HSBC 1st Half Profit Rises on Growth in Retail Banking, Wealth Management

August 06 2018 - 2:33AM

Dow Jones News

By Kenan Machado

HONG KONG--HSBC Holdings PLC (0005.HK) said first-half net

profit rose 2.4% from a year earlier thanks to fees from

money-management services, particularly in Hong Kong.

The U.K. lender said Monday net profit for the six months ended

in June increased to $7.17 billion from $7.00 billion.

Profit before tax rose 4.6% to $10.71 billion.

Revenue rose 4.3% to $27.29 billion from $26.2 billion on higher

margins on deposits and balance growth as well as favorable

currency effects, the bank said.

However, taking into account currency moves and one-time

charges, adjusted profit before tax fell 1.8%.

Higher deposits by retail customers and "strong" sales of wealth

management products in Hong Kong helped revenue grow in the

lender's retail banking and wealth management segments, HSBC said.

The segments' collective contribution to first-half profit rose to

nearly 30% from 27.5%.

"We also grew our share of the U.K. mortgage market," said Group

Chief Executive John Flint.

Banks, particularly in Hong Kong and elsewhere in Asia, earn

lucrative fees for managing the money of wealthy clients who seek

to beat low returns on deposits. Having significant operations in

Hong Kong has helped HSBC as rich Chinese opt to keep money in the

city, outside the mainland.

For the second quarter, net profit rose 5.7% from a year

earlier, to $4.09 billion from $3.87 billion. Profit before tax

rose to $5.96 billion from $5.3 billion.

HSBC announced a dividend of $0.31 per ordinary share.

Hong Kong-listed shares of HSBC rose nearly 1% to 73 Hong Kong

dollars after the lunch break.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

August 06, 2018 02:18 ET (06:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

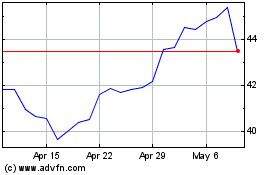

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

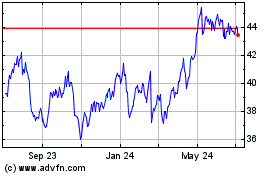

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024