13,674)

|

8.2%

|

|

Depreciations and amortizations

|

(164)

|

(174)

|

-5.7%

|

(337)

|

(351)

|

-4.0%

|

|

Personnel expenses

|

(4,406)

|

(3,454)

|

27.6%

|

(9,247)

|

(8,789)

|

5.2%

|

|

Expenses with services provider

|

(987)

|

(730)

|

35.2%

|

(2,275)

|

(1,677)

|

35.7%

|

|

Leases and Rents

|

(190)

|

(188)

|

1.1%

|

(296)

|

(389)

|

-23.9%

|

|

Others expenses

|

(1,418)

|

(1,675)

|

-15.3%

|

(2,635)

|

(2,468)

|

6.8%

|

As of March 2017, we began to consolidate general and administrative expenses of the operation in Paraguay, which were previously accounted for under the equity pick up.

In 6M18, general and administrative expenses increased by 8.2% in comparison to the same period of the previous year, from R$13.7 million to R$14.8 million.

The 35.7% increase in expenses with service providers is mainly due to the expenses with advisors for the development of new projects, legal advice and information technology.

|

www.brasil-agro.com

|

14

|

BRASILAGRO 2018

|

The 23.9% decrease in leases and rents is mainly due to renegotiations of lease contracts.

OTHER OPEARTING INCOME / EXPENSES

|

(R$ thousand)

|

2Q18

|

2Q17

|

Change

%

|

6M18

|

6M17

|

Change

%

|

|

Other operating income/expenses

|

(723)

|

(3,006)

|

-75.9%

|

(1,244)

|

(5,617)

|

-77.9%

|

|

Gain/Loss on sale of fixed assets

|

(124)

|

(33)

|

275.8%

|

(159)

|

(522)

|

-69.5%

|

|

Management Fee - Cresca Reversal

|

-

|

(1,440)

|

-100.0%

|

-

|

(2,490)

|

-100.0%

|

|

Provisions for lawsuits

|

209

|

(93)

|

n.a.

|

(111)

|

(462)

|

-76.0%

|

|

Others

|

(808)

|

(1,440)

|

-43.9%

|

(974)

|

(2,143)

|

-54.5%

|

In 6M18, other operating expenses dropped by 77.9%, from R$5.6 million in 6M17 to R$1.2 million in 6M18. This drop was mainly due to the management fee reversal of Cresca, in the amount of R$2.5 million.

FINANCIAL RESULT

|

(R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Total

|

(1,367)

|

3,068

|

n.a.

|

7,485

|

16,420

|

-54.4%

|

|

Interest

|

(1,983)

|

(1,007)

|

96.9%

|

6,120

|

(2,065)

|

n.a.

|

|

Exchange variations

|

133

|

(171)

|

n.a.

|

160

|

(310)

|

n.a.

|

|

Monetary Variations

|

1,644

|

(377)

|

n.a.

|

64

|

223

|

-71.3%

|

|

Unwind of present value adjustment

|

(2,080)

|

(3,594)

|

-42.1%

|

(1,409)

|

(1,493)

|

-5.6%

|

|

Results with derivatives

|

754

|

6,347

|

-88.1%

|

2,279

|

10,180

|

-77.6%

|

|

Other financial income / expenses

|

165

|

1,870

|

-91.2%

|

271

|

9,885

|

-97.3%

|

The consolidated financial result is composed of the following items: (i) interest on financing; (ii) the impact of the monetary variation on the amount payable from the acquisition of the Nova Buriti Farms; (iii) the impact of the U.S. dollar exchange variation on the offshore account and Cresca’s receivables; (iv) the present value of Cremaq, Araucária and Jatobá Farms’ sales receivables, fixed in soybean bags; (v) the result from hedge operations; and (vi) bank fees and expenses and returns on cash investments.

Interest variation is mainly due to the recognition of the financial revenue obtained from the Nova Buriti Farm renegotiation, in the amount of R$9.3 million and interest on loans and financing in the amount of R$4.7 million.

The derivatives result reflects the commodities hedge operations result and the impact of the exchange variation on cash, which was partially dollarized in order to maintain purchasing power in regard to inputs, investments and new acquisitions, which have a positive correlation with the U.S. currency. In 6M18, the result of derivative transactions was R$2.3 million, of which R$45.0 thousand are related to currency operations and R$2.2 million are related to operations with commodities. In 6M17, derivative operations totaled R$10.2 million, of which R$6.2 million are a loss related to currency operations and R$4.0 million are in operations with commodities.

|

www.brasil-agro.com

|

15

|

BRASILAGRO 2018

|

The reduction in other financial income / expenses is due to the decrease in the Company’s cash position, from an average cash flow of R$178.4 million in 6M17 to R$52.0 million in 6M18 and also decrease in the SELIC rate (Brazil’s basic interest rate) in the period, in addition to bank fees and expenses with financial investments.

On August 30, 2017, the title deed for the Nova Buriti Farm was given and, consequently, the payment of the Farm balance was paid. The Farm’s total price was adjusted, with the partial cancellation of the monetary adjustments (by the IGP-M – General Market Price Index) that would be owed by the Company. The amount of R$9.3 million was recognized as financial income in 6M18 and the outstanding balance of the debt will not be restated.

DERIVATIVE OPERATIONS

Our risk policy primarily aims to hedge the Company’s cash flow. In this context, we are concerned not only with the main components of our revenue, but also the main components of our production costs. We therefore monitor on a daily basis: a) the international prices of the main agricultural commodities produced by the Company, usually expressed in U.S. dollars; b) the base premium, i.e. the difference between the international and domestic commodity price; c) exchange rates; and d) the prices of the main components such as freight, fertilizers and chemicals, that can significantly impact costs.

The points analyzed when deciding on the price and margin hedging strategy and tools are listed below:

• Estimated gross margin based on the current price environment.

• Standard deviation from the estimated gross margin for different pricing strategy scenarios.

• Analysis of the estimated gross margin in stress scenarios for different hedge strategies.

• Comparison between current estimates and the Company’s budget.

• Comparison of the estimated gross margin and the historical average.

• Market expectations and trends.

• Tax aspects.

|

www.brasil-agro.com

|

16

|

BRASILAGRO 2018

|

Hedge Position on January 31, 2018

|

Crop

|

Soybean

|

FX

|

|

Volume

(1)

|

% hedge

(2)

|

Price (USD/bu)

|

Volume (thousand)

|

% hedge

(3)

|

BRL/USD

|

|

17/18

|

54.182 ton

|

76.1%

|

10.49

|

27,135

|

99.6%

|

3.33

|

|

(1) Net production volume estimated + receivables from farm sales.

|

|

(2) Prcentage of volume in tons soybean locked in.

|

|

(3) Prcentage of expected revenur in USD.

|

|

www.brasil-agro.com

|

17

|

BRASILAGRO 2018

|

Balance Sheet

NET ASSET VALUE – NAV

|

(R$ thousand)

|

December 31, 2017

|

|

BOOK

|

NAV

|

|

Brazil Equity

|

693,770

|

693,770

|

|

Paraguay Equity

|

99,978

|

99,978

|

|

BrasilAgro's Equity

|

793,748

|

793,748

|

|

Brazil Equity

|

|

693,770

|

|

Brazil's Land Value

|

|

1,164,062

|

|

(-) Balance Sheet - Net Agri Openning Capex

|

|

-49,431

|

|

(-) Balance Sheet - Land Value

|

|

-395,409

|

|

Paraguay Equity

|

|

99,978

|

|

(+) Paraguay Land Value

|

|

143,074

|

|

(-) Balance Sheet - Land Value

|

|

-197,705

|

|

NAV

|

793,748

|

1,458,340

|

|

Shares

|

56,889

|

56,889

|

|

NAV per share

|

13.95

|

25.63

|

CASH AND CASH EQUIVALENTS

|

Cash and Cash equivalents

|

12/31/2017

|

06/30/2017

|

Change

|

|

Cash and Cash equivalents

|

21,422

|

43,798

|

-51.1%

|

|

Cash and Banks

|

12,775

|

15,159

|

-15.7%

|

|

Repurchase agreements

|

8,647

|

28,639

|

-69.8%

|

|

Markable securities

|

1,050

|

6,972

|

-84.9%

|

|

Restricted financial investments

|

2

|

2

|

0.0%

|

|

Bank deposit certificates

|

655

|

-

|

n.a.

|

|

Banco do Nordeste (loan guarantees)

|

-

|

5,502

|

-100.0%

|

|

Treasury financial bills

|

393

|

1,468

|

-73.2%

|

|

Restricted Markable securities

|

17,712

|

17,088

|

3.7%

|

|

Bank deposit certificates

|

9,298

|

8,982

|

3.5%

|

|

Banco do Nordeste (loan guarantees)

|

8,414

|

8,106

|

3.8%

|

|

Total

|

40,184

|

67,858

|

-40.8%

|

The Company ended the quarter with a cash position of R$40.2 million, a decrease of 40.8% over June 30, 2017, mainly due to debt payments of R$7.8 million, investments of R$2.7 million, payment of dividends in the amount of R$13.0 million and payment of bonuses in the amount of R$4.2 million.

|

www.brasil-agro.com

|

18

|

BRASILAGRO 2018

|

INVENTORY

|

(R$ thousand)

|

12/31/2017

|

06/30/2017

|

Change

|

|

Soybean

|

862

|

6,837

|

-87.4%

|

|

Corn

|

704

|

6,819

|

-89.7%

|

|

Livestock

|

22,110

|

11,153

|

98.2%

|

|

Other crops

|

299

|

50

|

498.0%

|

|

Agricultural Products

|

23,975

|

24,859

|

-3.6%

|

|

Supplies

|

19,366

|

8,952

|

116.3%

|

|

Total

|

43,341

|

33,811

|

28.2%

|

INDEBTEDNESS

|

Loans and Financing (R$ thousand)

|

Expiration (Position in 12/31/2017)

|

Annual Interest Tax - %

|

12/31/2017

|

06/30/2017

|

Change

|

|

Short term

|

|

|

|

|

|

|

Financiamento de Custeio Agrícola

|

Sep-18

|

8,50 to 12,75

|

54,203

|

10,703

|

406.4%

|

|

Financiamento Projeto Bahia

|

Dec - 18

|

TJLP + 3,45 and 4,45 / SELIC + 3,45 / Pre 4,00 to 9,00

|

3,132

|

15,236

|

-79.4%

|

|

Capital de Giro

|

May - 18

|

1,40 to 2,30% + 100% CDI

|

26,821

|

15,782

|

69.9%

|

|

Capital de Giro (USD)

|

Aug - 17

|

3.49%

|

-

|

5,031

|

-100.0%

|

|

Financiamento de Máquinas e Equipamentos

|

Dec - 18

|

TJLP + 3.73

|

198

|

1

|

19700.0%

|

|

Financiamento de cana-de-açúcar

|

Dec - 18

|

TJLP + 2.70 and 12.75

|

2,063

|

8,248

|

-75.0%

|

|

Arrendamento Financeiro Canavial - Parceria III

|

May - 18

|

6.92%

|

2,404

|

1,619

|

48.5%

|

|

|

|

|

88,821

|

56,620

|

56.9%

|

|

Long term

|

|

|

|

|

|

|

Financiamento de cana-de-açúcar

|

Dec - 23

|

TJLP + 2.70 and 12.75%

|

27,126

|

1,025

|

2546.4%

|

|

Financiamento de Máquinas e Equipamentos

|

Jun- 24

|

TJLP + 3,73%

|

5,866

|

1,208

|

385.6%

|

|

Financiamento Projeto Bahia

|

Aug- 23

|

TJLP + 3,45 and 4,45 / SELIC + 3,45 / Pre 4,00 to 9,00

|

22,139

|

30,862

|

-28.3%

|

|

Arrendamento Financeiro Canavial - Parceria III

|

Nov-18

|

6.92%

|

-

|

1,665

|

-100.0%

|

|

Arrendamento Financeiro Canavial - Parceria IV

|

Jan-32

|

R$/kg 0,6462

|

23,314

|

20,795

|

12.1%

|

|

|

|

|

78,445

|

55,555

|

41.2%

|

|

Total

|

|

|

167,266

|

112,175

|

49.1%

|

On December 31, 2017 and June 30, 2017, the balance of loans and financing was R$167.3 million and R$112.2 million, respectively. The payment of interest and principal totaled R$60.5 million in 6M18.

During the period, a total of R$101.3 million was disbursed in new financing referring to the cost of sugarcane, soybean and corn operations and R$7.9 million was disbursed for investments related to farm opening.

|

www.brasil-agro.com

|

19

|

BRASILAGRO 2018

|

ACQUISITIONS PAYABLE

|

(R$ thousand)

|

Adjustment Rate

|

12/31/2017

|

06/30/2017

|

Change

|

|

Nova Buriti Farm

|

IGP-M

|

5,371

|

22,085

|

-75.7%

|

|

São José Farm

|

CDI

|

2,417

|

2,561

|

-5.6%

|

|

Total

|

|

7,788

|

24,646

|

-68.4%

|

On August 30, 2017, the title deed for the Nova Buriti Farm was given and, consequently, the partial payment of R$5.8 million was made. Part of the remaining balance, R$1.5 million, was paid on October 18, 2017.

In January 2018, R$6.1 million of the outstanding balance of accounts payable on acquisitions were paid, which will be recorded in the next quarter.

At the time of the negotiation, the Farm’s total price was adjusted, with the partial cancellation of the monetary adjustments (by the IGP-M - General Market Price Index) that would be owed by the Company. The discount on the amount of R$9.3 million was recognized as financial income in 6M18 and the outstanding balance of the debt will not be restated.

PROPERTIES FOR INVESTMENT

The fundamental pillars of the Company’s business strategy are the acquisition, development, exploration and sale of rural properties suitable for agricultural activities. The Company acquires rural properties with significant potential for generating value, subsequently holding the assets and carrying out profitable agricultural activities on them.

Once we acquire our rural properties, we begin to implement high-value added crops and to transform these rural properties by investing in infrastructure and technology, while also entering into lease agreements with third parties. In line with our strategy, when we deem a rural property has reached its optimal value, we sell it to capture the capital gains.

The rural properties acquired by the Company are booked at their acquisition cost, which does not exceed their realized net value, and are recognized under “Non-Current Assets".

Properties for investment are evaluated at their historical cost, plus investments in buildings, improvements and the clearing of new areas, less accrued depreciation, in accordance with the same criteria detailed for fixed assets.

|

www.brasil-agro.com

|

20

|

BRASILAGRO 2018

|

|

Farm

|

Acquisition value

|

Buildings and improvements

|

Opening area

|

Construction in progress

|

Properties for Investment

|

|

Initial Balance

|

300,487

|

26,369

|

53,021

|

9,922

|

389,799

|

|

In June 30, 2017

|

|

|

|

|

|

|

Acquisitions

|

914

|

99

|

609

|

10,300

|

11,922

|

|

Reductions

|

-

|

-53

|

-

|

-1

|

-54

|

|

(-) Depreciation/ Amortization

|

-

|

-412

|

-5,846

|

-

|

-6,258

|

|

In December 31, 2017

|

301,401

|

26,003

|

47,784

|

20,221

|

395,409

|

On December 31, 2017, we recorded R$20.2 million in ongoing work, which refers to the clearance of areas at the Chaparral and Araucária Farms.

CAPEX – AREA OPENING

|

(R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Maintenance

|

1,428

|

1,245

|

14.8%

|

2,622

|

1,350

|

94.3%

|

|

Opening

|

1,221

|

1,973

|

-38.1%

|

5,609

|

5,761

|

-2.6%

|

|

Total

|

2,649

|

3,218

|

-17.7%

|

8,231

|

7,111

|

15.8%

|

DEPRECIATION – AREA OPENING

|

(R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Maintenance

|

(571)

|

(462)

|

23.7%

|

(1,143)

|

(926)

|

23.5%

|

|

Opening

|

(2,348)

|

(2,216)

|

5.9%

|

(4,690)

|

(4,387)

|

6.9%

|

|

Total

|

(2,919)

|

(2,678)

|

9.0%

|

(5,833)

|

(5,313)

|

9.8%

|

|

www.brasil-agro.com

|

21

|

BRASILAGRO 2018

|

CAPITAL MARKETS

The Company was the first agricultural production company to list its shares on the Novo Mercado segment of the B3 (São Paulo Stock Exchange) and was also the first Brazilian agribusiness company to list its ADRs (American Depositary Receipts) on NYSE (New York Stock Exchange).

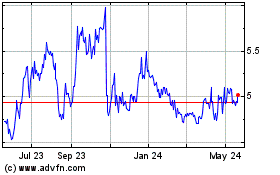

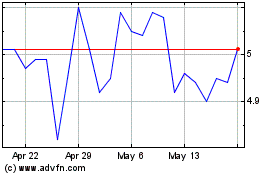

Share Performance

On February 02, 2018, BrasilAgro’s shares (AGRO3) were traded at R$13.48, resulting in a market cap of R$766.8 million, while its ADRs (LND) were traded at US$4.04.

|

HIGHLIGHTS - AGRO3

|

2Q18

|

2Q17

|

|

Average Daily Trade Volume (R$)

|

998,681

|

643,854

|

|

Maximun (R$ per share)

|

13.39

|

11.05

|

|

Mininum (R$ per share)

|

11.46

|

9.40

|

|

Average (R$ per share)

|

12.39

|

10.13

|

|

Closing Quote (R$ per share)

|

12.52

|

10.13

|

|

Variation in the period (%)

|

-1.65%

|

5.24%

|

During 2Q18, BrasilAgro’s shares reached a trading volume of R$58.4 million, from 8,316 trades, with a daily average traded volume of R$1.0 million.

|

www.brasil-agro.com

|

22

|

BRASILAGRO 2018

|

CORPORATE GOVERNANCE

BrasilAgro Day

On December 11, 2017, the Company held the BrasilAgro Day, which addressed market issues, with the presence of an industry expert, and presented the Company’s plans for the coming years.

The event was also attended by the Company’s executive officers and more than 60 people, including investors, shareholders, market analysts and other professionals.

|

www.brasil-agro.com

|

23

|

BRASILAGRO 2018

|

Social and environmental

In accordance with its values, the Company is commited to be socially and environmentally responsible, since part of our business is to invest in properties and in its surroundings. And the Company has been increasingly transforming this commitment into concrete actions, investing in social and environmental actions that contribute to the development of the regions where it operates. Below are some of these actions carried out in São Paulo.

|

Bloomberg Square Mile Relay Race

|

|

|

The Company participated in the street race, organized by Bloomberg, whose registration fee was used to help fund the Parque Ibirapuera Conservação Institution, responsible for the park conservation.

|

|

Sementes do Amanhã Institution

|

|

|

The Sementes do Amanhã (Seeds of Tomorrow) Institution provides activities for the development and social inclusion of underprivileged children in Taboão da Serra – SP. In November and December, the Company’s employees collected children’s books that were donated to the Institution’s library.

|

|

|

www.brasil-agro.com

|

24

|

BRASILAGRO 2018

|

|

Casa do Zezinho

|

|

|

|

Since its foundation, Casa da Zezinho has been a space that promotes the development for 900 children and young people living in situations of high social vulnerability. The Company sponsored - and its employees worked as volunteers - at the Institution's end-of-year party, which was attended by children and adolescents participating in the project.

|

|

Amigos do Bem

|

|

|

The Amigos do Bem Institution promotes income generation to the communities of the backlands of Brazil's Northeast region, through the cultivation of cashew and sale of handicrafts, in addition to providing infrastructure to these communities. We have a partnership with the Institution where our team of agricultural technicians assisted in the agricultural evaluation of its cashew plantation areas in the Northeastern region, as well as providing technical support to the land irrigation viability project.

|

|

|

www.brasil-agro.com

|

25

|

BRASILAGRO 2018

|

|

Disclaimer

|

|

The statements contained in this document related to the prospects for BrasilAgro’s businesses, projected operating and financial income and growth are merely projections, and as such are based exclusively on management’s expectations. These expectations depend materially on market conditions, the performance of the Brazilian economy, the industry and international markets, and are therefore subject to change without prior notice.

|

WEIGHTS AND MEASURES USED IN AGRICULTURE

|

www.brasil-agro.com

|

26

|

BRASILAGRO 2018

|

INCOME STATEMENT

|

(R$ thousand)

|

2Q18

|

2Q17

|

Change

|

6M18

|

6M17

|

Change

|

|

Revenues from grains

|

6,300

|

190

|

3215.8%

|

15,577

|

6,973

|

123.4%

|

|

Revenues from sugarcane

|

39,938

|

16,345

|

144.3%

|

115,347

|

50,590

|

128.0%

|

|

Revenues from leasing

|

1,384

|

906

|

52.8%

|

2,434

|

934

|

160.6%

|

|

Revenues from Livestock

|

2,547

|

-

|

n.a.

|

2,547

|

-

|

n.a.

|

|

Other revenues

|

(376)

|

1,298

|

n.a.

|

69

|

1,670

|

-95.9%

|

|

Deductions from gross revenue

|

(1,955)

|

(1,147)

|

70.4%

|

(4,390)

|

(2,420)

|

81.4%

|

|

Net Sales Revenue

|

47,838

|

17,592

|

171.9%

|

131,584

|

57,747

|

127.9%

|

|

Change in fair value of biological assets and agricultural products

|

27,866

|

2,118

|

1215.7%

|

42,101

|

5,223

|

706.1%

|

|

Impairment

|

(45)

|

(38)

|

18.4%

|

913

|

(251)

|

n.a.

|

|

Net Revenue

|

75,659

|

19,672

|

284.6%

|

174,598

|

62,719

|

178.4%

|

|

Cost of agricultural products sale

|

(47,438)

|

(11,844)

|

300.5%

|

(114,249)

|

(51,287)

|

122.8%

|

|

Gross Profit

|

28,221

|

7,828

|

260.5%

|

60,349

|

11,432

|

427.9%

|

|

Selling expenses

|

(1,353)

|

(210)

|

544.3%

|

(2,090)

|

(120)

|

1641.7%

|

|

General and administrative expenses

|

(7,165)

|

(6,221)

|

15.2%

|

(14,790)

|

(13,674)

|

8.2%

|

|

Depreciations and amortizations

|

(164)

|

(174)

|

-5.7%

|

(337)

|

(351)

|

-4.0%

|

|

Personnel expenses

|

(4,406)

|

(3,454)

|

27.6%

|

(9,247)

|

(8,789)

|

5.2%

|

|

Expenses with services provider

|

(987)

|

(730)

|

35.2%

|

(2,275)

|

(1,677)

|

35.7%

|

|

Leases and Rents

|

(190)

|

(188)

|

1.1%

|

(296)

|

(389)

|

-23.9%

|

|

Others expenses

|

(1,418)

|

(1,675)

|

-15.3%

|

(2,635)

|

(2,468)

|

6.8%

|

|

Other operating income/expenses, net

|

(723)

|

(3,006)

|

-75.9%

|

(1,244)

|

(5,617)

|

-77.9%

|

|

Equity pick up

|

(656)

|

(1,157)

|

-43.3%

|

(1,397)

|

(2,300)

|

-39.3%

|

|

Financial result

|

(1,367)

|

3,068

|

n.a.

|

7,485

|

16,420

|

-54.4%

|

|

Financial income

|

22,917

|

25,477

|

-10.0%

|

42,997

|

50,328

|

-14.6%

|

|

Interest on Financial Investments

|

481

|

2,771

|

-82.6%

|

1,271

|

12,279

|

-89.6%

|

|

Interest on assets

|

812

|

1,435

|

-43.4%

|

10,838

|

2,595

|

317.6%

|

|

Monetary variations

|

321

|

-

|

n.a.

|

321

|

-

|

n.a.

|

|

Foreign exchange variations on liabilities

|

5,180

|

7,252

|

-28.6%

|

5,706

|

8,021

|

-28.9%

|

|

Unwind of present value adjustment

|

9,405

|

(693)

|

n.a.

|

12,347

|

3,145

|

292.6%

|

|

Realized results with derivatives

|

1,646

|

6,292

|

-73.8%

|

3,616

|

9,907

|

-63.5%

|

|

Unrealized results with derivatives

|

5,072

|

8,420

|

-39.8%

|

8,898

|

14,381

|

-38.1%

|

|

Financial expenses

|

(24,284)

|

(22,409)

|

8.4%

|

(35,512)

|

(33,908)

|

4.7%

|

|

Interest expenses

|

(91)

|

(529)

|

-82.8%

|

(671)

|

(1,578)

|

-57.5%

|

|

Bank charges

|

(225)

|

(372)

|

-39.5%

|

(329)

|

(816)

|

-59.7%

|

|

Interest on liabilities

|

(2,795)

|

(2,442)

|

14.5%

|

(4,718)

|

(4,660)

|

1.2%

|

|

Monetary variations

|

(188)

|

(171)

|

9.9%

|

(161)

|

(310)

|

-48.1%

|

|

Foreign exchange variations on liabilities

|

(3,536)

|

(7,629)

|

-53.7%

|

(5,642)

|

(7,798)

|

-27.6%

|

|

Unwind of present value adjustment

|

(11,485)

|

(2,901)

|

295.9%

|

(13,756)

|

(4,638)

|

196.6%

|

|

Realized results with derivatives

|

(2,613)

|

(641)

|

307.6%

|

(3,894)

|

(2,079)

|

87.3%

|

|

Unrealized results with derivatives

|

(3,351)

|

(7,724)

|

-56.6%

|

(6,341)

|

(12,029)

|

-47.3%

|

|

Profit (loss) before income and social contribution taxes

|

16,957

|

302

|

5515.1%

|

48,313

|

6,141

|

686.7%

|

|

Income and social contribution taxes

|

(5,454)

|

(1,682)

|

224.3%

|

(16,676)

|

(4,499)

|

270.7%

|

|

Profit (loss) for the period

|

11,503

|

(1,380)

|

n.a.

|

31,637

|

1,642

|

1826.8%

|

|

Outstanding shares at the end of the period

|

56,888,916

|

56,888,916

|

0.0%

|

56,888,916

|

56,888,916

|

0.0%

|

|

Basic earnings (loss) per share - R$

|

0.20

|

(0.02)

|

n.a.

|

0.56

|

0.03

|

18.27

|

|

www.brasil-agro.com

|

27

|

BRASILAGRO 2018

|

BALANCE SHEET – ASSETS

|

Assets (R$ thousand)

|

12/31/2017

|

06/30/2017

|

Change

|

|

Current assets

|

|

|

|

|

Cash and Cash equivalents

|

21,422

|

43,798

|

-51.1%

|

|

Markable securities

|

1,050

|

6,972

|

-84.9%

|

|

Trade accounts receivable

|

74,277

|

54,026

|

37.5%

|

|

Inventories

|

21,231

|

22,658

|

-6.3%

|

|

Biologial assets

|

84,060

|

38,260

|

119.7%

|

|

Derivative financial instruments

|

4,713

|

4,090

|

15.2%

|

|

Transactions with related parties

|

2,595

|

1,298

|

99.9%

|

|

|

209,348

|

171,102

|

22.4%

|

|

Non-current assets

|

|

|

|

|

Biological assets

|

22,110

|

13,435

|

64.6%

|

|

Markable securities

|

17,712

|

17,088

|

3.7%

|

|

Diferred taxes

|

38,076

|

53,780

|

-29.2%

|

|

Derivative financial instruments

|

85

|

1

|

8400.0%

|

|

Accounts receivable and sundry credits

|

40,783

|

44,605

|

-8.6%

|

|

Investment properties

|

395,409

|

389,799

|

1.4%

|

|

Transactions with related parties

|

36,800

|

35,640

|

3.3%

|

|

Investments

|

99,978

|

101,426

|

-1.4%

|

|

Property, plant and euipment

|

58,518

|

54,745

|

6.9%

|

|

Intagible assets

|

1,490

|

1,672

|

-10.9%

|

|

|

710,961

|

712,191

|

-0.2%

|

|

|

|

|

|

|

Total assets

|

920,309

|

883,293

|

4.2%

|

|

www.brasil-agro.com

|

28

|

BRASILAGRO 2018

|

BALANCE SHEET – LIABILITIES

|

Liabilities (R$ thousand)

|

12/31/2017

|

06/30/2017

|

Change

|

|

Current liabilities

|

|

|

|

|

Trade accounts payable and other obligations

|

34,474

|

55,615

|

-38.0%

|

|

Loans and financing

|

88,821

|

56,620

|

56.9%

|

|

Labor obligations

|

4,359

|

11,513

|

-62.1%

|

|

Derivative financial instruments

|

4,643

|

3,978

|

16.7%

|

|

Accounts payable for acquisitions

|

7,788

|

24,646

|

-68.4%

|

|

Transactions with related parties

|

4,965

|

4,784

|

3.8%

|

|

|

145,050

|

157,156

|

-7.7%

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

Trade accounts payable and other obligations

|

1,286

|

1,520

|

-15.4%

|

|

Loans and financing

|

78,445

|

55,555

|

41.2%

|

|

Derivative financial instruments

|

53

|

-

|

n.a.

|

|

Provision for legal claims

|

1,705

|

1,594

|

7.0%

|

|

|

81,489

|

58,669

|

38.9%

|

|

Total liabilities

|

226,539

|

215,825

|

5.0%

|

|

|

|

|

|

|

Equity

|

|

|

|

|

Capital

|

584,224

|

584,224

|

n.a.

|

|

Capital reserves

|

1,153

|

1,525

|

-24.4%

|

|

Treasury shares

|

(35,208)

|

(36,797)

|

-4.3%

|

|

Profits reserves

|

68,615

|

68,615

|

0.0%

|

|

Proposed additional dividends

|

-

|

6,486

|

-100.0%

|

|

Equity variation adjustment

|

43,329

|

43,415

|

-0.2%

|

|

Accumulated losses

|

31,657

|

-

|

n.a.

|

|

Total equity

|

693,770

|

667,468

|

3.9%

|

|

Total liabilities and equity

|

920,309

|

883,293

|

4.2%

|

|

www.brasil-agro.com

|

29

|

BRASILAGRO 2018

|

CASH FLOW

|

R$ (thousand)

|

6M18

|

6M17

|

Change

|

|

CASH FLOW OF OPERATIONAL ACTIVITIES

|

|

|

|

|

Profit (loss) for the period

|

31,637

|

1,642

|

1826.8%

|

|

Adjustments to reconcile net income

|

-

|

-

|

0.0%

|

|

Depreciation and amortization

|

17,973

|

6,838

|

162.8%

|

|

Residual value of fixed assets

|

201

|

1,456

|

-86.2%

|

|

Cost result capitalized in investment properties

|

54

|

62

|

-12.9%

|

|

Equity Pickup

|

1,397

|

2,300

|

-39.3%

|

|

Gain (loss) unrealized results with derivatives

|

(2,557)

|

(2,352)

|

8.7%

|

|

Exchange rate, monetary and financial charges unrealized

|

(6,195)

|

(8,549)

|

-27.5%

|

|

Adjustment to present value for receivables from sale of farms, machinery and financial leasings

|

1,409

|

1,493

|

-5.6%

|

|

Income and social contribution taxes

|

15,704

|

2,765

|

468.0%

|

|

Fair value of biological assets and agricultural products and depletion of harvest

|

(42,101)

|

(5,224)

|

705.9%

|

|

Provision (Reversal) of impairment of agricultural products after harvest

|

(913)

|

251

|

n.a.

|

|