UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2022

Commission File Number 1-15224

Energy Company of Minas Gerais

(Translation of registrant’s name into English)

Avenida Barbacena, 1200

30190-131 Belo Horizonte, Minas Gerais, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [_]

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [_]

Indicate by check mark whether by furnishing the information contained

in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

Index

CEMIG Geração e Transmissão

S.A. Announces Expiration and Final Results of its Cash Tender Offer for its 9.250% Senior Notes due 2024

Belo Horizonte, Brazil – December 27, 2022 – CEMIG

Geração e Transmissão S.A. (“CEMIG GT”), a wholly-owned subsidiary of Companhia Energética

de Minas Gerais (“CEMIG Holding”), today announced the expiration and final results of its previously announced

offer (the “Offer”) to purchase for cash up to the Maximum Amount (as defined below) of its outstanding 9.250%

Senior Notes due 2024 (the “Notes”). When used in this press release, the terms “we,” “us”

and “our” refer collectively to CEMIG GT and CEMIG Holding, in each case, unless the context otherwise requires.

The Offer was made upon the terms and subject to the conditions set forth

in the Offer to Purchase dated November 28, 2022 (the “Offer to Purchase”). This press release is qualified

in its entirety by the Offer to Purchase.

The Offer expired at 11:59 p.m. (New York City time) on December 23, 2022

(the “Expiration Date”). As of the Expiration Date, according to information received from D.F. King & Co.,

Inc., the information and tender agent for the Offer, U.S.$243,890,000, or approximately 24.39% of the aggregate principal amount outstanding,

of the Notes was validly tendered, and not validly withdrawn. Of the U.S.$ 243,890,000 of the Notes that was validly tendered, and not

validly withdrawn, U.S.$240,702,000 was previously settled on December 21, 2022 in connection with the early settlement of the principal

amount of the Notes validly tendered, and not validly withdrawn, on or prior to 5:00 p.m. (New York City time) on December 9, 2022 (the

“Early Tender Date”). The remaining U.S.$3,188,000 of the Notes was validly tendered, and not validly withdrawn,

after the Early Tender Date and on or prior to the Expiration Date.

The following table sets forth the principal amount of the Notes validly

tendered and not validly withdrawn, as well as the principal amount of Notes that CEMIG GT expects to accept after giving effect to the

Maximum Amount (as described below).

| Title of Security |

CUSIPs |

ISINs |

Principal

Amount Outstanding |

Maximum

Amount

(1) |

Principal Amount Validly Tendered and Not Validly Withdrawn Prior to Expiration Date (2) |

Principal Amount Expected To Be Accepted (3) |

9.25%

Senior Notes due 2024 |

12517M AA0

/ P2205LAC9 |

US12517MAA09

/ USP2205LAC92 |

U.S.$1,000,000,000 |

U.S.$250,000,000 |

U.S.$243,890,000 |

U.S.$243,890,000 |

___________________

| (1) | The Maximum Amount equals an aggregate principal amount of Notes of U.S.$250 million (the “Maximum Amount”). |

| (2) | As reported by D.F. King & Co., Inc., the information and tender agent for the Offer, as of the Expiration Date. |

| (3) | Amount includes (i) U.S.$240,702,000 that was previously settled on December

21, 2022 in connection with the early settlement of the principal amount of the Notes validly tendered, and not validly withdrawn, on

or prior to the Early Tender Date and (ii) U.S.$3,188,000 of the Notes that was validly tendered, and not validly withdrawn, after the

Early Tender Date and on or prior to the Expiration Date. |

Because the aggregate principal amount of the Notes validly

tendered, and not validly withdrawn, after the Early Tender Date and on or prior to the Expiration Date did not exceed the Maximum Amount,

CEMIG GT expects to purchase all of the Notes validly tendered, and not validly withdrawn, after the Early Tender Date and on or prior

to the Expiration Date on the terms described below.

Holders who validly tendered and did not validly withdraw their

Notes after the Early Tender Date, but on or prior to the Expiration Date, are eligible to receive the tender consideration of U.S.$981.25

per U.S.$1,000 principal amount of Notes tendered and accepted (the “Tender Consideration”).

For any Notes that have been validly tendered after the Early

Tender Date and on or prior to the Expiration Date and that are accepted for purchase, settlement will occur on the date that we settle

all Notes not previously settled on the Early Settlement Date, if any (the “Final Settlement Date”), subject

to all conditions set forth in the Offer to Purchase having been satisfied or, where possible, waived by CEMIG GT. The Final Settlement

Date for the Offer is expected to be promptly following the Expiration Date. Assuming that the Offer is not extended and all conditions

set forth in the Offer to Purchase have been satisfied or, where applicable, waived by CEMIG GT, it expects that the Final Settlement

Date will occur on or about December 28, 2022.

Holders whose Notes are accepted for purchase in the Offer

after the Early Tender Date, but on or prior to the Expiration Date, shall receive accrued and unpaid interest from, and including, the

last interest payment date to, but not including, the Final Settlement Date, payable on the Final Settlement Date.

The deadline for holders of Notes to validly withdraw tenders

of Notes has passed. Accordingly, Notes tendered at or before the Expiration Date may not be withdrawn or revoked, except as required

by applicable law.

CEMIG GT’s obligation to accept for purchase, and pay

for, Notes that are validly tendered and not validly withdrawn pursuant to the Offer is conditioned upon the satisfaction or waiver by

CEMIG GT of a number of conditions described in the Offer to Purchase.

CEMIG GT has the right, in its sole discretion, to amend or

terminate the Offer at any time, subject to applicable law.

We have retained Banco Bradesco BBI S.A., Goldman Sachs &

Co. LLC, Morgan Stanley & Co. LLC and Santander Investment Securities Inc. to serve as dealer managers and D.F. King & Co., Inc.

to serve as information and tender agent for the Offer. The full details of the Offer, including complete instructions on how to tender

Notes, are included in the Offer to Purchase. Holders of Notes are strongly encouraged to carefully read the Offer to Purchase, including

materials incorporated by reference therein, because they contain important information. Requests for the Offer to Purchase and any related

supplements may also be directed to D.F. King & Co., Inc. by telephone at +1 (212) 269-5550 or +1 (800) 578-5378 (US toll free) or

in writing at cemig@dfking.com. Questions about the Offer may be directed to Banco Bradesco BBI S.A. by telephone at +1 (646) 432-6642,

Goldman Sachs & Co. LLC by telephone at +1 (212) 357-1452 (collect) or +1 (800) 828-3182 (toll free), Morgan Stanley & Co. LLC

by telephone at +1 (800) 624-1808 (toll free) or +1 (212) 761-1057 (collect) and Santander Investment Securities Inc. by telephone at

+1 (855) 404-3636 (toll free) or +1 (212) 940-1442 (collect).

This press release shall not constitute an offer to purchase

or a solicitation of acceptance of the offer to purchase, which are being made only pursuant to the terms and conditions contained in

the Offer to Purchase.

None of CEMIG GT, CEMIG Holding, the information and tender

agent, the dealer managers or the trustee with respect to the Notes, nor any of their respective affiliates, has authorized any person

to give any information or to make any representation in connection with the Offer other than the information and representations contained

in the Offer to Purchase.

Neither the U.S. Securities and Exchange Commission, any U.S.

state securities commission nor any regulatory authority of any other country has approved or disapproved of the Offer, passed upon the

merits or fairness of the Offer or passed upon the adequacy or accuracy of the disclosure in the Offer to Purchase.

About CEMIG GT and CEMIG Holding

CEMIG GT is a wholly-owned subsidiary of CEMIG Holding, a state-controlled

mixed capital company domiciled in and controlled by the State of Minas Gerais, Brazil. CEMIG Holding is domiciled in Brazil, whose objects

include, but are not limited to: construction, operation and commercialization of systems for generation, transmission, distribution and

sale of energy, and also activities in the various fields of energy sector and gas distribution, for the purpose of commercial operation,

either directly by CEMIG Holding or by subsidiaries or other companies in which CEMIG Holding is a shareholder.

Forward-Looking Statements

Statements in this press release may be “forward-looking

statements,” which are subject to risks and uncertainties. Other than statements of historical fact, information regarding activities,

events and developments that we expect or anticipate will or may occur in the future are forward-looking statements based on management’s

estimates, assumptions and projections. Many forward-looking statements may be identified by the use of words such as “expect,”

“anticipate,” “intend,” “plan,” “believe, “estimate” and similar expressions. Forward-looking

statements contained in this press release are predictions only and actual results could differ materially from management’s expectations

due to a variety of factors, including those described in the section titled “Risk Factors” in CEMIG Holding’s Annual

Report for fiscal year 2021 on Form 20-F. All forward-looking statements attributable to CEMIG GT or CEMIG Holding are expressly qualified in their entirety

by such risk factors, in each case as applicable. The forward-looking statements that we make in this press release are based on management’s

current views and assumptions regarding future events and speak only as of their dates. We assume no obligation to update developments

of these risk factors or to announce publicly any revisions to any of the forward-looking statements that we make, or to make corrections

to reflect future events or developments, except as required by U.S. federal securities laws.

DISCLAIMER

This press release must be read in conjunction with the Offer

to Purchase. This announcement and the Offer to Purchase contain important information which must be read carefully before any decision

is made with respect to the Offer. If any holder of Notes is in any doubt as to the action it should take, it is recommended to seek its

own legal, tax, accounting and financial advice, including as to any tax consequences, immediately from its stockbroker, bank manager,

attorney, accountant or other independent financial or legal adviser.

Forward-Looking Statements

This report contains statements about expected future events and financial

results that are forward-looking and subject to risks and uncertainties. Actual results could differ materially from those predicted in

such forward-looking statements. Factors which may cause actual results to differ materially from those discussed herein include those

risk factors set forth in our most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. CEMIG undertakes

no obligation to revise these forward-looking statements to reflect events or circumstances after the date hereof, and claims the protection

of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG

|

|

| By: /s/ Leonardo George de Magalhães |

|

| Name: Leonardo George de Magalhães |

|

| Title: Chief Finance and Investor Relations Officer |

|

Date: December 27, 2022

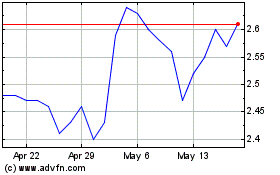

Companhia Energetica de ... (NYSE:CIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

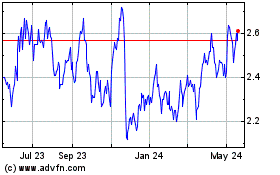

Companhia Energetica de ... (NYSE:CIG)

Historical Stock Chart

From Apr 2023 to Apr 2024