As filed with the U.S. Securities and Exchange Commission on February 22, 2024

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

Global Payments Inc.

(Exact name of registrant as specified in its charter)

| |

Georgia

|

|

|

58-2567903

|

|

| |

(State or other jurisdiction of

incorporation or organization)

|

|

|

(I.R.S. Employer

Identification Number)

|

|

3550 Lenox Road

Atlanta, Georgia 30326

(770) 829-8000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David L. Green

Senior Executive Vice President, Chief Administrative and Legal Officer and Corporate Secretary

Global Payments Inc.

3550 Lenox Road

Atlanta, Georgia 30326

(770) 829-8256

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

Jacob A. Kling

Meng Lu

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

(212) 403-1000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☒

|

|

|

Accelerated filer ☐

|

|

| |

Non-accelerated filer ☐

|

|

|

Smaller reporting company ☐

|

|

| |

|

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

GLOBAL PAYMENTS INC.

$1,500,000,000 1.00% Convertible Senior Notes due 2029

and

any Common Stock issuable upon conversion

On August 8, 2022, we sold $1,500,000,000 principal amount of our 1.00% Convertible Senior Notes due 2029 (the “notes”) pursuant to an investment agreement among us and Silver Lake Partners VI DE (AIV), L.P., a Delaware limited partnership, and Silver Lake Alpine II, L.P, a Delaware limited partnership (the “Initial Purchasers”). The offer and sale of the notes were effected in transactions exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”).

The notes are currently held by SLP VI Galaxy Holdings II, L.P., SLP VI Galaxy Holdings, L.P., SLA II Galaxy Holdings, L.P. and SLP Galaxy Co-Invest, L.P. (collectively, the “selling securityholders”), each an affiliate of the Initial Purchasers. This prospectus may be used from time to time by the selling securityholders to offer up to $1,500,000,000 in aggregate principal amount of the notes and the shares of our common stock, no par value (“common stock”) issuable upon conversion of the notes, if any, in any manner described under “Plan of Distribution” in this prospectus. The selling securityholders may sell the notes or any such shares of common stock in one or more transactions at fixed prices, at prevailing market prices at the time of sale, at prices related to such prevailing market prices, at varying prices determined at the time of sale or at privately negotiated prices directly to purchasers or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions. If the selling securityholders use underwriters, broker-dealers or agents, we will name them and describe their compensation in a supplement to this prospectus as may be required. We will receive no proceeds from any sale by the selling securityholders of the securities offered by this prospectus, but in some cases we have agreed to pay certain registration expenses. Please read this prospectus and any applicable prospectus supplement carefully before you invest.

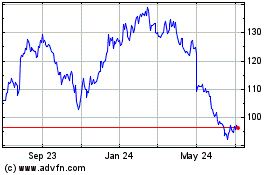

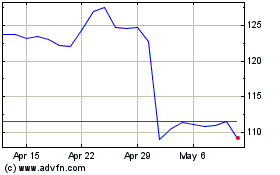

The notes are not listed on any securities exchange. Our common stock is listed on the New York Stock Exchange (“NYSE”) and trades under the symbol “GPN.” On February 21, 2024, the closing sale price of our common stock was $132.46 per share.

You should read this prospectus and the applicable prospectus supplement, as well as the documents incorporated and deemed to be incorporated by reference in this prospectus and any applicable prospectus supplement, carefully before you invest in the securities described in the applicable prospectus supplement.

Investing in our securities involves risks. You should carefully consider the risk factors referred to on page 9 of this prospectus, in any applicable prospectus supplement and in the documents incorporated by reference or deemed incorporated by reference in this prospectus and any applicable prospectus supplement before you invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus or any prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 22, 2024.

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

48 |

|

|

|

|

|

|

|

|

58 |

|

|

|

|

|

|

|

|

59

|

|

|

Unless we state otherwise or the context requires otherwise, references to “Global Payments,” the “Company”, “we,” “us,” “our” or similar terms are to Global Payments Inc. and its subsidiaries. References to “$” and “dollars” are to United States dollars.

This prospectus, any applicable prospectus supplement and any free writing prospectus filed by us do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do they constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

For investors outside of the United States, neither we nor any selling securityholders have done anything that would permit the offering, possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to the offering, possession or distribution of this prospectus outside of the United States.

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement that we filed on Form S-3 with the Securities and Exchange Commission (the “SEC”) under a “shelf” registration process. By using a shelf registration statement, the selling securityholders named in this prospectus may offer and sell the securities described in this prospectus in one or more offerings or resales.

In connection with an offer or sale of the securities described in this prospectus, we may provide a prospectus supplement or other type of offering document or supplement (together referred to herein as a “prospectus supplement”) that may add, update or change information contained in this prospectus, and accordingly, to the extent inconsistent, information in this prospectus is superseded by the information in such applicable prospectus supplement or free writing prospectus. Information about the selling securityholders may change over time. Any changed information given to us by the selling securityholders will be set forth in a prospectus supplement if and when necessary. Further, in some cases, the selling securityholders will also be required to provide a prospectus supplement containing specific information about the terms on which it is offering and selling notes or shares of common stock. You should read this prospectus and any applicable prospectus supplement together with the additional information described under the heading “Where You Can Find More Information.”

This prospectus contains summaries of certain provisions contained in key documents described in this prospectus. All of the summaries are qualified in their entirety by the actual documents, which you should review before making your investment decision. Copies of the documents referred to herein have been filed, or will be filed or incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

You should rely only on the information contained or incorporated or deemed incorporated by reference in this prospectus, in any applicable prospectus supplement or in any free writing prospectus filed by us or on behalf of us with the SEC. We have not authorized anyone to provide any information other than that contained in this prospectus or in any prospectus supplement or free writing prospectus prepared by or on behalf of us or to which we may have referred you. We do not take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We have not authorized any other person to provide you with different or additional information, and we are not making an offer to sell securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date hereof or, in the case of information incorporated or deemed incorporated by reference herein, as of the date thereof, regardless of the time of delivery of the prospectus or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since the date of such information. Neither the delivery of this prospectus or any applicable prospectus supplement nor any distribution of securities pursuant to such documents shall, under any circumstances, create any implication that there has been no change in the information set forth in this prospectus or any applicable prospectus supplement or in our affairs since the date of this prospectus or any applicable prospectus supplement.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from the SEC website at http://www.sec.gov.

The SEC allows us to incorporate by reference the information we file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and later information that we file with the SEC will automatically update and, to the extent inconsistent, supersede this information. SEC rules and regulations also permit us to “furnish” rather than “file” certain reports and information with the SEC. Any such reports or information which we “furnish” or have “furnished” shall not be deemed to be incorporated by reference into or otherwise become a part of this prospectus, regardless of when furnished to the SEC. We incorporate by reference the following documents listed below and any future filings made with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (other than, in each case, information deemed to have been furnished and not filed in accordance with SEC rules), on or after the date of this prospectus until we have terminated the offerings of all of the securities to which this prospectus relates:

•

•

•

•

the description of our common stock contained in Exhibit 4.7 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and any other amendments and reports filed for the purpose of updating such description.

Information that becomes a part of this prospectus after the date of this prospectus will automatically update and, to the extent inconsistent, replace information in this prospectus and information previously filed with the SEC.

You may request a copy of these filings (other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing), at no cost, by writing or calling us at the following address:

Global Payments Inc.

3550 Lenox Road

Atlanta, Georgia 30326

(770) 829-8478

Attn: Investor Relations

Certain of our SEC filings, including our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to them, can be viewed and printed from the investor relations section of our website at www.globalpaymentsinc.com free of charge. We have included our website address for the information of prospective investors and do not intend it to be an active link to our website. Information contained on our website is not part of this prospectus or any accompanying prospectus supplement (or any document incorporated by reference herein or therein), and you should not rely on that information in making your investment decision unless that information is also in this prospectus or any accompanying prospectus supplement or has been expressly incorporated by reference into this prospectus or any accompanying prospectus supplement. Our common stock is listed on the New York Stock Exchange. You may inspect reports, proxy statements and other information about us at the office of the New York Stock Exchange, NYSE Euronext, 20 Broad Street, New York, NY 10005.

FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated by reference into this prospectus, includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These forward-looking statements include all statements other than statements of historical facts included or incorporated by reference in this prospectus, including statements concerning our business operations, economic performance and financial condition, our business strategy and means to implement our strategy, the amount of future capital expenditures, our success in developing and introducing new products and expanding our business, the successful integration of future acquisitions, and the timing of the introduction of new and modified products or services. You can sometimes identify forward-looking statements by our use of the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “forecast,” “guidance” and similar terms and/or expressions. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Although we believe that the plans and expectations reflected in or suggested by our forward-looking statements are reasonable, those statements are based on a number of assumptions, estimates, projections or plans that are inherently subject to significant risks, uncertainties and contingencies, many of which are beyond our control, cannot be foreseen and reflect future business decisions that are subject to change. Accordingly, we cannot guarantee you that our plans and expectations will be achieved. Our actual revenues, revenue growth rates and margins, other results of operations and shareholder values could differ materially from those anticipated in our forward-looking statements as a result of many known and unknown factors, many of which are beyond our ability to predict or control.

A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements, including, but not limited to, the risk factors described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. These cautionary statements qualify all of our forward-looking statements, and you are cautioned not to place undue reliance on these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Our forward-looking statements speak only as of the date they are made and should not be relied upon as representing our plans and expectations as of any subsequent date. Except to the extent required by law, we do not undertake, and expressly disclaim, any duty or obligation to update publicly any forward-looking statement after the date the statement is made, whether as a result of new information, future events, changes in assumption or otherwise.

THE COMPANY

Global Payments is a leading payments technology company delivering innovative software and services to our customers globally, with worldwide reach spanning North America, Europe, Asia-Pacific and Latin America. Our technologies, services and team member expertise allow us to provide a broad range of solutions that enable our customers to operate their businesses more efficiently across a variety of channels around the world.

We were incorporated in 2000 and spun-off from our former parent company in 2001. Including our time as part of our former parent company, we have been in the payment technology services business since 1967. Since our spin-off, Global Payments has expanded in existing markets and into new markets internationally by pursuing further acquisitions and joint ventures. In 2016, Global Payments merged with Heartland Payment Systems, Inc., which significantly expanded our small- and medium-sized enterprise distribution, customer base and vertical reach in the United States. In September 2019, we consummated our merger with Total System Services, Inc. (“TSYS”). Prior to our merger with TSYS, TSYS was a leading global payments provider, offering seamless, secure and innovative solutions to issuers, merchants and consumers.

In 2023, we acquired EVO Payments, Inc. (“EVO”), a payment technology and services provider, offering payment solutions to merchants ranging from small and middle market enterprises to multinational companies and organizations across the Americas and Europe, for total purchase consideration of approximately $4 billion. The acquisition of EVO aligns with our technology-enabled payments strategy, expands our geographic presence and augments our business-to-business software and payment solutions business.

We are organized under the laws of the state of Georgia. The address and telephone number of our executive offices are 3550 Lenox Road, Atlanta, Georgia 30326, and (770) 829-8000. Our common stock is traded on the NYSE under the symbol “GPN”.

INDUSTRY AND MARKET DATA

We may use or incorporate by reference in this prospectus data and industry forecasts which we have obtained from internal surveys, market research, publicly available information and industry publications. Industry publications generally state that the information they provide has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed. Similarly, we believe that the surveys and market research we or others have performed are reliable, but we have not independently verified this information.

SUMMARY

This summary highlights information contained elsewhere in this prospectus and the documents incorporated by reference. This summary does not contain all of the information that you should consider before deciding to invest in our notes or common stock. You should read this entire prospectus carefully, including the “Risk Factors” beginning on page 9 of this prospectus and our consolidated financial statements and the related notes and other documents incorporated by reference before you decide to invest in our notes or common stock.

The Company

Global Payments is a leading payments technology company delivering innovative software and services to our customers globally. Our technologies, services and team member expertise allow us to provide a broad range of solutions that enable our customers to operate their businesses more efficiently across a variety of channels around the world.

We were incorporated in 2000 and spun-off from our former parent company in 2001. Including our time as part of our former parent company, we have been in the payment technology services business since 1967.

We are organized under the laws of the state of Georgia. The address and telephone number of our executive offices are 3550 Lenox Road, Atlanta, Georgia 30326, and (770) 829-8000. Our common stock is traded on the NYSE under the symbol “GPN”.

Silver Lake Transaction

On August 1, 2022, we entered into an investment agreement with Silver Lake Partners VI DE (AIV), L.P., a Delaware limited partnership and Silver Lake Alpine II, L.P., a Delaware limited partnership (the “Initial Purchasers”), relating to the purchase and sale of $1.5 billion principal amount of 1.00% Convertible Senior Notes due 2029. In connection with the closing of the transaction on August 8, 2022, we entered into an indenture, dated August 8, 2022, with U.S. Bank Trust Company, National Association, as amended by the First Supplemental Indenture, dated as of December 14, 2022, between us and U.S. Bank Trust Company, National Association, pursuant to which the notes were issued. The notes are currently held by SLP VI Galaxy Holdings II, L.P., SLP VI Galaxy Holdings, L.P., SLA II Galaxy Holdings, L.P. and SLP Galaxy Co-Invest, L.P. (collectively, the “selling securityholders” and together with the Initial Purchasers, “Silver Lake”), each an affiliate of the Initial Purchasers.

Common Stock

The holders of shares of our common stock are entitled to one vote for each share held. Holders of our common stock are entitled to receive dividends as and when declared by our board of directors in its discretion, payable out of any of our assets at the time legally available for the payment of dividends in accordance with the Official Code of Georgia. Holders of our common stock are entitled to receive the net assets of Global Payments upon dissolution. The holders of our common stock have no preemptive or conversion rights, redemption provisions or sinking fund provisions. Our common stock is not subject to future calls or assessments by us. In this prospectus, we have summarized certain general features of the common stock under the heading “Description of Capital Stock — Common Stock.”

The Notes

$1,500,000,000 principal amount of our 1.00% Convertible Senior Notes due 2029.

August 15, 2029, unless earlier converted or repurchased by us.

Interest and Interest Payment Dates

1.00% per year, payable semi-annually in arrears on February 15 and August 15 of each year (beginning on February 15, 2023).

February 1 and August 1 of each year, preceding the relevant interest payment date.

Holders may convert all or a portion of their notes at any time prior to the close of business on the scheduled trading day immediately preceding the maturity date based on the applicable conversion rate. The notes are convertible based on an initial conversion rate of 7.1089 shares of common stock per $1,000 principal amount of notes (which is equal to an initial conversion price of $140.67 per share). This conversion rate is subject to adjustment, however, as described in this prospectus under “Description of Notes — Conversion Rights — Adjustments to the Conversion Rate.”

Upon conversion of any note, under the terms of the notes and the indenture governing the notes, we will pay or deliver, as the case may be, to the converting holder, in respect of each $1,000 (or any integral multiple of $1,000 in excess thereof) principal amount of notes being converted, (i) cash in the amount of principal plus accrued and unpaid interest and (ii) shares of common stock, cash or a combination of cash and shares of common stock at Global Payments’ election in the amount of premium owed, if any, together with cash, if applicable, in lieu of delivering any fractional share of common stock. See “Description of Notes — Conversion Rights.” Holders who convert their notes in connection with a make-whole fundamental change, as defined herein, may be entitled to a make-whole premium in the form of an increase in the conversion rate. See “Description of Notes — Adjustment to the Conversion Rate Upon the Occurrence of a Make-whole Fundamental Change.”

If we undergo a fundamental change, as defined herein, subject to certain conditions, a holder will have the right, at its option, to require us to repurchase for cash any or all of its notes. The fundamental change repurchase price will equal 100% of the principal amount of the notes to be repurchased, plus accrued and unpaid interest, if any, to, but excluding, the fundamental change repurchase date. See “Description of Notes — Holders May Require Us to Repurchase Their Notes Upon a Fundamental Change.”

The notes are not optionally redeemable.

The notes are our senior unsecured obligations and rank:

•

senior in right of payment to any of our existing and future indebtedness or other obligations that are expressly subordinated in right of payment to the notes;

•

equal in right of payment to any of our existing and future unsecured indebtedness or other obligations that are not so subordinated;

•

effectively junior in right of payment to any of our secured indebtedness to the extent of the value of the assets securing such indebtedness; and

•

structurally junior to all existing and future indebtedness and other liabilities (including trade payables) of our subsidiaries.

As of December 31, 2023, we had outstanding, on a consolidated basis, approximately $16.0 billion of unsecured unsubordinated indebtedness and no secured indebtedness (in each case, excluding finance leases, software financing arrangements, settlement facilities and the notes offered hereby).

The selling securityholders will receive all of the proceeds from the sale under this prospectus of the notes and the shares of common stock issuable upon conversion of the notes, if any. We will not receive any proceeds from these sales.

We prepared this prospectus in connection with our obligations under an investment agreement which provides the Initial Purchasers and the selling securityholders with certain registration rights with respect to the resale of the notes and the shares of common stock issuable upon conversion of the notes, if any. Pursuant to such investment agreement, we will use our reasonable efforts to keep the shelf registration statement of which this prospectus is a part effective until the earliest of (i) such time as all registrable securities under the investment agreement (y) have been sold in accordance with the plan of distribution disclosed in this prospectus or (z) otherwise cease to qualify as registrable securities under the investment agreement or (ii) such time as we consolidate or merge with or into another entity and our company stock is, in whole or in part, converted into or exchanged for securities of a different issuer and/or cash in a transaction that constitutes a change of control of Global Payments and our shares of common stock are delisted from the NYSE.

The notes are not listed on any securities exchange. Our common stock is listed on the NYSE under the symbol “GPN.” The address and telephone number of our executive offices are 3550 Lenox Road, Atlanta, Georgia 30326, and (770) 829-8000.

See “Risk Factors” and other information included or incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding to invest in the notes or the common stock.

RISK FACTORS

Investing in the notes or common stock (collectively “securities”) involves risks. You should carefully consider the risk factors described below and incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K filed after the date of this prospectus, all other information contained or incorporated by reference in this prospectus, as updated by our subsequent filings under the Exchange Act of 1934, as amended (the “Exchange Act”), and the risk factors and other information contained in the applicable prospectus supplement before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the securities. See also “Forward-Looking Statements.” For more information, see the section entitled “Where You Can Find More Information” above.

Risks Relating to the Notes and Common Stock

We may issue additional shares of common stock (including upon conversion of the notes) or instruments convertible into shares of common stock, which may materially and adversely affect the market price of our shares of common stock and the trading price (if any) of the notes.

We may conduct future offerings of our shares of common stock, preferred stock or other securities convertible into our shares of common stock to fund acquisitions, finance operations or for other purposes. In addition, we may also issue shares of our common stock under our equity awards plans. The notes do not contain restrictive covenants that would prevent us from offering our shares of common stock or other securities convertible into our shares of common stock in the future. The market price of our shares of common stock or the trading price (if any) of the notes could decrease significantly if we conduct such future offerings, if any of our existing shareholders sells a substantial amount of our shares of common stock or if the market perceives that such offerings or sales may occur. Moreover, any additional issuance of our shares of common stock will dilute the ownership interest of our existing shareholders, and may adversely affect the ability of holders of the notes to participate in any appreciation of our shares of common stock.

The notes are effectively subordinated to any secured indebtedness we may incur and are structurally subordinated to all of the obligations of our subsidiaries, including trade payables, which may limit our ability to satisfy our obligations under the notes.

The notes are our senior unsecured obligations and rank:

•

senior in right of payment to any of our existing and future indebtedness or other obligations that are expressly subordinated in right of payment to the notes;

•

equal in right of payment to any of our existing and future unsecured indebtedness or other obligations that are not so subordinated;

•

effectively junior in right of payment to any of our secured indebtedness to the extent of the value of the assets securing such indebtedness; and

•

structurally junior to all existing and future indebtedness and other liabilities (including trade payables) of our subsidiaries.

As of December 31, 2023, we had outstanding, on a consolidated basis, approximately $16.0 billion of unsecured unsubordinated indebtedness and no secured indebtedness (in each case, excluding finance leases, software financing arrangements, settlement facilities and the notes offered hereby). In addition, as of December 31, 2023, our subsidiaries had no indebtedness to third parties (excluding finance leases, software financing arrangements and settlement facilities) and had issued no preferred equity.

Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due on the notes or to make any funds available for payment on the notes, whether by dividends, loans or other payments. In addition, the payment of dividends and the making of loans and advances to us by our subsidiaries may be subject to statutory, contractual or other restrictions, may depend on their earnings or financial condition and are subject to various business considerations. As a result, we may be unable to gain access to the cash flow or assets of our subsidiaries.

Regulatory actions may adversely affect the trading price (if any) and liquidity of the notes.

Investors in, and potential purchasers of, the notes who employ, or seek to employ, a convertible arbitrage strategy with respect to the notes may be adversely impacted by regulatory developments that may limit or restrict such a strategy. The SEC and other regulatory and self-regulatory authorities have implemented various rules and may adopt additional rules in the future that restrict and otherwise regulate short selling and over-the-counter swaps and security-based swaps, which restrictions and regulations may adversely affect the ability of investors in, or potential purchasers of, the notes to conduct a convertible arbitrage strategy with respect to the notes. This could, in turn, adversely affect the trading price (if any) and liquidity of the notes.

A holder of notes will not be entitled to any rights with respect to our shares of common stock, but may be subject to any changes made with respect to our shares of common stock.

A holder of notes will generally not be entitled to any rights with respect to our shares of common stock (including, without limitation, voting rights and rights to receive any dividends or other distributions on shares of common stock), but will be subject to all changes affecting our shares of common stock to the extent (i) the trading price of the notes (if any) depends on the market price of our shares of common stock, (ii) such holder receives shares of common stock upon conversion of such holder’s notes and (iii) such changes result in adjustment to the then applicable conversion rate. For example, if an amendment is proposed to our articles of incorporation which requires shareholder approval, a holder of notes will not be entitled to vote on the amendment, although such holder will nevertheless be subject to any changes in the powers, preferences or special rights of the common stock implemented by that amendment.

Upon conversion of the notes, you may receive less valuable consideration than expected because the value of our shares of common stock may decline after you exercise your conversion right but before we settle our conversion obligation.

Under the notes, a converting holder will be exposed to fluctuations in the value of our shares of common stock during the period from the date such holder surrenders notes for conversion until the date we settle our conversion obligation. If we settle the amount of premium owed, if any, upon conversions of notes through payment or delivery, as the case may be, of shares of common stock, cash or a combination of cash and shares of common stock, the amount of consideration that you will receive upon conversion of your notes will be determined by reference to the volume weighted average prices of our shares of common stock for each volume-weighted average price (“VWAP”) trading day in a 20 VWAP trading day observation period. As described under “Description of Notes — Conversion Rights — Settlement Upon Conversion,” the observation period with respect to any note surrendered for conversion, means: (i) if the relevant conversion date occurs prior to May 15, 2029, the 20 consecutive trading-day period beginning on, and including, the second trading day immediately succeeding such conversion date; and (ii) if the relevant conversion date occurs on or after May 15, 2029, the 20 consecutive trading days beginning on, and including, the 21st scheduled trading day immediately preceding the maturity date.

If the price of our shares of common stock decreases during the period from the date such holder surrenders notes for conversion until the date we settle our conversion obligation, the amount and/or value of consideration you receive will be adversely affected. In addition, if the market price of our shares of common stock at the end of such period is below the average of the volume weighted average prices of our shares of common stock during the relevant observation period, the value of any shares of common stock that you may receive in satisfaction of our conversion obligation will generally be less than the value used to determine the amount of consideration that you will receive upon conversion.

Volatility in the market price and trading volume of our common stock could adversely impact the trading price (if any) of the notes.

A decrease in the market price of our common stock would likely adversely impact the trading price (if any) of the notes. The market price of our common stock could also be affected by possible sales of our common stock by investors who view the notes as a more attractive means of equity participation in us and by hedging or arbitrage trading activity that may develop involving our common stock. This trading activity could, in turn, affect the trading price of the notes. Although we have entered into privately negotiated

capped call transactions with financial institutions in connection with the issuance of the notes (the “capped call transactions”) which are expected generally to increase the effective conversion premium of the notes to a cap price and reduce the potential dilutive effect on our common stock upon conversion of the notes or, at our election (subject to certain conditions), offset any cash payments made by us, the counterparties to the capped call transactions or another designated financial institution may modify their hedge positions by entering into or unwinding various derivative transactions with respect to our common stock and/or purchasing or selling our common stock or other securities in secondary market transactions prior to the maturity of the notes (and are likely to do so in connection with any conversion of the notes). This activity could also cause or avoid an increase or a decrease in the market price of our common stock or the trading price (if any) of the notes.

Economic volatility affects our operations and our debt.

An economic downturn or contraction may negatively affect demand for our products and services, which would negatively affect our financial results of operations and cash flows necessary to service our debt. The credit environment could impact our ability to borrow money in the future. Additional financing or refinancing of our existing indebtedness might not be available and, if available, may not be available on economically favorable terms. Further, an increase in leverage could lead to deterioration in our credit ratings. A reduction in our credit ratings, regardless of the cause, could also limit our ability to obtain additional financing and/or increase our cost of obtaining financing. There is no guarantee we will be able to access the capital markets at financially economical interest rates, which could negatively affect our business. While we believe that we will continue to have adequate credit available to meet our needs, there can be no assurance of that.

An increase in market rates could result in a decrease in the trading price (if any) of the notes.

In general, as market interest rates rise, notes bearing interest at a fixed rate decline in value. Consequently, if you purchase the notes and market interest rates increase, the trading price (if any) of your notes may decline. We cannot predict the future level of market interest rates.

The notes and the indenture that governs the notes contain limited protections against certain types of important corporate events and may not protect your investment upon the occurrence of such corporate events and do not protect your investment upon the occurrence of other corporate events.

The indenture for the notes does not:

•

require us to maintain any financial ratios or specific levels of net worth, revenues, income, cash flows or liquidity;

•

protect holders of the notes in the event that we experience significant adverse changes in our financial condition or results of operations;

•

limit the amount of additional indebtedness that we can create, incur, assume or guarantee, nor does the indenture limit the amount of indebtedness or other liabilities that our subsidiaries can create, incur, assume or guarantee;

•

limit our ability to incur indebtedness with a maturity date earlier than the maturity date of the notes;

•

restrict our subsidiaries’ ability to issue equity securities to third parties that would rank senior to the equity securities of our subsidiaries held by us, which would entitle those third parties to receive any assets of those subsidiaries prior to any distribution to us in the event of a liquidation or dissolution of those subsidiaries;

•

restrict our ability to purchase or prepay our securities other than the notes; or

•

restrict our ability to make investments or to purchase or pay dividends or make other payments in respect of our shares of common stock or other securities ranking junior to the notes.

Furthermore, the indenture for the notes contains only limited protections in the event of a change in control.

We will not be obligated to purchase the notes upon the occurrence of all significant transactions that are likely to affect the market price of our shares of common stock and/or the trading price (if any) of the notes.

Upon the occurrence of a fundamental change, you have the right to require us to purchase your notes. However, the fundamental change provisions do not afford protection to holders of notes in the event of certain transactions that could adversely affect the notes. For example, transactions such as leveraged recapitalizations, refinancings, restructurings or acquisitions initiated by us could substantially affect our capital structure and the value of the notes and our shares of common stock, but may not constitute a fundamental change requiring us to purchase the notes. In the event of any such transaction, holders of the notes would not have the right to require us to purchase their notes, even though each of these transactions could increase the amount of our indebtedness, or otherwise adversely affect our capital structure, the value of the notes and our shares of common stock or any credit ratings, thereby adversely affecting holders of the notes.

The conversion rate of the notes may not be adjusted for all dilutive events.

The conversion rate of the notes is subject to adjustment upon the occurrence of specified events, including, but not limited to, the issuance of stock dividends on our shares of common stock, the issuance of certain rights or warrants to holders of our shares of common stock, subdivisions or combinations of our shares of common stock, distributions of capital stock, indebtedness or assets to holders of our common stock, certain cash dividends and certain issuer tender or exchange offers, as described under “Description of Notes — Conversion Rights — Adjustments to the Conversion Rate.” However, the conversion rate will not be adjusted for other events, such as third party tender offers or exchange offers or the issuance of shares of common stock, or securities convertible into shares of common stock, in underwritten or private offerings, that may adversely affect the market price of our shares of common stock and the trading price (if any) of the notes. An event that adversely affects the trading price of the notes may occur, and that event may not result in an adjustment to such conversion rate.

The trading price (if any) of the notes may be adversely affected by whether an active trading market develops for the notes and other factors.

There is currently no active trading market for the notes. We do not intend to apply for listing of the notes on any securities exchange or for inclusion in any automated dealer quotation system. A market may not develop for the notes or, if developed, may not continue. There can be no assurance as to the liquidity of any market that may develop for the notes. If a market develops, the notes could trade at prices that may be lower than the initial offering price of the notes. The liquidity of the trading market in the notes, and the market price quoted for the notes, may be adversely affected by changes in the overall market for this type of security, by changes in the market price of our shares of common stock, which may be volatile, and by changes in our financial performance or prospects or in the prospects for companies in our industry generally. If an active, liquid market does not develop for the notes, the trading price (if any) and liquidity of the notes may be adversely affected.

We may not have adequate cash available to settle the principal amount of the notes in cash in the event of conversion or to repurchase the notes upon the occurrence of a fundamental change.

Under the terms of the notes and the indenture governing the notes, any conversion of the notes will be settled in (i) cash in the amount of the principal amount of the notes being converted and any accrued and unpaid interest thereon and (ii) shares of common stock, cash or a combination of cash and shares of common stock at Global Payments’ election in the amount of premium, if any (and cash in lieu of any fractional shares).

If we do not have adequate cash available, either from cash on hand, funds generated from operations or existing financing arrangements, or we cannot obtain additional financing arrangements, we may not be able to settle the principal amount of the notes in cash. Although we have entered into the capped call transactions, which are expected generally to increase the effective conversion premium of the notes to a cap price and reduce the potential dilutive effect on our common stock upon conversion of the notes or, at our election (subject to certain conditions), offset any cash payments made by us, there can be no guarantee that the capped call transactions will increase the effective conversion premium or offset the cash payments made by us.

Our ability to repurchase the notes in cash upon the occurrence of a fundamental change or make any other required payments may be limited by law or the terms of other agreements relating to our indebtedness outstanding at the time. Our failure to repurchase the notes when required would result in an event of default with respect to the notes and may constitute an event of default or prepayment under, or result in the acceleration of the maturity of our then-existing indebtedness. If the repayment of the other indebtedness were to be accelerated, we may not have sufficient funds to repay that indebtedness and to purchase the notes or to pay the amount of cash (if any) due upon conversion. Our inability to pay for your notes that are surrendered for purchase or upon conversion could result in your receiving substantially less than the principal amount of the notes.

The adjustment to the conversion rate for notes converted in connection with a make-whole fundamental change may not adequately compensate holders for any lost value of their notes as a result of such make-whole fundamental change.

If a make-whole fundamental change occurs, under certain circumstances, we will increase the conversion rate for the notes by a number of additional shares of common stock for notes converted in connection with such make-whole fundamental change. The increase in the conversion rate will be determined based on the date on which the make-whole fundamental change becomes effective and the price paid (or deemed paid) per share of our shares of common stock in such transaction, if in cash, or the average of the closing sale prices per share of common stock for the five consecutive trading days immediately preceding, but excluding, the effective date, as described below under “Description of Notes — Conversion Rights — Adjustment to Conversion Rate Upon the Occurrence of a Make-Whole Fundamental Change.”

The adjustment to the conversion rate, if any, for notes converted in connection with a make-whole fundamental change may not adequately compensate a holder for lost value of its notes as a result of such transaction. In addition, if the applicable price in the transaction is greater than $350 per share or less than $122.32 per share (in each case, subject to adjustment), no increase will be made to the conversion rate. Moreover, in no event will the conversion rate as a result of such increase exceed 8.1752 shares per $1,000 principal amount of notes, subject to adjustment at the same time and in the same manner as the conversion rate as described under “Description of Notes — Conversion Rights — Adjustments to the Conversion Rate.” The obligation to increase the conversion rate upon the occurrence of a make-whole fundamental change could be considered a penalty, in which case the enforceability thereof would be subject to general principles of reasonableness and equitable remedies.

The fundamental change and make-whole fundamental change provisions may delay or prevent an otherwise beneficial takeover attempt of us.

The fundamental change repurchase rights, which allow holders to require us to repurchase all or a portion of their notes upon the occurrence of a fundamental change, as defined in “Description of Notes — Holders May Require Us to Repurchase Their Notes Upon a Fundamental Change,” and the provisions requiring an increase to the conversion rate for conversions in connection with a make-whole fundamental change may delay or prevent a takeover of us and the removal of incumbent management that might otherwise be beneficial to investors.

Conversion of the notes may dilute the ownership interest of existing shareholders, including holders who had previously converted their notes, or may otherwise depress the price of our shares of common stock.

Under the terms of the notes and the indenture governing the notes, any conversion of the notes will be settled in (i) cash in the amount of aggregate principal amount of the notes being converted and any accrued and unpaid interest thereon and (ii) shares of common stock, cash or a combination of cash and shares of common stock at Global Payments’ election in the amount of premium, if any (and cash in lieu of any fractional shares). The conversion of some or all of the notes will dilute the ownership interests of existing shareholders to the extent we do not cash settle any amount associated therewith, and deliver shares upon conversion of any of the notes. Any sales in the public market of such shares of common stock issuable upon such conversion could adversely affect prevailing market prices of our shares of common stock. In addition, the existence of the notes may encourage short selling by market participants because

such conversion could be used to satisfy short positions, or anticipated conversion of the notes into shares of common stock could depress the price of our shares of common stock.

The credit ratings assigned to the notes may not reflect all risks of an investment in the notes.

We have not, and do not intend to seek a rating for the notes. However, one or more rating agencies may rate the notes in the future. Such rating agencies may assign the notes a rating lower than the rating expected by investors. In addition, ratings agencies’ ratings of the notes wouldnot address all material risks relating to an investment in the notes, but rather reflect only the view of each rating agency at the time the rating is issued. An explanation of the significance of such rating may be obtained from such rating agency. There can be no assurance that such credit ratings will remain in effect for any given period of time or that a rating will not be lowered, suspended or withdrawn entirely by the applicable rating agencies if, in such rating agency’s judgment, circumstances so warrant. Agency credit ratings are not a recommendation to buy, sell or hold any security. Each agency’s rating should be evaluated independently of any other agency’s rating. Actual or anticipated changes or downgrades in our credit ratings, including any announcement that our ratings are under further review for a downgrade, could affect the market value and trading price of the notes and increase our corporate borrowing costs.

You may be subject to tax if we make or fail to make certain adjustments to the conversion rate of the notes even though you do not receive a corresponding cash distribution.

The conversion rate of the notes is subject to adjustment in certain circumstances, including the payment of certain cash dividends in excess of the dividend threshold, as described under “Description of Notes — Conversion Rights — Adjustments to the Conversion Rate.” If the conversion rate is adjusted as a result of a distribution that is taxable to our shareholders, such as certain cash dividends, you may be deemed to have received a dividend subject to U.S. federal income tax without the receipt of any cash. In addition, a failure to adjust (or to adjust adequately) the conversion rate after an event that increases your proportionate interest in us could be treated as a deemed taxable dividend to you. If a make-whole fundamental change occurs prior to maturity, under some circumstances, we will increase the conversion rate for notes converted in connection with the make-whole fundamental change. That increase may also be treated as a distribution subject to U.S. federal income tax as a dividend. See “Certain U.S. Federal Income Tax Considerations — U.S. Holders — Constructive Distributions.”

If you are a non-U.S. holder (as defined under “Certain U.S. Federal Income Tax Considerations”), any deemed dividend would generally be subject to U.S. federal withholding tax at a 30% rate (or such lower rate as may be specified by an applicable income tax treaty). The amount of any such withholding tax may be set off against any subsequent payment or distribution otherwise payable on the notes (or the issuance of shares of common stock upon a conversion of the notes). See “Certain U.S. Federal Income Tax Considerations — Non-U.S. Holders — Distributions on Common Stock.”

Shares of our common stock are equity interests and therefore subordinate to our indebtedness and preferred stock.

Shares of our common stock are equity interests in the Company and do not constitute indebtedness. As such, shares of our common stock rank junior to all indebtedness and other non-equity claims on the Company with respect to assets available to satisfy claims on the Company, including in a liquidation of the Company. Additionally, holders of our common stock are subject to the prior dividend and liquidation rights of any holders of preferred stock we may issue in the future.

USE OF PROCEEDS

The selling securityholders will receive all of the proceeds from the sale under this prospectus and any accompanying prospectus supplement of the notes or the common stock issuable upon conversion of the notes, if any. We will not receive any proceeds from these sales. This prospectus is being filed in accordance with the investment agreement between us and the Initial Purchasers.

This prospectus contains summary descriptions of the notes and common stock that may be sold under this prospectus from time to time. These summary descriptions are not meant to be complete descriptions of any security.

DESCRIPTION OF NOTES

The notes were issued under an indenture dated as of August 8, 2022, between us and U.S. Bank Trust Company, National Association, as trustee (which we refer to as the “trustee”), as amended by the First Supplemental Indenture, dated as of December 14, 2022, between us and the trustee (which we refer to as the “indenture”). A copy of the indenture is filed as an exhibit to the registration statement of which this prospectus forms a part. The following summary of the terms of the notes and the indenture does not purport to be complete and is subject, and qualified in its entirety by reference, to the detailed provisions of the notes and the indenture. Those documents, and not this description, define a holder’s legal rights as a holder of the notes. The terms of the notes include those expressly set forth in the indenture and those made part of the indenture by reference to the Trust Indenture Act of 1939, as amended (the “TIA”). For purposes of this summary, the terms “Global Payments,” “we,” “us” and “our” refer only to Global Payments Inc. and not to any of its subsidiaries, unless we specify otherwise. Unless the context requires otherwise, the term “interest” includes defaulted interest, if any, payable pursuant to the indenture and “additional interest” payable pursuant to the provisions described under “— Events of Default.”

General

We issued $1.5 billion aggregate principal amount of our 1.00% Convertible Senior Notes due 2029 (the “notes”). The notes bear interest at a rate of 1.00% per annum, payable semi-annually in arrears on February 15 and August 15 of each year, beginning on February 15, 2023, to holders of record at the close of business on the preceding February 1 and August 1 immediately preceding the February 15 and August 15 interest payment dates, respectively, except as described below.

The notes:

•

were issued in minimum denominations of integral multiples of $1,000 principal amount;

•

are our unsecured senior obligations;

•

are convertible at any time prior to the close of business on the business day immediately preceding the maturity date into shares of common stock at a conversion rate, based on an initial conversion rate of 7.1089 shares of common stock per $1,000 principal amount of notes (which is equal to an initial conversion price of $140.67 per share), subject to adjustment as described in this prospectus under “Description of Notes — Conversion Rights — Adjustments to the Conversion Rate”;

•

are subject to repurchase by us at the option of the holder upon a fundamental change, as described under “— Holders May Require Us to Repurchase Their Notes Upon a Fundamental Change,” at a repurchase price in cash equal to 100% of the principal amount of the notes to be repurchased, plus accrued and unpaid interest to, but excluding, the fundamental change repurchase date;

•

bear additional interest under the circumstances described under “— Events of Default;” and

•

mature on August 15, 2029.

The notes were issued as global securities as described below under “— Form, Denomination and Registration of Notes.” We will make payments in respect of the notes by wire transfer of immediately available funds to The Depository Trust Company, or DTC or the depository, or its nominee as registered owner of the global securities.

A holder may convert notes at the office of the conversion agent, present notes for registration of transfer or exchange at the office of the registrar for the notes and present notes for payment at maturity at the office of the paying agent. We have appointed the trustee as the initial conversion agent, registrar and paying agent for the notes. We will not provide a sinking fund for the notes. The indenture does not contain any financial covenants and does not limit our ability to incur additional indebtedness, pay dividends or repurchase our securities. In addition, the indenture does not provide any protection to holders of notes in the event of a highly leveraged transaction or a change in control, except as, and only to the limited extent,

described under “— Conversion Rights — Adjustment to the Conversion Rate Upon the Occurrence of a Make-whole Fundamental Change,” “— Holders May Require Us to Repurchase Their Notes Upon a Fundamental Change” and “— Consolidation, Merger and Sale of Assets.” If any payment date with respect to the notes falls on a day that is not a business day, we will make the payment on the next succeeding business day. The payment made on the next succeeding business day will be treated as though it had been made on the original payment date, and no interest will accrue on the payment for the additional period of time. The registered holder of a note (including DTC or its nominee in the case of notes issued as global securities) will be treated as its owner for all purposes. Only registered holders will have the rights under the indenture.

Additional Notes

Unless holders of 100% in aggregate principal amount of the outstanding notes consent, we may not increase the aggregate principal amount of the notes outstanding under the governing indenture by issuing additional notes in the future (except for notes authenticated and delivered upon registration of transfer or exchange for or in lieu of other notes in certain limited circumstances).

Ranking

The notes are our senior unsecured obligations and rank:

•

senior in right of payment to any of our existing and future indebtedness or other obligations that are expressly subordinated in right of payment to the notes;

•

equal in right of payment to any of our existing and future unsecured indebtedness or other obligations that are not so subordinated;

•

effectively junior in right of payment to any of our secured indebtedness to the extent of the value of the assets securing such indebtedness; and

•

structurally junior to all existing and future indebtedness, other liabilities (including trade payables) of our subsidiaries.

Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due on the notes or to make any funds available for payment on the notes, whether by dividends, loans or other payments. In addition, the payment of dividends and the making of loans and advances to us by our subsidiaries may be subject to statutory, contractual or other restrictions, may depend on their earnings or financial condition and are subject to various business considerations. As a result, we may be unable to gain access to the cash flow or assets of our subsidiaries. The indenture does not limit the amount of additional indebtedness that we can create, incur, assume or guarantee, nor does the indenture limit the amount of indebtedness or other liabilities that our subsidiaries can create, incur, assume or guarantee.

Interest Payments

We will pay interest on the notes at a rate of 1.00% per annum, payable semi-annually in arrears on February 15 and August 15 of each year, beginning on February 15, 2023. Except as described below, we will pay interest that is due on an interest payment date to holders of record at the close of business on the February 1 and August 1 immediately preceding the February 15 and August 15 interest payment dates, respectively. Interest will accrue on the notes from, and including, the last date in respect of which interest has been paid or provided for, as the case may be, to, but excluding, the next interest payment date or the maturity date, as the case may be. We will pay interest on the notes on the basis of a 360-day year consisting of twelve 30-day months.

Accrued and unpaid interest, if any, to, but excluding, the relevant settlement date of any conversion shall be paid in cash to the applicable holders upon conversion, together with the conversion obligation. However, if notes are converted after the close of business on a record date but prior to the open of business on the next interest payment date, holders of such notes at the close of business on the record date will, on the corresponding interest payment date, receive the full amount of the interest payable on such notes on that interest payment date.

For a description of when and to whom we must pay additional interest, if any, see “— Events of Default.”

Conversion Rights

Holders of notes may convert their notes at any time prior to the close of business on the scheduled trading day immediately preceding the maturity date in integral multiples of $1,000 principal amount at a conversion rate, based on an initial conversion rate of 7.1089 shares of common stock per $1,000 principal amount of notes (which is equal to an initial conversion price of $140.67 per share). The conversion rate, and thus the conversion price, will be subject to adjustment as described below. Except as described below, we will not make any payment or other adjustment on conversion with respect to any accrued interest on the notes, and we will not adjust the conversion rate to account for accrued and unpaid interest.

We will not issue a fractional share of common stock upon conversion of a note. Instead, we will pay cash in lieu of fractional shares based on the daily VWAP (as defined below) on the last trading day of the relevant observation period (as defined below).

“Closing sale price” on any date means the per share price of our common stock on such date, determined (i) on the basis of the closing sale price per share (or if no closing sale price per share is reported, the average of the bid and ask prices or, if more than one in either case, the average of the average bid and the average ask prices) on that date as reported in the composite transactions for the relevant stock exchange or (ii) if the common stock is not listed on a U.S. national securities exchange on the relevant date, the last quoted bid price for the common stock on the relevant date, as reported by OTC Markets Group, Inc. or a similar organization; provided, however, that in the absence of any such report or quotation, the closing sale price shall be the price determined by a nationally recognized independent investment banking firm retained by us for such purpose as most accurately reflecting the per share price that a fully informed buyer, acting on his own accord, would pay to a fully informed seller, acting on his own accord in an arm’s-length transaction, for one share of common stock. The closing sale price will be determined without reference to after-hours or extended market trading.

“Relevant stock exchange” means the NYSE or, if the common stock (or other security for which the closing sale price must be determined) is not then listed on the NYSE, the principal other U.S. national securities exchange or market on which the common stock (or such other security) is then listed.

“Trading day” means a day on which (i) there is no market disruption event, (ii) trading in the common stock generally occurs on the relevant stock exchange or, if the common stock is not then listed on a U.S. national securities exchange, on the principal other market on which the common stock is then traded, and (iii) a closing sale price for the common stock is available on such securities exchange or market; provided that if the common stock (or other security for which a closing sale price must be determined) is not so listed or traded, “trading day” means a business day.

“Market disruption event” means, with respect to common stock or any other security, (i) a failure by the relevant stock exchange to open for trading during its regular trading session or (ii) the occurrence or existence for more than one half-hour period in the aggregate on any “scheduled trading day” (as defined below) for common stock or such other security of any suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant stock exchange or otherwise) of the common stock or such other security or in any options contracts or future contracts relating to the common stock or such other security, and such suspension or limitation occurs or exists at any time before 1:00 p.m., New York City time, on such day.

“Scheduled trading day” means a day that is scheduled to be a trading day on the relevant stock exchange. If the common stock is not listed on any U.S. national securities exchange, “scheduled trading day” means a business day.

Conversion Procedures

To convert its note, a holder of a physical note must:

•

complete and manually sign the required conversion notice, or a facsimile thereof, with appropriate notarization or signature guarantee, and deliver the completed conversion notice or a facsimile thereof to the conversion agent;

•

surrender the note to the conversion agent;

•

furnish appropriate endorsements and transfer documents if required by the registrar or conversion agent; and

•

if required, pay all transfer or similar taxes.

If a holder holds a beneficial interest in a global note, to convert such note, the holder must comply with the last requirement listed above and comply with DTC’s procedures for converting a beneficial interest in a global note. The date a holder complies with the applicable requirements is the “conversion date” under the indenture.

Settlement Upon Conversion

Under the terms of the notes and the indenture governing the notes, upon conversion, we shall pay or deliver the applicable settlement amount (as defined below).

Not later than the close of business on the business day immediately following the relevant conversion date, we may specify the portion of the daily share amount that will be settled in cash (any such portion of the daily share amount to be settled in cash, the “cash percentage”) by written notice (a “cash percentage notice”) to each converting holder, the trustee, the conversion agent (if other than the trustee); provided, however, that we shall deliver a cash percentage notice no later than the close of business on the business day immediately preceding May 15, 2029 to all holders, the trustee and the conversion agent (if other than the trustee) with respect to all conversions occurring on or after May 15, 2029. If we timely elect to specify a cash percentage, the amount of cash that we will deliver in lieu of all or applicable portion of the shares of common stock comprising the daily share amount for any trading day in the applicable observation period will equal the daily net cash portion (as defined below). The number of shares of common stock, if any, that we shall deliver in respect of each trading day in the applicable observation period will be a percentage of the daily share amount equal to 100% minus the cash percentage. If we do not timely specify a cash percentage for a conversion date, we shall no longer have the right to specify a cash percentage with respect to the applicable conversion and shall be required to settle 100% of the daily share amount for each trading day of the applicable observation period with shares of common stock, if any; provided that we shall pay cash in lieu of fractional shares otherwise issuable upon conversion of securities.

The “daily settlement amount,” for each of the 20 consecutive trading days during the observation period, shall consist of:

(a)

cash in an amount equal to the lesser of (i) $50.00 and (ii) the daily conversion value on such trading day; and

(b)

if the daily conversion value on such trading day exceeds $50.00, a number of shares of common stock equal to (i) the difference between the daily conversion value and $50.00, divided by (ii) the daily VWAP for such trading day (the “daily share amount”).

The “settlement amount” means the sum of the daily settlement amounts for each trading day in the observation period.

The “daily net cash portion” means, for each of the 20 consecutive trading days during the observation period, the product of:

(a) the cash percentage;

(b) the daily share amount for such trading day; and

(c) the daily VWAP for such trading day.

The “daily conversion value” means, for each of the 20 consecutive trading days during the observation period, one-twentieth (1/20) of the product of (a) the conversion rate on such trading day and (b) the daily VWAP for such trading day.

The “daily VWAP” means, for each trading day during the relevant observation period, the per share volume-weighted average price as displayed under the heading “Bloomberg VWAP” on Bloomberg page “GPN <equity> AQR” (or its equivalent successor if such page is not available) in respect of the period from the scheduled open of trading until the scheduled close of trading of the primary trading session on such trading day (or if such volume-weighted average price is unavailable, the market value of one share of common stock on such trading day determined, using a volume-weighted average method, by a nationally recognized independent investment banking firm retained for this purpose by us). The “daily VWAP” shall be determined without regard to after-hours trading or any other trading outside of the regular trading session trading hours.

“Observation period” with respect to any security surrendered for conversion, means: (i) if the relevant conversion date occurs prior to May 15, 2029, the 20 consecutive trading day period beginning on, and including, the second trading day immediately succeeding such conversion date; and (ii) if the relevant conversion date occurs on or after May 15, 2029, the 20 consecutive trading day period beginning on, and including, the 21st scheduled trading day immediately preceding the maturity date.

Adjustments to the Conversion Rate

The conversion rate is subject to adjustment from time to time, without duplication, upon the occurrence of any of the following events:

•

If we issue shares of common stock as a dividend or distribution on our common stock, the conversion rate will be adjusted based on the following formula:

| |

CR’ = CR0 x

|

|

|

OS’

|

|

| |

OS0

|

|

where,

| |

CR0

|

|

|

=

|

|

|

the conversion rate in effect immediately prior to the open of business on the ex date (as defined below) of such dividend or distribution;

|

|

| |

CR’

|

|

|

=

|

|

|

the conversion rate in effect immediately after the open of business on the ex date for such dividend or distribution;

|

|

| |

OS0

|

|

|

=

|

|

|

the number of shares of common stock outstanding immediately prior to the open of business on the ex date for such dividend or distribution; and

|

|

| |

OS’

|

|

|

=

|

|

|

the number of shares of common stock outstanding immediately after giving effect to such dividend or distribution.

|

|

•

If we effect a share split or share combination, the conversion rate will be adjusted based on the following formula:

| |

CR’ = CR0 x

|

|

|

OS’

|

|

| |

OS0

|

|

where,

| |

CR0

|

|

|

=

|

|

|

the conversion rate in effect immediately prior to the open of business on the effective date of such share split or share combination;

|

|

| |

CR’

|

|

|

=

|

|

|

the conversion rate in effect immediately after the open of business on the effective date of such share split or share combination;

|

|

| |

OS0

|

|

|

=

|

|

|

the number of shares of common stock outstanding immediately prior to the open of business on the effective date of such share split or share combination, as the case may be; and

|

|

| |

OS’

|

|

|

=

|

|

|

the number of shares of common stock outstanding immediately after giving effect to such share split or share combination, as the case may be.

|

|